How CRM and ERP Stop Short—and What Revenue Execution Really Requires

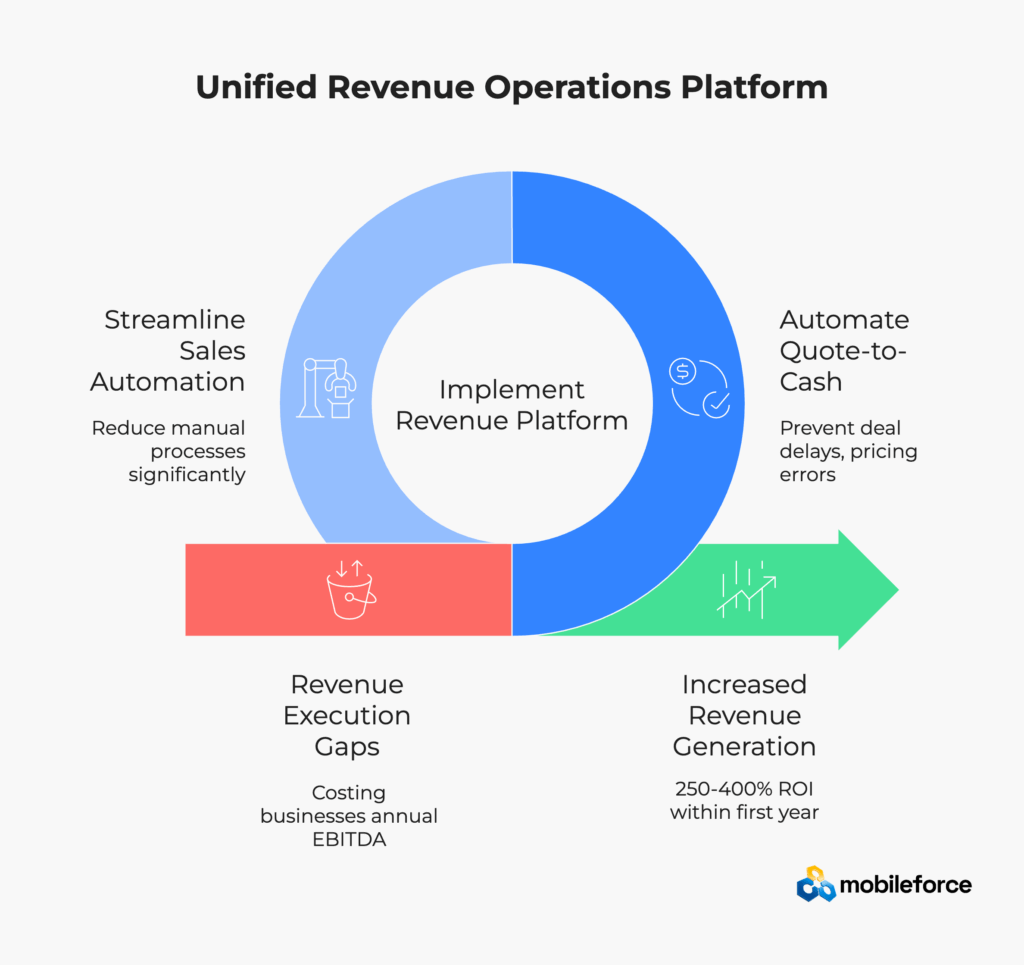

The global CRM market reached $101.4 billion in 2024, yet revenue teams continue to struggle with execution gaps that cost businesses 1-5% of annual EBITDA through revenue leakage. While CRM and ERP systems excel at recording data, they fall short of orchestrating real-time revenue execution workflows. Modern revenue teams need unified revenue operations platforms that bridge the gap between data capture and revenue generation, enabling automated quote-to-cash processes that prevent deal delays, eliminate pricing errors, and stop margin erosion. Organizations implementing comprehensive revenue execution software typically achieve 250-400% ROI within the first year through streamlined sales automation and reduced manual processes.

Sarah, a sales director at a mid-market manufacturing company, had all the customer information she needed. Her CRM showed every interaction, every preference, and every pain point. The ERP system contained accurate pricing, inventory levels, and financial data. Yet when her biggest prospect requested a complex quote for industrial equipment, her deal stalled for seven days.

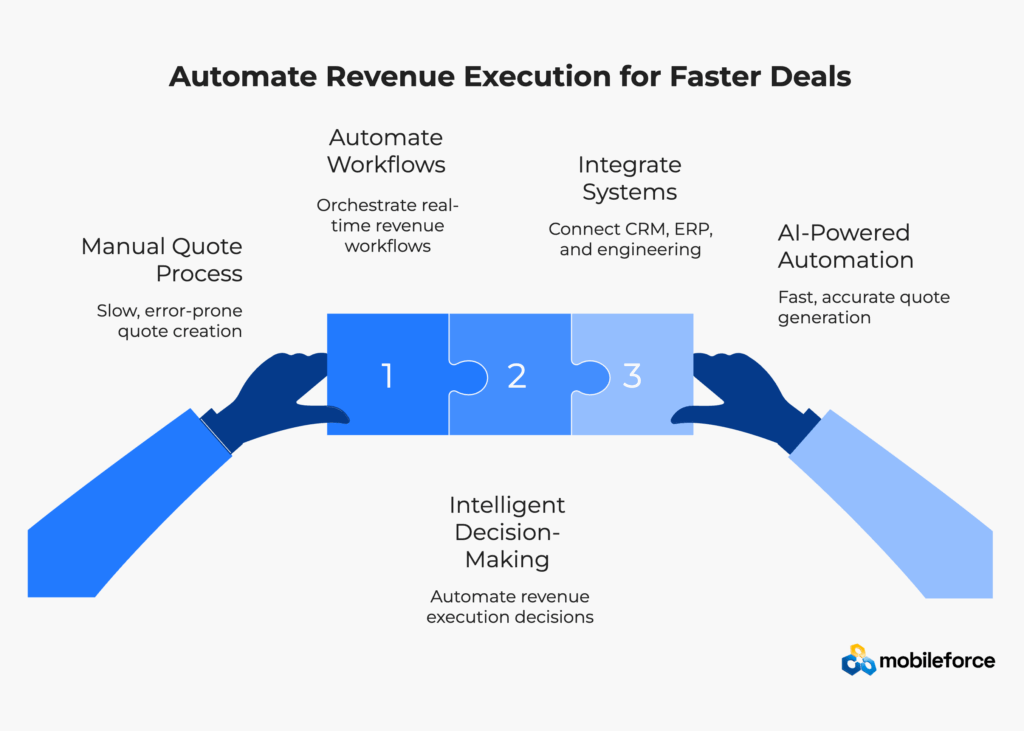

The problem wasn’t missing data. Sarah’s team had to manually extract information from the CRM, calculate pricing in spreadsheets, route approvals through email chains, and coordinate with engineering through a separate system. By the time they delivered a professional quote, the prospect had already moved forward with a competitor who responded in 24 hours using AI-powered automation.

This scenario repeats thousands of times daily across revenue teams worldwide. Despite investing in sophisticated systems of record, companies continue to lose deals, leak revenue, and frustrate both customers and internal teams through execution gaps that no amount of data can solve. Organizations implementing best sales operations tools see dramatic improvements in response times and deal closure rates.

Systems of record serve as centralized databases that capture, store, and organize business data for reporting and compliance purposes. Traditional CRM and ERP platforms function as systems of record, focusing primarily on data integrity and historical tracking. In contrast, systems of action utilize stored data to orchestrate real-time workflows, automate decision-making, and drive immediate business outcomes. While systems of record excel at answering “what happened,” systems of action focus on “what should happen next” through intelligent workflow orchestration and automated revenue execution.

Customer Relationship Management and Enterprise Resource Planning systems represent the backbone of modern business operations. According to Fortune Business Insights, the global CRM market reached $101.4 billion in 2024 and is projected to grow to $262.74 billion by 2032, reflecting their critical importance in business operations.

CRM and ERP systems excel at their core function: capturing, storing, and organizing business data with precision. CRM.org research shows that 74% of users report improved access to customer data, while Nucleus Research demonstrates that CRM delivers an average return of $8.71 for every dollar spent.

These systems provide essential capabilities including centralized customer databases, comprehensive reporting dashboards, audit trails for compliance, and integration with other business applications. For businesses focused primarily on data management and reporting, systems of record deliver substantial value. HubSpot users particularly benefit from comprehensive contact management and marketing automation capabilities, while SugarCRM implementations offer flexible customization options for data organization.

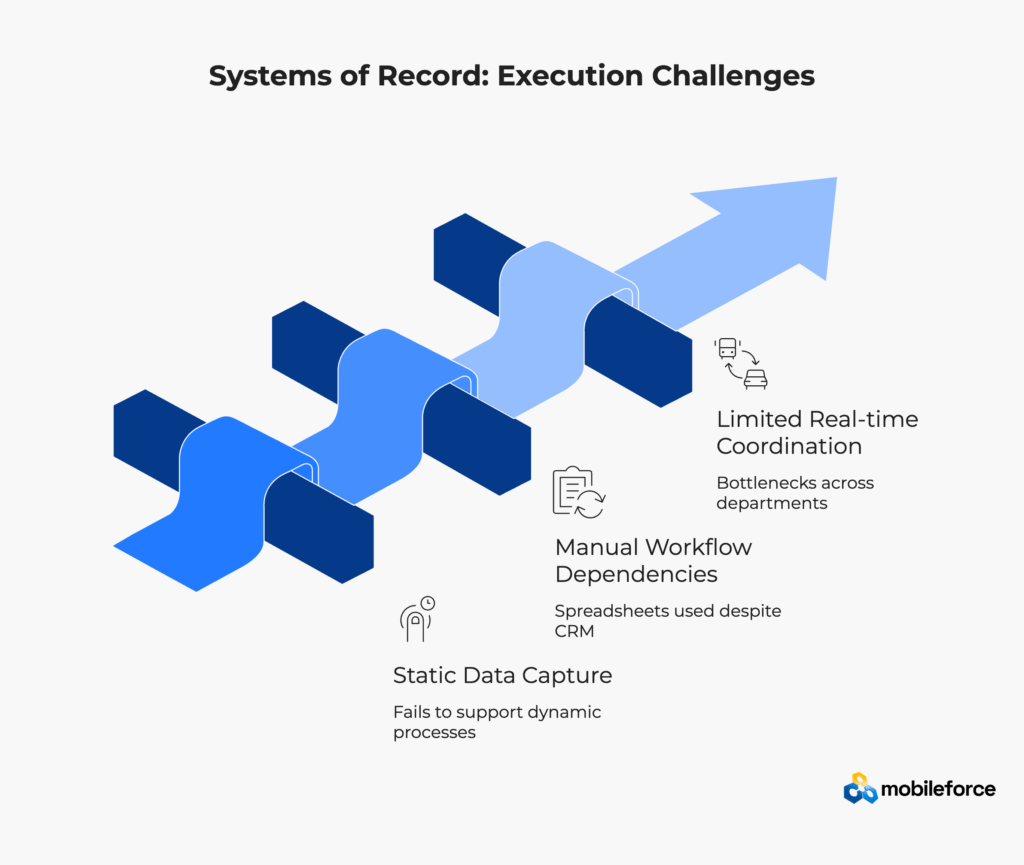

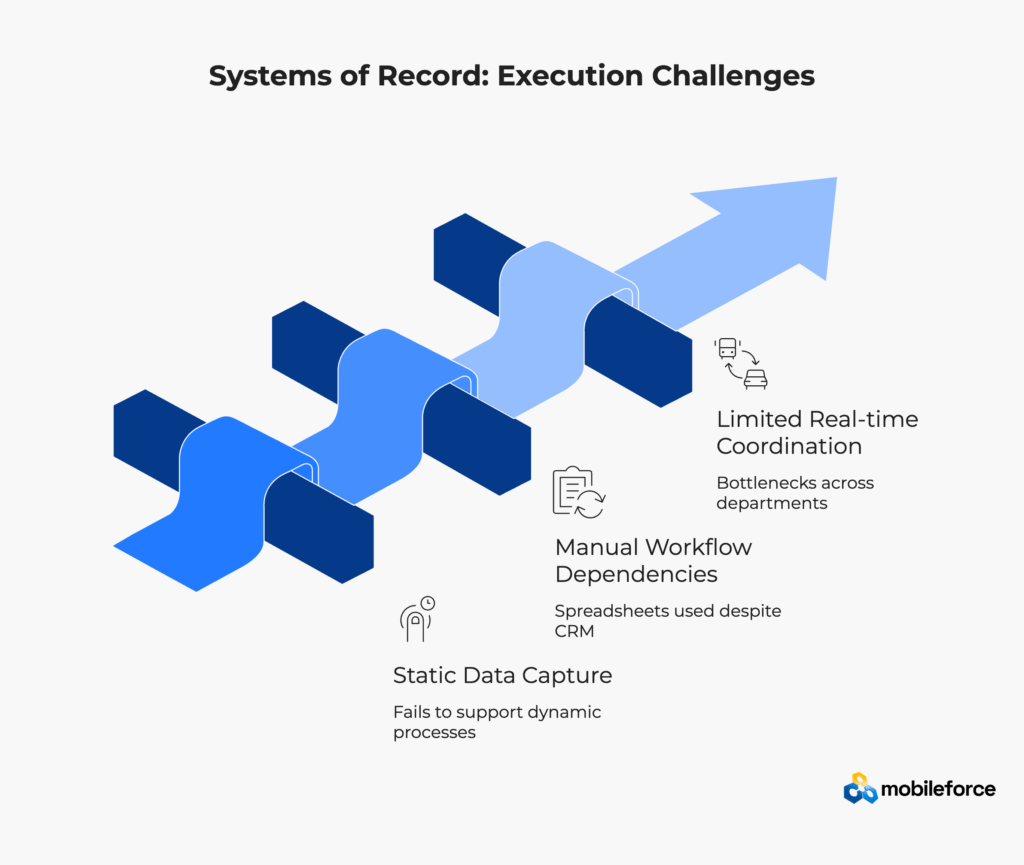

However, systems of record encounter fundamental limitations when revenue teams need to execute complex workflows in real-time. These constraints manifest in several critical areas that directly impact revenue generation.

Static data capture fails to support dynamic business processes. While CRM systems record customer interactions, they don’t actively guide next steps or automate follow-up actions. Sales representatives must interpret data and manually decide what actions to take, creating delays and inconsistencies.

Manual workflow dependencies plague most implementations. According to research from multiple sources, 40% of salespeople still use spreadsheets and informal methods to store customer data, even when CRM systems are available. This statistic reveals the gap between data availability and workflow execution.

Limited real-time coordination across departments creates execution bottlenecks. When sales teams need pricing approvals, inventory confirmations, or engineering support, systems of record don’t orchestrate these cross-functional workflows automatically. Manufacturing companies especially struggle with complex product configurations that require engineering input during the quoting process.

The disconnect between recording revenue data and executing revenue processes creates measurable business impact. Research from multiple industry sources reveals the scope of this challenge and its financial consequences.

Despite significant CRM investments, revenue teams continue struggling with execution challenges. Studies indicate that CRM systems improve sales forecast accuracy by 42%, yet sales cycle improvement remains limited to 8-14% reductions in complexity.

The issue lies in CRM systems’ reactive nature. They capture what happened but don’t actively orchestrate what should happen next. Sales representatives must manually identify next best actions, leading to delayed responses and missed opportunities.

Heavy reliance on user discipline compounds this challenge. When systems require manual updates and decision-making, execution quality depends on individual performance rather than systematic processes. Gartner research indicates that 68% of B2B buyers prefer to research solutions independently, requiring revenue teams to respond faster when prospects do engage.

Modern CPQ platforms address these limitations by automating quote generation and embedding approval workflows directly into existing CRM environments, eliminating the manual coordination that causes execution delays. For Salesforce users particularly, integrating automated quoting processes can bridge the workflow gap that traditional CRM faces.

ERP systems contain comprehensive pricing logic, inventory data, and financial controls. However, this information often remains disconnected from the selling process until too late in the cycle.

Pricing logic trapped in ERP systems forces sales teams to request quotes through separate processes, creating delays and potential for errors. When competitive situations require rapid responses, these bottlenecks can lose deals entirely. AI-powered quoting solutions can bridge this gap by accessing ERP data in real-time during the quote creation process.

Approval workflows that exist outside core systems create additional delays. Manual routing through email and disconnected systems extends quote-to-customer timelines beyond competitive thresholds. Organizations implementing automated sales processes see significant improvements in response times.

Research from MGI Research reveals that B2B companies lose up to 31.8% of annual revenue through pricing inefficiencies and process gaps, with 42% of companies experiencing revenue leakage. For a $100 million company, this represents $1-5 million in lost revenue each year from EBITDA leakage alone.

Harvard Business Review research indicates that organizations implementing automated revenue processes see 25-40% reduction in manual errors and 30-50% faster cycle times. Meanwhile, McKinsey studies show that sales automation can increase productivity by 14.5% while reducing administrative time by up to 20%.

Revenue leakage occurs through multiple channels including delayed quotes that lose competitive positioning, pricing errors from manual calculations, broken handoffs between sales and service teams, and margin erosion that doesn’t appear clearly in standard reports. Organizations with complex product configurations face additional risks from configuration errors and compatibility issues.

According to Chief B2B Sales research, well-run subscription businesses target less than 1-2% leakage on recurring revenue, while leakage above 3-5% of expected revenue indicates structural problems requiring systematic fixes. Companies implementing field service management alongside sales processes often see additional revenue protection through better service delivery coordination. Enterprise CPQ solutions provide comprehensive safeguards against these common leakage sources.

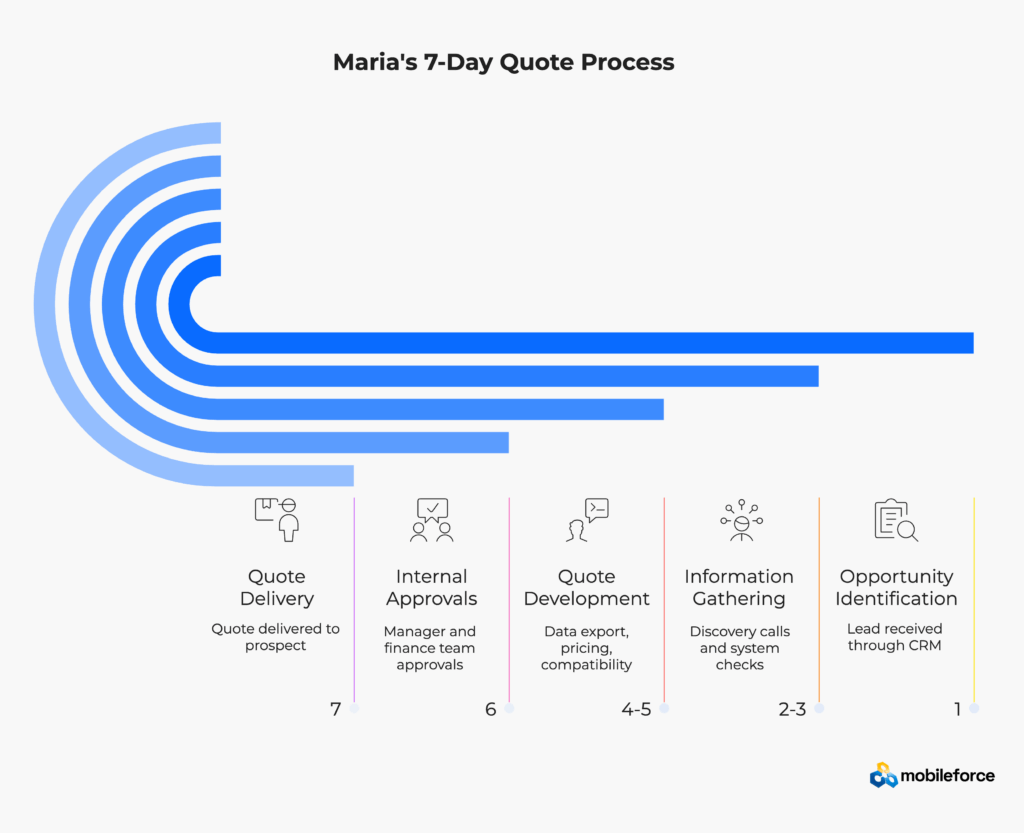

Consider Maria, a sales representative at a technology distributor, as she works through a typical complex deal cycle spanning seven days.

Day 1: Opportunity Identification Maria receives an inbound lead through the CRM system. The prospect needs a comprehensive solution including hardware, software, and ongoing support services. She schedules an initial discovery call and logs the interaction in CRM.

Day 2-3: Information Gathering Maria conducts discovery calls and updates CRM with detailed requirements. However, she needs to check inventory levels in the ERP system, verify pricing through a separate portal, and confirm engineering specifications through email with technical teams.

Day 4-5: Quote Development To create an accurate quote, Maria exports customer data from CRM into a spreadsheet, looks up products in multiple systems, calculates pricing manually, and emails the technical team for compatibility verification. She then formats everything into a professional proposal template.

Day 6: Internal Approvals The quote requires manager approval due to special pricing. Maria emails the quote to her manager, who reviews it and requests changes. After modifications, she sends it to the finance team for final approval.

Day 7: Quote Delivery Finally, Maria delivers the quote to the prospect. However, the seven-day timeline exceeded the prospect’s expectations, and they’ve already begun serious conversations with a competitor.

The Hidden Costs Every system recorded something during this process. CRM captured customer interactions, ERP maintained accurate pricing data, and email systems logged all approvals. However, none of these systems coordinated execution across the entire workflow.

Modern revenue teams need to think beyond data storage toward workflow orchestration. This evolution requires understanding three distinct layers that support effective revenue operations.

Systems of Record serve as the foundational layer, storing truth about customers, products, and transactions. CRM and ERP systems excel in this capacity, providing reliable data repositories with robust reporting capabilities.

Systems of Insight analyze stored data to generate actionable intelligence. Business intelligence platforms, analytics tools, and forecasting systems extract patterns and predictions from historical information.

Systems of Action operationalize insights through real-time workflow orchestration. These platforms connect data sources, automate decision-making, and coordinate activities across departments to execute revenue processes efficiently.

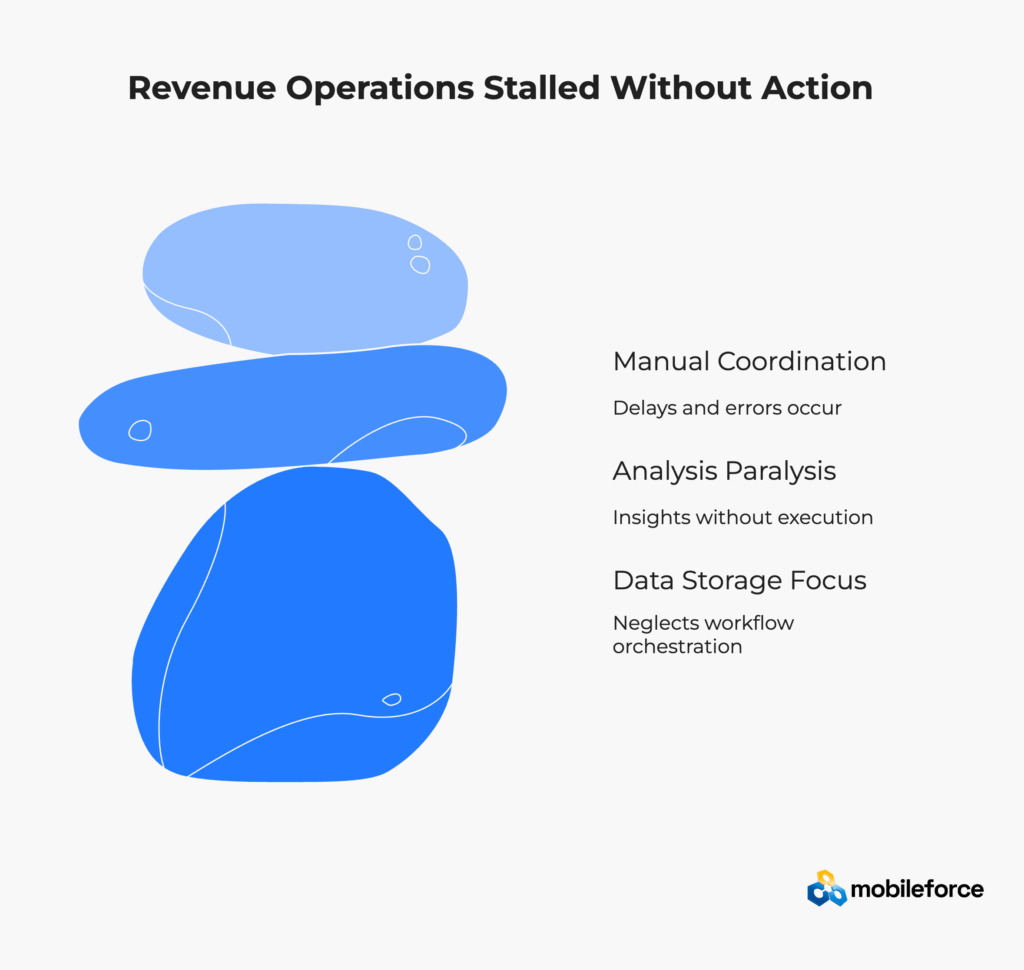

Insights without execution capability leave revenue teams in analysis paralysis. Teams can see what should happen but lack tools to make it happen systematically and consistently.

Research from various sources indicates that sales teams save 4-5 hours per week when manual processes are automated, with CRM automation reducing administrative tasks by up to 80%. However, these benefits only materialize when systems actively orchestrate workflows rather than simply storing data.

Traditional approaches rely too heavily on human coordination between systems. When revenue execution depends on manual handoffs, delays and errors become inevitable, especially as deal complexity increases.

Contemporary revenue challenges require platforms designed for execution rather than just storage. Teams need real-time quote-to-cash execution that connects every step from initial inquiry through service delivery.

Unified workflows across sales, finance, and service eliminate the handoff delays that plague traditional approaches. When systems orchestrate cross-functional processes automatically, revenue cycles accelerate and accuracy improves. Intelligent pricing capabilities enable dynamic adjustments based on market conditions and customer requirements.

Embedded rules, approvals, and pricing logic enable real-time decision-making without manual interventions. Systems that incorporate business logic directly into workflows reduce approval delays and eliminate calculation errors. Revenue lifecycle management solutions provide comprehensive frameworks for these integrated processes.

Automation that works inside existing CRM and ERP environments leverages current investments while adding execution capabilities. Rather than replacing systems of record, effective solutions extend their capabilities with workflow orchestration. Partner program integrations ensure compatibility across diverse technology ecosystems.

|

Aspect |

Traditional Approach |

Unified Revenue Operations |

|

Quote Generation |

3-7 days via multiple systems |

Same-day automated quotes |

|

Approval Workflows |

Email chains and manual routing |

Real-time embedded approvals |

|

Pricing Accuracy |

Manual calculations prone to errors |

Automated pricing with validation |

|

Service Handoffs |

Disconnected deal-to-delivery |

Seamless quote-to-service flow |

|

Revenue Recognition |

Month-end reconciliation |

Real-time revenue tracking |

|

Customer Experience |

Delayed responses and inconsistencies |

Immediate responses and accuracy |

Revenue teams often attempt to solve execution gaps through various approaches, but each alternative encounters specific limitations that prevent comprehensive solutions.

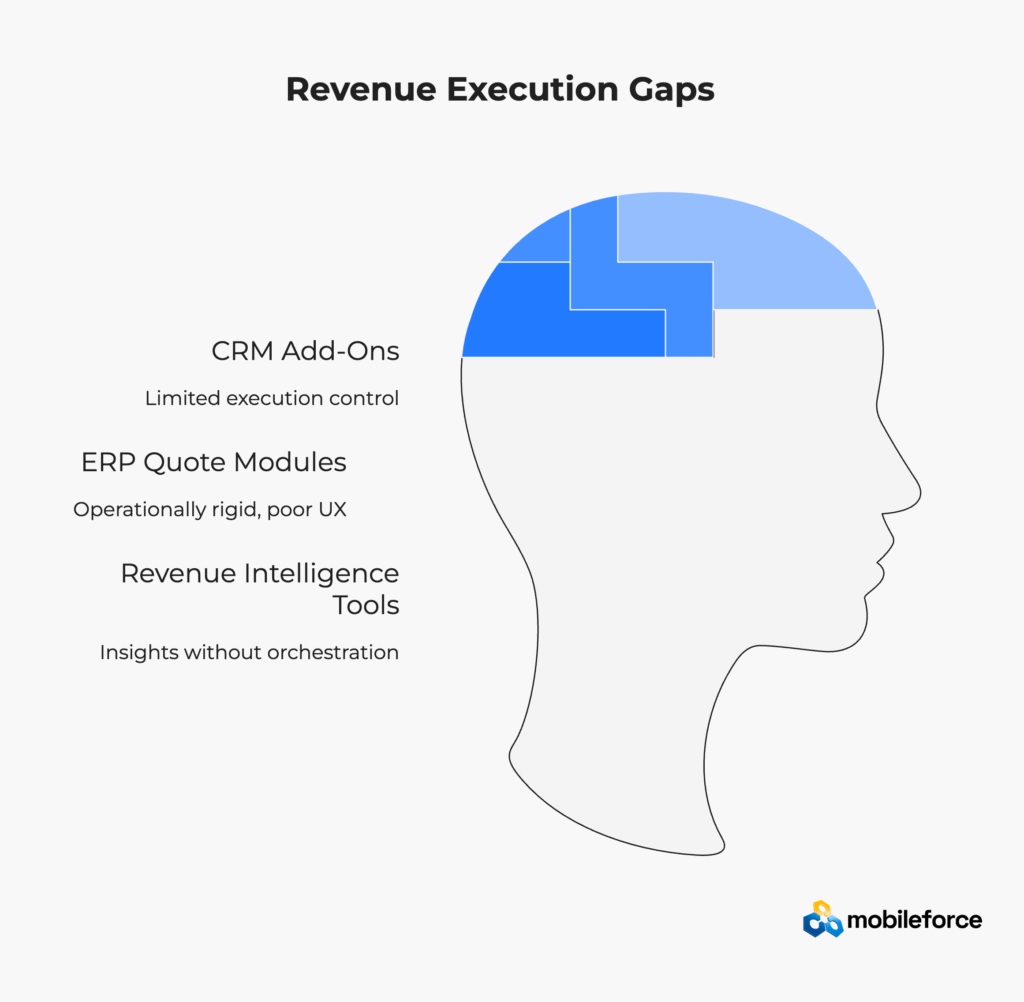

CRM platforms offer extensive add-on ecosystems that promise to extend functionality beyond basic data management. While these solutions provide improved reporting and some automation capabilities, they encounter significant limitations in execution contexts.

Heavy customization requirements make CRM add-ons expensive and time-consuming to implement. According to industry research, organizations often underestimate the administrative overhead required to maintain complex CRM configurations. Companies evaluating HubSpot versus Mobileforce capabilities find that specialized revenue execution platforms often provide better ROI than extensive CRM customization.

Limited execution control means most CRM add-ons excel at capturing and analyzing data but struggle with real-time workflow orchestration across multiple departments and systems. Organizations implementing Creatio CRM with integrated CPQ see better workflow coordination than traditional add-on approaches. Contract lifecycle management becomes particularly complex when managed through CRM add-ons rather than purpose-built platforms.

ERP systems frequently include quoting modules designed to leverage their comprehensive product and pricing data. These solutions offer financial accuracy and robust approval workflows, but encounter usability and flexibility constraints.

Financially accurate but operationally rigid describes most ERP quoting experiences. While calculations remain precise, the user experience often frustrates sales teams accustomed to more intuitive interfaces. Organizations implementing headless CPQ architectures can maintain ERP accuracy while providing modern user experiences.

Poor sales experience leads to adoption challenges and workaround behaviors. When core quoting tools are difficult to use, sales teams create shadow processes that undermine data integrity and workflow efficiency. Salesforce CPQ end-of-sale considerations highlight the importance of user-friendly interfaces in revenue execution platforms. Companies transitioning from legacy CPQ systems often prioritize improved user experience alongside functional capabilities.

Business intelligence platforms excel at analyzing revenue data and predicting future trends. However, they focus primarily on insight generation rather than execution facilitation.

Surface insights without orchestration capabilities limit the practical value of most revenue intelligence tools. Teams can see what should happen but lack integrated tools to make it happen systematically. Organizations implementing CPQ with CLM see better alignment between insights and execution capabilities.

Dependency on upstream data quality means revenue intelligence tools inherit the accuracy limitations of their source systems. When underlying data comes from manual processes, insights may be misleading or incomplete. Companies with secure CPQ implementations ensure data integrity at the source rather than attempting to clean data downstream. Psychology of pricing considerations become particularly important when revenue intelligence identifies pricing optimization opportunities.

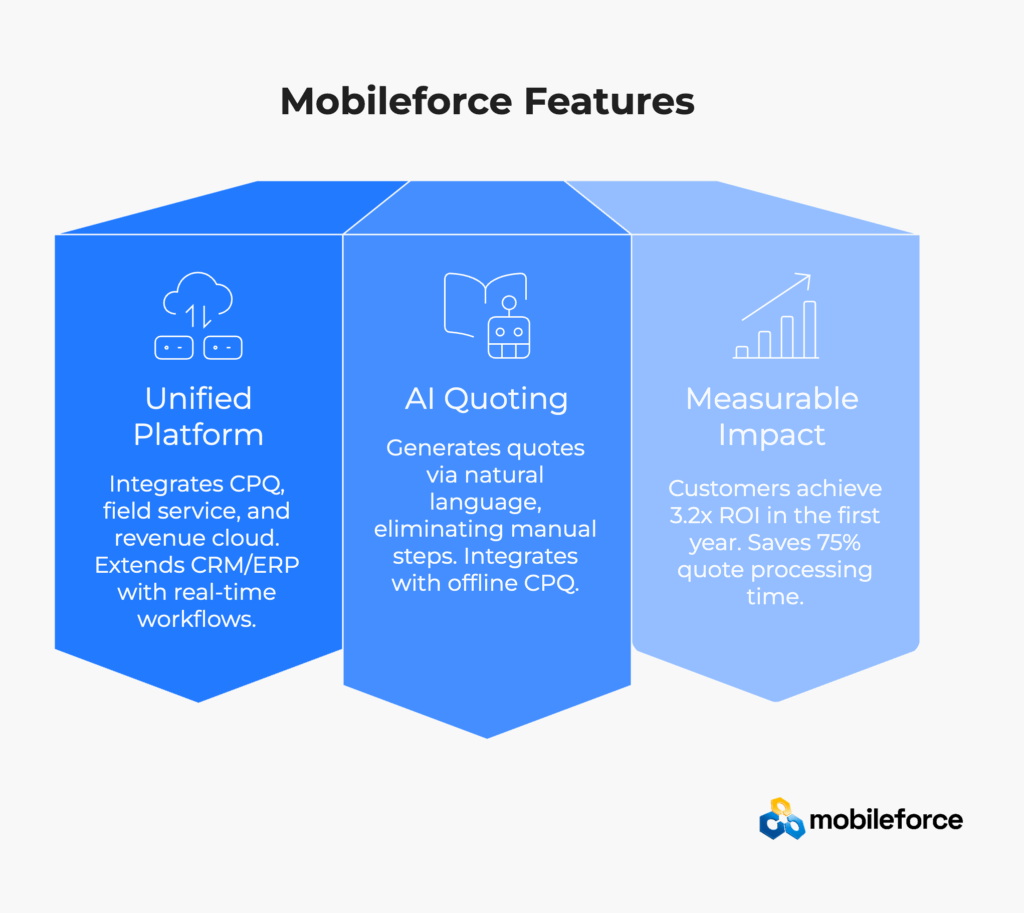

Modern revenue execution requires platforms specifically designed to orchestrate workflows rather than just manage data. Mobileforce’s Revenue Operations Cloud addresses these challenges through unified quote-to-cash-to-service workflows that connect every step of the revenue cycle.

The Mobileforce platform integrates CPQ (Configure, Price, Quote), field service management, and revenue cloud capabilities into a single execution environment. Rather than replacing existing CRM and ERP systems, it extends their capabilities with real-time workflow orchestration.

Real-time integration with leading CRMs including HubSpot, Salesforce, SugarCRM, Creatio, and Microsoft Dynamics ensures seamless data flow without duplicate entry or synchronization delays. Enterprise HubSpot CPQ implementations demonstrate the platform’s ability to scale with growing organizations.

No-code configuration capabilities allow revenue teams to adapt workflows to complex business requirements without extensive technical resources or long implementation cycles. Organizations benefit from professional services during initial setup and ongoing optimization. Companies can also explore free trial options to evaluate platform capabilities before full implementation.

The AskCPQ AI assistant enables sales teams to generate complex quotes through natural language requests, eliminating the manual configuration steps that typically slow quote generation. Advanced implementations integrate with offline CPQ capabilities for field sales teams without consistent internet connectivity.

AI-powered product recommendations analyze customer history and requirements to suggest optimal configurations and identify upselling opportunities automatically. What exactly is CPQ functionality becomes clearer when enhanced with intelligent recommendations and automated workflows.

Automated pricing validation ensures quotes remain within margin guidelines and approval requirements while accelerating response times to competitive levels. Organizations implementing Conga CPQ alternatives often prioritize these validation capabilities for improved margin protection.

Organizations implementing Mobileforce’s unified revenue execution platform report significant improvements across key performance indicators:

According to data from the company’s homepage, customers achieve an average 3.2x return on investment within the first year, with implementations typically completed within 25-47 days rather than months.

Time savings of 75% in quote processing allow sales teams to focus on relationship building and deal advancement rather than administrative tasks.

Quote generation speed improvements of 40% enable teams to respond to opportunities within competitive timeframes while maintaining accuracy and professionalism.

Real-world applications of unified revenue execution platforms demonstrate the practical benefits available to revenue teams across different industries and business models.

A mid-market industrial equipment manufacturer struggled with complex product configurations and lengthy approval processes that extended quote cycles beyond competitive thresholds. Sales teams needed to coordinate between engineering, pricing, and finance departments for every proposal.

Challenge: Complex pricing calculations, engineering approvals, and financial reviews extended quote cycles to 10-15 business days, causing lost opportunities in competitive situations.

Execution Approach: Implementation of unified quote-to-cash workflows that embedded pricing logic, approval rules, and product configuration guidance directly into the sales process.

Measurable Outcomes: Quote cycle compression to 2-3 business days, reduced pricing errors through automated validation, improved quote accuracy through integrated product configurators, and cleaner ERP handoff with pre-validated data.

A technology services company faced disconnected workflows between sales and service delivery teams. Deals closed successfully but service implementation frequently encountered issues due to incomplete or inaccurate information handoffs.

Challenge: Disconnected deal-to-delivery workflows created service delays, customer satisfaction issues, and additional costs for project corrections.

Execution Approach: Implementation of quote-to-cash-to-service workflows that maintained deal context throughout the entire customer lifecycle.

Measurable Outcomes: Improved service delivery consistency, reduced project startup delays, enhanced customer satisfaction scores, and decreased costs associated with service delivery corrections. Organizations implementing integrated field service management alongside sales processes see additional benefits from coordinated sales-to-service handoffs.

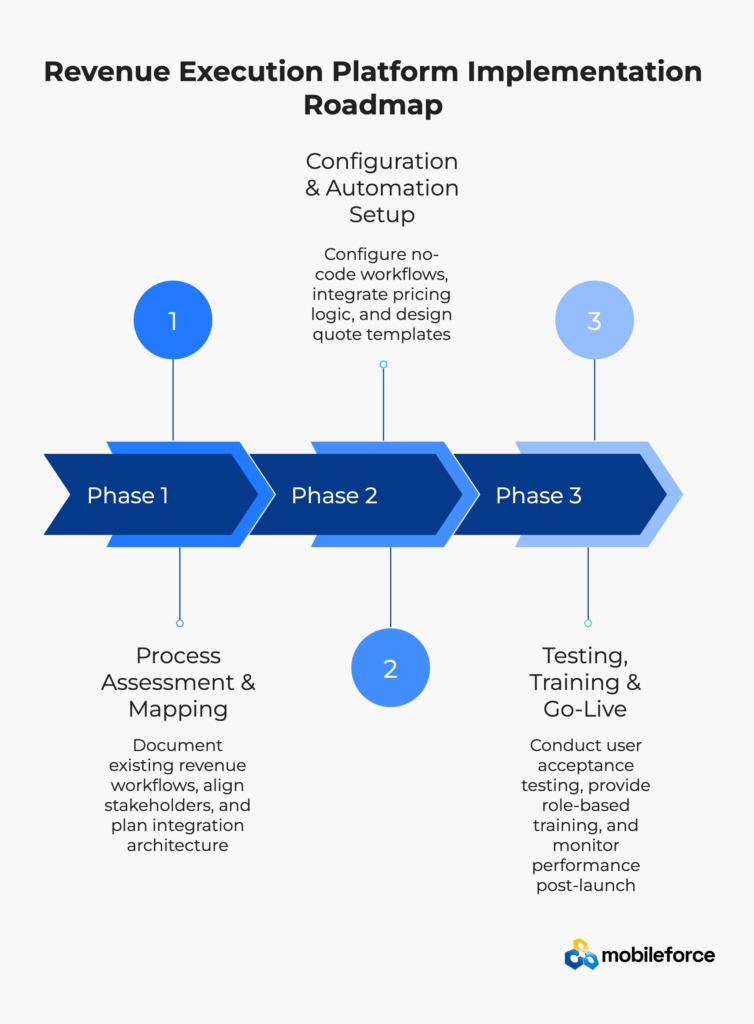

Organizations transitioning from systems of record to revenue execution platforms need structured implementation methodologies that minimize disruption while maximizing value realization. Modern revenue operations software deployment follows proven frameworks that ensure successful adoption and measurable outcomes.

Current State Documentation Effective implementations begin with comprehensive mapping of existing revenue processes, including quote creation workflows, approval hierarchies, pricing methodologies, and customer handoff procedures. This documentation identifies specific execution gaps that revenue automation can address. CPQ quoting for manufacturing requires particularly detailed process mapping due to product complexity.

Stakeholder Alignment and Requirements Gathering Revenue execution software impacts multiple departments beyond sales, including finance, operations, and customer service. Successful implementations involve stakeholders from all affected areas to ensure unified workflow requirements and shared success metrics. Organizations often benefit from professional services support during stakeholder alignment phases.

Integration Architecture Planning Modern revenue execution platforms integrate with existing CRM and ERP investments rather than replacing them. Technical planning should address data synchronization requirements, API capabilities, and security protocols that maintain system integrity throughout implementation. CPQ with ERP integration requires careful architecture planning for optimal performance.

No-Code Workflow Configuration Leading revenue execution platforms provide no-code configuration capabilities that allow business users to define approval workflows, pricing rules, and quote templates without technical development requirements. This approach accelerates implementation while enabling business teams to maintain ongoing workflow optimization. Organizations often benefit from migration services when transitioning from legacy systems to modern no-code platforms.

Pricing Logic Integration Automated pricing engines require configuration that reflects current business rules while adding dynamic capabilities for complex scenarios. Effective implementations establish pricing hierarchies, discount approval limits, and margin protection rules that prevent revenue leakage through automated validation. Companies with sophisticated pricing strategies often implement smart discounting engines to optimize deal profitability.

Quote Template and Document Generation Professional quote generation requires templates that reflect brand standards while accommodating complex product configurations. Revenue execution software should provide flexible document generation that produces professional proposals directly from configured workflow processes.

User Acceptance Testing with Real Scenarios Implementation success depends on testing with actual deal scenarios rather than simplified examples. Organizations should validate complex configurations, edge cases, and integration functionality before full deployment to prevent post-implementation disruptions. UX considerations for CPQ implementations play a critical role in user acceptance testing success.

Role-Based Training and Adoption Support Different user roles require tailored training that focuses on relevant workflow areas. Sales representatives need training on quote generation and customer interaction features, while managers require approval workflow and reporting capabilities training. CPQ administrators particularly benefit from comprehensive platform training to support ongoing optimization.

Performance Monitoring and Optimization Post-implementation success requires ongoing monitoring of key performance indicators including quote cycle times, approval delays, pricing accuracy, and revenue leakage metrics. Continuous optimization ensures that revenue execution platforms deliver sustained value improvement. Organizations implementing hybrid cloud CPQ require additional monitoring for performance across distributed architectures.

Revenue teams can assess whether they need systems of action by evaluating current workflow performance and identifying execution bottlenecks.

|

Warning Sign |

Impact Level |

Action Required |

|

Quotes created outside CRM systems |

High |

Immediate workflow integration needed |

|

Approval processes via email/spreadsheets |

High |

Embedded approval workflows required |

|

Service teams lack deal context post-close |

Medium |

Quote-to-service integration essential |

|

Revenue accuracy improving but speed stagnant |

Medium |

Execution layer implementation needed |

|

Manual pricing calculations and validations |

High |

Automated pricing and validation critical |

|

Cross-department coordination delays |

Medium |

Unified workflow orchestration beneficial |

Quote Generation Process: Are quotes created outside the CRM system due to complexity or usability limitations? When teams bypass primary systems, it indicates execution gaps that data alone cannot solve.

Approval Workflows: Do approvals live in email chains or spreadsheet-based processes rather than integrated systems? Manual approval routing creates delays and reduces visibility into deal status.

Service Integration: Does the service team lack complete deal context after sales closure? Disconnected handoffs indicate missing workflow integration between revenue functions.

Execution Speed vs. Data Quality: Is revenue data accuracy improving while execution speed remains constant? This pattern suggests strong systems of record with weak systems of action.

Revenue teams answering “yes” to multiple assessment questions likely need systems of action to complement their existing data infrastructure.

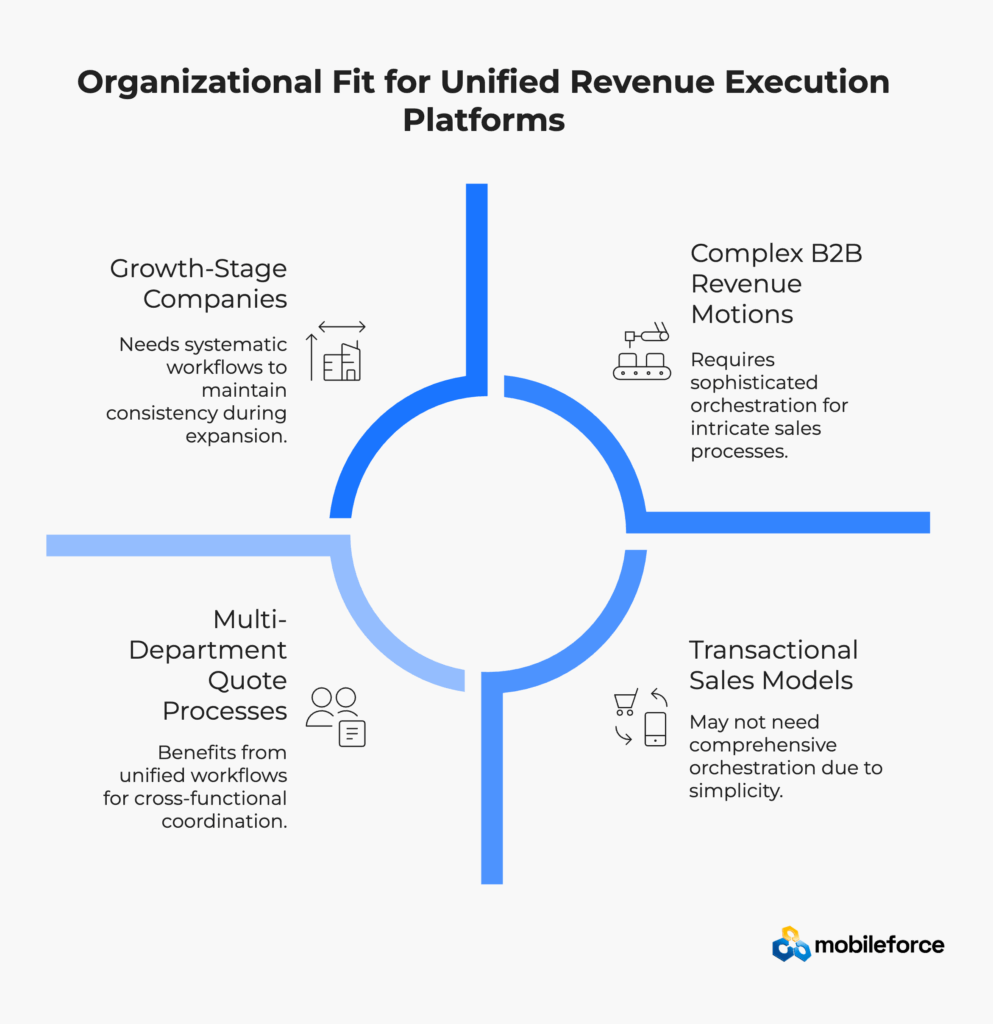

Unified revenue execution platforms provide the most value for specific organizational profiles and business models, while simpler approaches may suffice for others.

Complex B2B Revenue Motions: Organizations with multi-step sales processes, complex product configurations, or extensive approval requirements benefit significantly from workflow orchestration capabilities. Manufacturing companies with intricate product lines see particular value from automated configuration management.

Multi-Department Quote Processes: Companies requiring coordination between sales, engineering, finance, and service teams see substantial efficiency gains from unified workflows. Revenue operations teams often drive these cross-functional initiatives for systematic improvement.

Sales Plus Service Revenue Models: Organizations generating revenue through both initial sales and ongoing service delivery need integrated quote-to-cash-to-service workflows. Companies implementing industrial business service strategies particularly benefit from unified platforms.

Growth-Stage Companies: Rapidly scaling organizations benefit from systematic workflow orchestration that maintains consistency as teams expand. SaaS growth strategies often require sophisticated revenue execution capabilities.

Transactional Sales Models: Simple SMB sales with flat pricing, minimal customization, and straightforward approval processes may not require comprehensive workflow orchestration. However, even smaller organizations implementing CPQ software alternatives should evaluate future scaling needs.

Single-Department Revenue Functions: Organizations where sales teams operate independently without cross-functional coordination needs may find existing CRM capabilities sufficient. Sales teams focused on efficiency can still benefit from basic automation capabilities.

Very Early Stage Companies: Startups with limited complexity and small teams might benefit more from establishing basic CRM processes before adding execution layers. Free trial programs allow early-stage companies to explore advanced capabilities without immediate commitment.

This transparency about fit helps organizations make informed decisions based on their specific requirements rather than pursuing solutions that exceed their actual needs.

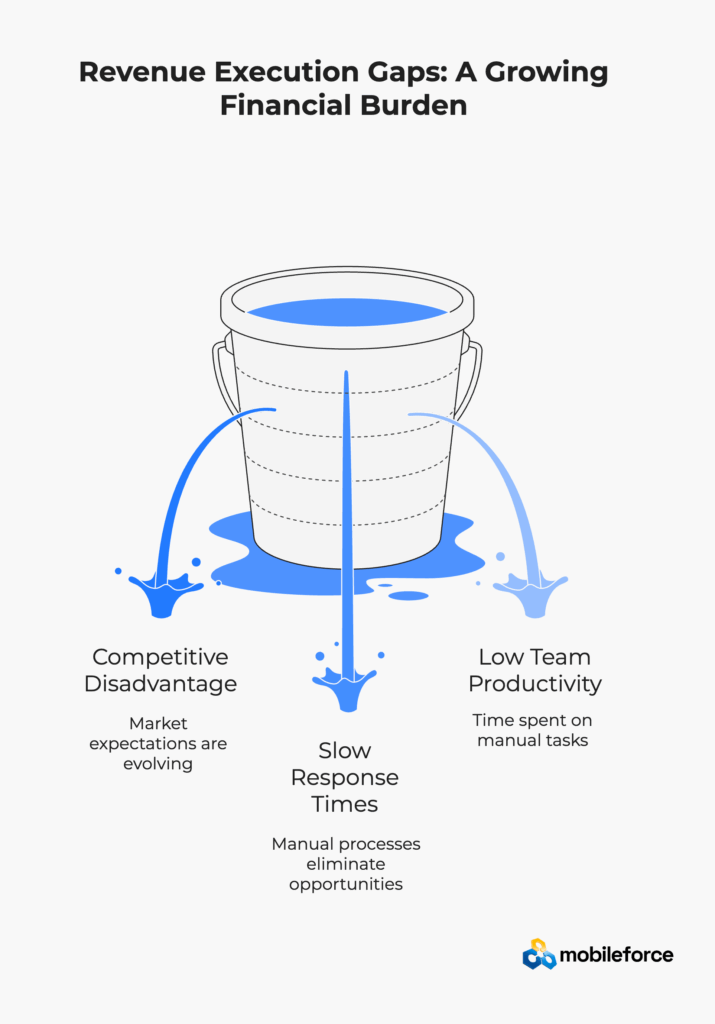

The financial impact of execution gaps compounds over time, making the cost of maintaining status quo approaches increasingly expensive relative to systematic solutions.

Revenue teams operating primarily with systems of record face accelerating competitive disadvantages as market expectations continue evolving. Research from Clari indicates that companies lose an average of 16-26% of expected revenue to various forms of revenue leakage.

Customer expectations for rapid responses continue increasing, making manual processes unsustainable for competitive positioning. When prospects expect same-day quotes, seven-day manual processes eliminate opportunities before teams can compete effectively.

Internal team productivity suffers when significant time is spent coordinating between systems rather than engaging with customers. According to multiple industry sources, sales representatives spend 32% of their time on manual data entry and administrative tasks rather than selling activities.

Modern revenue success requires platforms designed for execution rather than just storage. Organizations implementing unified revenue execution platforms report measurable improvements in quote speed, pricing accuracy, customer experience, and internal productivity.

The transition from systems of record to systems of action represents a strategic evolution rather than a technology replacement. Successful implementations leverage existing CRM and ERP investments while adding the workflow orchestration capabilities that drive revenue results.

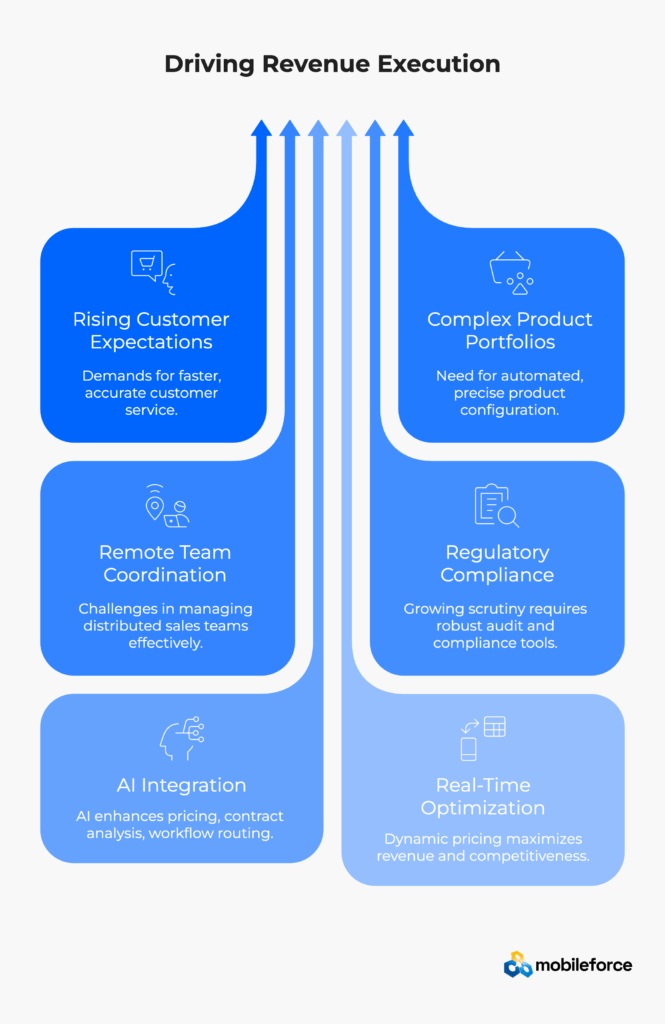

The revenue operations landscape continues evolving rapidly as organizations recognize the limitations of traditional data-centric approaches and embrace workflow orchestration platforms that drive measurable business outcomes.

Rising Customer Expectations for Speed and Accuracy Modern B2B buyers expect the same responsiveness they experience in consumer transactions, putting pressure on revenue teams to deliver accurate quotes within hours rather than days. Organizations that maintain manual quote processes face increasing competitive disadvantage as buyer expectations continue accelerating beyond traditional timelines. Sales teams implementing modern CPQ report significant improvements in customer responsiveness.

Complex Product Portfolios Requiring Advanced Configuration As companies expand product offerings and customization options to meet diverse market demands, manual configuration and pricing processes become unsustainable. Revenue execution platforms provide automated product configuration engines that handle complex scenarios while maintaining pricing accuracy and margin protection. Manufacturing companies with intricate product lines see particular value from advanced configuration capabilities.

Remote and Distributed Sales Team Coordination Challenges The shift toward distributed sales operations requires systematic workflow coordination that doesn’t depend on manual handoffs or informal communication channels. Revenue execution software provides centralized workflow orchestration that maintains process consistency regardless of team location or structure. Organizations adopting mobile sales solutions enable distributed teams to maintain productivity from any location.

Increasing Regulatory Compliance and Audit Requirements Organizations face growing regulatory scrutiny around pricing accuracy, quote validation, and revenue recognition processes. Automated revenue execution platforms provide comprehensive audit trails and validation controls that support compliance requirements while reducing manual documentation burdens. Companies implementing ASC 606 compliance through CPQ software achieve better regulatory adherence with less manual effort.

Enterprise Software Research Findings According to recent analysis from leading industry research firms, organizations implementing comprehensive revenue execution platforms achieve average productivity improvements of 35-50% within the first year. These gains result primarily from eliminating manual coordination delays rather than replacing human decision-making capabilities.

Revenue Operations Best Practices Leading revenue operations professionals emphasize the importance of treating revenue execution as a strategic capability rather than a tactical efficiency improvement. Organizations that achieve sustained competitive advantage through revenue execution platforms focus on systematic workflow optimization rather than incremental process improvements.

Technology Integration Strategies Successful revenue execution implementations leverage existing CRM and ERP investments while adding orchestration capabilities that connect systems for unified workflow management. This integration approach delivers faster value realization compared to wholesale system replacements that require extensive data migration and user retraining.

Artificial Intelligence Integration in Revenue Processes Next-generation revenue execution platforms incorporate AI capabilities for predictive pricing optimization, automated contract analysis, and intelligent workflow routing based on deal characteristics and historical success patterns. These AI enhancements augment human expertise rather than replacing strategic decision-making. Organizations implementing AI-powered quoting solutions see dramatic improvements in quote accuracy and speed.

Real-Time Revenue Optimization and Dynamic Pricing Advanced revenue execution software enables dynamic pricing adjustments based on market conditions, inventory levels, competitive positioning, and customer behavior patterns. This real-time optimization capability helps organizations maximize revenue while maintaining competitive responsiveness.

Comprehensive Customer Lifecycle Management The evolution toward quote-to-cash-to-service platforms reflects growing recognition that revenue optimization extends beyond initial sales transactions to include ongoing customer value realization and retention strategies. Service-integrated approaches create additional revenue opportunities while strengthening customer relationships.

What is the difference between systems of record and systems of action?

Systems of record focus on capturing, storing, and organizing business data with accuracy and compliance, functioning primarily as centralized databases. CRM and ERP systems serve as systems of record by maintaining customer information, transaction history, and business rules. Systems of action utilize this stored data to orchestrate real-time workflows, automate decision-making, and coordinate cross-departmental activities that drive immediate business outcomes. Revenue execution platforms function as systems of action by automating quote-to-cash processes, embedded approval workflows, and integrated pricing calculations that eliminate manual coordination delays.

Why aren’t CRM systems sufficient for modern revenue operations?

CRM systems excel at data capture and reporting but lack the workflow orchestration capabilities required for complex revenue processes. While CRM platforms improve data access and forecast accuracy by up to 42%, they don’t automate pricing calculations, embedded approval routing, or real-time coordination between sales, engineering, and finance departments. Organizations with complex products, multi-step approvals, or sales-plus-service models need revenue execution software that complements CRM data investments with automated workflow capabilities that prevent deal delays and execution gaps. Sales teams implementing advanced automation report significant improvements in deal velocity and customer satisfaction. Companies with partner channel programs particularly benefit from standardized quoting processes across distributed sales networks.

How much revenue leakage do most companies experience annually?

Research indicates that 42% of companies experience measurable revenue leakage, with businesses typically losing 1-5% of annual EBITDA through inefficient revenue processes, pricing errors, and manual workflow delays. Well-managed organizations with comprehensive revenue operations target less than 1-2% leakage through automated pricing validation and systematic quote-to-cash processes, while leakage above 3-5% indicates structural problems requiring revenue execution platforms and process improvements.

How do revenue execution platforms prevent revenue leakage?

Revenue execution platforms prevent revenue leakage through multiple automated controls including real-time pricing validation, embedded approval workflows, automated margin protection rules, systematic deal handoff processes between sales and service teams, and comprehensive audit trails that identify potential revenue gaps before they impact financial results. These platforms eliminate manual calculation errors, reduce quote delays that lose competitive positioning, and ensure accurate revenue recognition through integrated quote-to-cash-to-service workflows. Organizations implementing unified revenue operations see measurable reductions in revenue leakage across all touchpoints. Advanced platforms also provide quote personalization capabilities that maximize deal value while maintaining competitive pricing.

Can revenue execution software integrate with existing CRM and ERP investments?

Yes, modern revenue execution platforms integrate seamlessly with existing CRM systems including Salesforce, HubSpot, Microsoft Dynamics, and major ERP platforms through real-time API connections and data synchronization. This integration approach leverages current data investments while adding workflow orchestration capabilities that complement rather than replace existing systems. Organizations maintain their established data governance and reporting while gaining automated revenue execution workflows that bridge system gaps. Comprehensive CRM integration guides help ensure seamless implementation.

What ROI can organizations expect from revenue execution platform implementation?

Organizations typically achieve 250-400% ROI within the first year through quantifiable improvements including 75% time savings in quote processing, 40% faster quote delivery, 60-80% reduction in pricing errors, and prevention of 1-3% annual revenue leakage. Additional benefits include improved sales team productivity, enhanced customer experience through faster responses, and reduced administrative costs through automated workflows. Mid-market companies implementing modern CPQ often achieve payback within 6-9 months of full revenue execution software deployment.

What are the key warning signs that indicate need for revenue execution software?

Critical indicators include quotes being consistently created outside CRM systems due to complexity limitations, approval processes happening through email chains rather than embedded workflows, service teams lacking complete deal context after sales closure, pricing calculations being performed manually in spreadsheets despite CRM investments, and revenue data accuracy improving while execution speed remains stagnant. Additional warning signs include cross-departmental coordination delays, inconsistent quote formatting across sales teams, and missed opportunities due to slow response times in competitive situations. RevOps teams often identify these patterns first when analyzing sales process efficiency. Organizations experiencing legacy CPQ system limitations particularly notice these execution gaps.

How long does revenue execution platform implementation typically take?

Modern revenue execution software with no-code configuration capabilities requires 25-47 days for full deployment, compared to traditional ERP implementations that may extend 6-18 months. Implementation timeline depends on workflow complexity, integration requirements with existing CRM and ERP systems, user training needs, and organizational change management requirements. Phased rollout approaches and migration strategies can deliver initial value within 30 days while comprehensive deployments including advanced automation typically complete within 60-90 days.

Do small and mid-market businesses need revenue execution platforms?

Small businesses with simple transactional sales models and standard pricing may find CRM process optimization sufficient for their immediate needs. However, companies with complex products, multi-step approval requirements, configurable solutions, or combined sales-plus-service revenue models benefit from workflow orchestration regardless of organization size. The determining factor is process complexity and revenue execution requirements rather than company size in evaluating revenue execution platform value. CPQ administrators can help organizations determine appropriate platform capabilities.

What specific features should organizations prioritize when evaluating revenue execution software?

Essential capabilities include automated pricing engines with dynamic discount rules and margin protection, embedded approval workflows with role-based routing and escalation, real-time CRM integration with bidirectional data synchronization, professional quote generation with configurable templates, comprehensive revenue leakage prevention controls, and detailed analytics for performance monitoring. Additional valuable features include mobile accessibility for field sales teams, AI-powered assistants for natural language quoting, and proven implementation methodologies with dedicated support resources.