Where Revenue Actually Breaks in the Quote-to-Cash Stack—and Why Integration Isn’t Enough

TL;DR

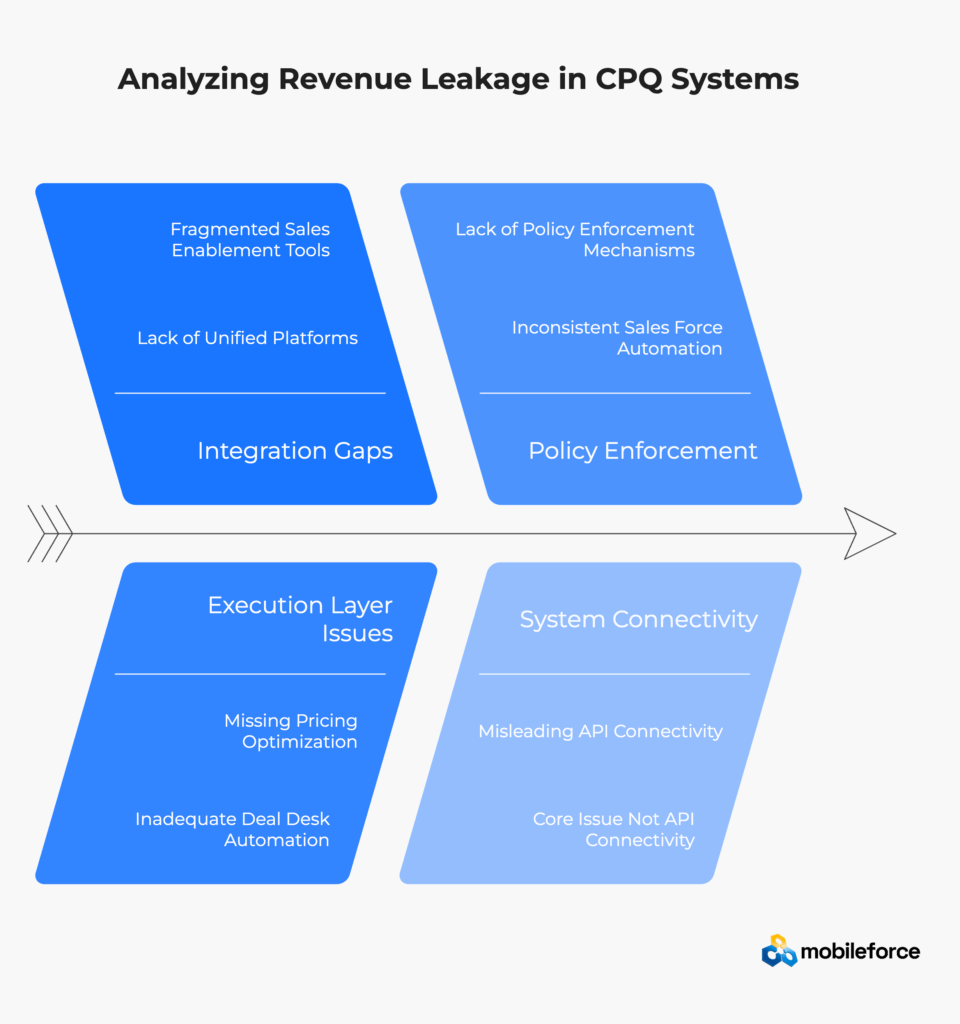

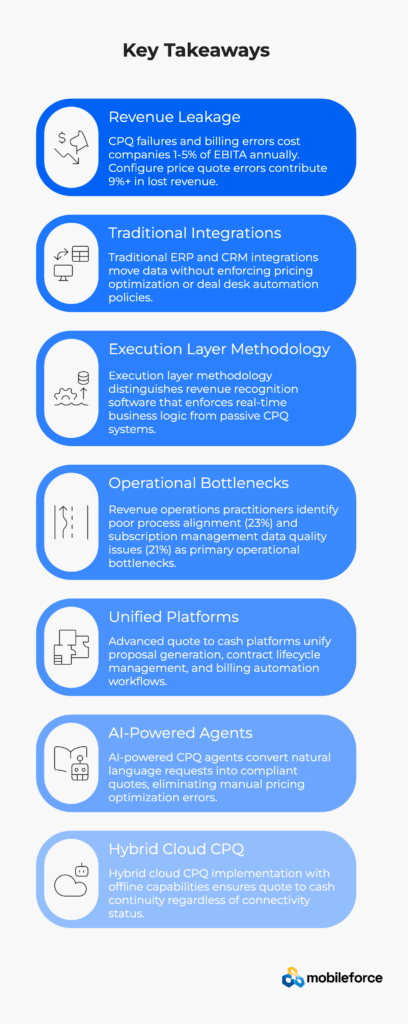

Enterprise CPQ software and quote to cash systems appear integrated but fracture at critical handoff points between configure price quote, contract lifecycle management, and billing automation processes, costing companies between 1-9% in revenue leakage annually. The core issue isn’t API connectivity—it’s the missing execution layer that enforces pricing optimization, deal desk automation, and sales force automation policies where revenue actually flows. Modern revenue operations teams solve this through unified quote to cash platforms that eliminate gaps between customer relationship management, proposal generation, subscription management, and order management systems, transforming fragmented sales enablement tools into intelligent revenue engines.

Ready to eliminate revenue handoff breaks? Schedule your personalized Mobileforce demo to see unified quote to cash execution in action.

Revenue leakage in configure price quote systems refers to the measurable financial loss occurring when enterprise CPQ software fails to capture, price, or bill correctly during the quote to cash process. This phenomenon affects billing automation, subscription management, and order management systems across manufacturing, technology, and service industries.

According to the Price Waterhouse Revenue Leakage Analysis Framework, revenue leakage manifests in five primary categories:

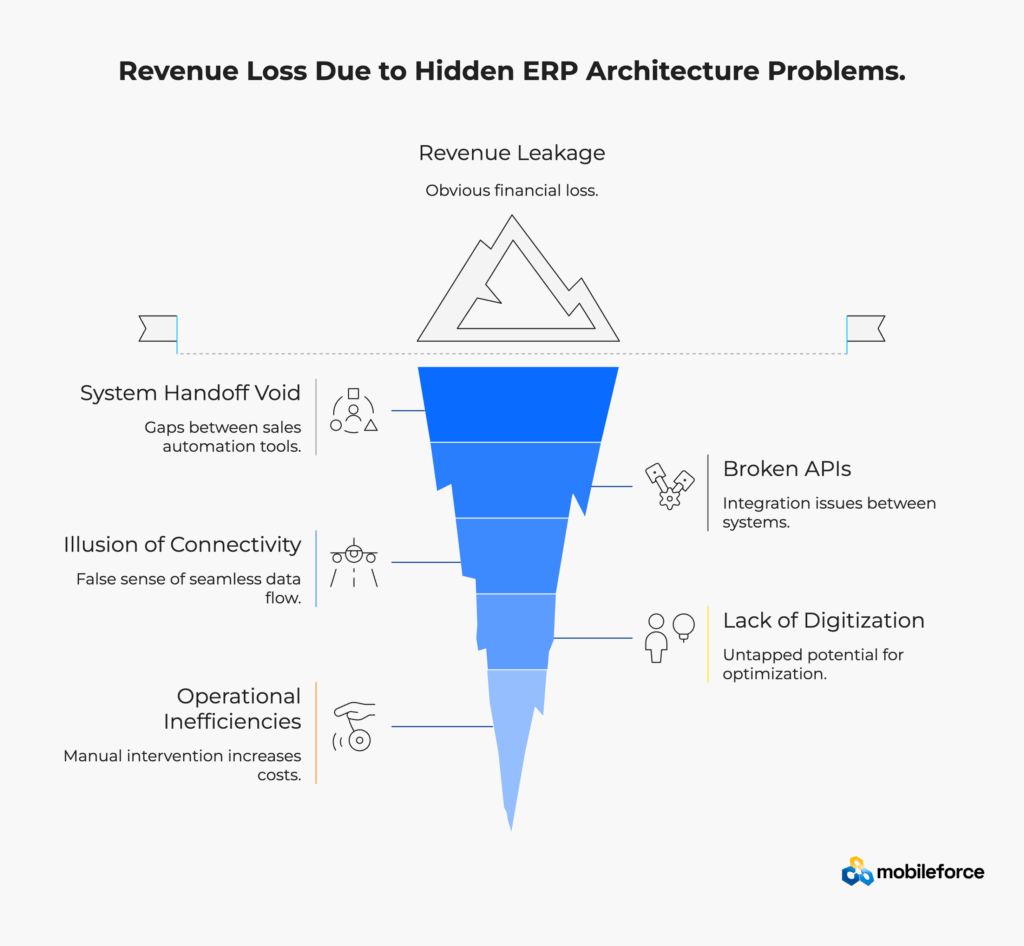

Picture this common CPQ implementation scenario: Your customer relationship management system captures a million-dollar manufacturing opportunity. Your enterprise CPQ software configures the perfect industrial equipment solution with field service management components. Your contract lifecycle management platform generates compliant legal terms. But somewhere between proposal generation approval and billing automation processing, $50,000 vanishes into the system handoff void.

This scenario affects thousands of enterprise CPQ software deployments daily across manufacturing companies, technology firms, and professional services organizations. According to Ernst & Young revenue optimization research, between 1-5% of realized EBITA evaporates annually due to revenue leakage—money that should flow directly to the bottom line instead disappears into configure price quote process gaps and customer relationship management integration failures. Additionally, McKinsey research indicates that most industries remain less than 40% digitized, demonstrating significant untapped potential for quote to cash optimization.

The problem runs deeper than broken enterprise resource planning APIs or subscription management data sync issues. Modern sales enablement tools stacks create an illusion of seamless connectivity while hiding fundamental quote to cash execution gaps. Each order management system excels at its core function—customer relationship management tracks relationships, configure price quote handles pricing optimization, contract lifecycle management processes legal workflows, billing automation manages payments—but the spaces between these sales force automation tools become black holes where revenue disappears.

Revenue leakage costs extend beyond immediate financial impact. Manufacturing companies report that configure price quote errors delay production planning, disrupt field service management scheduling, and damage customer relationships. Technology firms find that subscription management failures create billing disputes that require extensive customer success intervention. Professional services organizations discover that deal desk automation breakdowns force manual intervention that increases operational costs and reduces sales team productivity.

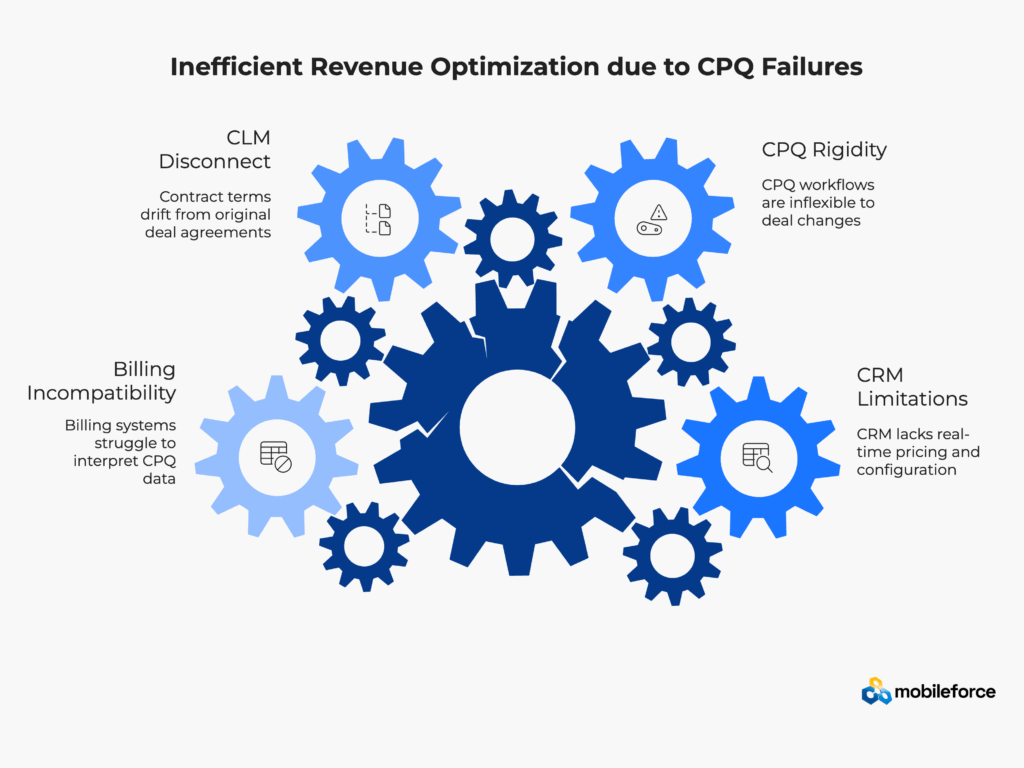

Revenue optimization failures occur across four critical enterprise CPQ software integration points. Understanding where each sales enablement tool breaks down helps organizations prioritize CPQ implementation improvements and reduce quote to cash cycle friction.

Customer relationship management platforms excel at capturing opportunity intent and tracking deal progression through sales force automation workflows. Sales teams diligently log field service management activities, update revenue forecasts, and maintain contact records across manufacturing, technology, and professional services industries. However, when deals require real-time pricing optimization or complex product configuration, customer relationship management systems reveal critical execution limitations.

The gap becomes apparent during field sales scenarios common in manufacturing and industrial equipment markets. A sales representative meets a customer on-site, discusses custom machinery requirements, and needs immediate proposal generation. Their customer relationship management system contains complete opportunity details but lacks the configure price quote logic needed for complex product relationships or current pricing optimization policies.

Three specific failure patterns emerge:

The representative either delays the quote to cash process or makes estimates requiring manual correction later—both scenarios introduce error potential and slow competitive positioning in manufacturing markets.

Configure price quote systems represent significant evolution beyond spreadsheet-based proposal generation. They encode business rules, enforce pricing optimization policies, and generate professional quotes through deal desk automation workflows. Yet traditional CPQ implementation approaches struggle with the fluid reality of modern B2B selling across manufacturing, technology, and service industries.

Complex enterprise deals rarely follow linear configuration paths in real markets. Manufacturing customers request equipment modifications mid-quote, technology buyers discover new integration requirements during product demonstrations, and professional services clients evolve pricing discussions based on competitive dynamics. Rigid configure price quote workflows force users into predefined paths that may not match actual deal progression, leading to system workarounds and manual overrides that defeat the purpose of automated pricing optimization.

The challenge intensifies when sales teams need offline access for field service management activities. Field representatives visiting manufacturing facilities, attending trade shows, or working in remote customer locations find themselves unable to access configure price quote functionality precisely when revenue opportunities emerge. This connectivity gap affects quote to cash velocity and competitive positioning.

Contract lifecycle management platforms promise to streamline legal processes and ensure terms alignment with negotiated deals across enterprise CPQ software implementations. In practice, they often become sophisticated document repositories struggling with the dynamic nature of enterprise contract negotiations in manufacturing, technology, and professional services markets.

The challenge emerges from timing disconnects in the quote to cash process:

This creates what revenue operations professionals call “contract chaos”—legally compliant documents that don’t match the economic terms agreed during the sales process.

Billing automation systems represent the final checkpoint where all previous configure price quote decisions must translate into accurate invoices. This is where enterprise CPQ software integration failures become financially visible, as billing errors directly impact cash flow and customer relationships across subscription management and order management scenarios.

The complexity stems from parameter translation challenges:

Subscription businesses face additional challenges as their billing requirements evolve over time. Software-as-a-Service companies, manufacturing equipment lessors, and professional services firms with retainer agreements require adaptive billing automation logic that can accommodate changing requirements without manual intervention or revenue recognition errors.

Experiencing billing reconciliation headaches? Discover how unified quote to cash platforms eliminate configure price quote translation errors.

Many organizations approach revenue system integration by building more connections between existing sales enablement tools. They invest in middleware platforms, hire enterprise resource planning integration specialists, and create elaborate data flow diagrams connecting customer relationship management, configure price quote, and billing automation systems. Yet increased connectivity often amplifies rather than solves underlying pricing optimization and deal desk automation problems.

Enterprise resource planning APIs excel at moving data between order management systems but struggle with business policy enforcement across quote to cash workflows. A customer relationship management platform can send opportunity data to a configure price quote system, which pushes configuration details to a contract lifecycle management platform, which forwards billing parameters to a revenue recognition engine. However, none of these data transfers enforce business policies about:

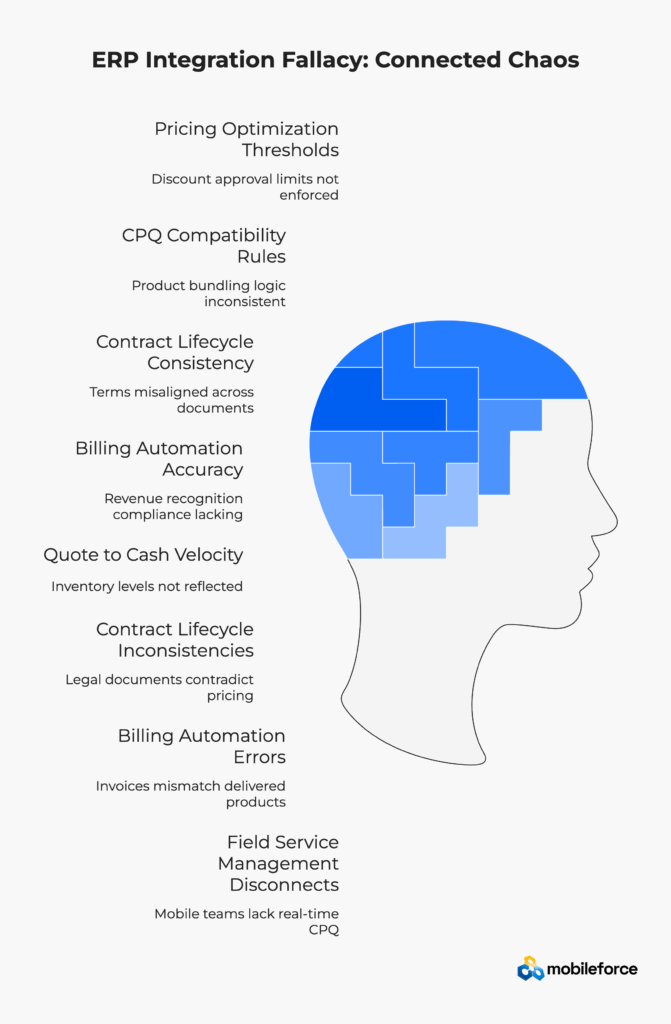

This creates what revenue operations professionals call “connected chaos”—sales force automation systems that share data efficiently but lack coordinated intelligence for pricing optimization and deal desk automation decisions. The symptoms include:

Organizations pursuing traditional enterprise resource planning integration strategies report several costly outcomes:

Increased complexity without improved outcomes – Adding more API connections between customer relationship management, configure price quote, and billing automation systems creates additional failure points without addressing core business logic enforcement needs.

Higher maintenance overhead – Each integration point requires ongoing monitoring, error handling, and version management as underlying sales enablement tools evolve.

Delayed problem detection – Issues often surface late in the quote to cash process when correction costs are highest and customer relationship impact is greatest.

Scalability limitations – Integration-heavy architectures become increasingly difficult to modify as business requirements evolve across manufacturing, technology, and professional services markets.

Forward-thinking revenue operations teams are recognizing that the solution requires a fundamentally different approach to quote to cash orchestration—one that prioritizes business logic enforcement over data movement efficiency.

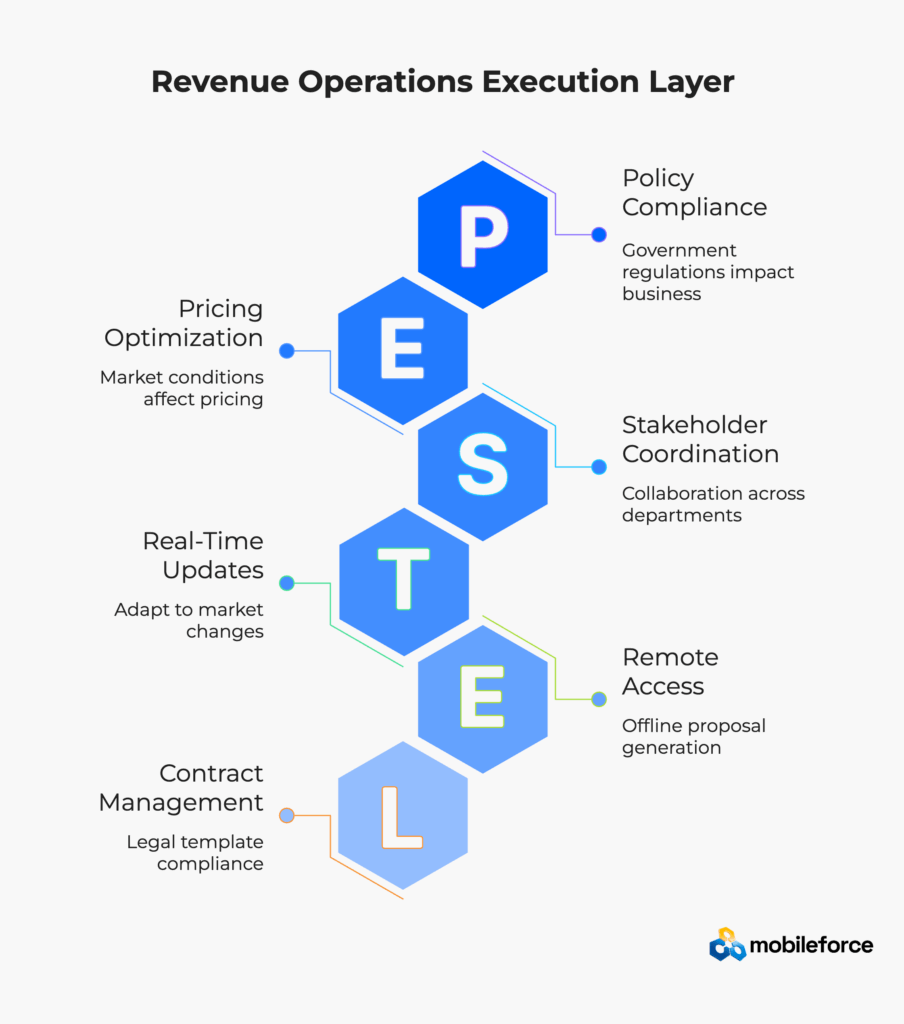

Forward-thinking revenue operations teams are moving beyond traditional enterprise resource planning integration approaches toward a fundamentally different architecture: execution layer systems that enforce pricing optimization policies and orchestrate quote to cash workflows in real-time across customer relationship management, configure price quote, and billing automation touchpoints.

An execution layer system is a revenue operations platform that enforces business logic and coordinates workflows where sales activities actually occur, rather than simply storing data like traditional sales enablement tools. This methodology distinguishes between:

Systems of Record – Platforms that store information:

Systems of Execution – Platforms that enforce business policies:

Execution layer platforms designed for manufacturing, technology, and professional services markets provide five critical capabilities that traditional sales force automation and enterprise CPQ software cannot deliver:

Rather than hoping downstream order management systems respect business rules, execution layers prevent pricing violations before they occur during the proposal generation process. Discount approval thresholds get enforced during configure price quote generation, not discovered during contract lifecycle management review or billing automation processing.

Example: A manufacturing sales representative configuring industrial equipment cannot exceed established margin thresholds without automatic routing to appropriate deal desk automation approvers, regardless of customer pressure or competitive situation.

Complex revenue processes involve multiple stakeholders across sales force automation, legal, and finance departments with varying approval stages. Execution layers coordinate these workflows intelligently, routing decisions to appropriate approvers based on deal characteristics and ensuring nothing falls through communication gaps between customer relationship management and billing automation systems.

Traditional configure price quote handoffs lose important context about why specific pricing optimization decisions were made during the sales process. Execution layers maintain decision history and rationale throughout the entire quote to cash cycle, supporting subscription management changes and field service management modifications months after initial proposal generation.

Enterprise CPQ software rules evolve constantly in dynamic manufacturing, technology, and professional services markets. Execution layers allow pricing optimization policy updates to take effect immediately across all related quote to cash processes, without requiring individual customer relationship management, configure price quote, or billing automation system configuration changes.

Field sales teams and field service management personnel need consistent access to configure price quote functionality during customer visits, trade show interactions, and remote site engagements. Execution layers provide full proposal generation capabilities regardless of connectivity status, with automatic synchronization once communication resumes.

Leading revenue operations organizations across manufacturing, technology, and professional services industries have identified specific patterns that consistently reduce configure price quote handoff friction and improve pricing optimization predictability. These patterns focus on execution orchestration rather than traditional customer relationship management integration approaches, resulting in measurable improvements to deal desk automation efficiency and field service management revenue capture.

Manufacturing organizations implementing execution layer methodologies report average improvements of 35% in quote to cash cycle velocity and 23% reduction in pricing optimization errors. Key patterns include:

Centralized Configure Price Quote Policy Enforcement – Rather than distributing pricing optimization rules across multiple enterprise CPQ software systems, successful manufacturing companies consolidate business logic into unified rule engines accessible throughout the sales force automation process.

Example: A heavy machinery manufacturer ensures field sales representatives configuring industrial equipment apply identical margin protection logic whether working through mobile configure price quote interfaces during customer site visits or desktop enterprise CPQ software from headquarters.

Real-Time Inventory Integration – Manufacturing revenue operations teams eliminate proposal generation delays by providing immediate access to production capacity, component availability, and delivery scheduling data during the configure price quote process.

Field Service Management Continuity – Industrial equipment companies require seamless quote to cash functionality during customer facility visits, maintenance calls, and trade show interactions where connectivity may be limited.

Technology firms leveraging execution layer approaches achieve average improvements of 42% in subscription management accuracy and 28% faster deal desk automation processing. Critical success patterns include:

Dynamic Pricing Optimization – Software companies implement real-time pricing engines that adjust based on competitive intelligence, customer usage patterns, and market conditions without requiring manual configure price quote updates.

Subscription Management Complexity Handling – Technology firms successfully manage usage-based pricing, seat-based licensing, and hybrid deployment models through execution layer platforms that coordinate between customer relationship management opportunity data and billing automation requirements.

Multi-Product Bundle Logic – Enterprise software companies eliminate configuration errors through intelligent bundling rules that prevent incompatible product combinations while suggesting optimal upsell opportunities.

Professional services firms report 31% improvement in project profitability and 26% reduction in scope change issues through execution layer implementation. Key patterns include:

Resource Allocation Optimization – Consulting firms integrate configure price quote processes with resource planning systems to ensure proposal generation reflects actual consultant availability and project capacity.

Retainer and Subscription Billing Integration – Professional services companies streamline recurring billing for ongoing engagements through unified quote to cash platforms that coordinate between initial proposal generation and ongoing subscription management.

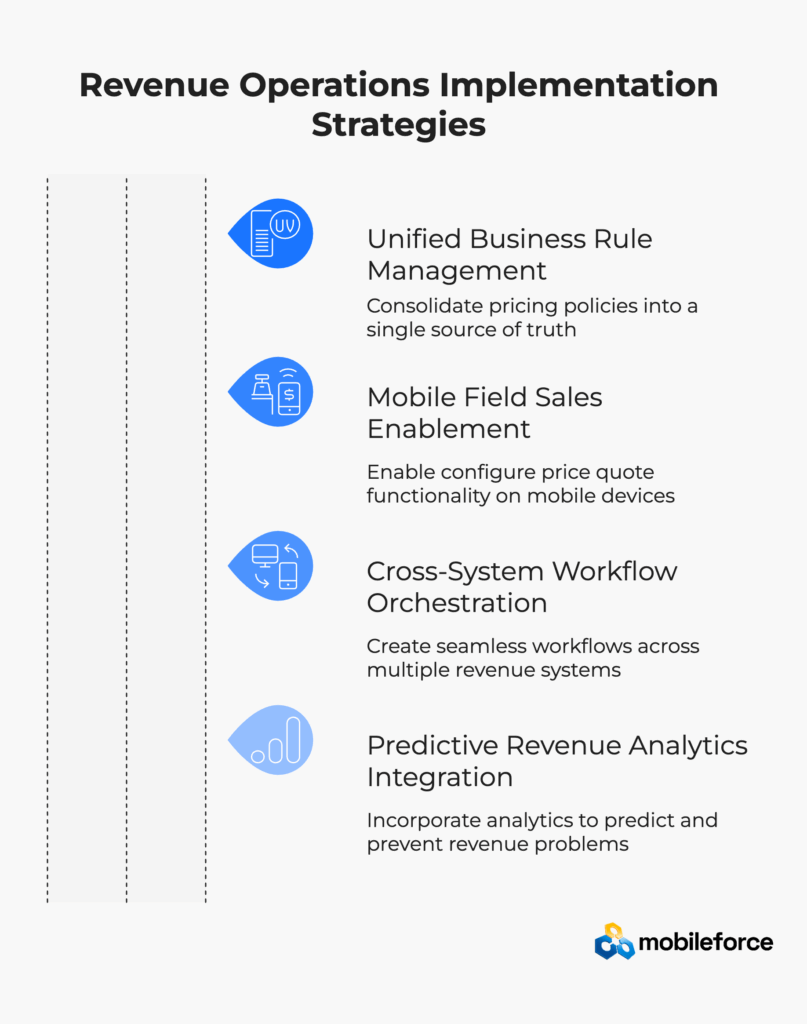

Effective revenue operations teams consolidate pricing optimization policies into single sources of truth that can be accessed throughout the quote to cash process. This approach ensures consistent application of discount policies, approval workflows, and configuration rules regardless of which specific sales enablement tool initiates a process.

Implementation typically involves:

Recognition that revenue activities happen outside traditional office environments drives deployment of hybrid execution platforms that maintain configure price quote functionality regardless of connectivity status. This capability transforms field service management effectiveness and manufacturing sales success rates.

Best practice implementation includes:

Instead of treating each revenue system as a separate operational domain, execution layer platforms create continuous workflows spanning multiple tools seamlessly. A configure price quote process initiated in one interface flows directly to contract lifecycle management generation and billing automation setup without manual data re-entry or format translation.

Key workflow improvements include:

Advanced execution layer platforms incorporate predictive analytics that identify potential quote to cash problems before they impact revenue capture. This capability enables proactive intervention rather than reactive problem-solving.

Analytics capabilities include:

Want to see quote to cash workflow continuity in action? Explore Mobileforce’s unified execution platform designed for seamless revenue orchestration.

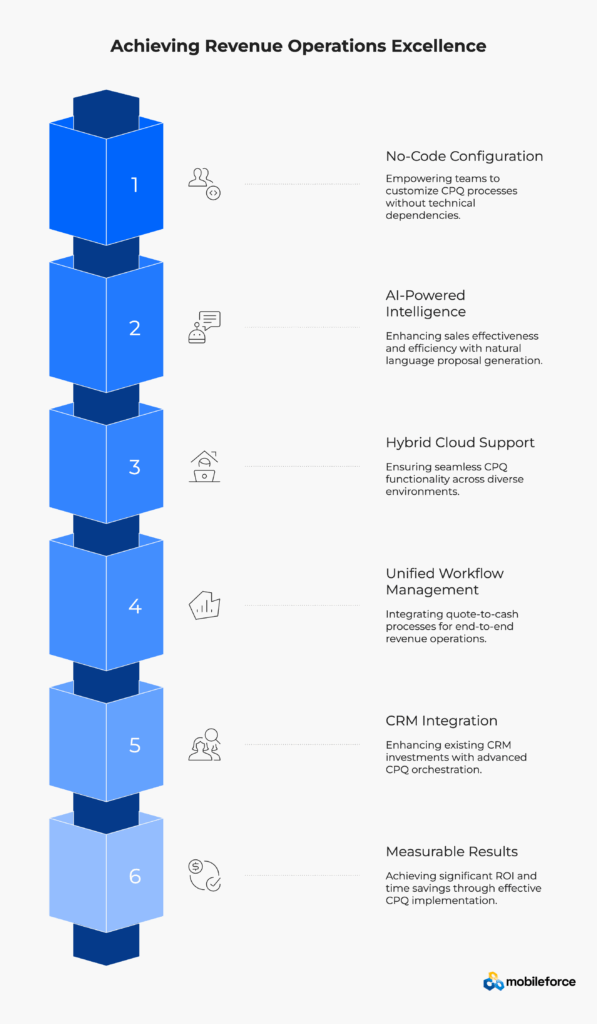

Mobileforce represents a new category of revenue operations platforms that function as execution layer systems rather than traditional point solutions for customer relationship management integration. Built specifically for the quote to cash challenges outlined above, the platform addresses revenue handoff problems through several enterprise CPQ software capabilities designed for manufacturing, technology, and professional services markets.

Traditional enterprise CPQ software systems require developer resources for customization and pricing optimization rule changes, creating bottlenecks that slow revenue operations responsiveness. Mobileforce’s no-code configuration platform allows revenue operations teams to build and modify product configuration logic, pricing optimization rules, and deal desk automation workflows without technical dependencies. This flexibility proves essential for manufacturing companies with evolving product lines, technology firms adapting to market requirements, and professional services organizations adjusting to client needs.

Key no-code capabilities include:

Rather than forcing users through rigid configure price quote workflows common in traditional enterprise CPQ software, Mobileforce’s AI assistant enables natural language proposal generation that dramatically improves field sales effectiveness and deal desk automation efficiency. Sales representatives can request “Quote industrial equipment maintenance contract for 500 machines with 24/7 field service management” and receive fully configured, compliant proposals within minutes.

This artificial intelligence capability eliminates the extensive configure price quote training requirements that slow adoption while ensuring pricing optimization policy compliance across manufacturing sales teams, technology account managers, and professional services consultants. The AI understands industry-specific terminology and product relationships, reducing configuration errors that traditionally plague complex enterprise CPQ software implementations.

Recognizing that quote to cash activities happen across diverse environments—from manufacturing facilities to customer data centers to trade show floors—Mobileforce provides full configure price quote functionality regardless of connectivity status. Field service management teams can generate proposals, obtain deal desk automation approvals, and update customer relationship management records with automatic synchronization once connectivity resumes.

This hybrid cloud approach addresses critical gaps in traditional enterprise CPQ software that fails during customer engagements when connectivity is unreliable. Manufacturing sales representatives visiting production facilities, technology consultants working in secure customer environments, and professional services teams operating in remote locations maintain complete quote to cash capabilities.

Offline capabilities include:

Rather than stopping at configure price quote generation like traditional enterprise CPQ software, Mobileforce extends through field service management delivery and billing automation reconciliation. This end-to-end approach eliminates the handoff gaps that traditionally cause revenue leakage between sales force automation and operations teams across manufacturing, technology, and professional services industries.

The unified workflow includes:

Deep integration with leading customer relationship management platforms including HubSpot, Salesforce, Microsoft Dynamics, Creatio, and SugarCRM ensures that execution layer capabilities enhance rather than replace existing sales force automation investments. Revenue operations teams continue working in familiar customer relationship management environments while gaining access to advanced configure price quote orchestration features.

Integration benefits include:

Mobileforce’s recognition as a HubSpot Platinum Solutions Partner demonstrates deep customer relationship management integration capability and proven results for HubSpot users seeking advanced revenue operations functionality. This partnership provides HubSpot customers with enterprise-grade configure price quote capabilities that seamlessly extend their existing sales force automation investments.

The Mobileforce platform has delivered quantifiable results for organizations struggling with quote to cash execution challenges across manufacturing, technology, and professional services markets:

Organizations interested in comparing CPQ pricing options can evaluate professional and enterprise tiers designed for different company sizes and complexity requirements.

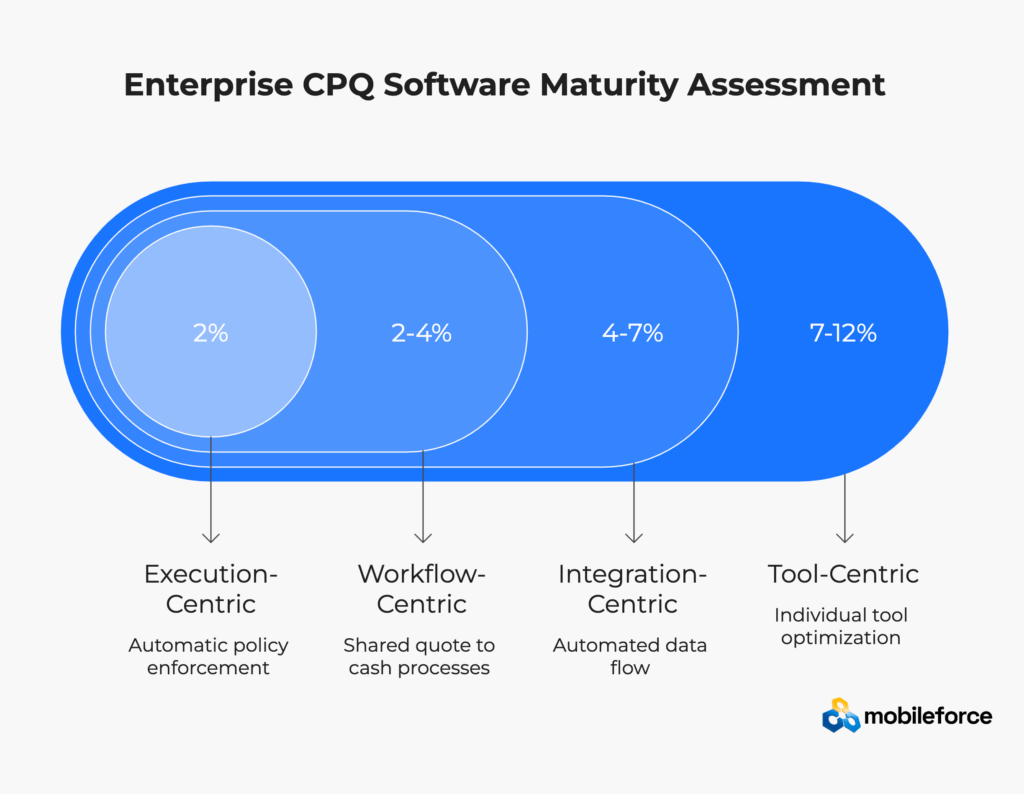

Understanding organizational readiness for execution layer solutions requires systematic assessment of current configure price quote operations maturity. Most manufacturing, technology, and professional services companies progress through four predictable stages of quote to cash sophistication, each with distinct characteristics and revenue leakage patterns.

Organizations at this maturity level optimize individual sales enablement tools without cross-functional coordination between customer relationship management, configure price quote, and billing automation systems. Departments excel at specific platform usage—sales teams master customer relationship management workflows, finance optimizes billing automation processes, operations manages enterprise resource planning efficiently—but integration happens manually through email, spreadsheets, and phone calls.

Characteristics of Level 1 Organizations:

Typical Revenue Leakage Sources:

Organizations invest in middleware and API connections to automate data flow between customer relationship management, configure price quote, contract lifecycle management, and billing automation systems. While information moves more efficiently, business policy enforcement remains inconsistent across sales force automation tools. Revenue leakage decreases but persists because integration focuses on data movement rather than process orchestration.

Integration-Centric Characteristics:

Remaining Revenue Leakage Sources:

Cross-functional teams coordinate around shared quote to cash processes rather than individual sales enablement tool optimization. Business rules get documented and standardized across customer relationship management, configure price quote, and billing automation departments. Revenue leakage reduces significantly, but execution still depends heavily on human coordination and oversight for pricing optimization and deal desk automation decisions.

Workflow-Centric Characteristics:

Reduced Revenue Leakage Sources:

Advanced organizations implement execution layer platforms that enforce pricing optimization policies and orchestrate quote to cash workflows automatically across customer relationship management, configure price quote, contract lifecycle management, and billing automation systems. Business rules get encoded into intelligent systems rather than relying on human compliance. Revenue leakage approaches minimal levels because systematic enforcement prevents most errors before they occur.

Execution-Centric Characteristics:

Minimal Revenue Leakage Sources:

Organizations can determine their current maturity level by evaluating these eight critical capabilities:

Wondering where your organization stands? Assess your execution maturity with Mobileforce’s revenue operations specialists.

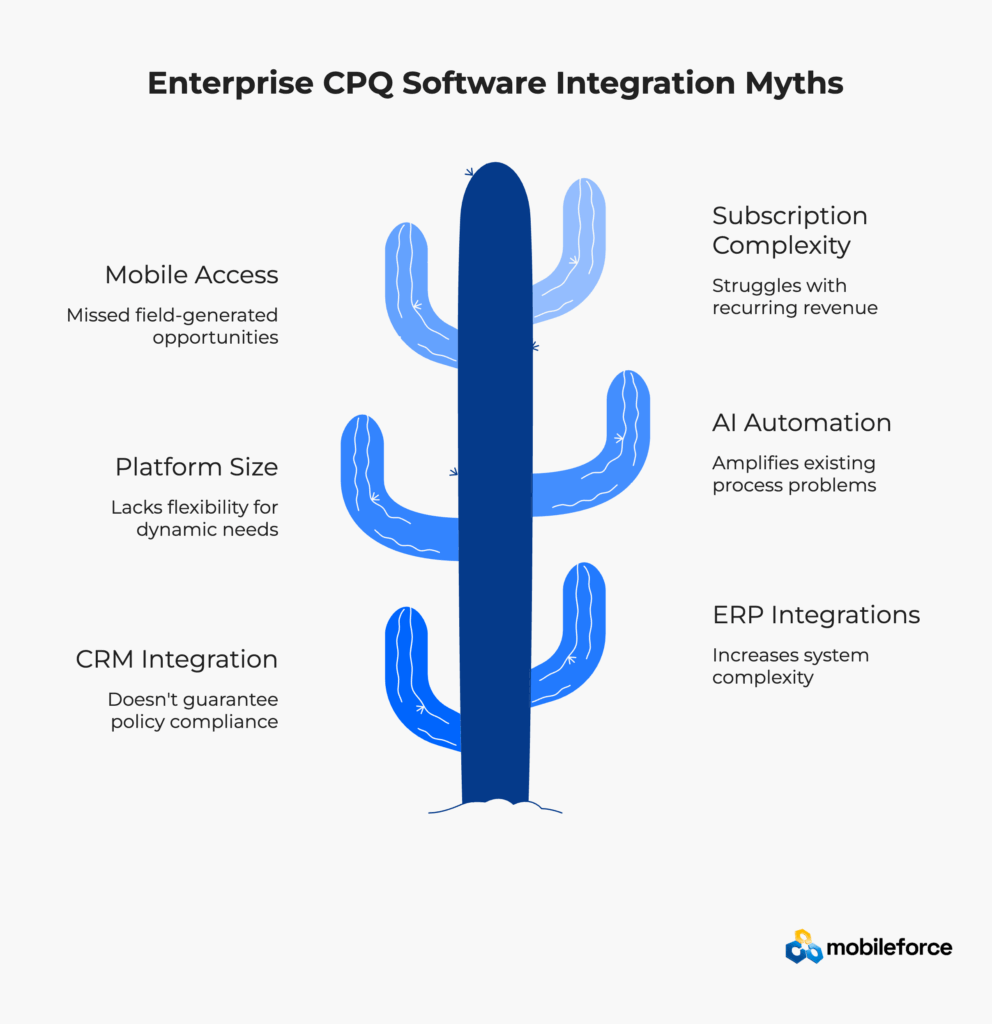

Several misconceptions prevent manufacturing, technology, and professional services organizations from addressing quote to cash execution layer gaps effectively. Understanding these myths helps revenue operations teams make informed decisions about configure price quote investments and pricing optimization strategies.

The Myth: Connecting configure price quote systems to customer relationship management platforms automatically eliminates revenue leakage and improves quote to cash velocity across manufacturing and technology markets.

The Reality: Customer relationship management platforms excel at opportunity data management but struggle with complex pricing optimization logic enforcement during proposal generation. Integration provides sales force automation visibility but doesn’t guarantee business policy compliance or deal desk automation process optimization.

Evidence: Manufacturing companies report that customer relationship management integration reduces data entry time by 35% but fails to prevent configure price quote policy violations that cause 3-7% revenue leakage in complex industrial equipment deals.

The Myth: Additional API connections between customer relationship management, configure price quote, contract lifecycle management, and billing automation systems will automatically reduce quote to cash friction and improve subscription management accuracy.

The Reality: Enterprise resource planning integration quantity matters less than integration intelligence. Additional connections often increase system complexity without addressing core workflow coordination issues between proposal generation and field service management execution.

Evidence: Technology firms with 8+ revenue system integrations report 23% higher maintenance overhead costs compared to companies using execution layer platforms that coordinate 3-4 core systems intelligently.

The Myth: Large-scale configure price quote implementations with extensive functionality will automatically deliver superior pricing optimization results and reduced revenue leakage across manufacturing and professional services markets.

The Reality: Enterprise software platforms provide extensive functionality but often lack the flexibility needed for dynamic business requirements in manufacturing customization, technology subscription models, and professional services project billing. Execution layer platforms frequently deliver better results through focused capabilities and adaptability.

Evidence: Professional services firms using focused quote to cash platforms report 31% faster deal desk automation processing compared to organizations implementing comprehensive but rigid enterprise CPQ software solutions.

The Myth: AI-powered configure price quote features will automatically solve pricing optimization challenges and eliminate revenue leakage without addressing underlying process design issues in customer relationship management and billing automation workflows.

The Reality: Artificial intelligence enhances human decision-making in quote to cash processes but requires well-designed workflows and clean data integration to function effectively. AI applied to broken proposal generation processes often amplifies existing problems rather than solving them.

Evidence: Manufacturing companies implementing AI on top of fragmented configure price quote systems experience 18% worse pricing optimization accuracy until underlying workflow issues are resolved.

The Myth: Field service management teams and manufacturing sales representatives can rely on office-based configure price quote access for proposal generation, with mobile customer relationship management apps providing sufficient functionality during customer interactions.

The Reality: Revenue opportunities frequently emerge during customer facility visits, trade show interactions, and field service management calls when immediate configure price quote access determines competitive positioning. Organizations without mobile quote to cash capabilities lose 15-25% of field-generated opportunities.

Evidence: Industrial equipment manufacturers report that mobile configure price quote access increases field sales win rates by 28% and reduces deal cycle length by 23% compared to teams requiring delayed proposal generation.

The Myth: Traditional configure price quote systems designed for one-time sales can handle subscription-based pricing, usage billing, and recurring revenue models without specialized execution layer capabilities.

The Reality: Technology companies, professional services firms, and manufacturing equipment lessors require sophisticated subscription management logic that coordinates between initial proposal generation and ongoing billing automation. Standard configure price quote platforms struggle with mid-contract changes, usage-based adjustments, and renewal pricing optimization.

Evidence: SaaS companies using execution layer platforms report 34% fewer billing automation errors and 29% higher subscription management accuracy compared to firms relying on traditional configure price quote solutions for recurring revenue scenarios.

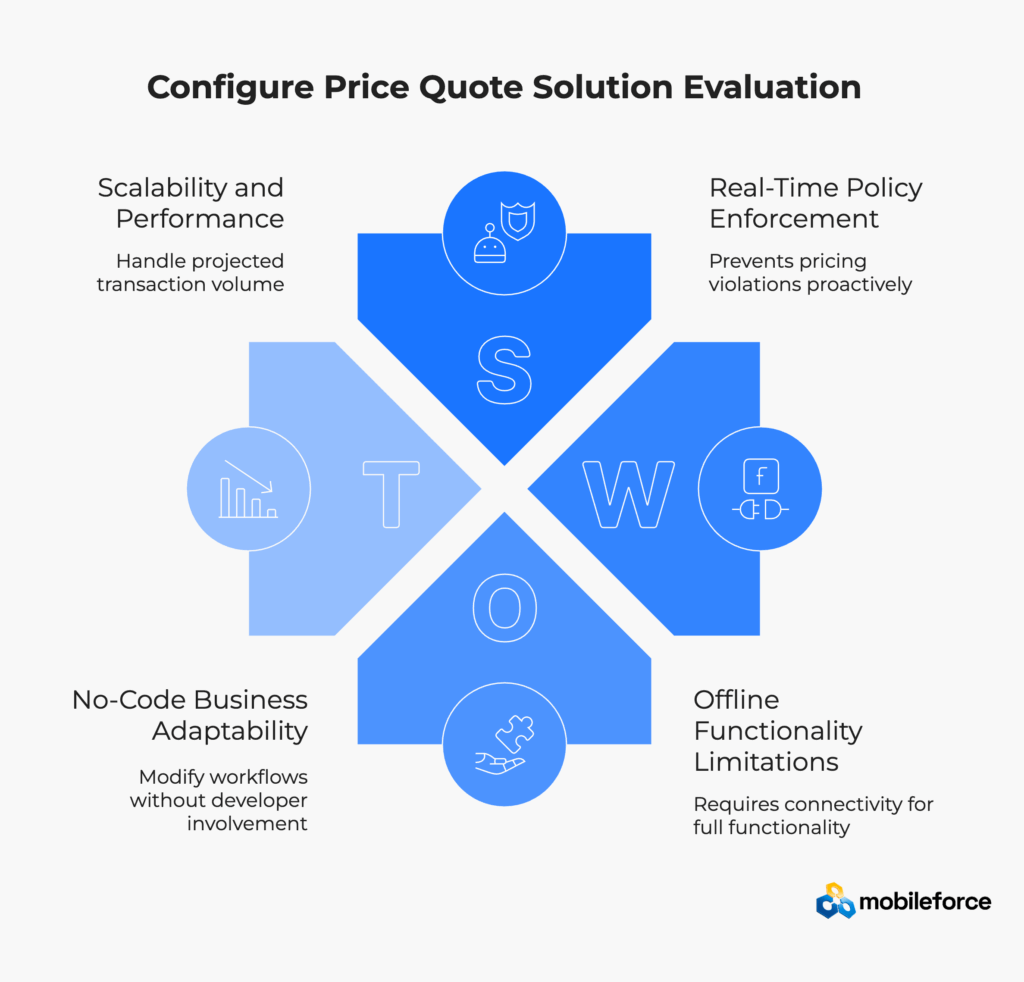

Organizations considering execution layer platforms for manufacturing, technology, and professional services markets should evaluate configure price quote solutions based on eight critical factors that directly impact quote to cash velocity, pricing optimization accuracy, and revenue leakage prevention.

Evaluation Question: Can the configure price quote platform prevent pricing violations before they occur, or does it only identify problems after proposal generation completion?

Assessment Criteria:

Red Flags: Systems requiring manual policy compliance checking, delayed approval notifications, or different pricing optimization rules across sales force automation access points indicate reactive rather than execution layer capabilities.

Evaluation Question: Does the configure price quote solution maintain full functionality regardless of connectivity status during field service management activities and customer facility visits?

Critical Requirements:

Testing Approach: Request live demonstration of configure price quote functionality with network connectivity disabled to validate true offline capabilities versus cached data limitations.

Evaluation Question: Can users initiate quote to cash processes in one interface and complete them seamlessly in contract lifecycle management and billing automation systems without manual data transfer?

Integration Intelligence Assessment:

Vendor Questions: Ask for specific examples of workflow automation between their configure price quote platform and your existing customer relationship management, contract lifecycle management, and billing automation systems.

Evaluation Question: Can business users modify pricing optimization workflows and configure price quote rules without developer involvement when market requirements change?

Flexibility Indicators:

ROI Impact: No-code capabilities typically reduce configure price quote maintenance costs by 45-60% compared to developer-dependent platforms requiring IT resources for business rule modifications. According to digital transformation research, only 35% of companies worldwide succeed in achieving their digital transformation goals, making execution-focused platforms essential for achieving projected configure price quote ROI expectations.

Ready to explore execution layer benefits for your organization? Schedule a personalized demo to see how Mobileforce addresses your specific quote to cash challenges.

Evaluation Question: Can the execution layer platform handle your projected transaction volume, user count, and geographic distribution without performance degradation?

Scalability Assessment Framework:

Performance Benchmarking: Request specific performance metrics from similar-sized organizations in your industry using the configure price quote platform under evaluation.

Evaluation Question: Does the quote to cash platform meet your industry’s security requirements and regulatory compliance needs for customer data protection and financial accuracy?

Security Checklist:

Evaluation Question: What is the realistic timeline for configure price quote deployment, and what change management support does the vendor provide for user adoption across your organization?

Implementation Evaluation:

Reference Requirements: Speak with at least two similar organizations that completed configure price quote implementations within the past 12 months to validate vendor claims about timeline and support quality.

Evaluation Question: What are the complete costs associated with configure price quote ownership over a 3-5 year period, including licensing, implementation, training, maintenance, and system integration expenses?

Cost Components to Evaluate:

ROI Calculation Framework:

Ready to evaluate execution layer solutions systematically? Schedule a Mobileforce assessment with detailed ROI analysis for your specific quote to cash requirements.

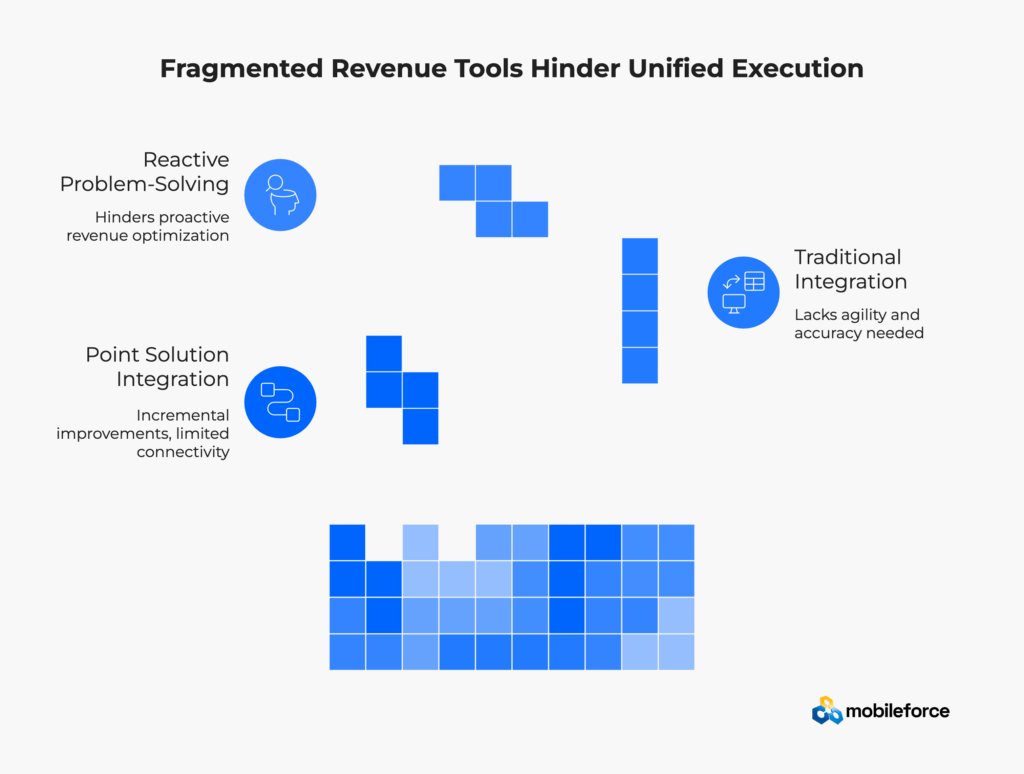

Revenue operations teams face a fundamental choice: continue investing in point solution integration or adopt execution layer platforms that coordinate business processes intelligently.

The integration approach promises incremental improvements through better data connectivity. Organizations can achieve some efficiency gains and error reduction through careful API management and middleware deployment.

The execution layer approach offers transformational improvements through intelligent process orchestration. Companies that adopt this approach typically experience dramatic reductions in revenue leakage, significant acceleration in deal cycles, and substantial improvements in forecast accuracy.

The choice often depends on organizational ambition and competitive requirements. Companies competing in fast-moving markets with complex product configurations increasingly find that traditional integration approaches cannot deliver the agility and accuracy they need.

For these organizations, execution layer platforms like Mobileforce’s Revenue Operations Cloud provide the coordination intelligence needed to turn fragmented revenue tools into cohesive business engines.

Ready to move beyond fragmented revenue tools? Schedule a Mobileforce demo to experience unified execution layer capabilities designed for modern revenue operations.

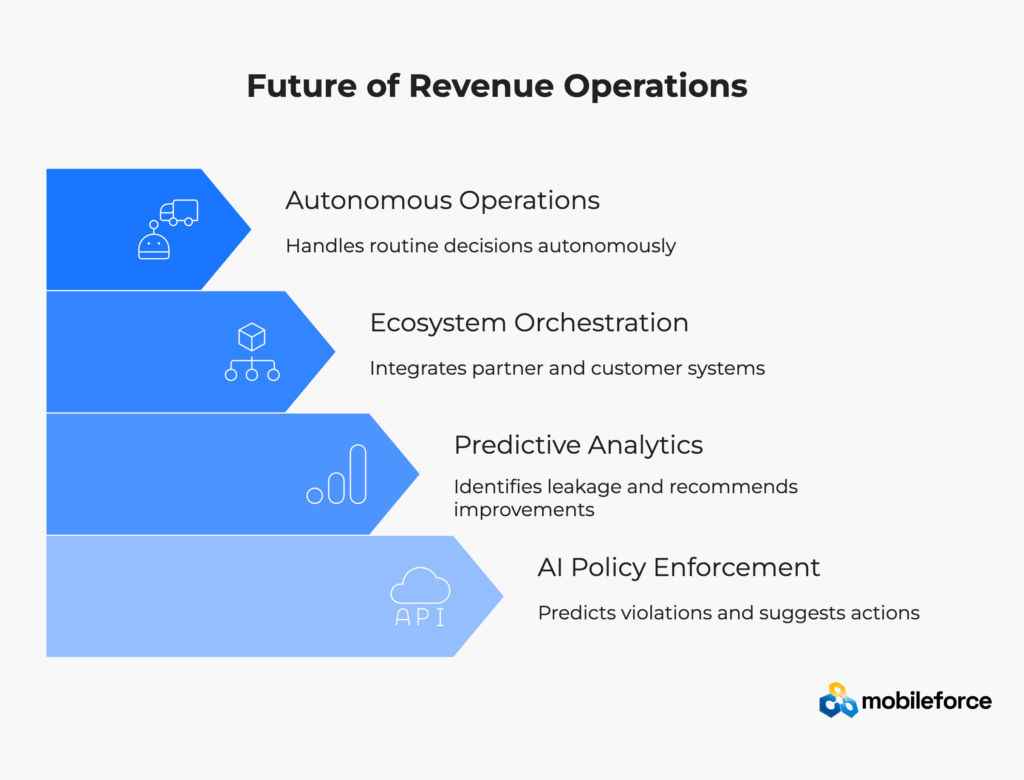

Revenue operations continues evolving rapidly as organizations recognize the strategic importance of execution layer capabilities. Several trends will shape this evolution:

AI-Enhanced Policy Enforcement: Machine learning algorithms will predict policy violations before they occur and suggest corrective actions automatically. Natural language processing will enable conversational interfaces for complex configuration and approval workflows.

Predictive Revenue Analytics: Advanced analytics will identify revenue leakage patterns and recommend process improvements based on historical data and market conditions. Organizations will shift from reactive problem-solving to proactive optimization.

Ecosystem Orchestration: Execution layer platforms will extend beyond internal tool coordination to include partner systems, supplier networks, and customer platforms. Revenue processes will span organizational boundaries seamlessly.

Autonomous Revenue Operations: Eventually, execution layer systems will handle routine revenue decisions autonomously, escalating only exceptional cases to human oversight. This evolution will free revenue operations professionals to focus on strategic optimization rather than tactical coordination.

The organizations that recognize and address execution layer gaps today position themselves to lead revenue operations evolution tomorrow. Those that continue relying on traditional integration approaches risk falling behind competitors with more sophisticated revenue orchestration capabilities.

Traditional CRM integration just moves data between systems, while execution layer platforms enforce pricing rules and coordinate workflows in real-time. The key difference: integration connects systems, execution platforms prevent pricing errors by automatically enforcing discount approvals, product compatibility rules, and contract consistency.

No, execution layer platforms work alongside your current CRM and billing systems rather than replacing them. Organizations get better ROI by enhancing existing systems, with manufacturing, technology, and professional services companies benefiting most when platforms integrate smoothly with current CRM workflows.

Most execution layer platforms deploy faster than traditional CPQ software, with Mobileforce typically deploying in 25-47 days. Timeline depends on CRM integration complexity, business rule migration, user training needs, and data quality preparation.

Organizations typically see measurable returns within the first year, with Mobileforce customers reporting average ROI of 3.2x and 75% time savings in quote processing. Benefits include 2-5% revenue recovery from reduced pricing errors, 1-3% margin protection, 25-40% faster quote cycles, and 15-25% win rate improvement for field sales.

Leading platforms maintain enterprise security standards including SOC 2, GDPR, and ISO certifications while enhancing security through consistent policy enforcement, complete audit trails, end-to-end encryption with role-based access, and geographic data residency compliance.

Execution layer platforms handle change through no-code configuration that lets business users modify workflows without technical dependencies. This enables real-time rule updates, visual workflow builders for quick changes, point-and-click rule creation, and rapid competitive pricing adjustments.

Yes, modern platforms like Mobileforce provide full functionality offline with automatic sync when connectivity returns. This includes complete product configuration and pricing, local proposal generation, cached approval workflows, and automatic CRM sync – essential for manufacturing visits, secure customer environments, and remote locations.

Leading platforms provide native integrations with major CRM, ERP, and billing systems without custom development. Benefits include single sign-on simplicity, real-time data sync, embedded user experience in existing CRM, live inventory and pricing data, and seamless billing parameter transfer – all focused on enhancing rather than replacing existing systems.