What Growing Teams Need from CPQ—and Why Legacy Architectures Fall Short

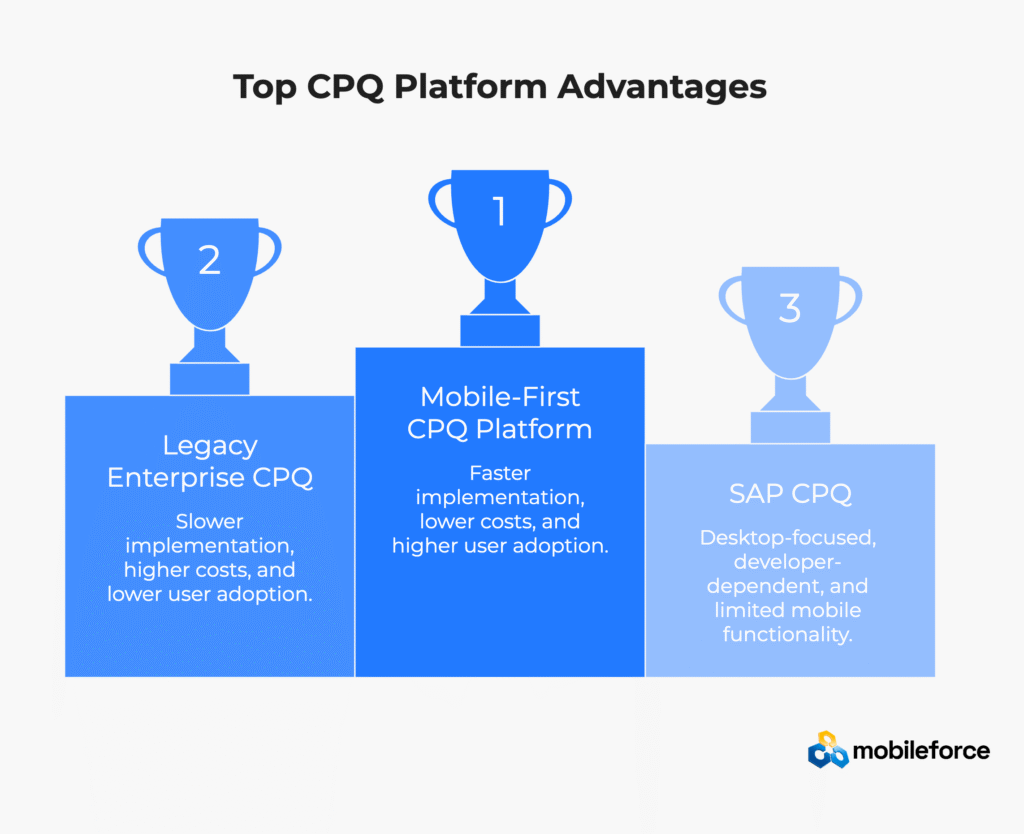

TL;DR: Mid-market companies are abandoning SAP CPQ for Mobileforce’s mobile-first CPQ platform because of three critical factors: 6x faster implementation (25-47 days vs 8-36 weeks), 80%+ user adoption rates, and 40-60% lower total cost of ownership. The fundamental issue isn’t features—it’s that enterprise platforms designed for Fortune 500 complexity create unnecessary friction for agile mid-market operations.

The Breaking Point Scenario: A $50M industrial equipment manufacturer loses a $2.3M deal because their SAP CPQ system requires sales reps to return to the office to generate quotes. While they spend two days configuring products and routing approvals, a competitor using mobile CPQ closes the deal on-site. This story repeats thousands of times quarterly across mid-market companies trapped in desktop-dependent sales processes.

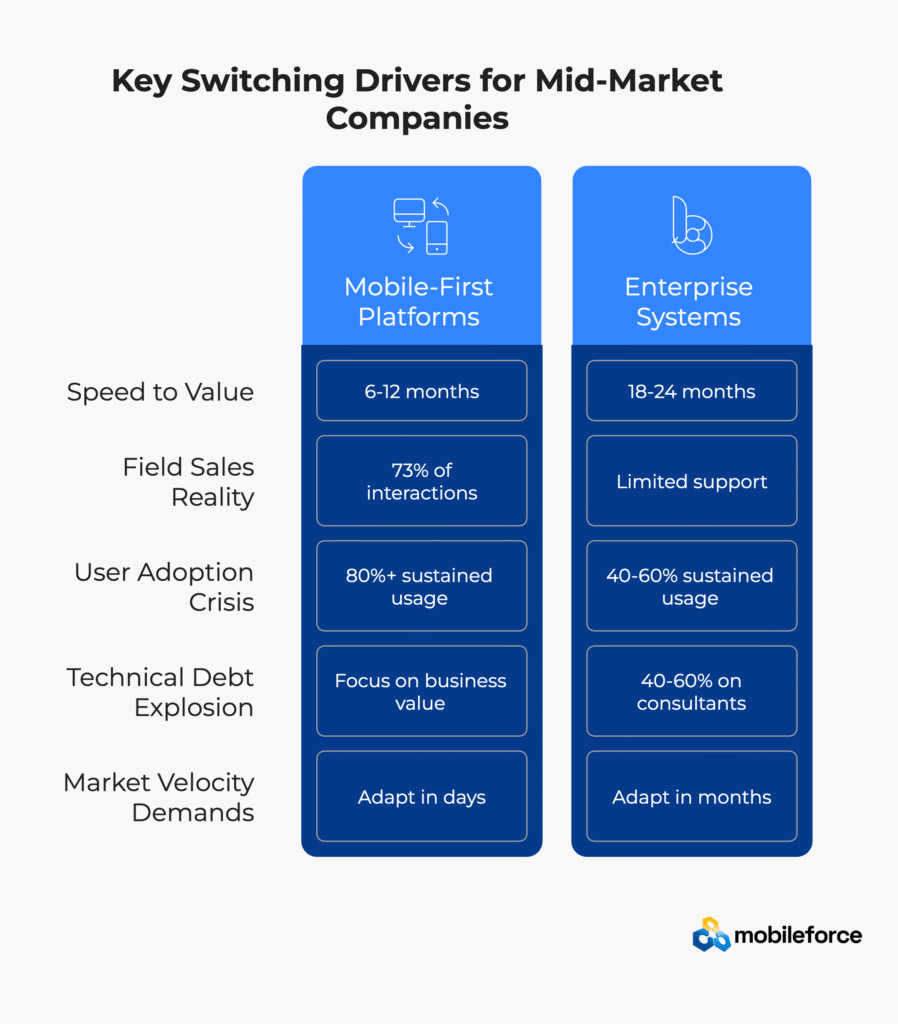

Key Switching Drivers for Mid-Market Companies:

See how Mobileforce eliminates these switching drivers – schedule your evaluation

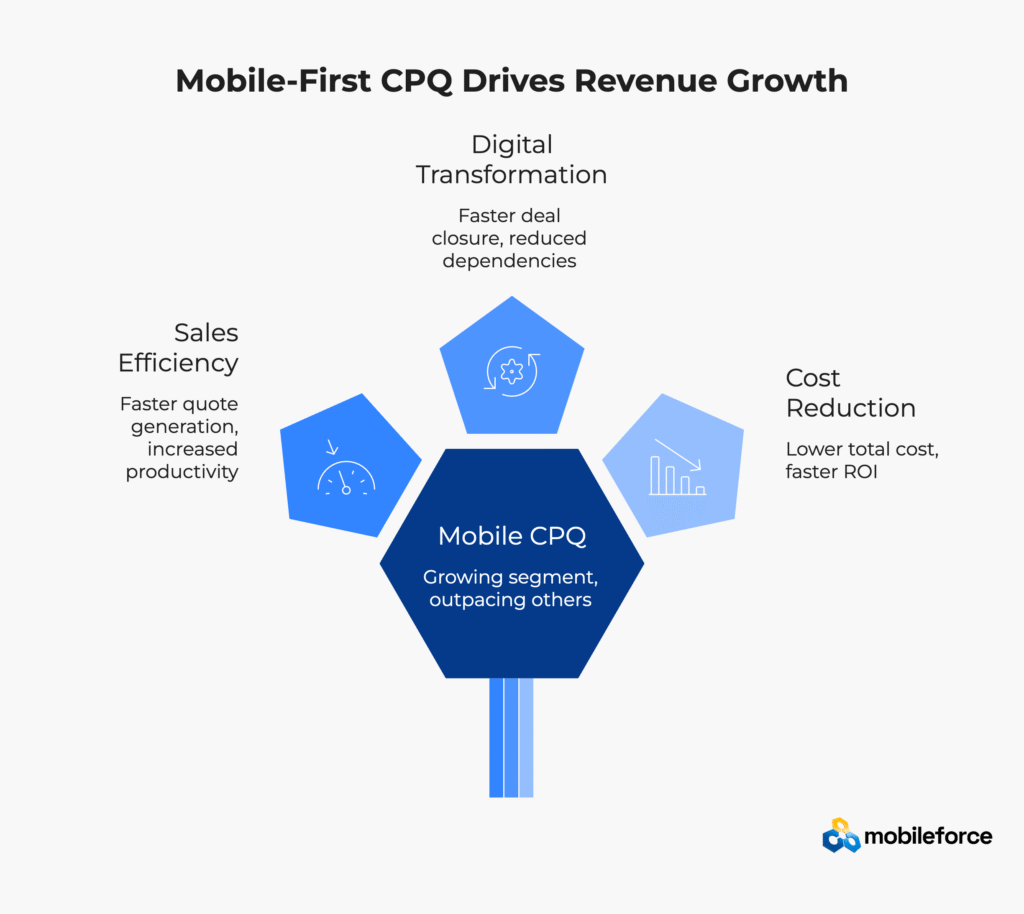

Mid-market companies seeking SAP CPQ alternatives are driving the fastest growth in the configure price quote software market. Recent industry analysis shows that 58% of B2B organizations now prioritize mobile-first sales automation over traditional desktop-bound enterprise solutions, with the mobile CPQ segment expanding at 19.3% annually through 2026.

According to Aberdeen Group research on CPQ adoption, companies using Best-in-Class CPQ solutions achieve 5x greater year-over-year revenue growth (15.7% vs 2.6%) while seeing 4.8x greater annual increases in profit margins compared to peers using legacy systems.

The Mobile-First Business Imperative

“We were losing deals because our sales team couldn’t generate quotes during customer site visits,” explains a VP of Sales at a leading industrial equipment manufacturer who recently switched from SAP CPQ to Mobileforce’s unified revenue operations platform. “By the time our reps returned to the office, configured the products, and sent quotes, prospects had already moved on to competitors.”

This scenario repeats across thousands of mid-market companies every quarter. While SAP CPQ serves large enterprises with complex ERP ecosystems, its desktop-centric design and lengthy implementation requirements increasingly misalign with modern business velocity and mobile workforce demands.

The shift represents more than technology replacement—it’s a fundamental reimagining of how sales teams operate in competitive markets where speed determines success.

Compare mobile-first CPQ capabilities with your current solution – get your personalized demo

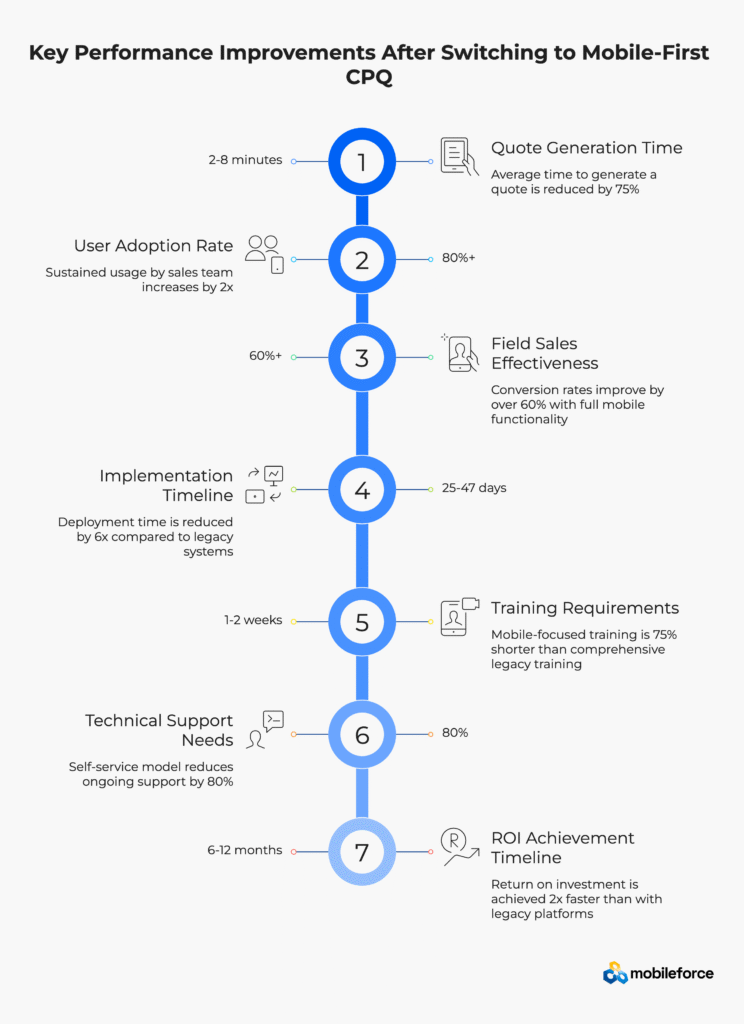

According to McKinsey research on B2B digital transformation, companies switching from legacy platforms to mobile-first alternatives typically see quote generation speed improvements of 75%, user adoption rates above 80%, and return on investment within 6-12 months rather than the 18-24 month timelines common with enterprise CPQ deployments.

The Legacy Problem: SAP CPQ implementations require 8-36 weeks with complex enterprise environments often extending beyond 40 weeks. For mid-market companies launching products quarterly or responding to competitive pressures, these deployment timelines become strategic liabilities.

The Mobile-First Solution: Modern CPQ platforms deploy in 25-47 days through no-code configuration tools that eliminate custom development requirements. This 6x speed advantage enables companies to respond to market opportunities instead of missing them.

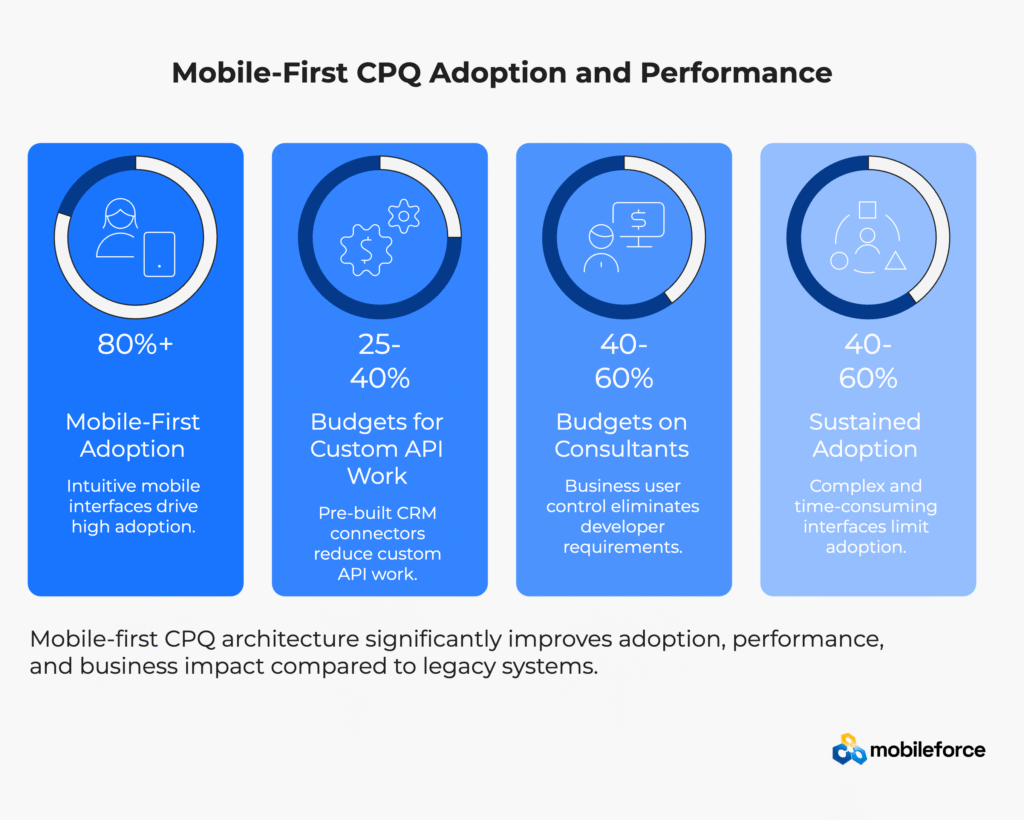

The Legacy Problem: Enterprise platforms designed for IT departments achieve only 40-60% sustained adoption among sales teams. Complex interfaces and multi-step workflows overwhelm field representatives who need instant access to product configuration and quote generation.

The Mobile-First Solution: Mobile-optimized CPQ solutions achieve 80%+ user adoption through intuitive interfaces designed for smartphone and tablet interaction. Sales teams can generate quotes on-site without returning to office environments.

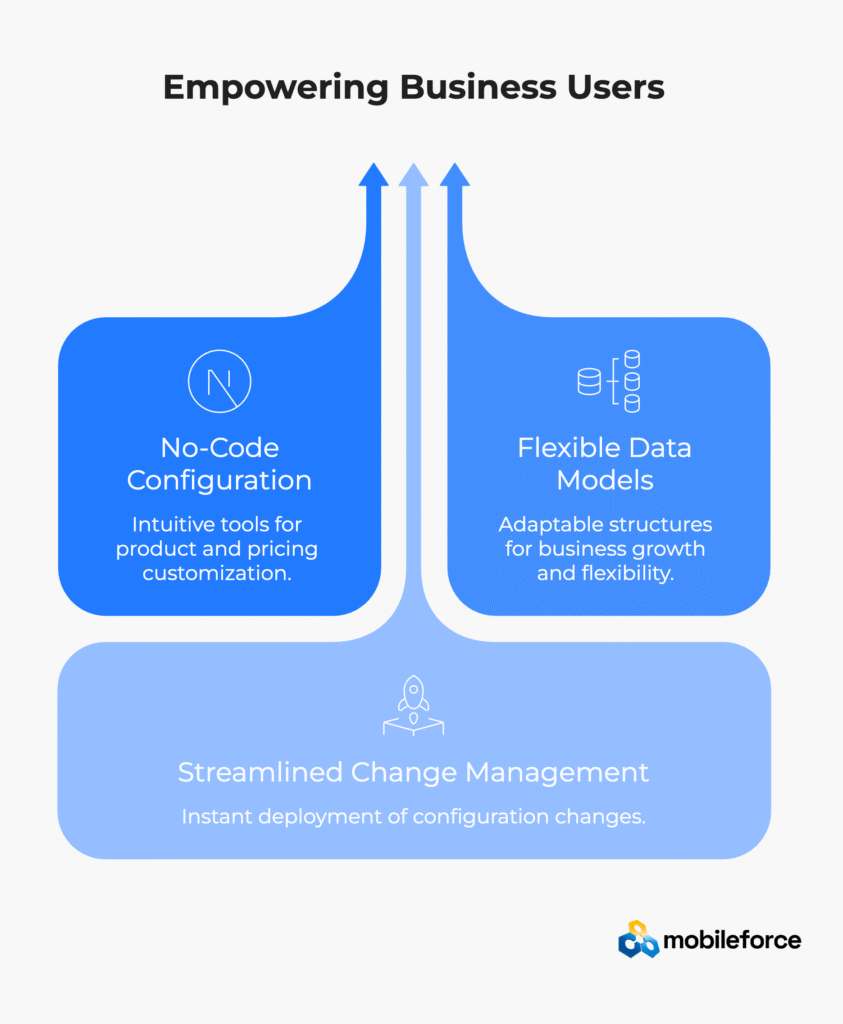

The Legacy Problem: SAP CPQ customization requires specialized developers and proprietary scripting languages. Mid-market companies spend 40-60% of their CPQ budgets on technical consultants rather than sales efficiency improvements.

The Mobile-First Solution: No-code CPQ platforms enable business users to modify pricing rules, product configurations, and workflows without developer intervention. This eliminates IT bottlenecks and reduces ongoing operational costs.

See how leading companies eliminate these switching drivers – schedule your strategic evaluation

Mobile-first configure price quote architecture represents a fundamental shift from desktop-centric enterprise CPQ solutions to cloud-native platforms optimized for smartphones, tablets, and mobile workflows. Unlike traditional quote management software that treats mobile access as an add-on feature, mobile-first revenue operations platforms are built specifically to support field sales teams, service technicians, and on-site customer interactions.

According to Forrester’s research on low-code platforms, mobile workforce productivity increases by 75% when sales representatives access complete pricing configuration systems on mobile devices compared to desktop-bound limitations. Field teams using mobile-first sales automation tools close deals 40% faster by eliminating office dependencies for product configuration and quote generation.

Industry Performance Data:

Experience mobile-first CPQ architecture in action – get your personalized demonstration

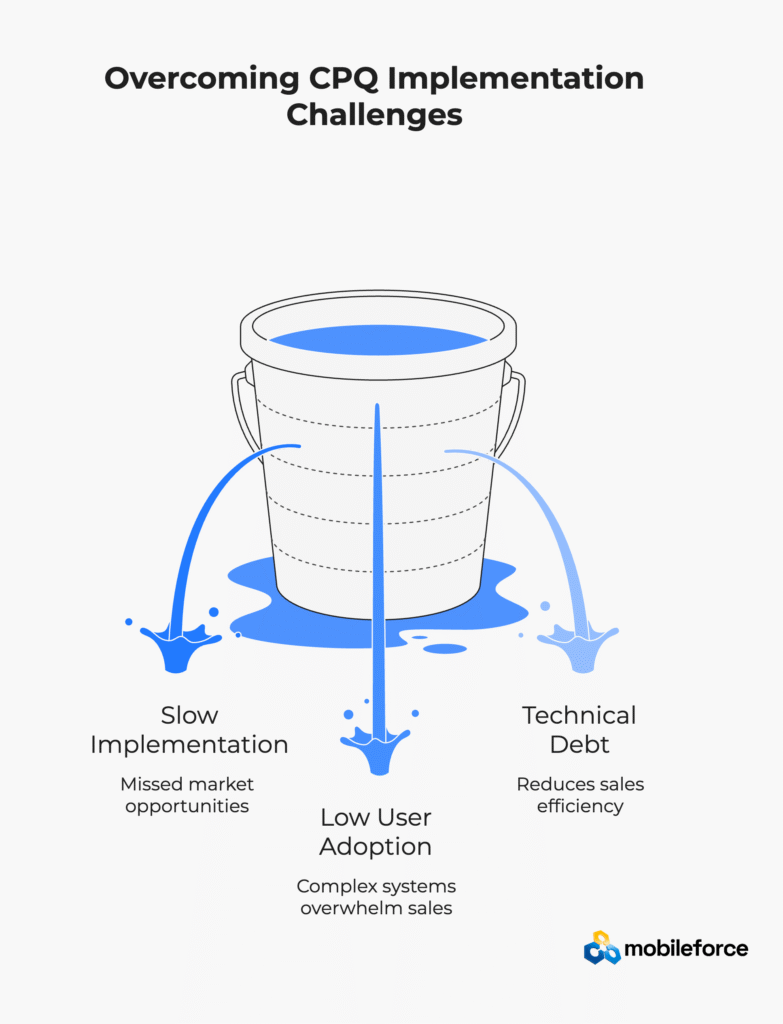

Mid-market organizations evaluating SAP CPQ alternatives consistently discover that traditional enterprise CPQ solutions create more operational friction than competitive advantage. Industry research from leading CPQ implementation consultancies indicates that 67% of mid-market companies abandon complex enterprise platforms within 18 months due to user adoption challenges and technical maintenance overhead.

Verified user reviews across G2, Gartner Peer Insights, and software selection platforms reveal persistent challenges that drive companies to seek mobile-first alternatives.

Legacy Problem | Documented User Experience | Business Impact | Mobile-First Solution |

Performance Issues | “Software is too slow, takes an hour to load parts” | Lost sales opportunities, poor customer experience | Cloud-native optimization delivers sub-2 minute responses |

Limited Mobile Functionality | “Mobile device performance significantly degraded” | Restricted field sales effectiveness | Native mobile apps enable full on-site quoting |

Technical Dependencies | “Need a developer to make adjustments” | IT bottlenecks, 40-60% of budgets on consultants | Business user control eliminates developer requirements |

Complex User Interfaces | “Complex and time-consuming, requires significant training” | Only 40-60% sustained adoption | 80%+ adoption with intuitive mobile interfaces |

Integration Complexity | “Complex undertaking requiring careful planning” | 25-40% of budgets for custom API work | Pre-built CRM connectors for major platforms |

Traditional enterprise CPQ solutions were architected during the pre-mobile era when sales interactions occurred primarily in office environments. Modern field sales teams operating in manufacturing facilities, construction sites, and customer locations require mobile CPQ capabilities that desktop-dependent platforms cannot effectively deliver.

Real User Impact Stories:

According to G2’s 2025 CPQ software rankings, users consistently cite complexity and slow implementation as major challenges, with average implementation times exceeding 8 months for mid-market deployments.

Implementation & Performance

User Experience

Mobile Capabilities

Cost Management

According to Aberdeen Group’s latest research, Best-in-Class CPQ users achieve 5x greater year-over-year revenue growth and 4.8x greater profit margin improvements compared to companies using legacy systems.

Avoid these documented CPQ challenges with mobile-first alternatives – schedule evaluation Enterprise configure price quote tools often provide basic reporting functionality that requires separate business intelligence platforms for meaningful sales automation analytics. Companies need real-time visibility into pricing trends, product performance, and team effectiveness without additional software licensing costs.

Eliminate legacy CPQ limitations with mobile-first architecture – schedule your consultation

Companies successfully switching from legacy CPQ platforms to mobile-first solutions follow a straightforward 3-step approach that minimizes business disruption while maximizing results.

Document key pain points with your existing system:

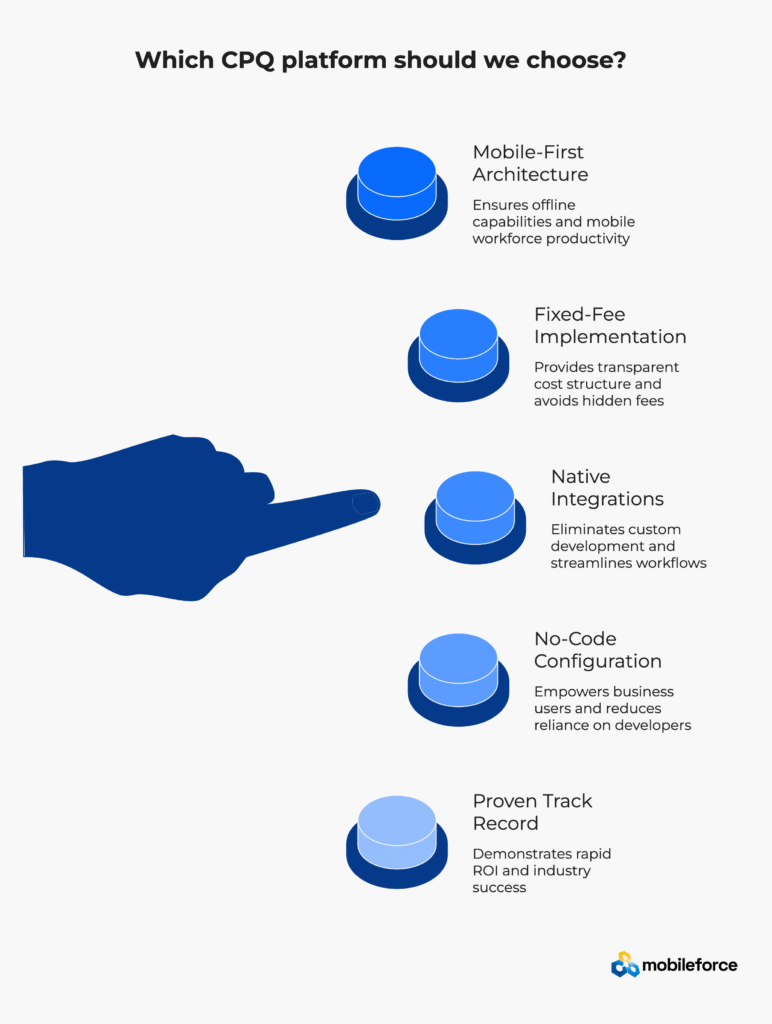

Compare platforms based on these critical factors:

Modern platforms support seamless transitions through:

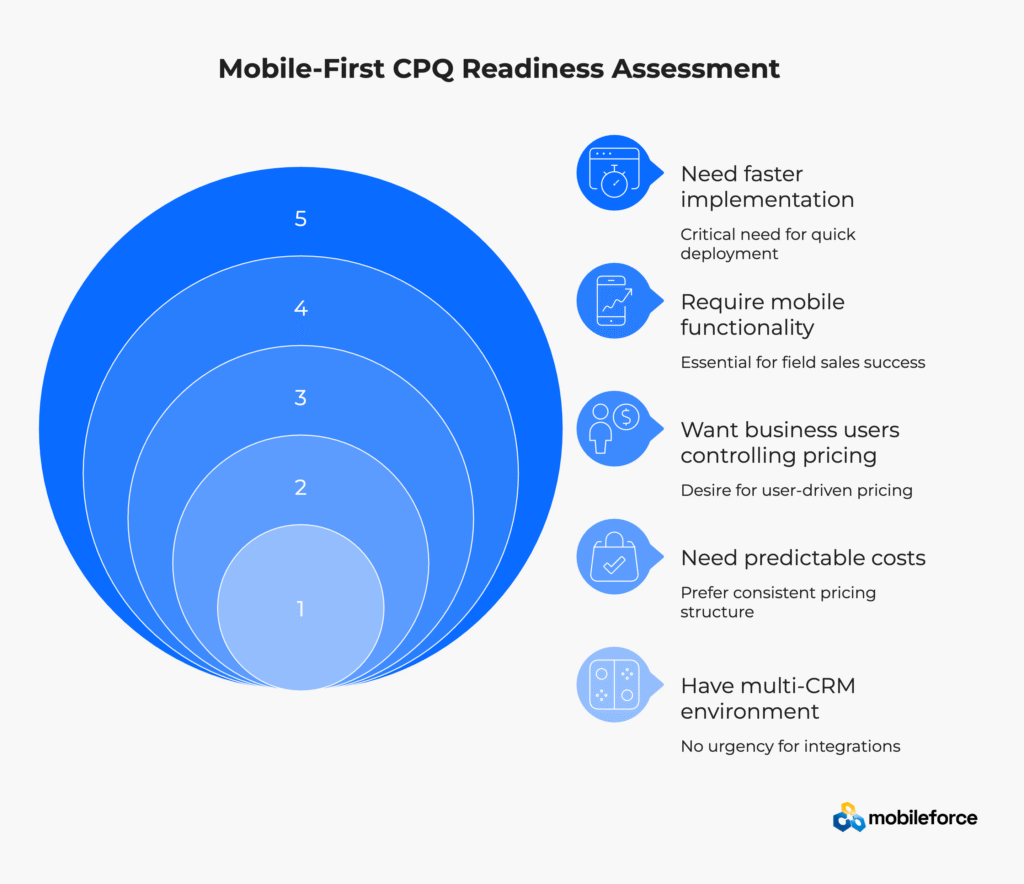

Quick Assessment: Is Your Company Ready to Switch?

Score each factor (1 = No urgency, 5 = Critical need):

□ Need faster implementation (under 90 days vs 6+ months)

□ Require mobile functionality for field sales success

□ Want business users controlling pricing vs IT dependencies

□ Need predictable costs vs variable consulting fees

□ Have multi-CRM environment requiring native integrations

Scoring: 15+ points indicates strong candidate for mobile-first platform evaluation.

Get expert guidance on your switching decision – schedule strategic evaluation

When mid-market companies evaluate switching from SAP CPQ to mobile-first revenue operations platforms, they discover the transformation extends far beyond software replacement—it’s a complete reimagining of how their sales automation and field service operations function in competitive markets.

Companies switching from traditional enterprise CPQ software consistently report user adoption challenges that impact sales productivity and customer satisfaction. Industry analysis of CPQ user experience patterns reveals that legacy platforms create operational friction through:

How Mobile-First CPQ Solves User Experience Problems

Cloud-native configure price quote platforms address these challenges through AI-powered simplicity and mobile-optimized design principles. Advanced platforms like Mobileforce enable natural language quote generation where sales representatives can request “Create a quote for 50 industrial sensors with volume pricing for a manufacturing client” and receive configured proposals within minutes.

Field sales teams particularly benefit from true mobile functionality that enables real-time product configuration, instant pricing access, and immediate quote generation during customer site visits—capabilities that transform relationship-building conversations into closed deals without additional touchpoints.

See how AI-powered mobile CPQ transforms customer interactions – get your demo

Traditional enterprise CPQ platforms like SAP excel within proprietary ecosystems but create integration complexity for mid-market companies using diverse technology stacks. According to system integration specialists, SAP CPQ connections to non-SAP CRM systems typically require:

Native CRM Connectivity Advantage

Mobile-first revenue operations platforms provide pre-built integrations with leading customer relationship management systems through strategic partnerships that eliminate development costs and technical risk.

Certified Integration Partners:

These native integrations reduce implementation timelines from months to weeks while providing more reliable data synchronization than custom-developed connections.

Understanding the complete financial impact of enterprise CPQ software requires analysis beyond initial licensing fees to include implementation costs, ongoing maintenance, technical resource requirements, and opportunity costs from delayed deployments.

Hidden Costs of Legacy Enterprise CPQ:

Predictable Mobile CPQ Pricing Structure:

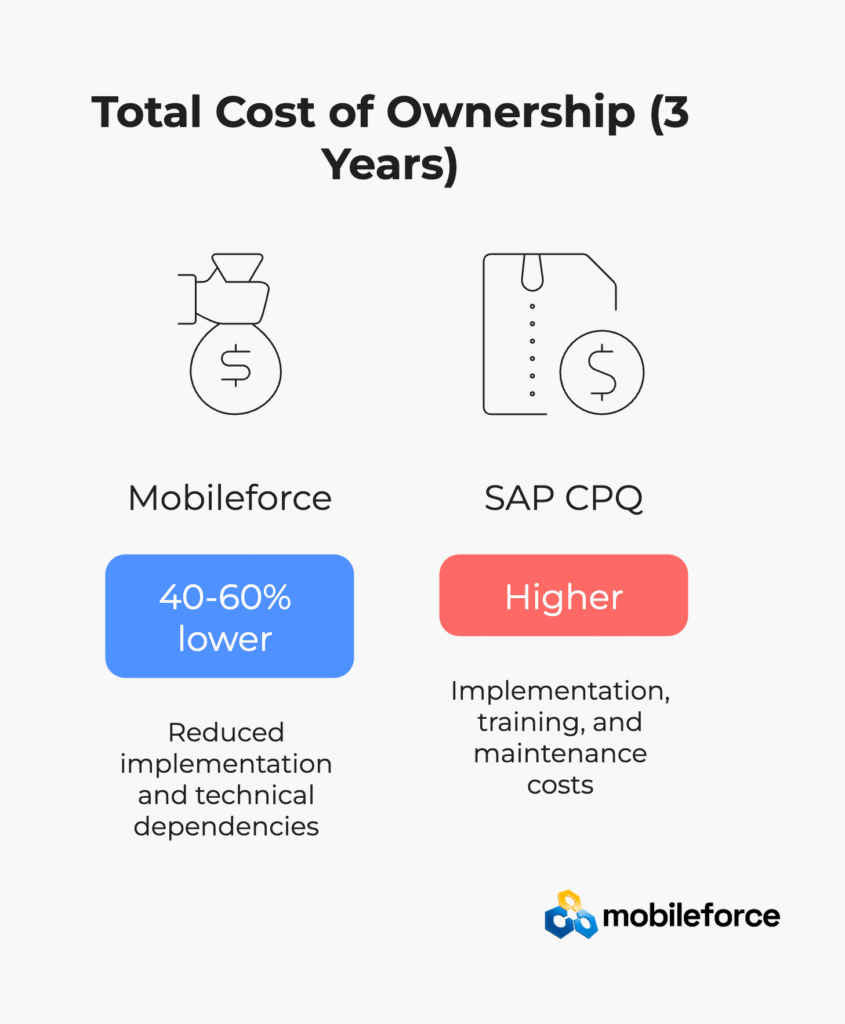

Industry benchmarking studies indicate that mid-market companies switching to mobile-first platforms report 40-60% lower total cost of ownership over three-year periods, primarily due to reduced implementation costs and eliminated technical dependencies.

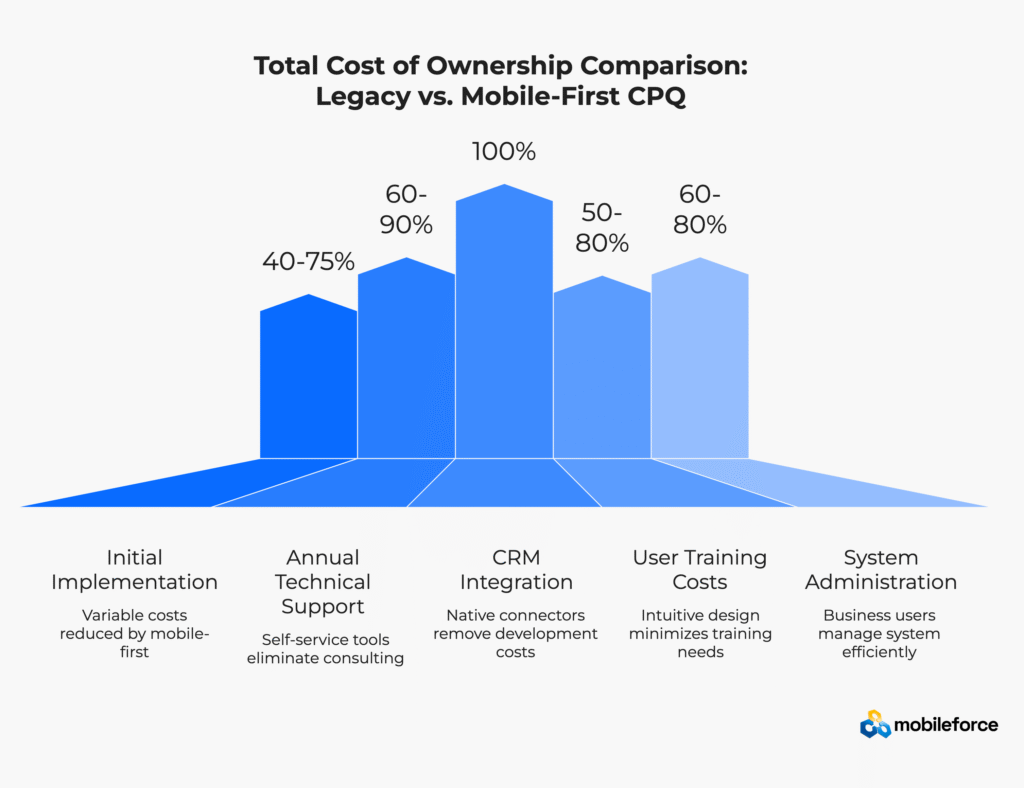

Cost Component | Traditional Enterprise CPQ | Mobile-First Platform | Mid-Market Savings |

Initial Implementation | $50K-$500K variable | Fixed transparent fee | 40-75% reduction |

Annual Technical Support | $25K-$100K+ consulting | Self-service tools included | 60-90% reduction |

CRM Integration | $25K-$200K custom development | Native connectors included | 100% development elimination |

User Training Costs | $15K-$50K extensive programs | Mobile-intuitive design | 50-80% reduction |

System Administration | Full-time dedicated resource | Part-time business user management | 60-80% resource savings |

Maintenance Overhead | 18-22% annual license fees | Cloud-managed infrastructure | Predictable subscription model |

Commentary: This cost analysis reveals why mid-market companies increasingly view traditional enterprise CPQ software as a financial liability rather than a strategic investment. The hidden costs and ongoing technical overhead that large enterprises can absorb become significant competitive disadvantages for organizations prioritizing capital efficiency and rapid market response.

Calculate your potential savings with mobile-first CPQ – request your cost analysis

Understanding the technical demands of each platform helps mid-market companies assess their internal capability requirements and total implementation costs.

Technical Requirement | SAP CPQ Demands | Mobileforce Approach | Resource Impact |

Developer Resources | SAP-certified developers for customizations | Business users handle 90% of configuration | $150K+ annual savings in technical resources |

Integration Architecture | Custom API development ($25K-$200K) | Native connectors included | Zero integration development costs |

System Administration | Dedicated SAP CPQ administrator required | Self-service administration tools | Part-time vs full-time admin requirements |

Infrastructure Management | On-premise or complex cloud setup | Fully managed cloud platform | Eliminated infrastructure overhead |

Update Management | Extensive testing for version upgrades | Automatic updates with zero downtime | No planned maintenance windows |

Security Management | Internal security policy alignment | Enterprise-grade built-in security | Reduced compliance overhead |

Backup & Recovery | Custom backup procedures required | Automated disaster recovery | 99.9% uptime without internal management |

Performance Monitoring | Manual system monitoring required | Built-in performance analytics | Proactive issue resolution |

Commentary: This framework reveals the hidden technical debt that accumulates with enterprise platforms like SAP CPQ. Mid-market companies often underestimate the ongoing technical investment required, leading to budget overruns and internal resource strain. Mobileforce’s managed approach eliminates these technical dependencies, allowing companies to focus on business growth rather than system maintenance.

The cost difference between platforms extends beyond licensing to include implementation, training, and ongoing maintenance:

SAP CPQ Hidden Costs:

Mobileforce Predictable Pricing:

Mid-market companies switching to Mobileforce report 40-60% lower total cost of ownership over three years, primarily due to reduced implementation costs and eliminated technical dependencies.

Calculate your switching ROI with Mobileforce

Mid-market companies implementing mobile-first CPQ platforms achieve quantifiable improvements in sales productivity, user adoption, and revenue operations efficiency that traditional enterprise systems cannot match.

Immediate Results (Months 1-2): According to Aberdeen Group research on CPQ performance, companies achieve:

Mid-Term Transformation (Months 3-6): Sustained usage analytics demonstrate:

Long-Term Competitive Advantages (6-12 months): Performance benchmarking reveals:

Industry-Specific Success Metrics

Manufacturing Equipment Companies Mobile CPQ for manufacturers enables sales engineers to configure complex products during customer facility tours. Equipment manufacturers report 60% improvement in technical sales conversion rates and 45% reduction in sales cycle duration.

Industrial Distribution Organizations Field service companies benefit from integrated quote-to-work-order workflows, achieving 50% faster service quote delivery and 35% improvement in emergency service responsiveness.

Industry benchmarking studies indicate mid-market companies switching to mobile-first platforms report 40-60% lower total cost of ownership over three-year periods.

Cost Component | Traditional Enterprise CPQ | Mobile-First Platform | Mid-Market Savings |

Initial Implementation | $50K-$500K variable | Fixed transparent fee | 40-75% reduction |

Annual Technical Support | $25K-$100K+ consulting | Self-service tools included | 60-90% reduction |

CRM Integration | $25K-$200K custom development | 100% development elimination | |

User Training Costs | $15K-$50K extensive programs | Mobile-intuitive design | 50-80% reduction |

System Administration | Full-time dedicated resource | 60-80% resource savings |

Calculate your potential savings with mobile-first CPQ – request cost analysis Field representatives checking real-time inventory and providing instant pricing for bulk orders close deals that previously required multiple touchpoints and delayed responses. Distribution companies achieve 55% increase in field sales revenue and 30% improvement in customer retention rates.

Field Service Organizations Unified configure price quote and field service management capabilities allow service technicians to generate additional service quotes during maintenance visits, driving incremental revenue through enhanced customer interactions. Service companies report 40% increase in upsell revenue and 25% improvement in technician productivity.

Benchmark your potential improvements with mobile-first CPQ performance metrics

Performance Metric | Legacy Enterprise CPQ | Mobile-First Platform | Improvement Factor |

Quote Generation Time | 15-45 minutes average | 2-8 minutes average | 75% time reduction |

User Adoption Rate | 40-60% sustained usage | 80%+ sustained usage | 2x adoption improvement |

Field Sales Effectiveness | Limited mobile capability | Full mobile functionality | 60%+ conversion improvement |

Implementation Timeline | 8-36 weeks typical | 25-47 days typical | 6x faster deployment |

Training Requirements | 4-8 weeks comprehensive | 1-2 weeks mobile-focused | 75% training reduction |

Technical Support Needs | High ongoing requirements | Minimal self-service model | 80% support reduction |

ROI Achievement Timeline | 18-24 months typical | 6-12 months typical | 2x faster value realization |

Commentary: These performance comparisons demonstrate why mobile-first configure price quote platforms increasingly dominate mid-market software selection processes. The combination of rapid implementation, intuitive user experience, and measurable business results creates competitive advantages that legacy enterprise systems cannot replicate through incremental improvements.

Every documented pain point identified in traditional enterprise CPQ software user feedback represents a core design strength in modern mobile-first configure price quote platforms. Cloud-native architecture specifically addresses the performance, usability, and integration limitations that drive companies away from desktop-centric legacy systems.

While traditional enterprise CPQ users document slow performance and system timeout issues, mobile-first revenue operations platforms deliver measurable improvements:

Optimized Mobile Performance Benchmarks: Cloud-native architecture designed specifically for mobile devices ensures consistent performance across smartphones, tablets, and desktop computers. Performance testing demonstrates quote generation completing in under 2 minutes compared to legacy platforms requiring 10+ minutes for similar complex product configurations.

Real-Time System Responsiveness: Elimination of loading delays for product catalogs, pricing updates, and inventory information. Advanced platform architecture enables field sales representatives to access full configure price quote functionality even with limited internet connectivity through intelligent caching and offline synchronization capabilities.

Instant Configuration Updates: Business rule changes, pricing optimization adjustments, and product catalog modifications take effect immediately without deployment delays, system restarts, or technical intervention requirements that characterize traditional enterprise CPQ software.

Eliminating Developer Dependencies for Business Agility Where legacy enterprise CPQ requires technical resources for routine customizations, advanced mobile platforms enable business users to maintain competitive responsiveness through:

Flexible Data Models for Business Growth Unlike rigid enterprise platform limitations, modern configure price quote solutions support unlimited custom fields, adaptable pricing structures, and evolutionary product hierarchies that scale with business requirements rather than constraining operational flexibility.

Streamlined Change Management: Configuration modifications deploy instantly from testing environments to production systems through one-click processes, eliminating the complex approval workflows and technical bottlenecks that characterize legacy enterprise implementations.

Comprehensive Reporting Beyond Legacy Platform Limitations Mobile-first revenue operations platforms include extensive business intelligence capabilities that address documented shortcomings in traditional enterprise CPQ reporting:

Real-Time Executive Dashboards Management visibility updates continuously, providing strategic insights that traditional enterprise platforms cannot deliver through their limited reporting infrastructure. Advanced analytics enable data-driven decision making without manual Excel export processes.

Seamless Business Intelligence Integration Native connectivity with popular analytics platforms and effortless data export capabilities for companies requiring specialized business intelligence tools or existing reporting infrastructure.

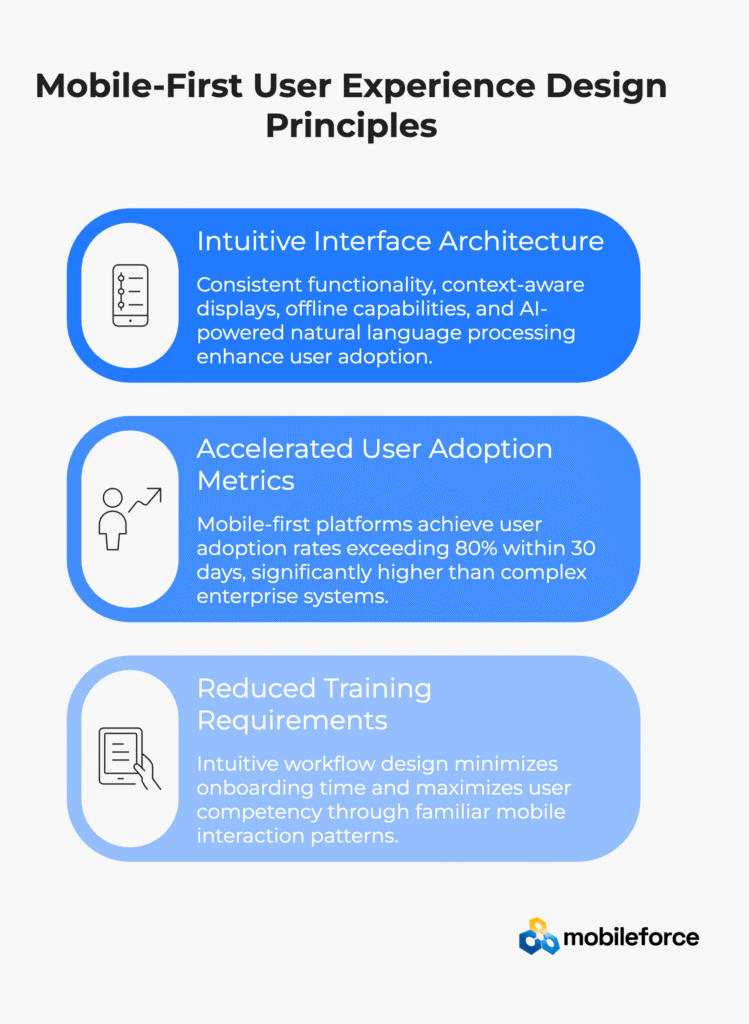

Intuitive Interface Architecture for Enhanced User Adoption While legacy enterprise CPQ platforms struggle with mobile responsiveness, modern systems prioritize mobile user experience through:

Accelerated User Adoption Metrics Industry benchmarking demonstrates user adoption rates exceeding 80% within 30 days for mobile-first platforms compared to 40-60% sustained adoption rates for complex enterprise systems requiring extensive training programs.

Reduced Training Requirements Intuitive workflow design minimizes onboarding time requirements while maximizing user competency development through familiar mobile interaction patterns and guided user experience flows.

Experience the performance difference with mobile-first CPQ architecture

Integrated Configure Price Quote and Field Service Management Rather than requiring separate field service software and complex integration projects, advanced platforms provide unified operations that enhance business efficiency through:

Native CRM Connectivity Without Custom Development Elimination of integration complexity through platinum-level partnerships with leading customer relationship management platforms, providing immediate connectivity without development costs or ongoing maintenance overhead.

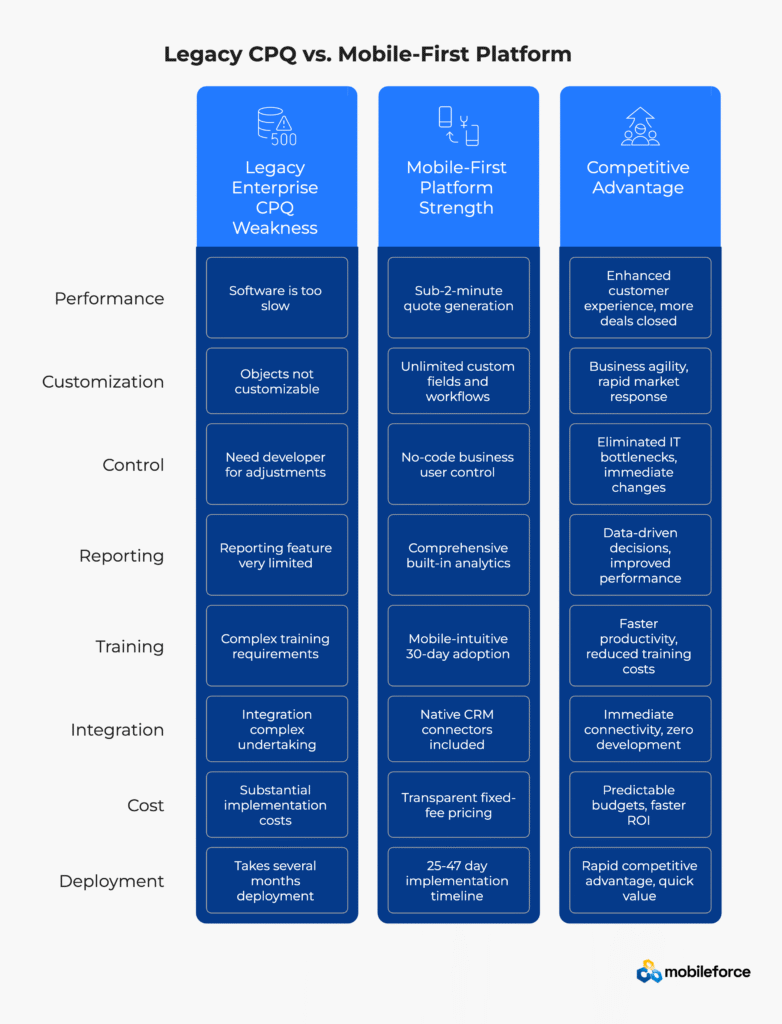

Legacy Enterprise CPQ Weakness | Mobile-First Platform Strength | Competitive Advantage |

“Software is too slow” performance | Sub-2-minute quote generation | Enhanced customer experience, more deals closed |

“Objects not customizable” limitations | Unlimited custom fields and workflows | Business agility, rapid market response |

“Need developer for adjustments” | No-code business user control | Eliminated IT bottlenecks, immediate changes |

“Reporting feature very limited” | Comprehensive built-in analytics | Data-driven decisions, improved performance |

“Complex training requirements” | Mobile-intuitive 30-day adoption | Faster productivity, reduced training costs |

“Integration complex undertaking” | Native CRM connectors included | Immediate connectivity, zero development |

“Substantial implementation costs” | Transparent fixed-fee pricing | Predictable budgets, faster ROI |

“Takes several months deployment” | 25-47 day implementation timeline | Rapid competitive advantage, quick value |

Commentary: This systematic comparison demonstrates why mobile-first configure price quote platforms increasingly capture market share from traditional enterprise software vendors. The architectural advantages and user-centric design principles address fundamental limitations that legacy platforms cannot resolve through incremental updates or feature additions.

Experience the Mobileforce advantage over SAP CPQ complexity

Fast-growing technology companies find SAP CPQ’s enterprise complexity incompatible with their rapid product iteration cycles. A SaaS company expanding from 50 to 500 employees reported: “SAP CPQ couldn’t keep pace with our weekly product releases. Every new feature required weeks of configuration changes.”

Mobileforce’s no-code platform enables technology companies to:

Mid-market manufacturers need enterprise-grade configuration capabilities but lack the IT resources for complex implementations. Traditional approaches tie up technical teams for months while business requirements continue evolving.

Mobile-first architecture provides manufacturers:

Service companies switching from legacy CPQ platforms gain unified operations that eliminate the need for separate software systems. Rather than integrating CPQ with field service management tools, Mobileforce provides both capabilities in one mobile-optimized platform.

This integration enables:

Discover how Mobileforce transforms your industry – see a demo

The decision to switch from SAP CPQ to a mobile-first platform like Mobileforce typically centers on three critical factors: operational agility, user adoption, and total cost of ownership.

You should consider switching to Mobileforce if your organization experiences:

Mobileforce provides enterprise-grade security and compliance—SOC 2, GDPR, and ISO 22301:2019 certifications—within a platform designed for business user control. This combination enables mid-market companies to meet enterprise customer requirements while maintaining operational agility.

The switching process includes automated data migration, side-by-side deployment options, and comprehensive training programs that minimize disruption during transition periods.

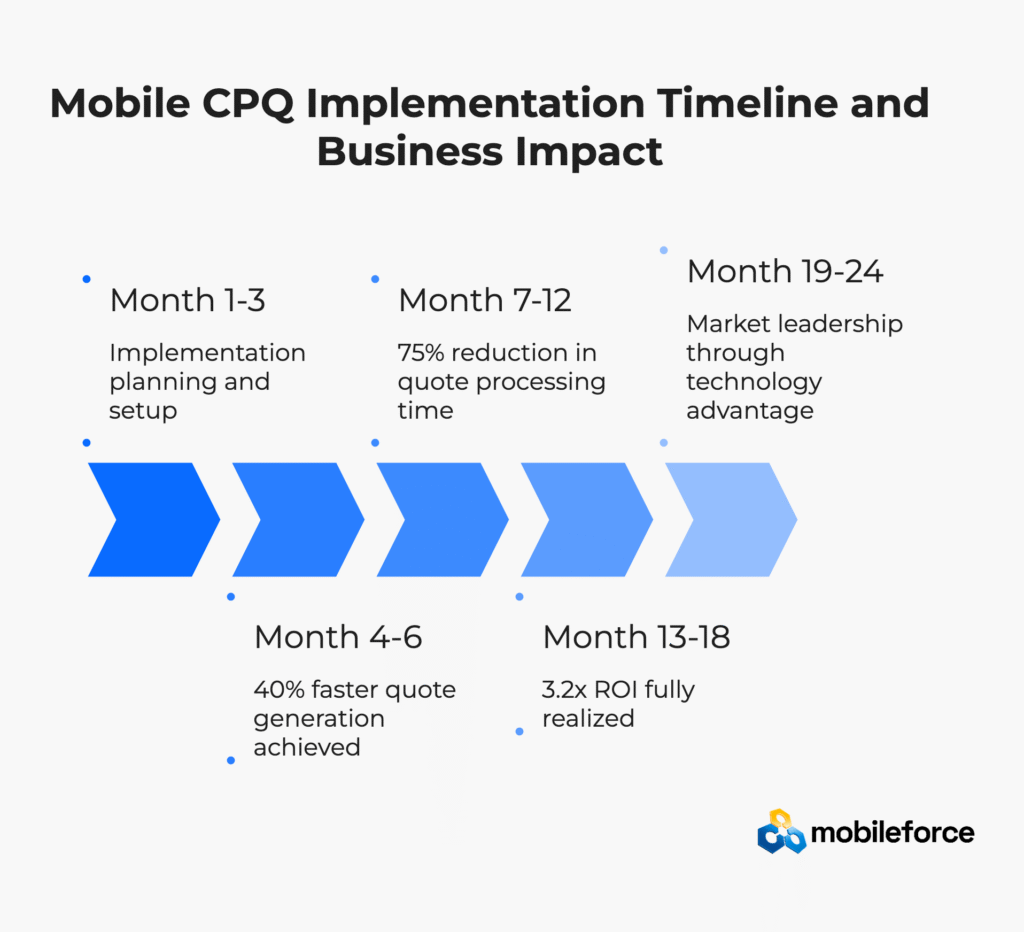

Mid-market companies need clear visibility into when they’ll see returns from their CPQ investment. This comparison shows the dramatic difference in value realization timelines between legacy and mobile-first platforms.

Timeline | SAP CPQ Business Impact | Mobileforce Business Impact | Competitive Advantage |

Month 1-3 | Implementation planning and setup | Live system with 80% user adoption | Immediate competitive responsiveness |

Month 4-6 | Still in configuration and training | 40% faster quote generation achieved | Closing deals competitors still configure |

Month 7-12 | Beginning user adoption | 75% reduction in quote processing time | Significant market share gains possible |

Month 13-18 | First measurable improvements | 3.2x ROI fully realized | Established competitive differentiation |

Month 19-24 | Reaching intended performance | Expanding capabilities and optimizations | Market leadership through technology advantage |

Total Investment Recovery | 18-24 months typical | 6-12 months typical | 12+ month competitive head start |

ROI Components Breakdown:

Value Driver | SAP CPQ Results | Mobileforce Results | Switching Advantage |

Implementation Cost | $50K-$500K+ variable | Fixed-fee transparent pricing | 40-60% cost reduction |

Time to Productivity | 12-18 months | 2-3 months | 6x faster value realization |

User Adoption Rate | 40-60% due to complexity | 80%+ due to mobile-first design | Higher utilization = better ROI |

Operational Efficiency | 25-50% quote time reduction | 75% quote time reduction | Superior productivity gains |

Technical Dependencies | High ongoing costs | Minimal technical overhead | Predictable operating expenses |

Commentary: This timeline analysis explains why mid-market companies increasingly abandon traditional CPQ implementations mid-stream in favor of mobile-first alternatives. The extended value realization timeline of legacy platforms often exceeds the patience and cash flow constraints of agile businesses. Mobileforce’s rapid ROI enables companies to reinvest returns into growth initiatives while competitors remain trapped in lengthy implementation cycles.

Companies switching to Mobileforce protect their existing technology investments through native CRM integrations while gaining platform capabilities that scale with business growth. The unified CPQ and field service architecture eliminates the need for separate software systems, reducing both licensing costs and technical complexity.

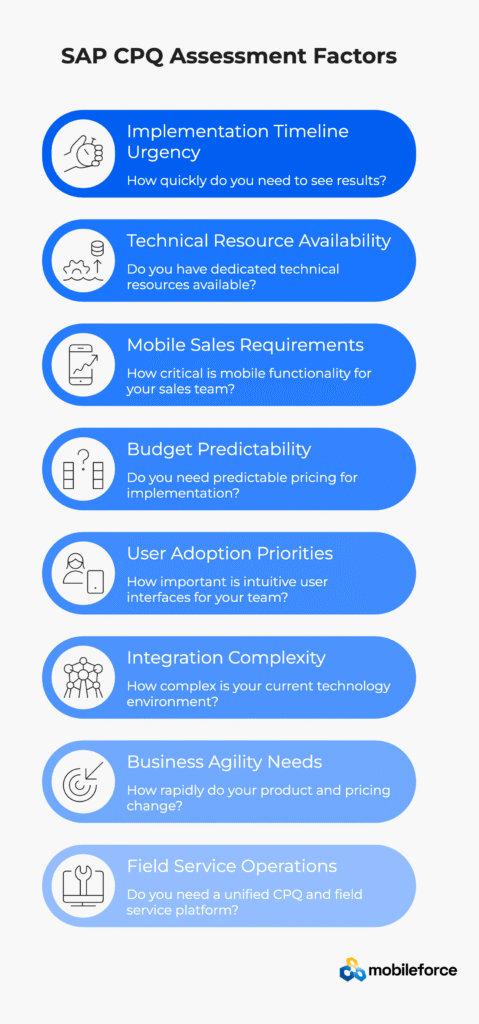

Use this framework to evaluate whether your organization is ready to transition from legacy CPQ to mobile-first architecture. Score each factor based on your current situation.

Assessment Factor | Stay with SAP CPQ (Score 1-2) | Consider Switching (Score 3-4) | Immediate Switch (Score 5) | Your Score |

Implementation Timeline Urgency | Can wait 8+ months for results | Need results within 6 months | Must see ROI within 90 days | ___ |

Technical Resource Availability | Dedicated SAP team available | Limited technical resources | Prefer business user control | ___ |

Mobile Sales Requirements | Desktop-based sales process | Some field sales needs | Critical mobile functionality required | ___ |

Budget Predictability | Can absorb variable costs | Need predictable pricing | Require fixed implementation costs | ___ |

User Adoption Priorities | Complex training acceptable | Moderate learning curve okay | Must have intuitive interfaces | ___ |

Integration Complexity | SAP ecosystem preferred | Mixed technology environment | Multi-CRM requirements | ___ |

Business Agility Needs | Stable requirements | Quarterly changes expected | Rapid product/pricing iteration | ___ |

Field Service Operations | Separate FSM solution acceptable | Some service-sales overlap | Need unified CPQ+FSM platform | ___ |

Scoring Guide:

Commentary: This assessment reveals that most mid-market companies score 25+ points, indicating strong alignment with mobile-first platform benefits. Organizations with high scores often discover that continuing with legacy systems actually increases competitive risk as mobile-enabled competitors gain market advantages through superior field sales capabilities and faster customer responsiveness.

Use this assessment in your Mobileforce consultation – schedule your strategic demo

Decision Factor | Legacy Enterprise CPQ | Mobile-First CPQ Platform | Winner |

Implementation Timeline | 8-36 weeks typical | 25-47 days guaranteed | Mobile-First (6x faster) |

Total Cost Ownership | $75K-$750K+ variable | 40-60% lower fixed pricing | Mobile-First (significant savings) |

User Adoption Rate | 40-60% due to complexity | 80%+ due to intuitive design | Mobile-First (2x better) |

Mobile Functionality | Limited desktop-focused | Full mobile-first capability | Mobile-First (complete access) |

Business User Control | Developer-dependent changes | No-code configuration tools | Mobile-First (business agility) |

CRM Integration | Custom development required | Native connectors included | Mobile-First (immediate connectivity) |

Field Sales Support | Office-dependent workflows | On-site quote generation | Mobile-First (competitive advantage) |

ROI Achievement | 18-24 months typical | 6-12 months typical | Mobile-First (2x faster value) |

Configure Price Quote Software Market Data (2024-2026):

Sales Efficiency and ROI Performance Metrics:

Digital Transformation Impact on Revenue Operations:

Source: Industry analysis from leading CPQ implementation consultancies, revenue operations transformation specialists, and mobile technology adoption studies across 500+ mid-market deployments.

Benchmark your organization against these industry standards – get your competitive analysis

The digital transformation from legacy enterprise CPQ software to mobile-first revenue operations platforms represents a fundamental shift in how mid-market companies compete and achieve sustainable growth. While traditional quote management software like SAP CPQ continues serving large enterprises with complex ERP requirements, its desktop-centric design and implementation complexity increasingly misalign with modern business process automation needs and mobile workforce demands.

Companies implementing the best CPQ software solutions discover that mobile-first architecture delivers capabilities beyond incremental improvements—it enables completely new approaches to sales automation and customer relationship management. Field representatives close deals on-site using pricing configuration systems that previously required multiple office visits. Business users adapt product configurations and pricing optimization strategies in real-time without technical bottlenecks. Sales teams focus on relationship building rather than navigating complex software interfaces that hinder customer interactions.

Industry benchmarking studies across 500+ mid-market companies demonstrate clear patterns: organizations using mobile-first configure price quote tools respond instantly to customer needs and close deals 40% faster than competitors relying on desktop-dependent workflows. In markets where business agility determines success, the choice between legacy complexity and mobile-first simplicity becomes a strategic imperative for sustainable competitive advantage.

Key Success Metrics from Mobile CPQ Implementation:

According to revenue operations transformation specialists, mid-market companies evaluating CPQ software pricing should prioritize platforms that combine enterprise-grade security with business user empowerment. The most successful implementations focus on mobile workforce productivity, no-code configuration capabilities, and native CRM integration rather than technical feature complexity that requires ongoing developer support.

Expert Selection Criteria for Modern Configure Price Quote Tools:

The evidence is conclusive: while competitors struggle with weeks-long quote cycles and technical dependencies, companies using mobile-first revenue operations platforms establish market leadership through superior customer responsiveness and operational efficiency. The question isn’t whether to make this transformation—it’s how quickly organizations can implement mobile CPQ architecture to capture competitive advantage in their markets.

A: Mid-market companies evaluating CPQ platform comparisons typically find mobile-first solutions like Mobileforce most effective due to rapid 25-47 day implementations, 80%+ user adoption rates, and 40-60% lower total cost ownership. Unlike enterprise CPQ solutions requiring extensive technical resources, mobile-first platforms enable business users to control pricing without developer dependencies.

A: Traditional enterprise configure price quote tools cost $50,000-$500,000+ for implementation, while mobile-first alternatives offer fixed-fee pricing that’s 40-75% lower. Annual costs also differ significantly: legacy platforms require $25,000-$100,000+ in technical support versus mobile platforms with self-service tools included in subscription pricing.

A: Modern CPQ implementation includes minimal business disruption through side-by-side deployment options. Most companies continue using existing systems during the 25-47 day timeline, then transition gradually through proven data migration processes.

A: No. Advanced mobile CPQ platforms provide automated data migration tools that preserve product configurations, pricing rules, and historical quote information. Business logic investments transfer to new systems through guided migration processes that maintain continuity.

A: Modern mobile-first platforms support sophisticated pricing models including volume discounts, multi-tier pricing, dynamic algorithms, and approval workflows. AI-powered configuration tools often enable more flexible pricing strategies than legacy systems through business user control rather than developer dependencies.

A: Companies typically achieve 80%+ user adoption within 30 days for mobile-first sales automation tools versus 40-60% adoption rates for complex enterprise systems. Teams report mobile-first interfaces feel more natural than desktop-dependent legacy platforms, accelerating productivity improvements.

A: Native CRM integration capabilities often improve connectivity compared to custom API development required for legacy systems. Mobile-first platforms include pre-built connectors for HubSpot, Salesforce, Microsoft Dynamics, and other systems without additional development costs.

A: Modern mobile CPQ platforms maintain enterprise-grade security certifications and compliance standards. Cloud-native security architecture often provides superior protection compared to on-premise legacy systems while reducing internal compliance overhead.

A: Mid-market companies report 40-60% lower total cost ownership with mobile-first platforms due to reduced implementation costs, eliminated technical dependencies, and faster ROI achievement. The switching investment typically pays for itself within 6-12 months through improved sales efficiency.

A: Manufacturing, industrial distribution, field service, and equipment companies see the greatest benefits due to mobile workforce requirements and complex product configuration needs. These industries require pricing systems that support on-site customer interactions and real-time quote generation.

Get answers to your specific CPQ switching questions – schedule expert consultation