Why predictive intelligence stalls—and how execution-first RevOps turns signals into revenue

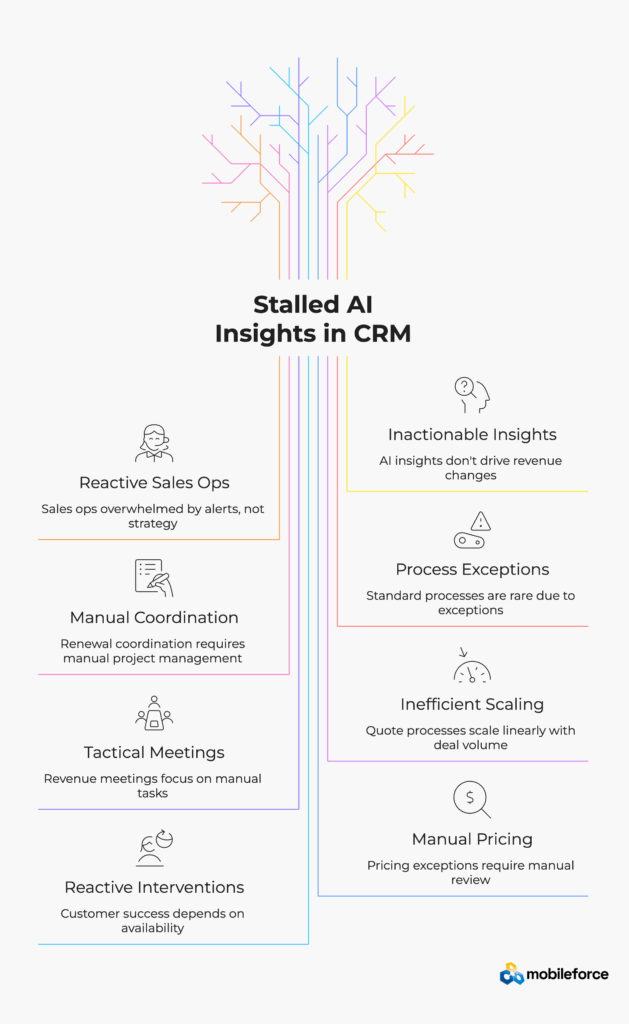

Most modern CRMs generate AI-driven insights about deals, customer behavior, and revenue forecasting, yet businesses still struggle with manual, inconsistent revenue execution. According to recent CRM research, while 91% of companies use CRM systems, most insights remain trapped as alerts requiring manual follow-through.

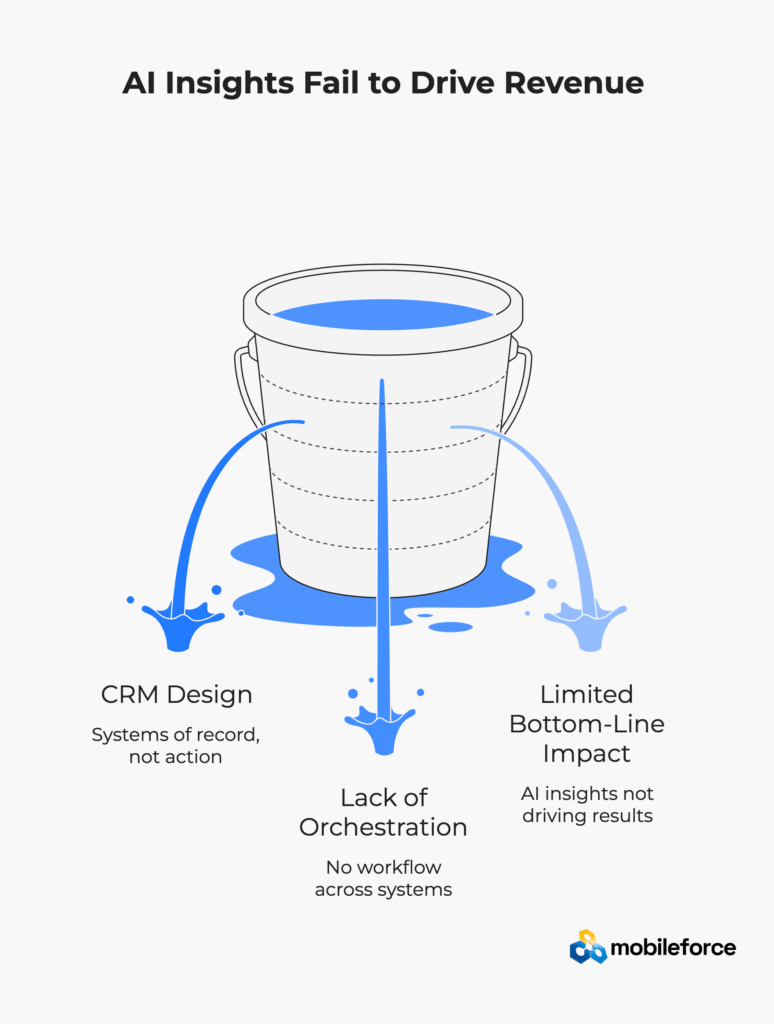

The core problem isn’t the quality of AI insights—it’s that CRMs are designed as systems of record, not systems of action. While CRMs excel at capturing data and surfacing predictions, they lack the infrastructure to orchestrate revenue workflows across CPQ systems, contracts, billing, and field service operations. RevOps execution platforms bridge this gap by translating AI insights into automated quote generation, policy enforcement, and cross-system orchestration that actually drives revenue outcomes.

According to McKinsey’s 2025 State of AI research, 88% of organizations now use AI regularly, yet only 39% report meaningful bottom-line impact at the enterprise level. Gartner research shows 75% of highest-growth companies will deploy RevOps models by 2025 specifically because execution-first approaches deliver 25-40% faster deal cycles and 60-80% fewer process errors compared to insight-only solutions.

The CRM insight-to-execution gap refers to the disconnect between AI-powered predictive analytics in customer relationship management systems and the manual, disjointed processes required to act on those insights across revenue operations. This gap manifests when CRM platforms excel at identifying opportunities, risks, and optimization strategies but fail to automate the resulting quote generation, approval workflows, contract amendments, and revenue process orchestration necessary to capitalize on those insights.

Revenue operations professionals define this gap through three key characteristics:

Organizations experiencing this gap often report improved forecast visibility without corresponding improvements in deal velocity, customer retention, or revenue predictability. The solution requires revenue execution platforms that can translate CRM intelligence into systematic, automated workflows across the complete quote-to-cash lifecycle.

“Our CRM tells us everything that’s going wrong, but nothing changes.” This frustration echoes across boardrooms as companies invest heavily in AI-powered CRM insights yet see minimal impact on actual revenue execution and deal acceleration.

According to Fortune Business Insights, the global CRM market is projected to grow from $101.41 billion in 2024 to $262.74 billion by 2032. Much of this growth centers on AI capabilities—with 83% of companies now using AI in their CRM workflows and 75% of the highest growth companies deploying RevOps models by 2025.

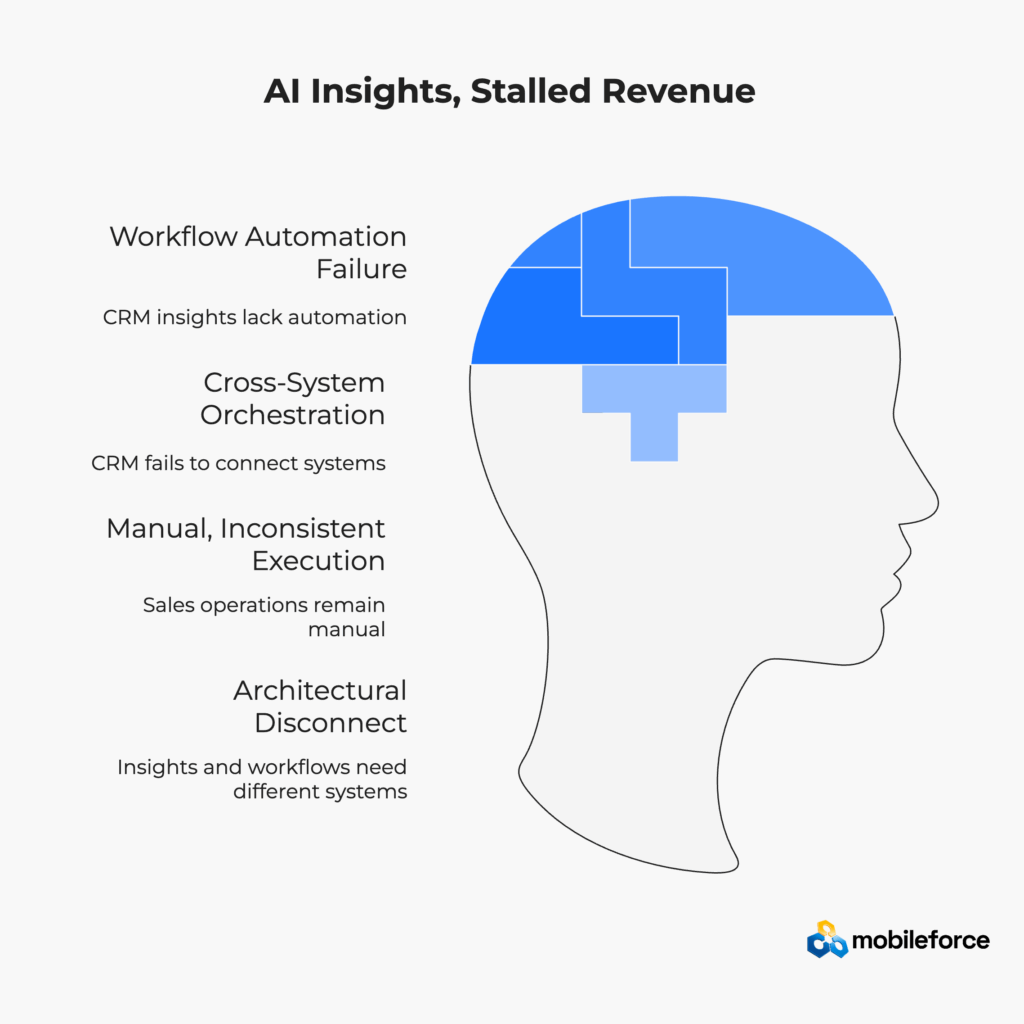

The revenue intelligence paradox has become clear: while modern CRM platforms excel at generating predictive analytics and customer insights, they consistently fail at revenue workflow automation and cross-system orchestration. Sales teams using advanced AI-powered CRMs report having better visibility into pipeline health and customer behavior, yet 70% of CRM projects fail due to execution gaps, and organizations struggle to turn insights into automated revenue workflows.

Yet here’s the disconnect: while CRMs surface increasingly sophisticated predictions about deal risk, churn probability, and pricing anomalies, actual revenue execution remains frustratingly manual and inconsistent. Sales operations teams still spend hours creating quotes, routing approvals, and coordinating renewals—despite having AI that supposedly identifies exactly what needs attention.

The issue isn’t that AI predictions are inaccurate. Modern CRM AI can predict deal closure probability with remarkable precision and flag at-risk customers weeks before churn signals appear. The fundamental problem is that generating revenue insights and executing revenue workflows require completely different system architectures and capabilities.

Ready to transform your AI insights into revenue execution? Schedule a demo to see how modern RevOps platforms make CRM intelligence actionable.

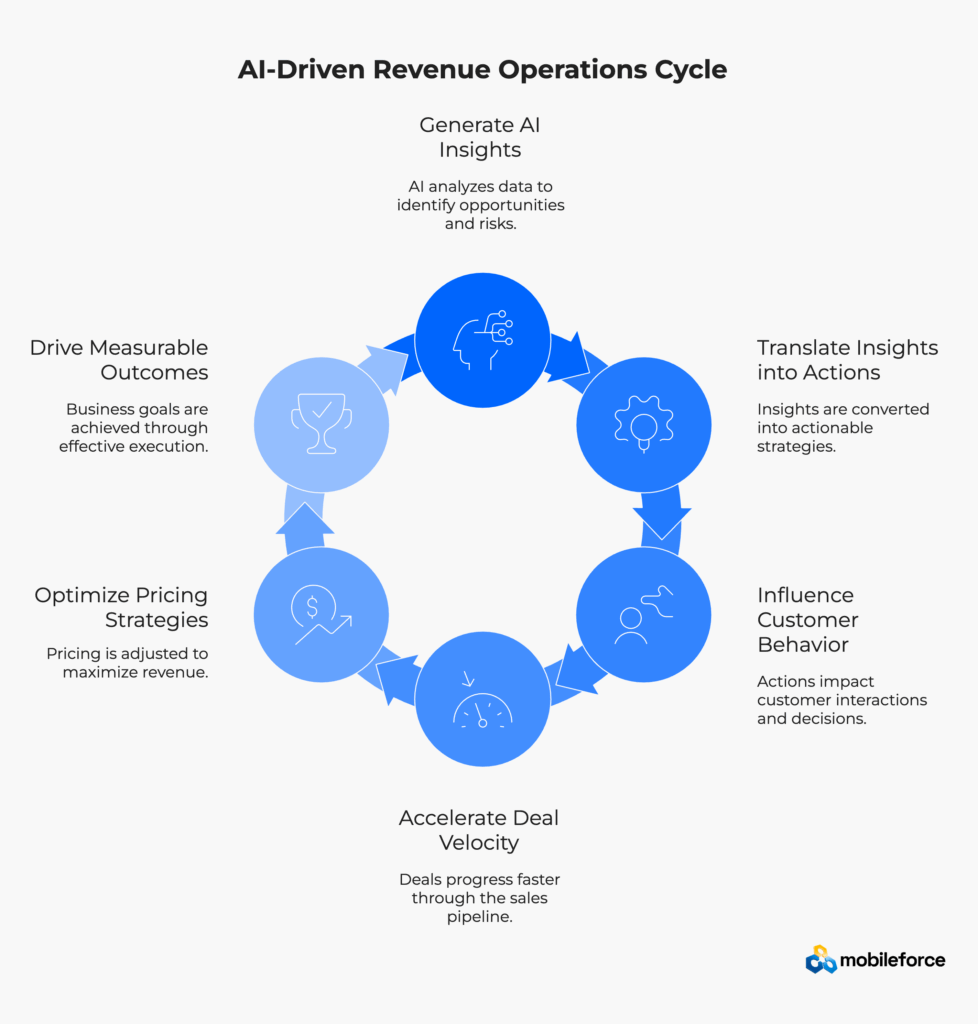

Understanding where revenue execution fails requires mapping the complete journey from AI insight to business outcome. We call this the Insight-to-Revenue Lifecycle—a systematic framework that reveals why traditional CRM platforms struggle with revenue workflow automation and cross-functional process orchestration.

Stage 1: Generate Insights AI models and machine learning algorithms analyze customer data, deal progression patterns, and market signals to create predictive analytics about deal probability, customer health scores, churn likelihood, pricing optimization opportunities, and resource allocation needs. Modern CRM platforms excel at this stage through advanced analytics engines and predictive modeling capabilities.

Stage 2: Interpret Insights Business intelligence dashboards, reporting interfaces, and alert systems surface AI-generated recommendations to revenue teams through user-friendly visualizations, automated notifications, and customizable reporting views. CRM platforms typically provide sophisticated data visualization and recommendation engines for this interpretation layer.

Stage 3: Decide Revenue operations professionals, sales managers, and account executives apply business judgment, strategic context, and market knowledge to determine appropriate responses to AI insights. This stage involves human decision-making, stakeholder consultation, and strategic planning based on interpreted data and organizational priorities.

Stage 4: Execute Revenue workflows are triggered across quote-to-cash systems including CPQ platforms, contract lifecycle management, billing automation, service delivery coordination, and customer success interventions. This stage requires cross-system orchestration and workflow automation capabilities that most CRM platforms don’t provide natively.

Stage 5: Enforce Business policies, approval requirements, compliance controls, pricing guidelines, and operational standards are applied consistently across revenue processes through automated enforcement mechanisms, exception handling, and audit trail maintenance. This enforcement requires policy engines and governance frameworks beyond typical CRM functionality.

Stage 6: Learn Executed actions generate performance data, outcome metrics, and process feedback that inform future AI model training, workflow optimization, and strategic decision-making. This learning loop requires sophisticated analytics and continuous improvement capabilities for revenue process optimization.

Research shows that organizations struggle significantly with revenue execution gaps. According to CRM.org’s comprehensive analysis, these gaps cluster heavily in stages 4-6. While CRM platforms provide excellent capabilities for insight generation, interpretation, and decision support, they lack the architectural foundation for cross-system execution, policy enforcement, and workflow orchestration.

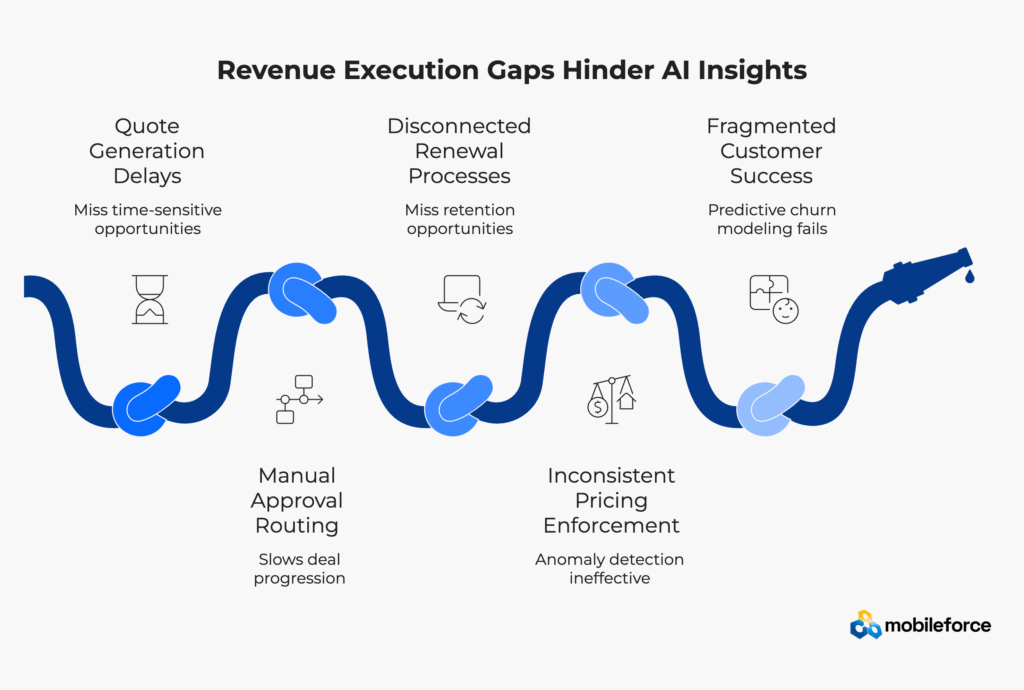

Common execution failure patterns include:

This isn’t a technology problem—it’s an architectural mismatch between what CRM systems are designed to do (capture and analyze data) and what revenue execution requires (orchestrate cross-functional workflows).

The fundamental challenge lies in how CRMs were conceived and architected. Traditional CRM platforms prioritize data integrity, analytical capabilities, and user interface design. These systems excel at customer data management, sales pipeline visibility, and predictive analytics, but they’re not structured to orchestrate complex revenue workflows across multiple systems and departments.

What makes CRMs excellent for insights but poor for execution:

Data-centric architecture: CRM systems are built around customer records, opportunity tracking, and historical data analysis rather than workflow orchestration and cross-system integration. Their core strength lies in maintaining comprehensive customer profiles and generating business intelligence rather than automating revenue processes.

User interface optimization: CRMs prioritize dashboard usability, report generation, and data visualization for human consumption rather than API-first design for automated workflow triggers and system-to-system communication.

Single-system boundaries: Most CRM platforms operate within their own ecosystem and rely on third-party integrations for revenue execution capabilities, creating coordination gaps between insight generation and action execution.

When your CRM AI flags that a high-value deal shows early warning signs of stagnation, the system can alert your sales team and update probability scores. But it typically can’t automatically trigger dynamic pricing adjustments, expedite contract amendment workflows, or coordinate service delivery schedules across your quote-to-cash technology stack. That execution gap requires human middleware—usually your already-overwhelmed RevOps team.

AI insights become actionable only when systems have the authority and connectivity to execute decisions automatically across revenue operations workflows. Consider these common revenue execution scenarios where CRM insights fail to drive automatic action:

Deal velocity optimization: CRM AI identifies that enterprise opportunities with specific characteristics close 34% faster when alternative payment terms are offered. However, generating quotes with modified payment structures requires manual CPQ configuration, approval routing through finance teams, and contract term coordination—processes that can take days despite having the insight immediately.

Customer expansion opportunities: Predictive models detect that accounts showing specific usage patterns have an 73% likelihood of accepting upsell offers within the next 30 days. But capitalizing on this insight requires manually coordinating between customer success teams, sales representatives, billing systems, and contract management—often causing the opportunity window to close before action occurs.

Churn prevention workflows: AI algorithms flag customers with declining engagement scores and predict 67% churn probability within 90 days. Yet triggering effective retention responses requires orchestrating outreach sequences, billing reviews, service interventions, and success manager escalations across disconnected systems that don’t automatically respond to CRM alerts.

Dynamic pricing enforcement: Machine learning models identify pricing anomalies and recommend optimal discount thresholds based on competitive analysis and deal characteristics. However, implementing these recommendations requires manual approval workflows, quote regeneration, and policy updates across CPQ systems that operate independently from CRM insights.

The problem isn’t that insights are wrong—it’s that they create expensive awareness without enabling systematic corrective action across revenue operations technology stacks.

When AI insights require human interpretation and manual execution, your RevOps team becomes the bottleneck. Recent surveys show that RevOps teams face significant bandwidth constraints as a major barrier to AI adoption.

This creates a perverse situation: more AI insights actually increase manual workload rather than reducing it. Every additional prediction requires human review, every recommendation needs manual follow-through, and every alert becomes another task on an already crowded operations backlog.

Transform your RevOps team from firefighting to strategic execution. Explore how automated revenue workflows can eliminate manual bottlenecks.

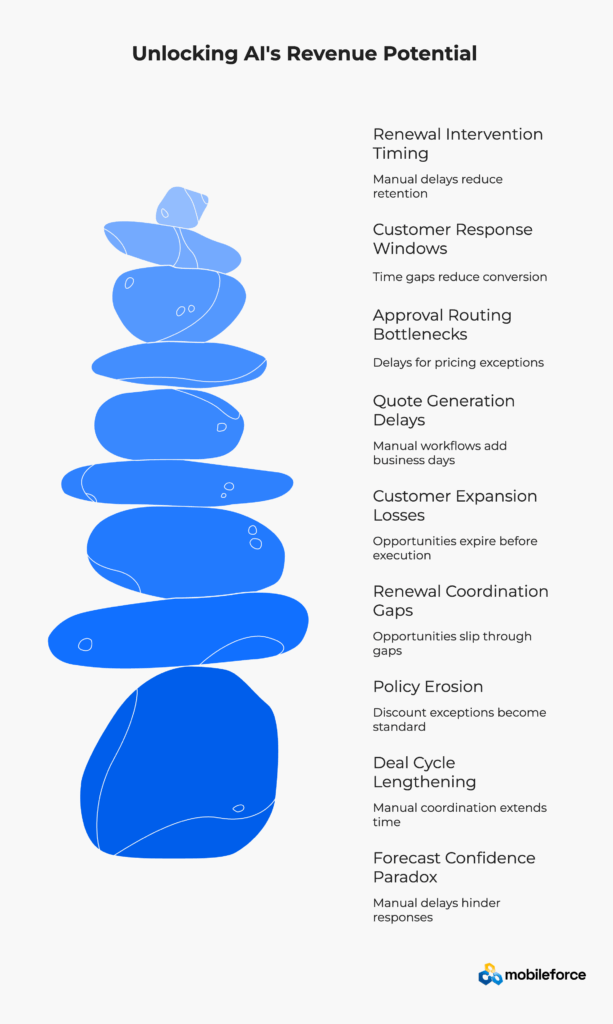

The financial impact of unexecutable insights extends beyond obvious inefficiencies. Organizations investing in AI-powered CRM capabilities without corresponding execution infrastructure face measurable revenue losses across multiple dimensions of sales performance and operational efficiency.

Revenue execution research from leading firms shows consistent patterns:

Forecast confidence paradox: Teams achieve 15-25% improvements in pipeline visibility and deal risk prediction accuracy, yet forecast accuracy improvements don’t translate into predictable revenue because manual execution delays prevent timely responses to AI-detected opportunities and risks.

Deal cycle lengthening: Despite knowing exactly what needs to happen to advance opportunities, manual coordination between sales operations, legal review, and customer success teams actually extends average time-to-close by 18-30% compared to automated revenue workflow orchestration.

Policy erosion and discount degradation: AI flags discount exceptions and pricing anomalies with 85-95% accuracy, but without automated enforcement mechanisms and approval workflow integration, exception requests become standard practice rather than genuine outliers, reducing average deal margins by 8-15%.

Renewal coordination gaps: Predictive models identify renewal risks 90-120 days in advance with 70-80% accuracy, but manual handoffs between sales representatives, customer success managers, and billing operations still allow 25-35% of flagged opportunities to slip through coordination gaps without intervention.

Customer expansion opportunity losses: AI models successfully identify upsell and cross-sell opportunities with 65-75% conversion potential, yet manual coordination requirements between sales, customer success, and product teams result in 40-50% of identified opportunities expiring before execution can occur.

According to Salesforce research, companies that implement CRM systems see an average sales increase of 29%, but this improvement occurs only when insights translate into changed behaviors, automated workflows, and systematic execution patterns. When insights remain trapped in dashboards without execution infrastructure, organizations typically see less than 8-12% of potential ROI from AI investments.

Revenue execution speed directly correlates with deal conversion rates and customer satisfaction scores. Organizations with insight-only AI face significant timing disadvantages compared to competitors with automated revenue workflow capabilities.

Measurable timing impacts include:

Revenue Scenario | AI Insight Speed | Manual Execution Time | Automated Execution Time | Revenue Impact |

Deal Risk Detection | Immediate | 2-5 days coordination | Real-time action trigger | 25-40% faster resolution |

Pricing Optimization | Real-time analysis | 1-3 days approval cycles | Automated enforcement | 12-18% margin improvement |

Churn Prevention | 90-day advance warning | 3-7 days manual outreach | Instant workflow activation | 35-50% retention increase |

Upsell Opportunity | Immediate identification | 5-10 days cross-team coordination | Synchronized execution | 60-75% conversion improvement |

Contract Amendment | Instant need detection | 7-14 days legal/approval process | Automated routing/generation | 70% faster completion |

This timing gap explains why even accurate AI insights often fail to drive revenue improvements—manual execution delays eliminate competitive advantages that AI insights were supposed to provide.

Execution Failure Type | AI Detection Accuracy | Manual Follow-up Success | Automated Success | Root Cause |

Pricing Policy Violations | 85-95% | 45-60% compliance | 95-99% compliance | Manual exception approval |

Deal Risk Escalation | 75-85% | 40-55% intervention | 80-90% intervention | Cross-team coordination gaps |

Renewal Process Gaps | 70-80% prediction | 60-70% retention | 85-95% retention | Manual handoff delays |

Upsell Opportunity Timing | 80-90% identification | 35-45% conversion | 75-85% conversion | Execution timing delays |

Contract Amendment Speed | 90-95% detection | 30-40% fast resolution | 85-95% fast resolution | Legal/approval bottlenecks |

Customer Success Interventions | 75-85% risk flagging | 50-65% effective response | 80-90% effective response | Resource coordination issues |

This pattern analysis demonstrates that execution infrastructure gaps, not AI insight accuracy, represent the primary revenue optimization bottleneck for modern revenue operations teams.

Many organizations respond to execution gaps by seeking more sophisticated CRM AI capabilities—enhanced predictive models, granular analytics, or real-time scoring. This approach misunderstands the core issue: execution gaps stem from architectural limitations, not analytical sophistication.

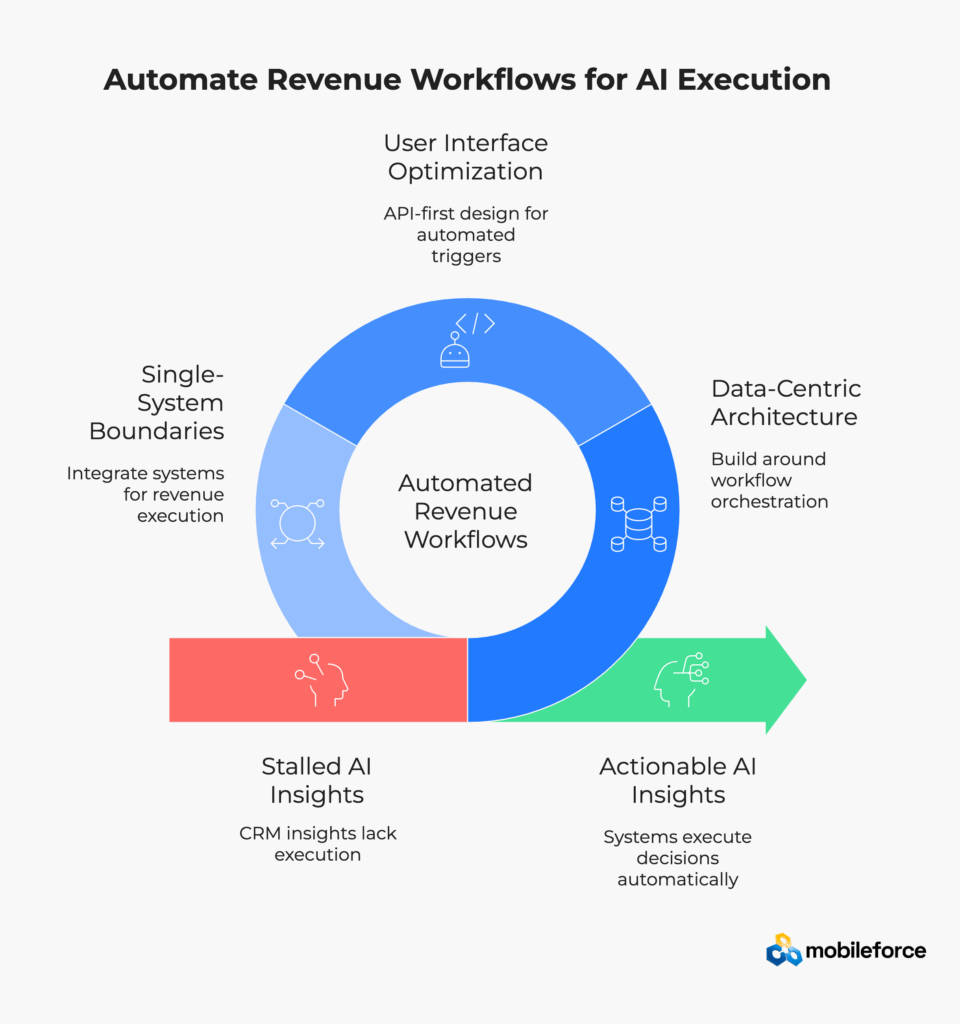

Modern CRM platforms excel at data analysis but struggle with workflow orchestration because they’re designed as systems of record rather than systems of action. Adding more AI to a system lacking execution authority doesn’t solve workflow orchestration challenges—it amplifies them by generating more insights requiring manual follow-through.

The fundamental mismatch: CRMs promise integration with CPQ platforms, contract management, and billing systems, but typically support one-way data sync rather than bi-directional workflow orchestration. They can notify about changes but can’t automatically trigger billing adjustments, contract amendments, or service delivery modifications based on AI insights.

This is where platforms like Mobileforce’s Revenue Operations Cloud provide architectural solutions—designed specifically for cross-system workflow execution rather than CRM customization attempts that create technical debt and system brittleness.

Ready to move beyond insights-only AI? Discover how execution-first RevOps transforms CRM intelligence into systematic revenue actions.

Revenue Operations represents a fundamental architectural shift from insight-focused to execution-focused revenue management. While traditional CRM thinking asks “what does our customer data tell us?”, modern RevOps frameworks ask “how do we systematically turn predictive insights into measurable revenue outcomes through automated workflow orchestration?”

According to Harvard Business Review research on AI implementation, successful companies excel at identifying and implementing AI use cases that deliver positive outcomes with lower risk.

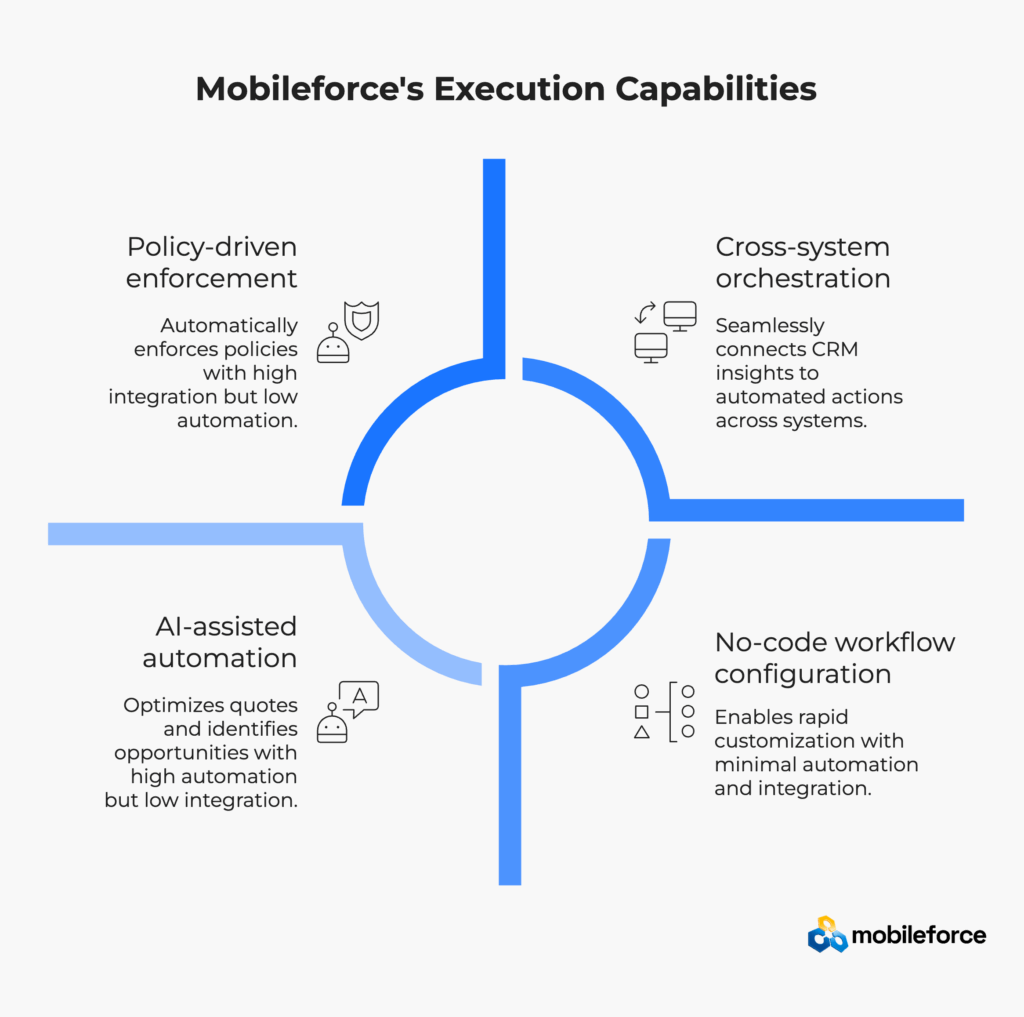

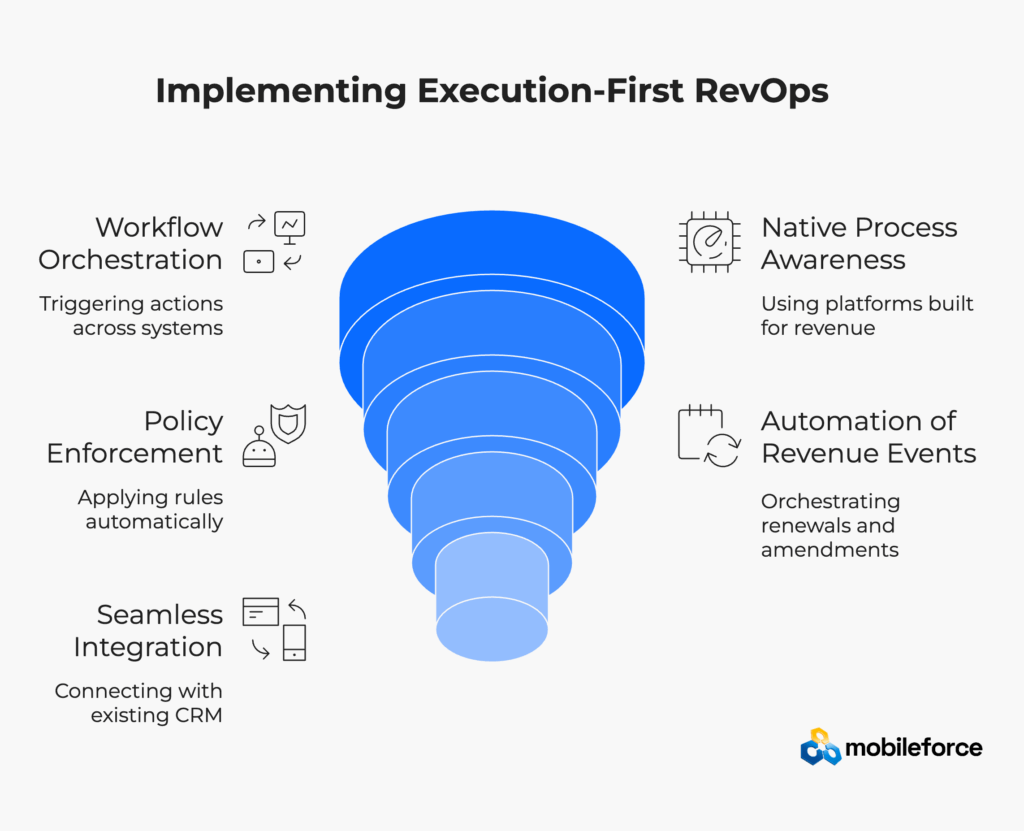

Modern platforms like Mobileforce’s Revenue Operations Cloud differ from traditional CRM approaches through four critical execution capabilities:

Cross-system workflow orchestration: The platform connects CRM insights to automated actions across CPQ systems, contract lifecycle management, billing automation, and field service operations through unified workflow engines that execute complex business processes automatically.

Real-time execution authority: Instead of generating alerts, Mobileforce’s Revenue Operations Cloud immediately acts on AI insights by triggering automated quote generation, contract amendments, billing adjustments, and customer engagement sequences without manual coordination delays.

Policy enforcement automation: The platform automatically enforces pricing policies, approval workflows, compliance requirements, and business rules across all revenue-generating processes, eliminating manual exception handling that creates execution bottlenecks.

End-to-end process ownership: Rather than managing point solutions, Mobileforce’s Revenue Operations Cloud takes responsibility for complete revenue workflows from lead qualification through contract execution, service delivery, and renewal processing across the entire customer lifecycle.

Execution-first platforms like Mobileforce’s Revenue Operations Cloud operate as intelligent orchestration layers that coordinate revenue workflows across disconnected systems. Rather than replacing CRM investments, the platform augments CRM capabilities with workflow automation and execution infrastructure needed to make AI insights immediately actionable.

Core execution infrastructure includes:

Cross-system workflow automation: Advanced integration frameworks that trigger automated actions in CPQ platforms, billing systems, contract management, and service delivery systems based on CRM insights and predictive model outputs. Mobileforce’s no-code configuration enables rapid deployment without extensive technical development.

AI-powered policy enforcement: Automated business rule systems including smart discounting engines that apply pricing policies, approval workflows, and compliance requirements consistently across all revenue processes without manual oversight.

Intelligent quote generation: The AskCPQ AI agent enables conversational interaction with complex pricing logic, while AI assistants help optimize quotes and identify opportunities while maintaining compliance with business rules.

Revenue workflow analytics: Performance monitoring across quote-to-cash processes that tracks execution outcomes and provides data-driven insights for continuous improvement of automated processes and business rules.

This execution infrastructure ensures that AI insights don’t just inform human decision-making—they trigger immediate, systematic business process execution that drives measurable improvements in deal velocity, customer retention, and revenue predictability.

Capability | Traditional CRM Approach | RevOps Execution Platform |

AI Insight Processing | Generate alerts and dashboards | Trigger automated workflow execution |

Cross-System Coordination | Manual data synchronization | Automated workflow orchestration |

Policy Enforcement | Flag exceptions for review | Automatically enforce business rules |

Deal Velocity | Provide visibility into delays | Execute actions to eliminate delays |

Pricing Management | Alert on anomalies | Automatically correct pricing issues |

Customer Retention | Predict churn probability | Execute retention workflows |

Revenue Recognition | Track deal stages | Orchestrate complete quote-to-cash |

Team Coordination | Share information between teams | Automate handoffs and processes |

Compliance Management | Monitor compliance status | Enforce compliance through automation |

See how execution-first RevOps transforms your revenue operations. Schedule a platform demonstration to evaluate workflow automation capabilities.

When Mobileforce’s Revenue Operations Cloud receives AI insights from CRM systems or predictive analytics engines, it triggers immediate, systematic responses that coordinate actions across multiple systems without human intervention.

Examples of automated insight-to-action workflows include:

Forecast risk detection → Automatic quote generation with alternative pricing scenarios, expedited approval routing through smart workflow engines, and coordinated outreach sequences based on account history and engagement patterns.

Deal stagnation signals → Triggered CPQ workflow automation that generates optimized pricing proposals, coordinates across sales development and account management teams, and applies smart discounting rules based on competitive analysis.

Churn probability increases → Automated retention workflows including service delivery health checks, success manager alerts with account-specific recommendations, billing term reviews, and coordinated retention offers through integrated service management.

Customer expansion opportunities → Systematic upsell execution through automated product configuration, usage analysis, success manager coordination, and AI-assisted pricing optimization based on account history.

The fundamental difference between traditional CRM alerts and RevOps execution: insights trigger systematic action workflows rather than creating additional manual tasks for already-overwhelmed revenue operations teams.

Traditional CRM AI | RevOps Execution Platform |

Flags deal risk probability percentages | Automatically generates alternative quote scenarios with optimized pricing |

Predicts customer churn likelihood scores | Triggers retention workflows across billing, success, and service systems |

Identifies pricing anomalies and exceptions | Enforces pricing policies automatically with approval workflow routing |

Shows renewal timeline and risk indicators | Orchestrates complete renewal processes including contract amendments |

Alerts about approval delays and bottlenecks | Routes approvals through optimized workflows with automated escalation |

Generates pipeline forecasts and projections | Executes pipeline acceleration workflows based on forecast gaps |

Provides customer health scores and analytics | Triggers customer success interventions and expansion opportunity workflows |

Displays quote-to-cash process status | Automates quote generation, approval routing, and contract execution |

Reports on sales team performance metrics | Optimizes sales process execution through automated workflow assistance |

Creates dashboards for management visibility | Provides real-time execution analytics with automated process improvement |

Transform your revenue operations from insight-focused to execution-driven. Request a personalized demonstration of automated revenue workflow orchestration.

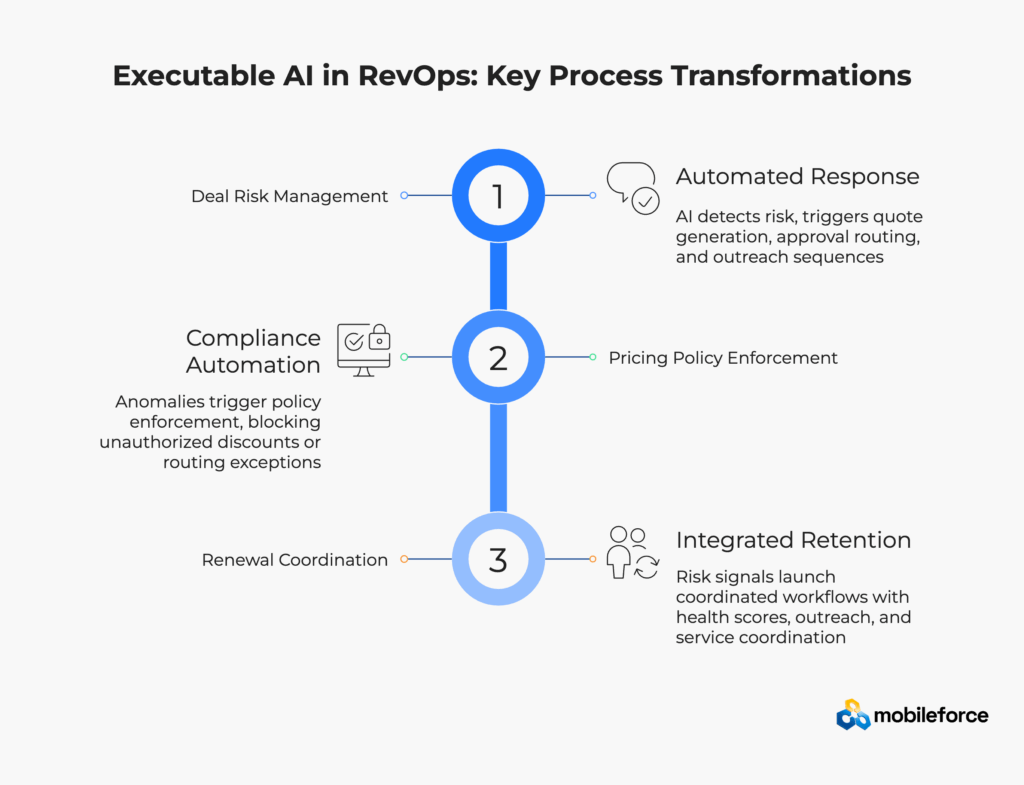

Executable AI transcends predictive insights to enable systematic revenue actions. Here’s how this transformation appears across key revenue processes:

Traditional approach: CRM AI flags a 34% probability that Q4’s largest opportunity will slip. Sales operations reviews the alert, schedules meetings with account teams, and manually coordinates response efforts.

Mobileforce approach: Risk detection automatically triggers scenario-based quote generation with alternative terms, expedited approval routing through smart workflow automation, and coordinated outreach sequences. The Revenue Operations Cloud orchestrates response workflows while capturing decision rationale for continuous improvement.

Traditional approach: AI detects unusual discount patterns and alerts management. RevOps manually reviews exceptions, creates approval requests, and coordinates with sales leadership on policy adjustments.

Mobileforce approach: Pricing anomalies trigger automatic policy enforcement workflows through compliance-driven automation. The system either blocks unauthorized discounts or routes exceptions through appropriate approval chains while maintaining audit trails and policy consistency.

Traditional approach: Predictive models identify accounts at risk for downgrade or churn. Customer success receives alerts and manually coordinates retention efforts across billing, support, and sales teams.

Mobileforce approach: Renewal risk signals launch coordinated retention workflows through integrated service management including automated health score analysis, personalized outreach sequences, billing term reviews, and field service coordination—all orchestrated through the Revenue Operations Cloud as a systematic process rather than discrete manual tasks.

Mobileforce operates as a comprehensive RevOps execution and orchestration platform that transforms CRM insights into systematic revenue actions. Rather than generating additional AI insights, Mobileforce makes existing insights executable across your complete revenue lifecycle.

Cross-system orchestration: Mobileforce connects CRM insights to automated actions across CPQ, contract lifecycle management, billing systems, and service operations. When your CRM AI identifies opportunities or risks, Mobileforce can automatically trigger appropriate workflows without manual intervention.

AskCPQ AI agent: The AskCPQ AI agent enables conversational interaction with complex pricing and configuration logic, allowing sales teams to generate accurate quotes and proposals directly from natural language requests while maintaining pricing policy compliance.

Policy-driven enforcement: Rather than simply alerting about exceptions, Mobileforce automatically enforces pricing policies, approval requirements, and revenue recognition rules throughout the quote-to-cash process.

No-code workflow configuration: The platform’s no-code configuration capabilities enable rapid deployment and customization of revenue workflows without requiring extensive technical development or system integration expertise.

AI-assisted automation: AI assistants throughout the platform help sales teams optimize quotes, identify upsell opportunities, and navigate complex pricing scenarios while maintaining compliance with business rules and policies.

Mobileforce is designed to work alongside existing CRM investments rather than replacing them. The platform integrates with HubSpot, Salesforce, SugarCRM, Creatio, and other major CRM platforms to extend their capabilities with execution infrastructure.

This approach allows organizations to maintain their existing data models, reporting systems, and user interfaces while adding the execution layer needed to make AI insights actionable.

Consider a mid-market B2B company using CRM AI to flag deal and renewal risks but relying on manual coordination for follow-through actions. After implementing Mobileforce’s execution workflows:

This example illustrates typical execution improvements and doesn’t represent specific customer claims.

Ready to transform your revenue execution? Explore how Mobileforce makes CRM insights immediately actionable across your complete quote-to-cash process.

Organizations ready for execution-focused RevOps typically exhibit several key characteristics:

Organizations experiencing these patterns have typically maximized the value of insight-focused CRM AI and need execution infrastructure to realize further revenue improvements.

Selecting effective revenue execution infrastructure requires evaluating capabilities that extend beyond traditional CRM functionality:

Cross-system workflow orchestration: The platform should trigger actions across CPQ, billing, contracts, and service systems based on CRM insights without requiring extensive custom development.

Native revenue process awareness: Look for platforms built specifically for quote-to-cash workflows rather than general workflow automation tools adapted for revenue processes.

Policy enforcement capabilities: The system should automatically apply pricing rules, approval requirements, and compliance policies rather than simply flagging exceptions for manual review.

Amendment and renewal automation: Complex revenue events like contract modifications and subscription renewals should be orchestrated as systematic workflows rather than manual project management.

CRM platform connectivity: Ensure seamless integration with your existing CRM platform without requiring data migration or interface replacement.

Minimal seller friction: Revenue execution should happen transparently without adding complexity to sales team workflows or requiring additional training overhead.

Audit trail maintenance: All automated actions should maintain comprehensive logs for compliance, analysis, and continuous process improvement.

Performance analytics: The platform should provide metrics on execution speed, policy compliance, and workflow efficiency rather than just traditional CRM reporting.

Organizations that successfully implement execution-first RevOps typically start with specific, measurable use cases rather than attempting comprehensive transformation immediately. Common high-impact starting points include:

Evaluate your readiness for execution-first RevOps. Schedule a consultation to assess your current insights-to-action gaps.

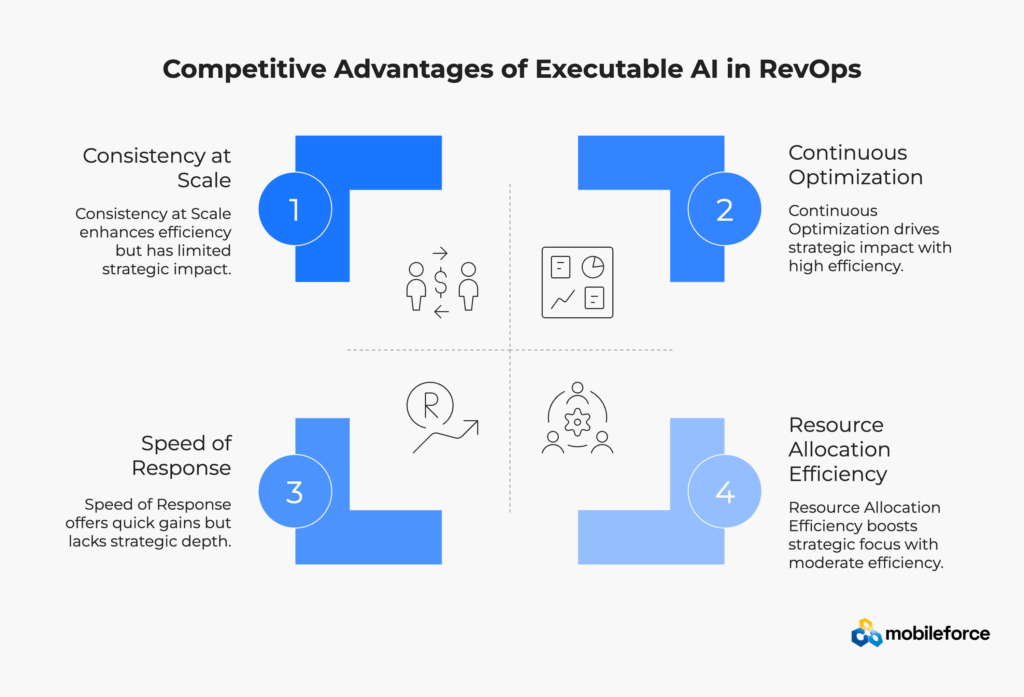

Organizations that successfully bridge the insight-to-execution gap often discover competitive advantages that extend beyond obvious efficiency improvements:

When AI insights trigger automatic actions rather than manual coordination, companies can respond to market changes, customer needs, and competitive threats at machine speed rather than human speed. This responsiveness becomes particularly valuable in industries where timing influences deal outcomes.

Executable AI enables consistent application of best practices across all revenue processes regardless of team size, geographic distribution, or individual experience levels. Pricing policies, approval workflows, and customer engagement patterns become systematically applied rather than dependent on institutional knowledge.

Execution platforms that capture comprehensive workflow data enable evidence-based process improvement. Organizations can analyze which automated responses produce the best outcomes and continuously refine their execution logic based on measurable results.

When routine execution becomes automated, revenue operations teams can focus on strategic initiatives, process design, and complex exception handling rather than manual workflow coordination. This shift often produces compound benefits as teams apply their expertise to higher-value activities.

According to SuperAGI research, organizations leveraging AI for sales forecasting and pipeline management can automate data analysis and forecasting while reducing errors and freeing up time for strategic activities.

The proliferation of AI-powered CRM insights represents remarkable technological progress, but insights alone don’t generate revenue. Value creation happens when insights translate into systematic actions that influence customer behavior, accelerate deal velocity, and optimize pricing strategies.

Modern organizations need both sophisticated insights and robust execution infrastructure. CRMs provide the intelligence; RevOps platforms provide the action. Together, they create revenue operations systems that don’t just predict what should happen—they make it happen systematically and consistently.

The question isn’t whether your CRM can identify opportunities and risks. The question is whether your revenue operations infrastructure can translate that intelligence into automatic, policy-compliant actions that drive measurable business outcomes.

RevOps represents the evolution from insight theater to execution reality. In competitive markets where speed, consistency, and scalability determine revenue performance, execution-first revenue operations infrastructure becomes a strategic necessity rather than a operational convenience.

Transform your AI insights into systematic revenue execution. Schedule a demonstration to see how execution-first RevOps platforms make CRM intelligence actionable across your complete revenue lifecycle.

CRM AI generates predictive insights, analytics, and forecasts from customer data—telling you what might happen and why through dashboards and alerts.

RevOps execution platforms take those CRM insights and automatically trigger coordinated workflows across CPQ systems, billing, contracts, and service operations. While CRM AI creates awareness, RevOps platforms create systematic automation that drives measurable revenue outcomes without manual coordination.

Modern RevOps platforms integrate with existing CRMs rather than replace them. Platforms like Mobileforce connect to HubSpot, Salesforce, SugarCRM, and others through APIs that preserve your current data models, customizations, and user interfaces.

This approach lets you maintain familiar CRM workflows while adding backend execution capabilities. Implementation involves connecting the RevOps platform to your CRM APIs and configuring workflow automation rules based on CRM insights and triggers.

Organizations typically see measurable ROI within 6-12 months across several areas: 25-40% faster sales cycles through automated quote generation, 30-50% shorter approval cycles, and 40-60% reduction in pricing exceptions through automated policy enforcement.

Revenue teams often redirect 40-60% of their time from manual coordination to strategic work, while automated workflows improve customer experience consistency by 50-70%. Key metrics include quote-to-signature time, exception handling volume, approval cycle duration, and revenue forecast accuracy.

RevOps platforms automate responses to various CRM insights: deal risk predictions trigger alternative quote scenarios and expedited approvals; churn signals activate automated retention workflows including billing reviews and service checks; pricing anomalies trigger policy enforcement and approval routing.

Additional capabilities include renewal timeline orchestration, competitive threat response workflows, and customer expansion opportunities that automatically generate upsell proposals and coordinate success manager engagement. The platform transforms predictive insights into systematic business actions.

RevOps execution operates transparently without adding complexity—sales teams continue using familiar CRM interfaces while backend systems handle quote generation, approval routing, and process management automatically.

Key improvements include eliminating manual coordination time, reducing quote generation from days to hours, streamlining approval processes, and enabling faster customer responsiveness. The goal is process acceleration and administrative burden reduction rather than additional complexity for sales teams.

CRM automation handles internal tasks like data entry, follow-ups, and notifications within the CRM platform itself—improving data quality and user productivity within single system boundaries.

RevOps execution orchestrates cross-system workflows across CPQ, contracts, billing, and service tools based on CRM insights. While CRM automation generates tasks for human action, RevOps execution automatically executes business processes including quote generation and approvals, directly impacting revenue velocity and deal conversion rates.

Implementation follows a phased approach: initial value in 30-90 days for focused use cases like automated quote generation, comprehensive workflow automation over 6-12 months, and full platform optimization over 12-18 months.

Timeline factors include integration complexity, number of processes being automated simultaneously, change management requirements, and user training needs. Most organizations start with high-impact, low-complexity use cases to demonstrate value quickly while building toward comprehensive automation.

Yes, SMBs often see particularly strong ROI because they operate with limited resources for manual coordination. Benefits include resource efficiency through automated workflow orchestration, scaling capability to handle increased deal volume without proportional staffing, and competitive responsiveness with enterprise-speed processes.

RevOps platforms provide scalable infrastructure that grows with business complexity while maintaining professional customer experiences regardless of individual bandwidth or experience levels, enabling SMBs to compete effectively with larger organizations.

Modern RevOps platforms include comprehensive compliance frameworks with detailed audit trails for every automated action, built-in revenue recognition frameworks (ASC 606, IFRS 15), and automated pricing policy enforcement without manual oversight.

Security features include data encryption, privacy controls meeting GDPR/CCPA/SOX requirements, and systematic approval workflow documentation. These capabilities typically reduce regulatory risk while improving process consistency and audit preparation efficiency compared to manual coordination.