Managing Subscriptions, Metered Usage, and Contracts in a Single CPQ System

TL;DR: Technology companies transitioning from fixed subscription pricing to hybrid and usage-based models face growing revenue leakage from fragmented quoting, billing, and usage systems. Modern CPQ platforms like Mobileforce.ai unify pricing logic, automate usage calculations, and orchestrate revenue execution across CRM, billing, and financial systems—enabling scalable monetization without sacrificing pricing control.

Walk into any technology company’s revenue operations meeting, and you’ll hear the same refrain: “Our CPQ software is getting too complex for spreadsheets.”

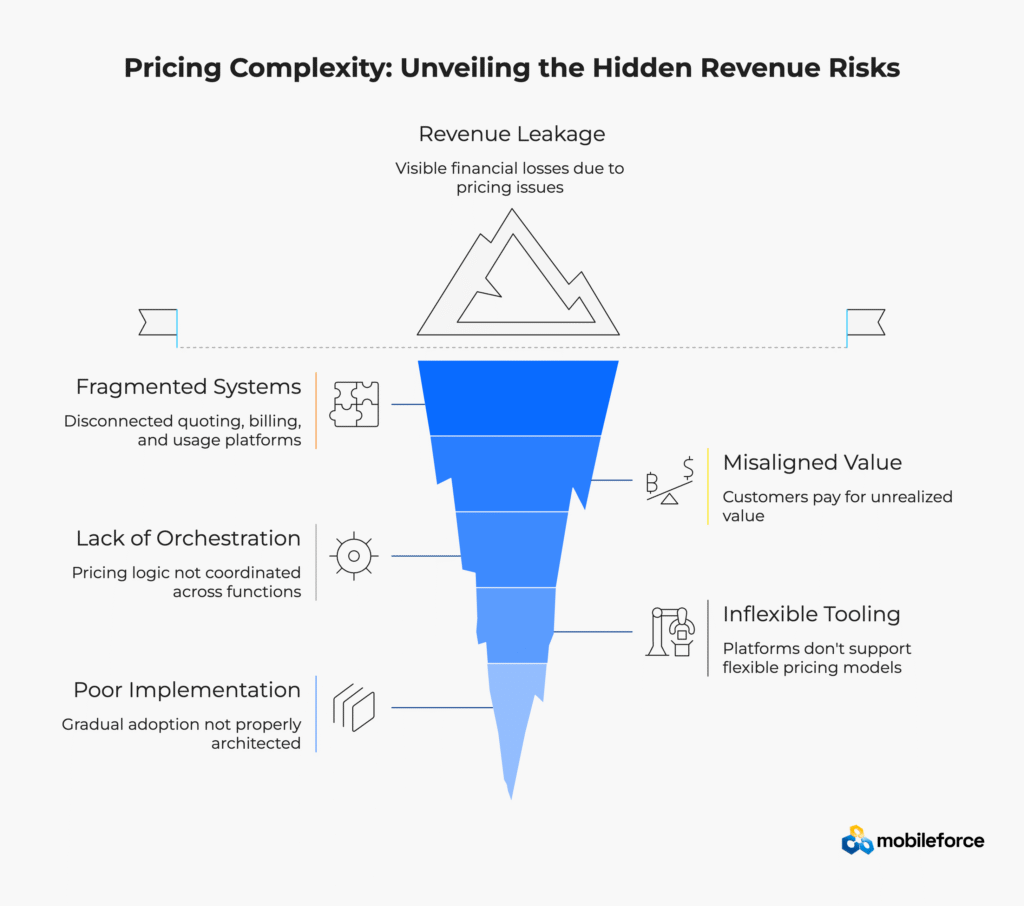

The shift from simple subscription tiers to hybrid and usage-based monetization has created a fundamental mismatch between pricing strategy and execution systems. What started as a basic quote-generation problem has evolved into sophisticated revenue orchestration that most traditional CPQ solutions weren’t designed to handle.

Consider the trajectory most SaaS companies follow. Initially, three subscription tiers cover 90% of deals. Sales reps memorize the pricing, quotes generate in minutes, and billing runs automatically. But as products mature and markets demand more flexible SaaS pricing models, this simplicity breaks down.

Technology companies discover that customers want consumption-based pricing rather than arbitrary seat counts. Enterprise buyers require custom pricing that reflects their specific usage patterns. Product teams introduce new features with different monetization models. Finance teams need accurate forecasting despite variable usage billing.

The result? Pricing complexity has shifted from operational nuisance to revenue risk, making CPQ software selection a critical business decision.

Ready to unify complex SaaS pricing? Request a demo to see how modern CPQ platforms handle hybrid pricing models.

Technology companies managing this transition find that legacy quoting systems create three critical gaps:

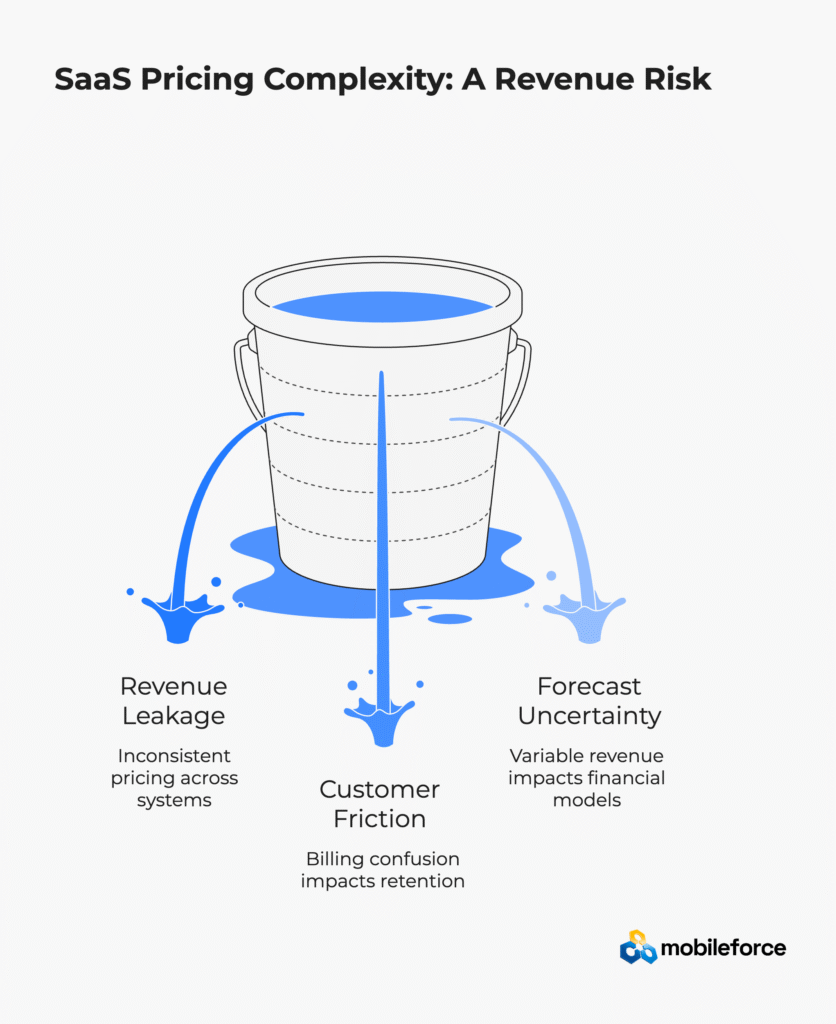

Revenue Leakage Through Pricing Inconsistency: Industry research consistently shows that B2B companies experience revenue leakage through pricing inconsistency when pricing logic lives across fragmented systems. When pricing logic lives in spreadsheets, sales reps apply different rules to similar deals. Usage calculations vary between quotes. Discount approvals follow inconsistent workflows. Finance discovers pricing exceptions only during reconciliation.

Customer Friction From Billing Confusion: Industry surveys consistently show billing transparency as a critical factor in customer retention, particularly for technology companies managing complex usage-based models. Fragmented systems produce bills that customers can’t understand or verify. Usage charges appear without clear connection to consumption. Overages surprise customers who thought they understood their pricing model. Support teams spend time explaining billing rather than delivering value.

Forecast Uncertainty From Variable Revenue: Companies with usage-based revenue models typically experience higher forecast variance than traditional subscription businesses due to the inherent variability in customer consumption patterns. Usage-based components introduce volatility that financial models struggle to incorporate. Sales leadership can’t accurately predict expansion revenue. Board reporting requires constant manual adjustment.

For technology companies navigating these challenges, platforms like Mobileforce.ai are designed to unify pricing logic, quoting, and revenue execution within governed workflows that scale with pricing sophistication. Mobileforce’s Revenue Operations Cloud platform combines native CPQ functionality with the AskCPQ AI agent for intelligent pricing assistance, while its offline-first architecture ensures sales teams can generate quotes even without internet connectivity.

CPQ has evolved beyond quote generation into revenue orchestration. In sophisticated technology companies, CPQ sits as the control layer between product pricing strategy and revenue execution across multiple systems.

Think of modern CPQ as the conductor of a revenue operations orchestra. Product management defines pricing models and packaging rules. Sales executes pricing through quotes and negotiations. Finance approves discounts and forecasts revenue. Billing systems process charges and collect payment. CPQ ensures each system operates with consistent pricing logic and complete context.

This orchestration becomes critical as pricing models grow complex. Simple subscription billing can operate independently of extensive CPQ functionality. But hybrid models—combining subscription bases with usage overages—require sophisticated coordination.

The Full Quote-to-Cash Lifecycle in SaaS

Modern SaaS companies operate quote-to-cash processes that span multiple departments and systems. CPQ platforms coordinate each stage:

Quote Creation: Sales reps configure products, apply pricing rules, and generate proposals with real-time approval routing and margin calculations.

Contract Management: Legal teams access pricing terms, negotiate contract modifications, and track commitment levels against usage projections.

Usage Tracking: Product systems measure consumption, calculate charges, and feed usage data back to CPQ for billing preparation and renewal planning.

Revenue Recognition: Finance teams receive clean data that supports ASC 606 compliance, accurate forecasting, and subscription revenue reporting.

Customer Success: Account teams monitor usage trends, identify expansion opportunities, and predict renewal likelihood based on consumption patterns.

When these processes operate through fragmented systems, information gets lost between handoffs. CPQ platforms maintain context and enforce business rules across the entire lifecycle.

Why Spreadsheet-Driven Quoting Fails

Most technology companies start with spreadsheet-based quoting because it’s flexible and familiar. Product pricing fits in simple tables. Sales reps can modify templates for custom deals. Finance can track quotes without additional software investment.

But spreadsheet quoting breaks down as pricing sophistication increases:

CRM-Native Quoting Limitations

Many technology companies attempt to solve quoting complexity through CRM-native tools. While this approach integrates with sales processes, it creates new limitations for sophisticated pricing:

Modern CPQ platforms such as Mobileforce.ai extend beyond quote generation by acting as revenue orchestration layers across CRM, billing, and financial systems—supporting flexible pricing without forcing companies into rigid billing schemas.

Considering CPQ beyond basic quoting? Explore Mobileforce’s Revenue Operations Cloud for technology companies managing complex pricing models.

Technology companies typically evolve through predictable pricing sophistication stages. Understanding these models helps technology leaders select CPQ platforms that support both current needs and future pricing evolution.

Subscription pricing provides predictable revenue and packaging simplicity that both customers and companies appreciate. Most SaaS companies begin with tiered subscriptions because they’re easy to understand, simple to implement, and familiar to buyers.

Predictable Revenue Advantages:

Where Subscription-Only Pricing Limits Expansion:

Technology companies often discover subscription limitations when successful customers hit usage ceilings. A customer paying $50,000 annually who processes 10x the expected volume creates a pricing problem—they’re receiving enormous value while the vendor captures minimal additional revenue.

Seat-based pricing remains popular in B2B SaaS because it’s intuitive and scales with customer size. Buyers understand paying for each person who uses software. Sales reps can calculate pricing quickly. Implementation is straightforward.

Scaling Challenges:

Buyer Pushback Patterns: Technology companies using seat-based pricing often encounter customer resistance around user definitions. Customers question whether read-only users should count. They argue that admin accounts shouldn’t require full licenses. They request pricing for seasonal or temporary users.

These conversations distract from value-based selling and position price as a barrier rather than reflecting customer value received.

Usage-based pricing charges customers based on consumption metrics like API calls, transactions processed, compute hours, or data volume processed. This model aligns price with realized customer value—customers pay more as they receive more benefit.

Common Usage Metrics:

Why Usage-Based Pricing Aligns Cost with Value: Customers pay based on success rather than anticipated usage. A startup processing 1,000 transactions monthly pays dramatically less than an enterprise processing 100,000 transactions. As customer businesses grow, technology spend grows proportionally.

This alignment creates natural expansion revenue. Customer success doesn’t require selling additional products—growth in customer usage automatically increases revenue. Sales teams can focus on landing new customers rather than constantly upselling existing accounts.

Hybrid models combine predictable subscription bases with variable usage charges. Customers commit to minimum monthly fees while paying additional charges for usage above included thresholds.

Base Commitments with Variable Overages:

Enterprise-grade CPQ platforms, including Mobileforce.ai, support hybrid pricing structures without forcing rigid billing schemas. This flexibility allows technology companies to experiment with different base/overage combinations while maintaining pricing control.

Pricing Model | Revenue Predictability | Customer Value Alignment | Implementation Complexity | Best For |

Subscription Tiers | High (90%+) | Low-Medium | Low | Early-stage SaaS, simple products |

Per-User/Seat | High (85%+) | Medium | Low-Medium | B2B tools, team collaboration |

Usage-Based | Low-Medium (60%) | High | High | APIs, infrastructure, transaction processing |

Hybrid (Sub + Usage) | Medium-High (75%) | High | Medium-High | Mature SaaS, enterprise products |

Why This Comparison Matters: Technology companies often assume they must choose one pricing model permanently. However, successful SaaS businesses frequently evolve from subscription-only to hybrid models as they scale. The key insight: pricing complexity should match product maturity and customer sophistication. Early-stage companies benefit from subscription simplicity, while mature products with diverse customer segments often require hybrid approaches to maximize revenue capture.

Decision Framework: Start with subscription pricing for predictability, then gradually introduce usage components as you develop reliable usage tracking and customer success processes. The transition typically occurs when your top 20% of customers consistently exceed their subscription limits, signaling opportunity for usage-based expansion revenue.

Exploring hybrid pricing for your technology company? See how Mobileforce handles complex pricing models with built-in usage tracking and billing integration.

Implementing usage-based billing requires more than selecting consumption metrics. Technology companies must design pricing that customers understand, finance teams can forecast, and billing systems can execute reliably.

The most successful usage-based pricing models select metrics that closely align with customer value realization. This alignment ensures that pricing feels fair to customers while scaling revenue appropriately with usage growth.

Product-Aligned vs Cost-Aligned Metrics

Product-Aligned Metrics measure outcomes customers care about:

Cost-Aligned Metrics reflect vendor infrastructure expenses:

Avoiding Metrics Customers Don’t Intuitively Understand

Successful usage-based pricing requires metrics that customers can predict and control. Abstract technical metrics create billing surprises that damage trust and increase support burden.

Problematic Metrics:

Metric Type | Customer Understanding | Predictability | Revenue Potential | Implementation Difficulty | Example Companies |

Product-Aligned | High (intuitive) | High (controllable) | High (scales with value) | Medium | Stripe (transactions), Twilio (messages) |

Cost-Aligned | Medium (technical) | Medium (usage varies) | Medium (reflects costs) | Low | AWS (compute hours), Cloudinary (storage) |

Activity-Based | High (user actions) | High (customer controls) | Medium-High (engagement scales) | Medium-High | Zoom (meeting minutes), Slack (messages) |

Outcome-Based | Highest (value clear) | Medium (depends on success) | Highest (tied to ROI) | High | HubSpot (contacts), Salesforce (leads) |

Technical/Infrastructure | Low (abstract) | Low (backend dependent) | Low (disconnect from value) | Low | API response time, server cycles |

Why This Comparison Matters: The usage metric you choose fundamentally shapes customer perception of value and willingness to pay. Product-aligned metrics feel fair because customers can directly connect usage to business value. Cost-aligned metrics can create customer resistance because they reflect vendor costs rather than customer benefits. The most successful SaaS companies choose metrics that customers can predict, control, and connect to their business outcomes.

Selection Framework: Start with outcome-based metrics if possible (contacts managed, leads qualified). If technical constraints require infrastructure metrics, bundle them into simplified product-aligned packages. Avoid metrics that create surprise bills or require customers to optimize for your costs rather than their success.

Customer-Friendly Metrics:

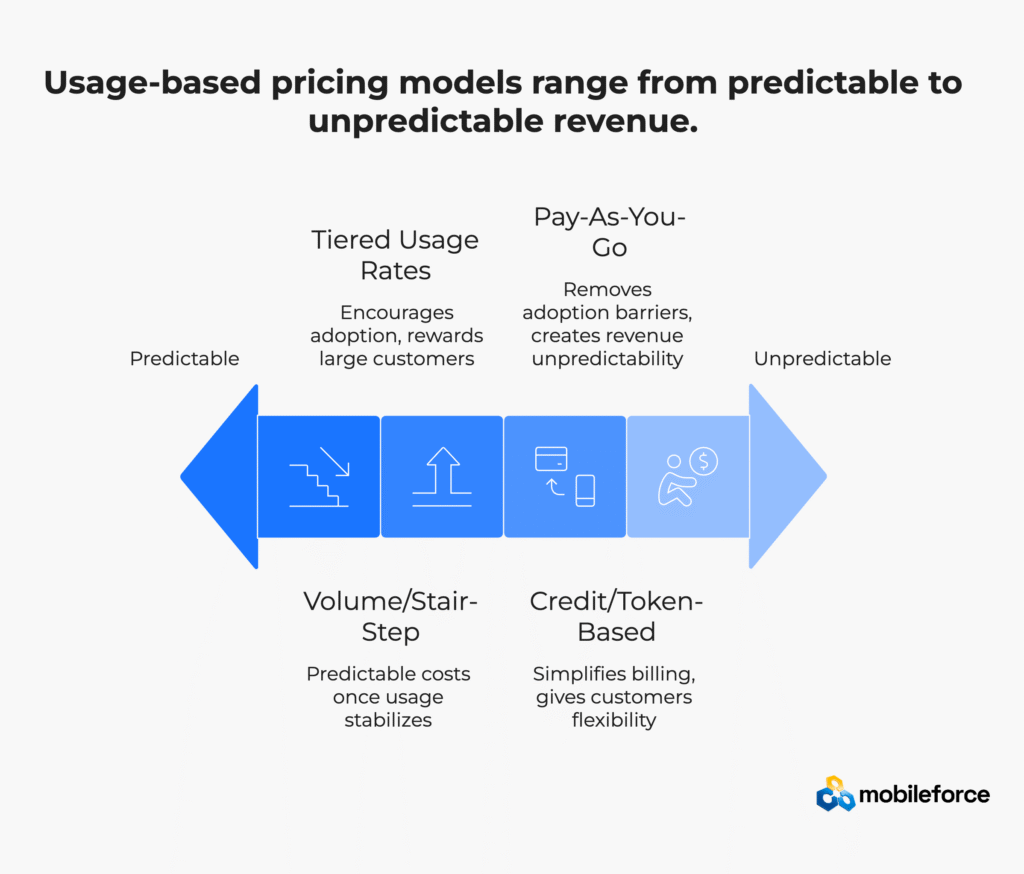

Technology companies can structure usage-based pricing through several models, each with different implications for customer behavior and revenue predictability.

Pay-As-You-Go Pure consumption pricing without minimum commitments. Customers pay exactly for usage with no base fees. This model removes barriers to adoption but creates revenue unpredictability.

Best For: Developer tools, occasional-use services, startup-focused products

Tiered Usage Rates

Different per-unit prices based on consumption levels. Higher usage earns lower per-unit rates, encouraging increased adoption while rewarding large customers.

Example Structure:

Volume/Stair-Step Pricing Customers move into different pricing tiers based on total monthly usage. All usage in a given month is billed at the tier rate, creating predictable costs once usage patterns stabilize.

Credit/Token-Based Consumption Customers purchase usage credits that can be consumed across different product features. This model simplifies billing while giving customers flexibility in how they use services.

Technology companies operating usage-based models require different metrics than traditional SaaS businesses. These KPIs help predict revenue, identify expansion opportunities, and detect potential churn risks.

ARPU and Expansion Revenue

Usage-to-Renewal Correlation Technology companies discover that usage patterns predict renewal likelihood better than traditional engagement metrics. Customers with consistent or growing usage typically renew at higher rates than customers with declining consumption.

Forecast Variance Usage-based revenue creates forecasting challenges that subscription models avoid. Revenue can vary significantly based on customer success, seasonal patterns, and economic conditions affecting customer businesses.

Churn Driven by Billing Volatility Customers may churn due to billing unpredictability rather than product dissatisfaction. Monitoring billing volatility helps identify customers at risk due to usage spikes rather than product issues.

In practice, CPQ solutions like Mobileforce.ai enable pricing teams to model usage tiers, thresholds, and overage logic at quote time—before contracts reach billing or finance teams. This front-end configuration prevents billing surprises and ensures accurate revenue forecasting.

Need help modeling usage-based pricing? Explore Mobileforce’s approach to configuring complex pricing structures with built-in usage tracking.

Technology companies implementing usage-based pricing need CPQ platforms that handle complexity without creating operational burden. Modern solutions coordinate pricing logic across multiple systems while maintaining flexibility for pricing experimentation.

Advanced CPQ platforms allow pricing teams to define sophisticated rules that sales reps execute without understanding underlying complexity. This abstraction enables consistent pricing execution while preserving sales velocity.

Real-Time Usage Integration Modern CPQ systems connect directly to product platforms for current usage data. Sales reps can show customers their existing consumption patterns and model pricing based on projected growth rather than abstract estimates.

Scenario Modeling Customers can see pricing impact across different usage scenarios. Enterprise buyers often request pricing models for their projected growth, seasonal fluctuations, and worst-case usage spikes.

Pricing Optimization Recommendations

AI-powered CPQ platforms can suggest optimal pricing structures based on customer usage patterns, similar customer analysis, and margin requirements. Companies implementing AI-driven pricing optimization typically see meaningful margin improvements within the first year of implementation through more consistent pricing execution and reduced manual errors.

Manual calculation of complex pricing creates errors that damage customer relationships and reduce margins. CPQ automation ensures consistent application of pricing rules while enabling sophisticated models that would be impossible to execute manually.

Tiered Pricing Automation

Overage Calculation

Threshold Management

Usage-based pricing creates ongoing customer lifecycle complexity that requires CPQ platforms to handle more than initial sales. Amendments, renewals, and expansions become regular occurrences that must be managed efficiently.

Mid-Contract Changes Customers frequently request pricing modifications as their usage patterns evolve. CPQ platforms must handle pro-rated billing, usage threshold adjustments, and pricing tier changes without creating billing confusion.

Usage-Informed Renewals

Renewal conversations benefit from complete usage history and trend analysis. CPQ platforms provide account teams with consumption patterns that support renewal pricing discussions and expansion opportunity identification.

Automatic Expansion Quotes Some CPQ platforms can automatically generate expansion quotes when customers approach usage thresholds, enabling proactive revenue growth without sales team intervention.

Technology companies operate complex system environments that require CPQ platforms to coordinate data across multiple systems without creating integration complexity.

CRM Integration

Billing System Coordination

ERP System Integration

Usage Data Sources

Mobileforce.ai is purpose-built for technology companies that require flexible pricing logic, CRM-agnostic integrations, and support for complex, usage-driven monetization—without the customization burden of legacy CPQ platforms. As a HubSpot Platinum Solutions Partner, Mobileforce provides native integrations with HubSpot, Salesforce, Microsoft Dynamics, and other leading CRM platforms, enabling unified quote-to-cash-to-service workflows.

Ready to see modern CPQ in action? Request a demo to explore how Mobileforce handles complex SaaS pricing with seamless system integration.

Finance teams approach usage-based pricing with different concerns than sales or product teams. While sales appreciates pricing flexibility and product teams value customer alignment, finance requires predictability, accuracy, and control.

CFOs face a fundamental tension with usage-based pricing: the model that best aligns with customer value creates the most forecasting uncertainty.

Predictability Concerns:

Upside Opportunities:

Smart finance teams develop forecasting models that account for usage variability while capturing expansion opportunity. This typically involves creating baseline usage assumptions with variance bands rather than point estimates.

Traditional SaaS forecasting relies on subscription commitments that provide revenue certainty. Usage-based models require different approaches that balance accuracy with the inherent uncertainty of consumption-based pricing.

Baseline Plus Variance Modeling Mature finance teams establish customer baseline usage patterns and model revenue around expected variance ranges rather than point estimates.

Cohort-Based Analysis

Grouping customers by signup date, company size, or industry reveals usage patterns that improve forecasting accuracy for similar customer segments.

Leading Indicator Tracking Finance teams identify operational metrics that predict usage changes before they impact revenue. Product adoption, feature usage, and customer success metrics often precede billing changes.

Usage-based pricing creates specific revenue recognition requirements that finance teams must address through proper systems and controls.

Performance Obligation Timing Revenue recognition occurs when usage happens rather than when contracts are signed. This requires systems that track consumption and revenue recognition simultaneously.

Variable Consideration Estimates Finance teams must estimate variable usage revenue for accounting periods, particularly for customers with monthly usage that spans accounting periods.

Contract Modification Tracking Changes to usage-based pricing require careful tracking to ensure proper revenue recognition treatment under accounting standards.

Why Finance Teams View CPQ as Control Layer

From finance perspectives, CPQ platforms serve as governance and control systems rather than just sales tools. Proper CPQ implementation ensures pricing decisions follow approved business rules and create clean data for downstream systems.

Pricing Approval Workflows CPQ systems enforce discount limits, require management approval for custom pricing, and maintain audit trails for pricing decisions.

Data Quality Assurance

Integration between CPQ, billing, and ERP systems reduces manual data entry that creates reconciliation issues and compliance risks.

Forecasting Data Integrity CPQ platforms provide structured data that supports accurate forecasting models without requiring manual cleansing and adjustment.

From a finance perspective, platforms such as Mobileforce.ai help standardize pricing rules upstream, reducing downstream billing exceptions and improving forecast reliability. This control layer approach gives CFOs confidence in variable revenue models.

Concerned about usage-based pricing impact on financial operations? Learn how Mobileforce integrates with ERP and billing systems to maintain financial control.

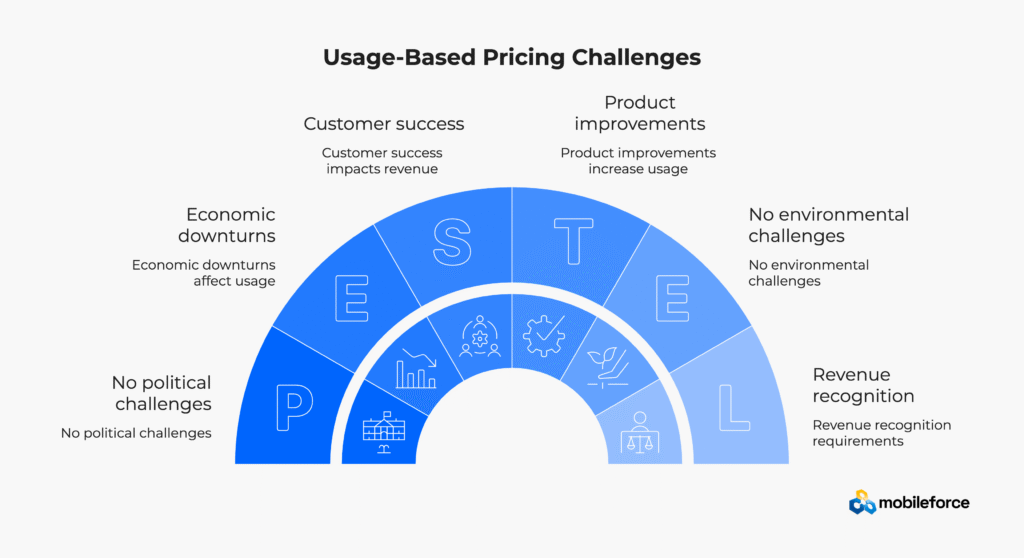

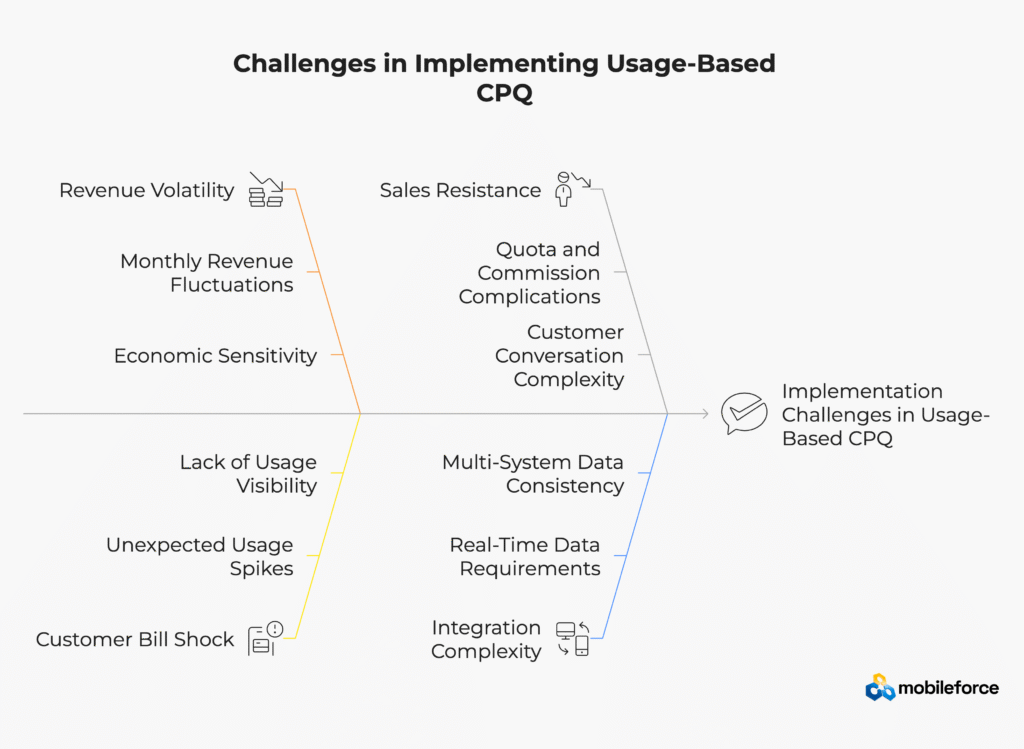

Technology companies often focus on usage-based pricing benefits while underestimating implementation challenges that can damage customer relationships and create operational complexity.

Usage-based pricing creates revenue fluctuations that affect everything from cash flow management to hiring decisions. Technology companies must develop new planning approaches that account for variability while maintaining growth targets.

Monthly Revenue Fluctuations Customer usage patterns create revenue swings that subscription models avoid. Enterprise customers may process high volumes during quarter-end periods, followed by light usage during the following month. Seasonal businesses contribute predictable but variable revenue throughout the year.

Security and Compliance Considerations

Usage-based pricing requires secure handling of consumption data and customer usage patterns. Companies handling usage data must implement appropriate data protection controls, particularly when usage metrics contain business-sensitive information about customer operations.

Economic Sensitivity Usage-based revenue often correlates more closely with general economic conditions than subscription revenue. When customer businesses slow down, usage decreases immediately—before subscription cancellations occur. SaaS companies with consumption-based models typically experience higher revenue correlation with economic cycles compared to pure subscription businesses.

Growth Investment Timing Variable revenue makes it challenging to determine when usage growth justifies additional infrastructure investment. Companies may over-invest during usage spikes or under-invest during temporary declines.

Usage-based pricing can create billing surprises that damage customer relationships even when pricing is technically accurate. Technology companies must actively prevent bill shock rather than simply explaining charges after they occur.

Unexpected Usage Spikes

Lack of Usage Visibility Customers who can’t monitor their consumption in real-time risk billing surprises. This is particularly problematic for enterprise customers with multiple team members who may not coordinate usage awareness.

Complex Pricing Structure Confusion Sophisticated pricing models with multiple tiers, thresholds, and special conditions can confuse customers who thought they understood their pricing model.

Sales teams often resist usage-based pricing models because they create deal uncertainty and require more complex customer conversations. This resistance can undermine adoption even when the pricing model benefits customers.

Quota and Commission Complications Variable pricing makes it difficult for sales reps to predict their commission income or plan territory strategies. Traditional quota models assume predictable deal sizes that usage-based pricing eliminates.

Customer Conversation Complexity

Sales reps must explain pricing models, help customers estimate usage, and address concerns about bill unpredictability. This requires different skills than traditional subscription selling.

Deal Forecasting Uncertainty Sales management struggles to forecast deal values when pricing depends on unknown future usage patterns. This affects territory planning, hiring decisions, and investor communication.

Usage-based pricing requires integration across systems that typically operate independently. This technical complexity often exceeds initial implementation estimates and creates ongoing operational overhead.

Real-Time Data Requirements Usage-based pricing requires current consumption data for accurate quoting and billing. Legacy systems may not provide real-time access or may require expensive custom integration work.

Multi-System Data Consistency Pricing data must remain synchronized across CPQ, billing, ERP, and usage tracking systems. Data inconsistencies create customer billing disputes and internal reconciliation challenges.

Historical Data Management Usage-based pricing requires extensive historical data for customer analysis, billing verification, and renewal planning. Many companies underestimate data storage and processing requirements.

Challenge Category | Business Impact | Technical Complexity | Customer Experience Risk | Mitigation Approach |

Revenue Volatility | High (unpredictable cash flow) | Low | Medium (budgeting difficulty) | Financial modeling, reserves, communication |

Customer Bill Shock | High (churn risk) | Medium | High (trust damage) | Usage alerts, caps, transparency dashboards |

Sales Team Resistance | Medium (adoption delays) | Low | Medium (complex conversations) | Commission alignment, training, pilot programs |

Data Integration | Medium (operational overhead) | High | High (billing disputes) | Unified platforms, real-time monitoring |

Complex Billing | Medium (support burden) | High | Medium (confusion) | Simplified tiers, clear documentation |

Forecasting Difficulty | High (planning challenges) | Medium | Low | Predictive analytics, scenario modeling |

Why This Framework Matters: Technology companies often focus on pricing model benefits while underestimating implementation challenges that can derail adoption. The most successful usage-based pricing implementations systematically address each challenge category before launch rather than reacting to problems after they occur.

Priority Management: Start with customer experience risks (bill shock, billing complexity) since these directly affect retention. Then address business impact issues (revenue volatility, forecasting) that affect operations. Technical complexity challenges often resolve themselves with proper platform selection and implementation methodology.

Addressing these challenges often requires CPQ platforms like Mobileforce.ai that balance pricing governance with commercial flexibility. Technology companies need solutions that prevent common usage-based pricing pitfalls while enabling pricing sophistication.

Concerned about usage-based pricing complexity? Explore how Mobileforce addresses common implementation challenges with built-in safeguards and automation.

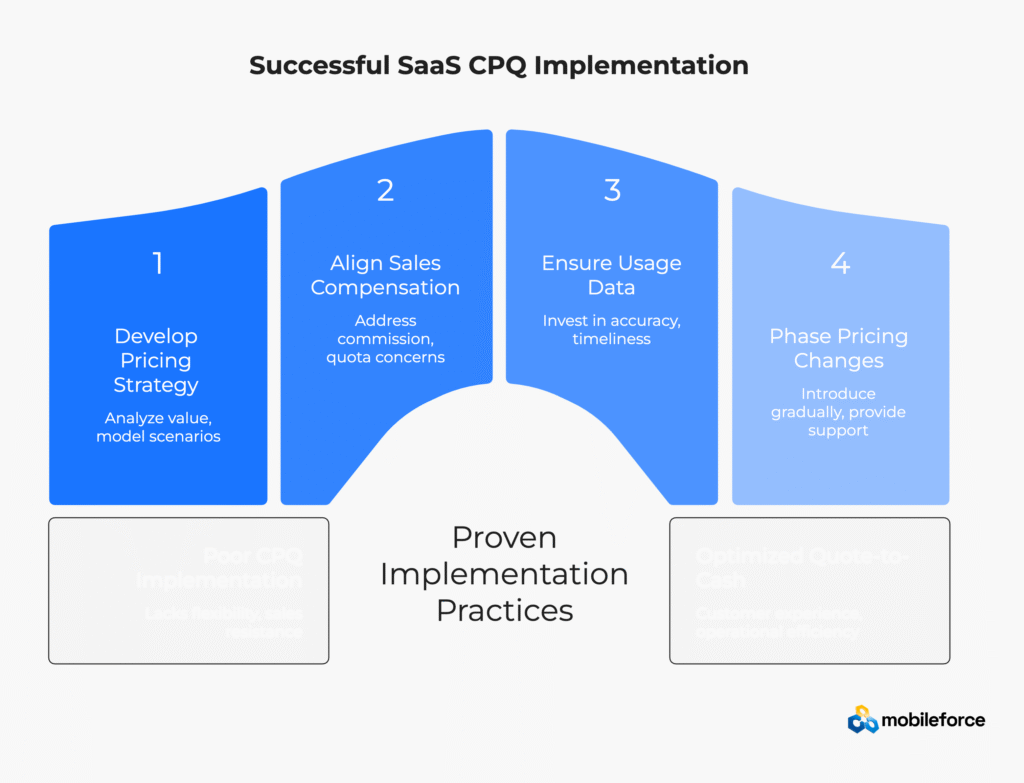

Technology companies implementing usage-based pricing through advanced CPQ software can avoid common pitfalls by following proven practices that prioritize customer experience while building internal operational capabilities for quote-to-cash optimization.

Many technology companies select CPQ platforms before fully developing their pricing strategy. This approach often leads to implementations that support current pricing models but lack flexibility for pricing evolution.

Pricing Strategy Development:

CPQ Platform Selection Criteria:

Sales team resistance often undermines usage-based pricing implementations when compensation models don’t align with new pricing approaches. Technology companies must address commission and quota concerns before launching usage-based pricing.

Commission Model Considerations:

Implementation Approaches:

Usage-based pricing is only as good as underlying usage data. Technology companies must invest in data reliability before implementing consumption-based billing to avoid customer disputes and support burden.

Data Quality Requirements:

Infrastructure Investment:

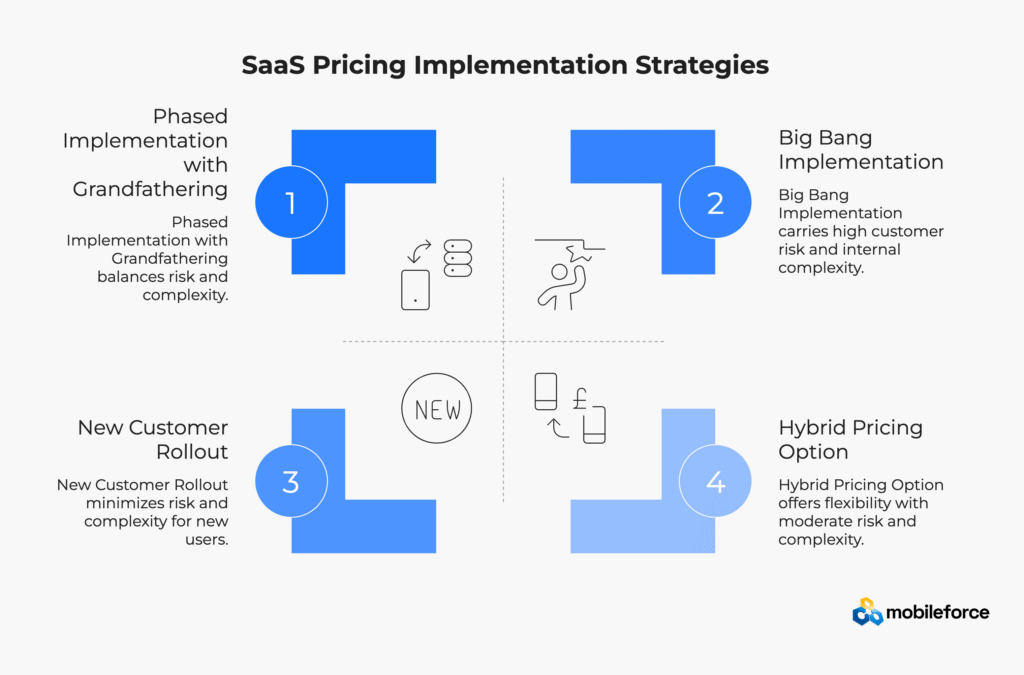

Sudden pricing model changes can shock customers and create internal operational complexity. Technology companies achieve better results by introducing usage-based pricing gradually and providing transition support.

Implementation Strategy | Customer Risk | Internal Complexity | Revenue Impact Timeline | Success Rate | Best For |

Big Bang (All-at-Once) | High (customer shock) | High (system/training) | Fast (immediate impact) | Low (60-70%) | Simple products, urgent competitive pressure |

New Customers Only | Low (grandfathering) | Medium (dual operations) | Slow (gradual growth) | High (85-90%) | Growing companies, complex pricing |

Opt-In Hybrid Model | Low (customer choice) | Medium-High (complexity) | Medium (customer-driven) | Medium-High (75-85%) | Uncertain customer response |

Gradual Feature Addition | Low (incremental change) | Low-Medium (staged rollout) | Slow-Medium (feature adoption) | High (80-90%) | Feature-rich products, conservative customers |

Pilot Program | Very Low (limited scope) | Low (controlled test) | Very Slow (learning phase) | High (90%+ for pilots) | High-stakes changes, complex customers |

Why Implementation Strategy Matters: The approach you choose for introducing usage-based pricing often determines success more than the pricing model itself. Customers who feel surprised or forced into new pricing models frequently churn, even when the new pricing provides better value. Conversely, gradual introductions with proper change management typically achieve higher adoption rates and customer satisfaction.

Risk-Adjusted Selection: Companies with high customer switching costs can afford faster implementations, while those in competitive markets should prioritize customer comfort over speed. The most successful implementations combine gradual rollouts with strong customer communication and support systems.

Phased Implementation Approaches:

Change Management:

Companies adopting Mobileforce.ai typically introduce usage-based models gradually rather than through disruptive, all-at-once changes. Mobileforce’s rapid implementation capabilities and no-code configuration tools enable rapid implementation without extensive IT involvement, allowing companies to test hybrid pricing models quickly while maintaining operational continuity. This incremental approach reduces risk while building organizational capability to manage consumption-based pricing effectively.

Planning a usage-based pricing implementation? Learn from Mobileforce’s implementation methodology for minimizing disruption while maximizing adoption success.

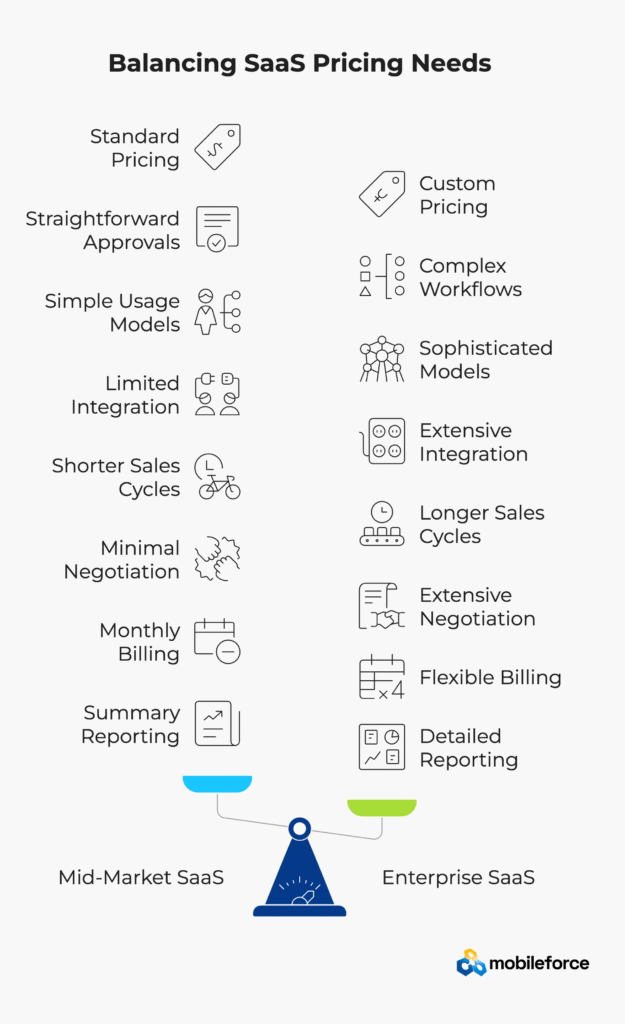

Pricing complexity scales with deal size and customer sophistication. Technology companies must select CPQ platforms that support both current deal complexity and anticipated growth without requiring platform migration.

Mid-Market Deal Characteristics ($10K-$100K ACV):

Enterprise Deal Characteristics ($100K+ ACV):

Mid-Market Sales Process:

Enterprise Sales Process:

Mid-Market Billing Preferences:

Enterprise Billing Requirements:

Requirement | Mid-Market SaaS CPQ | Enterprise SaaS CPQ |

Pricing Flexibility | Standard tiers with limited customization | Fully customizable pricing with complex rules |

Approval Workflows | Simple discount approval process | Multi-level approvals with role-based routing |

Usage Tracking | Basic consumption metrics | Multiple usage dimensions with detailed reporting |

Integration Depth | CRM and billing integration | ERP, procurement, and financial system integration |

Contract Management | Standard terms with minimal changes | Extensive contract customization and negotiation |

Implementation | Self-service with basic support | Dedicated implementation and customer success |

Why This Distinction Matters: Many technology companies assume they can scale their CPQ requirements linearly, but the jump from mid-market to enterprise deals requires fundamentally different capabilities. The most expensive mistake is choosing a “simple” CPQ solution that can’t grow with business sophistication, forcing costly platform migration later. Conversely, over-engineering CPQ for simple mid-market deals creates unnecessary complexity and slower sales cycles.

Selection Strategy: Choose platforms like Mobileforce.ai that provide enterprise-grade architecture with mid-market simplicity. This allows companies to start with straightforward pricing models while maintaining the option to add complexity without platform migration. The key is avoiding solutions that force you to choose between current simplicity and future sophistication.

While mid-market SaaS companies often outgrow lightweight quoting tools, enterprise organizations typically require platforms like Mobileforce.ai that support high-ACV deals, complex approvals, and multi-dimensional pricing models without forcing technology companies to choose between simplicity and sophistication.

Scaling from mid-market to enterprise deals? Explore how Mobileforce grows with your business complexity without requiring platform migration.

Technology companies need the ability to test pricing strategies without damaging customer relationships or creating operational complexity. Modern CPQ platforms enable controlled experimentation that provides market feedback while maintaining pricing governance.

Early-stage SaaS companies can succeed with simple pricing because customer needs are relatively homogeneous and competitive pressure is limited. But as markets mature, pricing requirements become more sophisticated.

Market Maturation Pressures:

Companies with dynamic pricing capabilities often achieve higher profit margins than those using static pricing models, with technology companies particularly well-positioned to benefit due to rapid feature evolution and diverse customer segments.

Customer Sophistication Growth:

Advanced CPQ platforms allow pricing teams to test new models with limited customer segments while maintaining existing pricing for other customers. This enables data-driven pricing evolution without enterprise-wide disruption.

Testing Usage Thresholds Technology companies can experiment with different usage thresholds to find optimal customer adoption levels. Too-low thresholds create frequent overage charges that damage customer experience. Too-high thresholds leave revenue on the table.

A/B Testing Pricing Models:

Bundles Versus Pure Consumption Some customers prefer bundled pricing that provides cost predictability, while others value pure consumption pricing that eliminates waste. CPQ platforms can offer both options and track customer preference patterns.

Segment/Region-Specific Pricing

Different customer segments and geographic regions may respond better to different pricing models. CPQ experimentation allows testing localized pricing without affecting global pricing strategies.

Pricing experimentation without proper controls can create customer confusion, internal operational complexity, and competitive intelligence leakage. CPQ platforms must provide experimentation capability with built-in safeguards.

Customer Communication Coordination

Internal Process Protection

Data Collection and Analysis

Some technology companies use CPQ platforms such as Mobileforce.ai to test pricing strategies safely without hardcoding pricing into product or billing systems. This separation allows rapid experimentation with easy rollback capability.

Interested in pricing experimentation? Learn how Mobileforce enables controlled testing of usage-based models without operational disruption.

Technology companies evaluating CPQ platforms for usage-based pricing must understand different architectural approaches and their implications for flexibility, integration, and total cost of ownership.

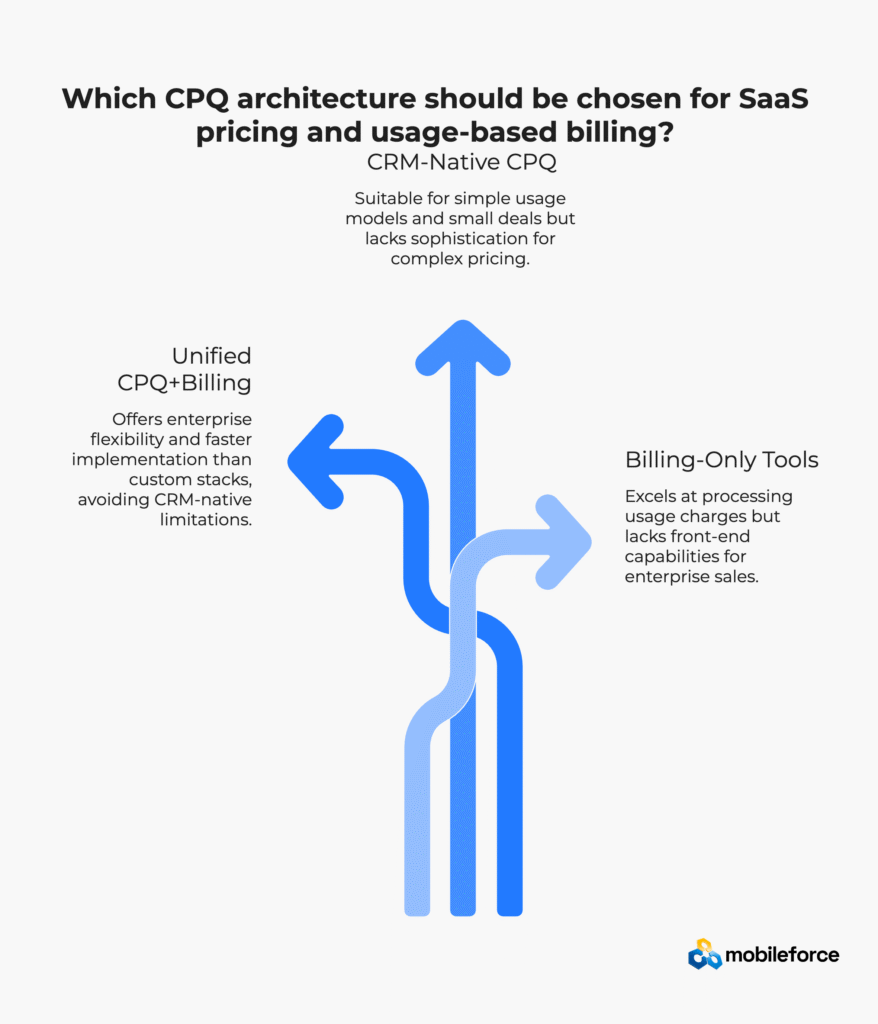

Technology companies must choose between different CPQ architectural approaches that have significant implications for implementation complexity, vendor management, and long-term flexibility.

Approach | Implementation Time | Vendor Management | Data Consistency | Flexibility | Total Cost of Ownership | Best For |

Unified CPQ + Billing | Fast (2-6 months) | Single vendor | High consistency | Medium-High | Medium | Growing SaaS companies |

Stitched-Together Stack | Slow (6-18 months) | Multiple vendors | Low-Medium consistency | Highest | High | Large enterprises with complex needs |

CRM-Native CPQ | Fastest (1-3 months) | CRM vendor only | Medium consistency | Low-Medium | Low | Simple pricing models |

Billing-Only Platforms | Medium (3-9 months) | Billing vendor + custom | Medium consistency | Medium | Medium-High | Usage-heavy, quote-light businesses |

Revenue Operations Platform | Medium (4-8 months) | Single vendor | Highest consistency | High | Medium-High | Quote-to-cash-to-service integration |

Why Architecture Choice Matters: The CPQ architecture decision affects not just initial implementation, but your ability to evolve pricing models, integrate new systems, and manage vendor relationships over time. Companies that start with simple solutions often face expensive migrations as they grow. Conversely, companies that over-engineer for theoretical future needs waste resources and slow initial deployment.

Decision Framework: Consider Mobileforce.ai’s Revenue Operations Cloud approach, which provides unified CPQ+billing architecture with enterprise flexibility. This eliminates the complexity of stitched-together stacks while avoiding the limitations of CRM-native solutions. The result: faster implementation than custom stacks with more sophistication than simple tools.

Most major CRM platforms offer native quoting functionality that seems attractive due to tight integration with sales processes. However, these solutions often lack sophistication required for usage-based pricing.

Common CRM-Native Limitations:

When CRM-Native Solutions Work:

Sophisticated billing platforms excel at processing usage charges and managing customer subscriptions, but they typically lack the front-end capabilities required for complex enterprise sales processes.

Billing Platform Strengths:

Enterprise Sales Process Gaps:

Unlike CRM-bound tools, CPQ platforms such as Mobileforce.ai operate independently of any single CRM, making them suitable for heterogeneous enterprise environments. This independence provides several advantages:

Multi-CRM Support:

Integration Flexibility:

Evaluating CPQ platforms for usage-based pricing? Compare Mobileforce’s approach to unified pricing orchestration vs. point solution integration.

Consider a high-growth technology company providing API infrastructure services to enterprise customers. After three years of rapid expansion using traditional subscription tiers, they faced a familiar challenge: their biggest customers were receiving enormous value while contributing disproportionately little revenue.

The company’s pricing model included three subscription tiers: Starter ($99/month for 50,000 API calls), Professional ($499/month for 500,000 API calls), and Enterprise ($1,999/month for 2 million API calls). Several enterprise customers were processing 20-50 million API calls monthly—10x to 25x their subscription allowance—while paying the same fixed fee.

Sales reps manually calculated overage quotes in spreadsheets, often taking days to respond to pricing inquiries. Finance spent significant time each month reconciling actual usage with contracted pricing. Customers complained about billing delays and inconsistent overage calculations between renewals.

The transition to hybrid pricing created three immediate operational challenges:

Quote Delays: Enterprise prospects expected pricing for their specific usage scenarios during initial sales conversations. Sales reps needed to coordinate with finance, engineering, and billing teams to provide accurate hybrid pricing quotes, extending deal cycles from 3-4 months to 6-8 months.

Inconsistent Pricing: Different sales reps applied different overage calculations for similar customer profiles. Some calculated overages monthly, others annually. Discount structures varied based on individual rep discretion rather than company-wide pricing standards.

Billing Disputes: Customers received surprise bills when usage exceeded expectations. The billing system couldn’t clearly explain overage calculations or connect charges to specific time periods. Customer success teams spent increasing time addressing billing confusion rather than driving product adoption.

In this anonymized scenario, the company implemented Mobileforce.ai as the CPQ layer to unify subscription and usage-based pricing across its enterprise sales motion. The implementation addressed each operational challenge:

Automated Quote Generation: Sales reps could generate hybrid pricing quotes in real-time based on prospect usage projections. The CPQ system automatically applied tiered overage rates, volume discounts, and commitment-based pricing without requiring finance team involvement.

Standardized Pricing Logic: All pricing calculations followed consistent rules defined in the CPQ platform. Enterprise deals with similar usage patterns received identical pricing, while custom configurations required explicit approval workflows that maintained pricing integrity.

Transparent Billing Integration: Customer invoices clearly showed base subscription charges, actual usage volumes, and overage calculations. Customers could access usage dashboards that predicted monthly costs based on current consumption trends.

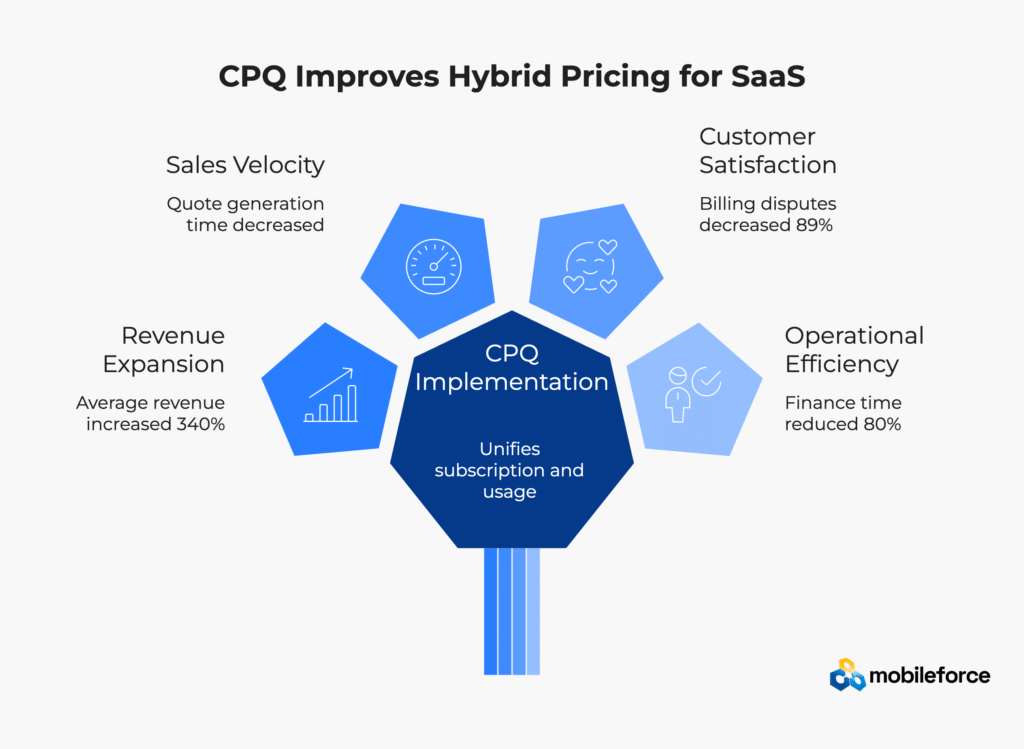

The hybrid pricing model with proper CPQ support delivered measurable improvements:

The implementation succeeded because the company addressed three critical elements simultaneously: pricing strategy, operational systems, and change management. They didn’t simply implement usage-based billing—they redesigned their entire revenue operation around hybrid pricing with proper technological support.

Considering a similar transition? See how Mobileforce supports hybrid pricing implementations for technology companies.

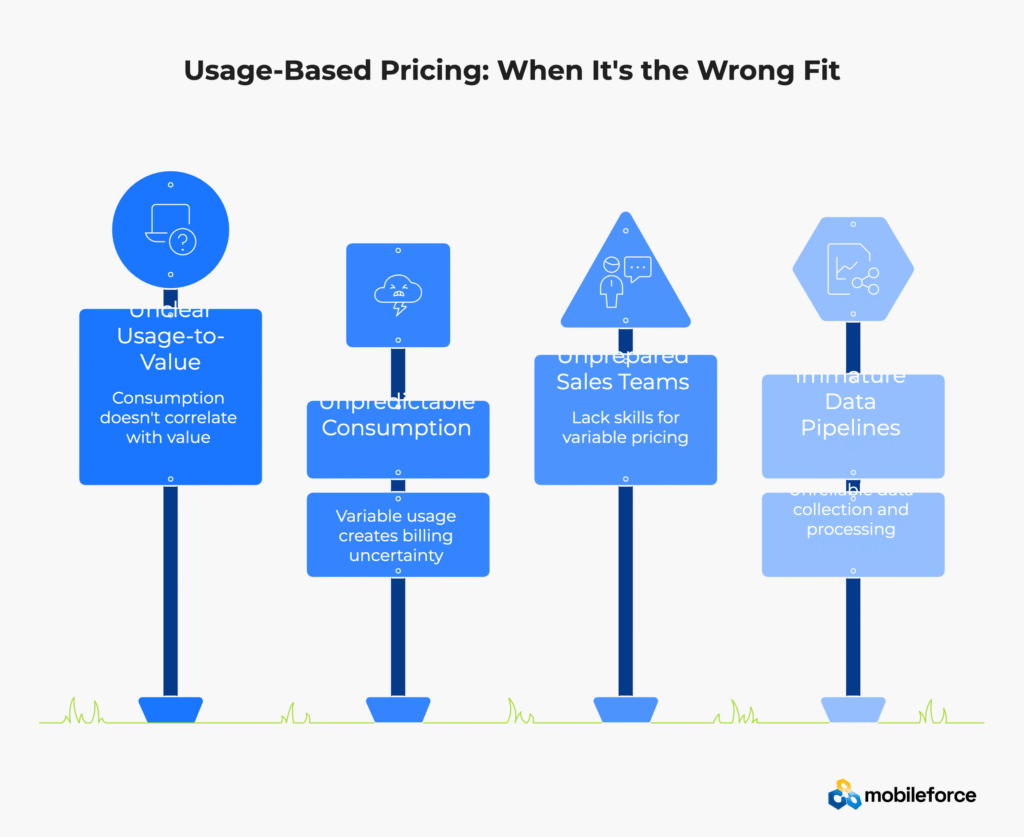

Technology companies shouldn’t assume usage-based pricing is automatically superior to subscription models. Certain product categories, customer segments, and business models benefit more from predictable subscription pricing than consumption-based charges.

Usage-based pricing works best when consumption metrics closely correlate with customer value. Some technology products create value in ways that don’t translate naturally to measurable usage.

Problematic Product Categories:

Alternative Pricing Approaches:

Usage-based pricing requires consumption patterns that customers can understand and predict. Products with highly variable or unpredictable usage create billing uncertainty that can damage customer relationships.

Unpredictable Usage Scenarios:

Customer Impact:

Usage-based pricing requires sales teams with different skills and training than traditional subscription selling. Companies without proper sales enablement may find usage-based models create more barriers than benefits.

Required Sales Capabilities:

Training and Enablement Requirements:

Usage-based pricing requires reliable, accurate, and timely usage data collection and processing. Companies with immature data infrastructure may create more problems than they solve by implementing consumption-based pricing.

Data Infrastructure Requirements:

Common Data Challenges:

Even with advanced CPQ platforms like Mobileforce.ai, usage-based pricing is not universally appropriate. Technology companies should carefully evaluate whether their products, customers, and organizational capabilities align with consumption-based pricing before making the transition.

Unsure if usage-based pricing fits your business model? Explore Mobileforce’s assessment framework for evaluating pricing model alignment with product and customer characteristics.

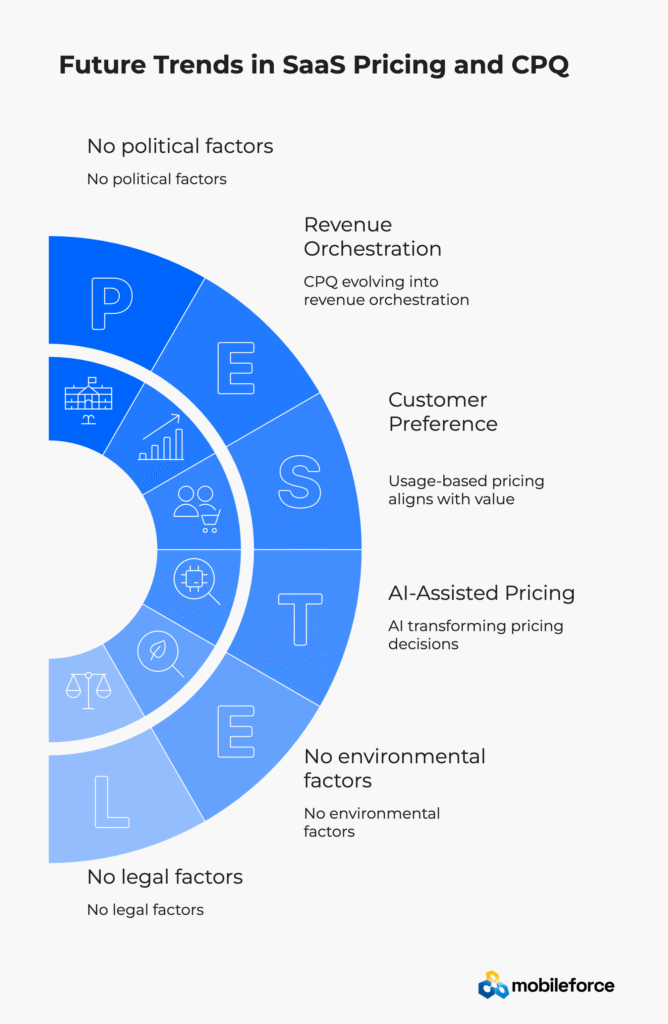

Technology companies planning CPQ investments must consider not just current requirements but also emerging trends that will shape pricing and revenue operations over the next several years.

Artificial intelligence is beginning to transform how technology companies approach pricing decisions. Rather than relying solely on human judgment and simple rules, AI-powered systems can analyze vast amounts of data to suggest optimal pricing for specific situations.

Current AI Applications:

Emerging AI Capabilities:

Industry trends suggest usage-based pricing will become the standard approach for most SaaS products rather than an alternative to subscription models.

Driving Forces:

Companies using consumption-based pricing models often see higher customer satisfaction and faster revenue growth compared to traditional subscription models, as customers pay only for value received.

Implications for Technology Companies:

Traditional CPQ focused primarily on quote generation and approval workflows. Modern platforms increasingly coordinate the entire revenue operation from initial pricing through customer billing and renewal.

Expanded Platform Scope:

Operational Benefits:

Technology companies increasingly recognize pricing as a strategic product capability rather than a finance or sales function. This evolution requires different organizational structures and technology platforms.

Product Team Involvement:

Platform Requirements:

Technology companies preparing for these trends benefit from CPQ platforms that support both current requirements and future evolution. Mobileforce.ai‘s approach to revenue orchestration positions technology companies for pricing sophistication growth without requiring platform migration. Its offline-first architecture ensures sales teams can generate complex usage-based quotes even without internet connectivity, while the Revenue Operations Cloud provides unified visibility across the entire customer lifecycle.

Interested in future-proofing your pricing technology? Explore Mobileforce’s product roadmap for AI-powered pricing and revenue orchestration capabilities.

Technology companies face a fundamental decision: continue managing pricing complexity through manual processes and fragmented systems, or invest in modern CPQ platforms that enable sophisticated monetization without operational burden.

The shift to usage-based and hybrid pricing models is accelerating across the SaaS industry. Companies that master this transition early gain competitive advantages through better customer value alignment, improved expansion revenue, and more accurate revenue forecasting. Those that delay risk falling behind competitors who offer more flexible and attractive pricing models.

Pricing strategy without proper execution systems fails to deliver value. Complex pricing models implemented through spreadsheets and manual processes create customer friction and internal operational overhead that undermines strategic benefits.

Conversely, sophisticated CPQ platforms cannot compensate for unclear pricing strategy. Technology companies need both strategic pricing clarity and execution systems that support pricing sophistication with operational efficiency.

Modern CPQ platforms provide the control layer that enables pricing experimentation without operational disruption. Technology companies can test new models, adjust pricing based on market feedback, and scale successful approaches across their customer base.

This capability becomes increasingly valuable as pricing complexity grows. Early-stage companies may succeed with simple pricing and basic tools, but scaling companies require platforms that grow with their sophistication.

For technology companies navigating SaaS pricing complexity and usage-based billing, Mobileforce.ai provides a scalable CPQ foundation to operationalize pricing strategy without sacrificing control or flexibility. The Revenue Operations Cloud platform combines native CPQ functionality with AskCPQ AI agent intelligence, no-code customization capabilities, and unified quote-to-cash-to-service integration—all supported by rapid deployment capabilities and HubSpot Platinum Partnership expertise.

Ready to transform your SaaS pricing operations? Request a personalized demo to see how Mobileforce.ai enables sophisticated pricing models with operational simplicity.

What is usage-based billing in SaaS CPQ?

Usage-based billing charges customers based on actual consumption metrics like API calls, transactions, or data volume rather than fixed subscription fees. Modern CPQ systems automatically calculate these charges by integrating real-time usage data from product platforms and applying predefined pricing rules and tier structures.

How does CPQ handle overages and tiered usage pricing?

CPQ platforms automatically apply tiered pricing rules based on consumption data. For example, customers pay $0.10 per API call for the first 5,000 calls, then $0.08 for additional calls. The system tracks usage against subscription limits and calculates overage charges when thresholds are exceeded.

Is usage-based pricing risky for revenue forecasting?

Usage-based pricing creates revenue variability requiring different forecasting approaches than subscription models. However, mature finance teams develop baseline usage patterns with variance models for accurate forecasting ranges. Revenue expansion from customer success often offsets the forecasting uncertainty through automatic growth.

How is CPQ different from billing software for SaaS companies?

CPQ platforms handle quote generation, pricing configuration, and deal approval workflows during sales. Billing software processes charges and manages subscriptions after deals close. For usage-based pricing, CPQ defines pricing rules that billing systems execute, while billing handles usage data processing and invoice generation.

When should a SaaS company adopt hybrid pricing models?

SaaS companies should adopt hybrid pricing when serving diverse customer segments where some prefer cost predictability while others want usage-based charges. This typically occurs when subscription pricing limits expansion revenue from high-usage customers or competitive pressure requires flexible pricing options.