Connecting contracts, quotes, and billing for smoother operations

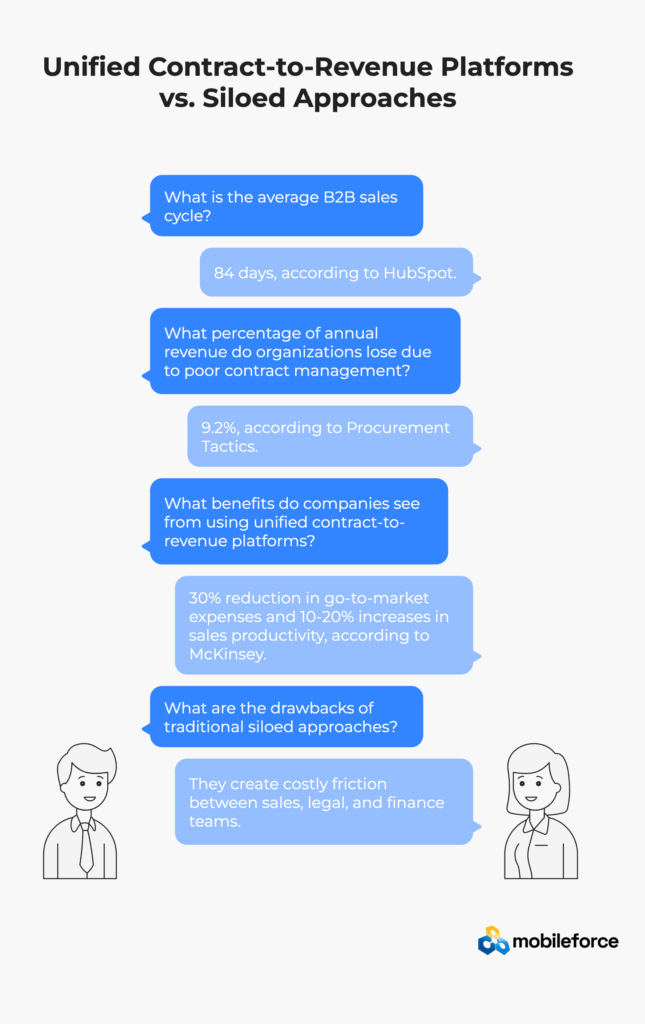

The average B2B sales cycle now takes 84 days according to HubSpot, but poor contract management causes organizations to lose an average of 9.2% of annual revenue. Companies using unified contract-to-revenue platforms see 30% reduction in go-to-market expenses and 10-20% increases in sales productivity, while traditional siloed approaches create costly friction between sales, legal, and finance teams. Enterprise contract lifecycle management software combined with configure price quote automation and revenue operations platforms eliminate handoff delays from quote generation through contract execution to billing and service delivery. Modern sales automation software transforms quote to cash processes through intelligent workflow automation and real-time data synchronization.

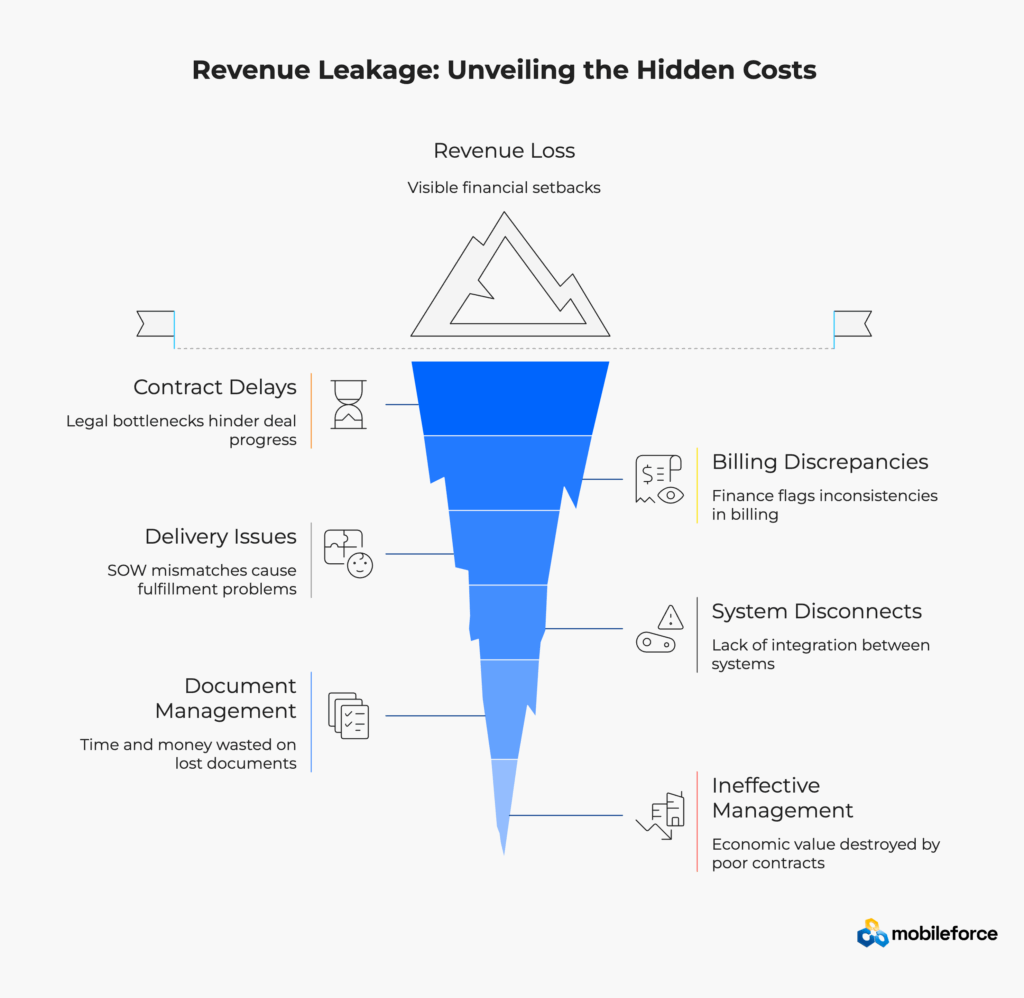

Picture this: Your sales team closes a major deal after weeks of negotiation. The quote looks perfect, pricing is competitive, and everyone’s celebrating. But then the contract gets stuck in legal for two weeks due to pricing mismatches with the original quote. Finance flags billing discrepancies. Delivery teams can’t fulfill because the SOW doesn’t match the actual product configuration. What started as a win becomes a costly nightmare.

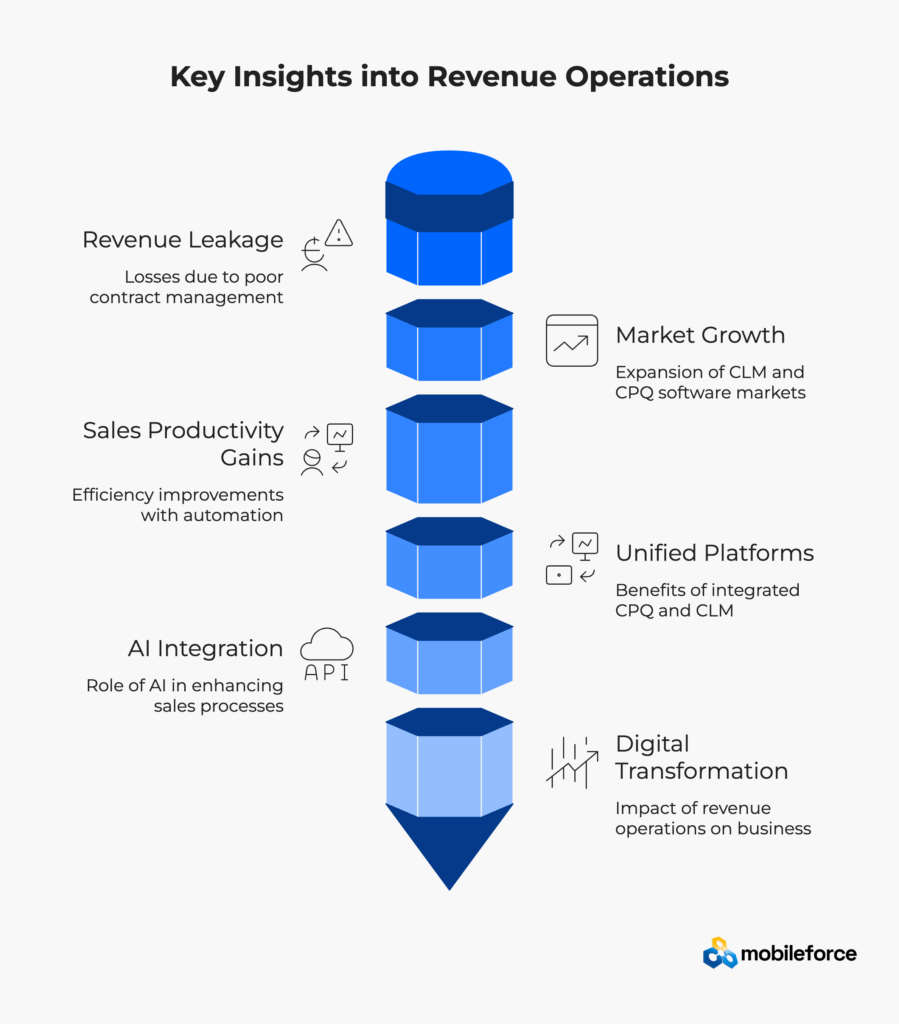

This scenario plays out thousands of times daily across B2B organizations. While sales teams often think the quote is the bottleneck, the real revenue leakage happens after the handshake. Research shows that poor contract management causes organizations to lose an average of 9.2% of annual revenue, yet most companies continue adding more tools rather than addressing the fundamental disconnect between systems.

The truth is stark: The average SaaS sales cycle lasts 84 days, with some enterprise deals stretching far longer. But cycle time is just one piece of the puzzle. Companies spend $2.5 to $3.5 million annually searching for lost documents or recreating them, while ineffective contract management causes $270 billion in economic value to be destroyed every year.

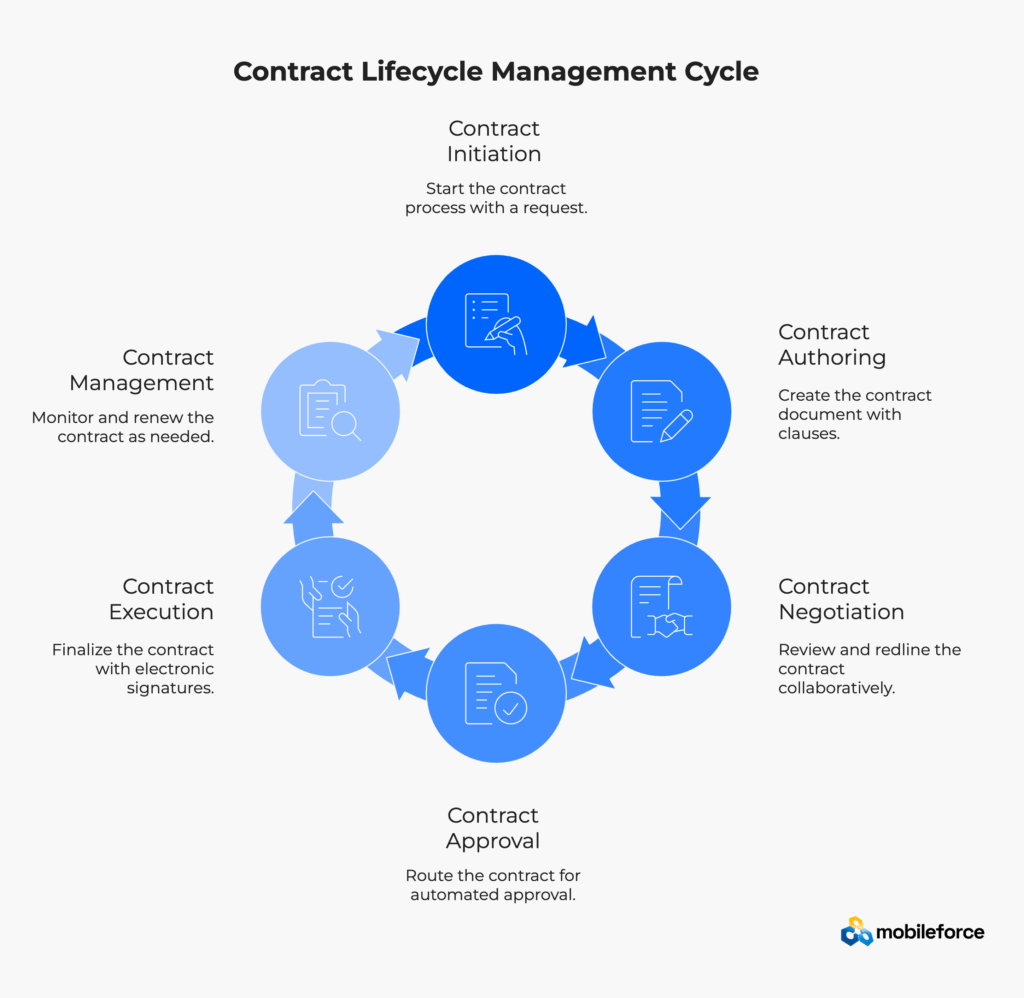

Contract lifecycle management refers to the systematic approach of managing contracts from initial request through negotiation, approval, execution, and renewal. Modern CLM software automates contract creation, streamlines approval workflows, and provides centralized contract repositories for improved visibility and compliance. The contract lifecycle management process typically includes six key stages:

Enterprise contract management solutions integrate these processes with existing business systems like CRM platforms, ERP software, and billing systems to create seamless data flow throughout the organization. Contract automation software reduces manual administrative tasks while improving contract accuracy and compliance monitoring.

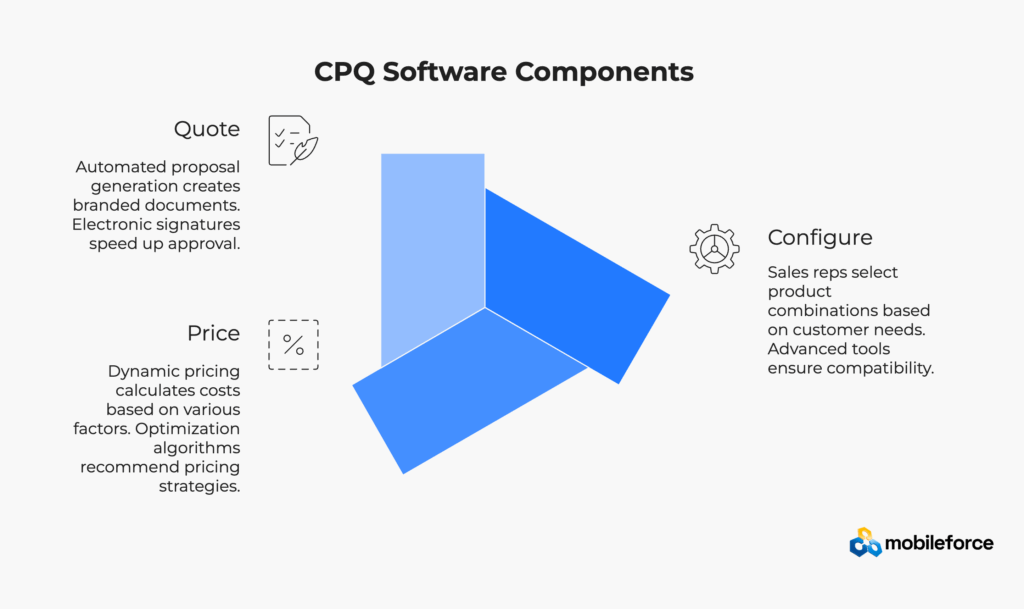

Configure price quote software enables sales teams to quickly generate accurate proposals for complex products and services. CPQ platforms guide users through product configuration options, apply dynamic pricing rules, and automatically generate professional proposals. The configure price quote process involves three core components:

Configure: Sales representatives select appropriate product combinations and service options based on customer requirements. Advanced product configuration tools ensure all selected options are compatible and meet technical specifications.

Price: Dynamic pricing engines calculate costs based on volume discounts, customer-specific agreements, geographic factors, and current market conditions. Pricing optimization algorithms recommend optimal pricing strategies to maximize revenue while maintaining competitiveness.

Quote: Automated proposal generation creates branded documents with accurate pricing, technical specifications, and terms and conditions. Electronic signature integration accelerates the approval process and reduces sales cycle duration.

CLM vs CPQ: Core Differences | |

Contract Lifecycle Management | Configure Price Quote |

Manages post-sales contract processes | Optimizes pre-sales quote generation |

Focuses on compliance and approval workflows | Emphasizes product configuration and pricing |

Legal and finance team primary users | Sales team primary users |

Handles contract amendments and renewals | Creates initial proposals and quotes |

Tracks contract obligations and milestones | Validates product compatibility and pricing |

Ready to see how a unified platform can eliminate these inefficiencies? Schedule a demo with Mobileforce to explore how quote-to-service integration transforms revenue operations.

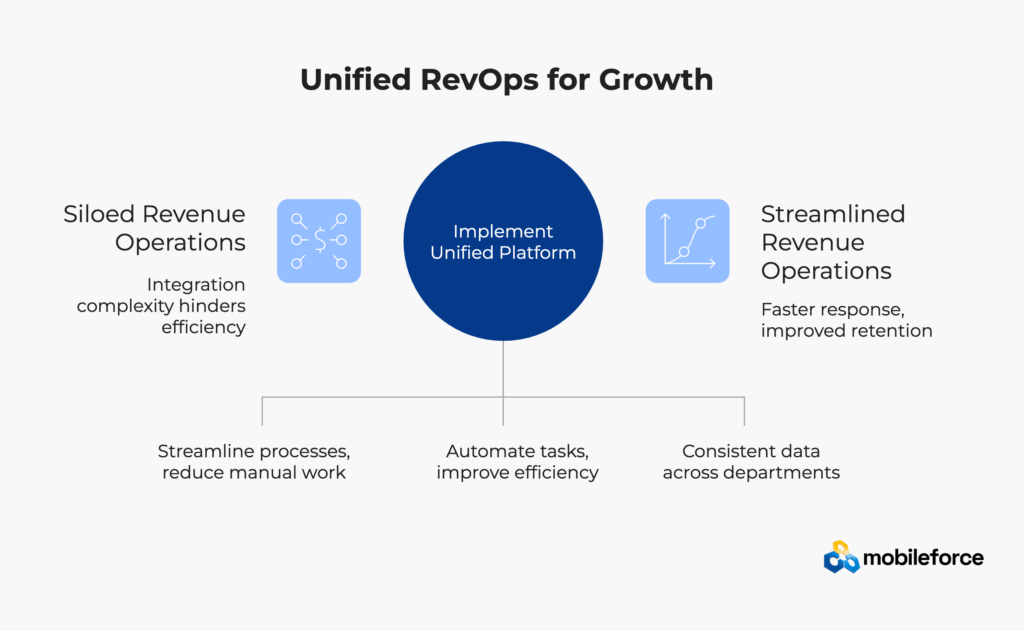

Today’s revenue operations resemble a relay race where runners can’t see each other and keep dropping the baton. Configure price quote systems optimize quote generation but operate in isolation from contract management platforms. Legal teams work in separate CLM software that doesn’t sync with sales pricing rules. Finance struggles with billing automation tools that require manual data entry from signed contracts. Delivery teams receive statements of work that don’t match the original product configuration.

The data reveals the scope of this fragmentation challenge. Within pre-sales operations, 30% of organizations lack joint accountability between Sales and Marketing for demand generation activities. Meanwhile, around 39% of enterprises report delays or added costs due to compatibility issues during CPQ software implementation with existing systems. Sales enablement technology adoption varies significantly, with only 65% of legal departments utilizing contract management software despite widespread recognition of its benefits.

Revenue operations best practices emphasize cross-functional alignment, yet most organizations continue operating with disconnected systems that create multiple points of failure. Business process automation initiatives often focus on individual department optimization rather than end-to-end workflow improvement. Customer relationship management systems contain valuable prospect data, but this information rarely flows seamlessly into contract generation and billing processes.

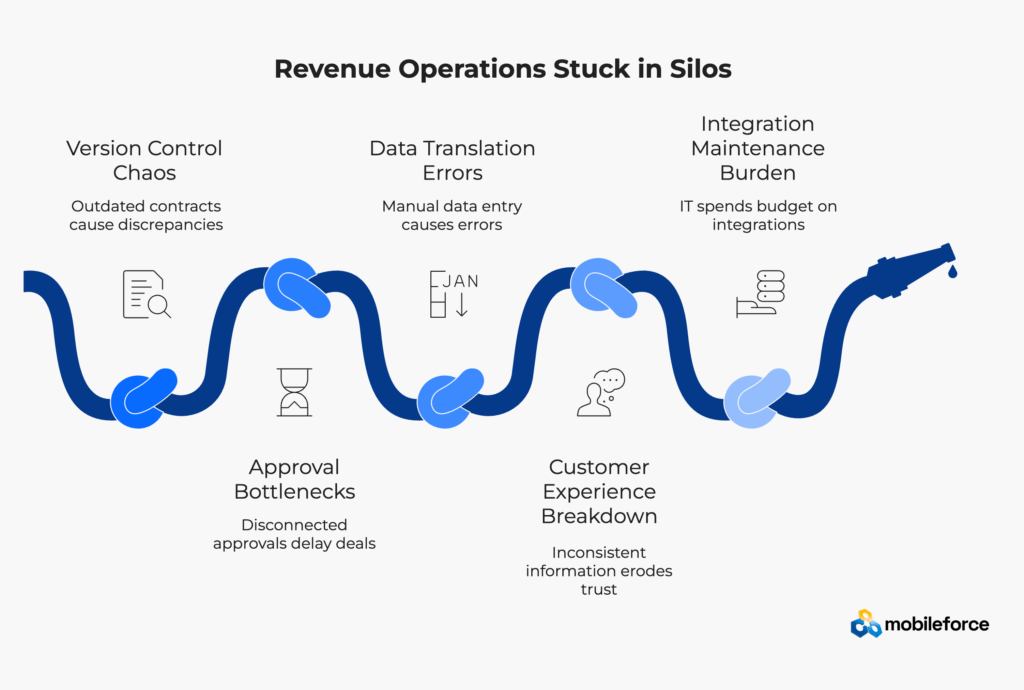

This departmental isolation creates multiple failure points across the customer lifecycle:

Version Control Chaos: Sales teams update pricing in CPQ platforms while legal departments work from outdated contract templates stored in separate document management systems. The result? Signed agreements that don’t reflect current market rates, product configurations, or approved discount structures.

Approval Bottlenecks: Complex deals require sign-offs from finance, compliance, and delivery teams who each use different approval systems with separate workflow automation rules. What should take hours stretches into weeks as approvals move through disconnected systems without visibility or coordination.

Data Translation Errors: Every system handoff requires manual data translation between platforms. Quote line items become contract clauses become billing parameters become delivery specifications. Each translation introduces human errors and processing delays that compound throughout the sales cycle.

Customer Experience Breakdown: Prospects receive different information from sales representatives (quote details), legal teams (contract terms), and delivery specialists (implementation scope). This inconsistency erodes customer trust and creates friction throughout the buying process, often resulting in deal delays or cancellations.

Integration Maintenance Burden: IT departments spend 30-40% of technology budgets maintaining point-to-point integrations between specialized systems. API management, data mapping, and troubleshooting integration failures consume resources that could be invested in strategic initiatives.

Traditional Siloed Approach | Unified Platform Approach |

Multiple disconnected systems requiring custom integrations | Single integrated platform with native data flow |

Manual data entry between CRM, CPQ, and billing systems | Automated data synchronization across all processes |

Version control challenges with multiple document sources | Single source of truth with real-time updates |

Extended approval cycles through separate workflow systems | Streamlined workflow automation with parallel processing |

Frequent pricing errors due to system disconnects | Dynamic pricing validation with real-time accuracy |

Delayed revenue recognition from manual billing setup | Real-time billing integration with automated revenue tracking |

High integration maintenance costs and system complexity | Simplified architecture with reduced IT overhead |

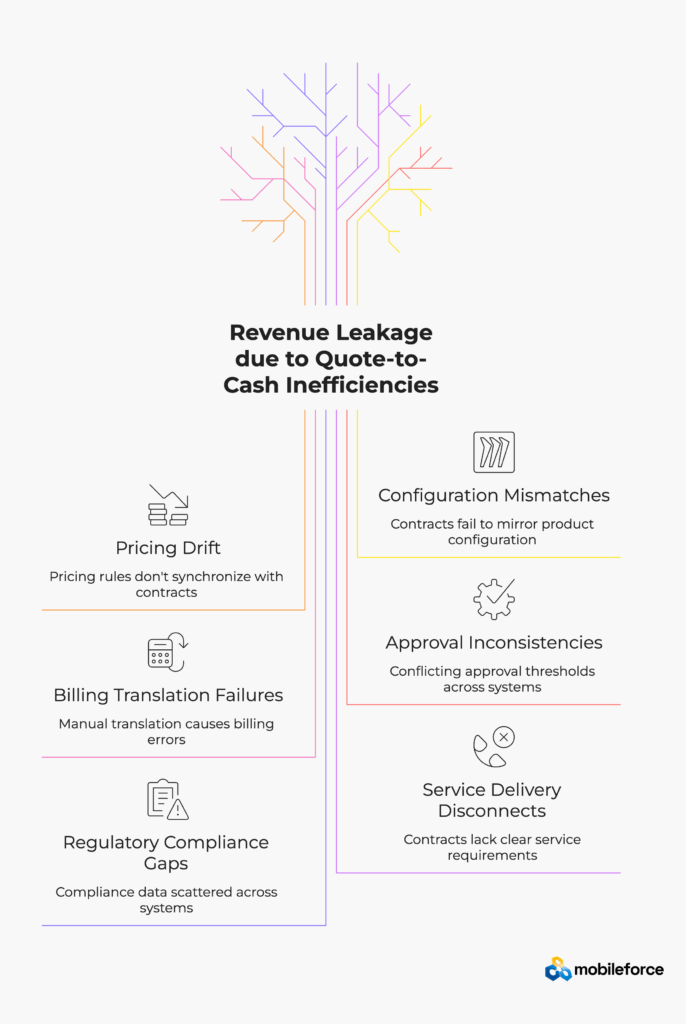

Revenue leakage doesn’t happen in dramatic, visible ways. Instead, it accumulates through dozens of small inefficiencies that compound over time. Understanding where the typical quote-to-cash process breaks down helps organizations identify opportunities for sales process optimization and revenue recovery.

Configuration Mismatches and Product Complexity: Sales representatives configure product bundles in CPQ software based on customer requirements, but when legal departments draft contracts, they often miss key dependencies or add incompatible options. Companies implementing configure price quote solutions report a 57% increase in quote accuracy, but this benefit disappears if contracts don’t mirror the original product configuration. Manufacturing companies with complex bill-of-materials face particular challenges when technical specifications don’t translate accurately from quotes to contracts to delivery documentation.

Pricing Drift and Dynamic Rate Management: Dynamic pricing rules in CPQ platforms often don’t synchronize with contract templates stored in separate document management systems. Sales representatives offer volume discounts, geographic adjustments, or customer-specific terms that aren’t reflected in standard contract language. Legal teams either rewrite contracts (introducing delays) or proceed with mismatched terms that create billing discrepancies later. Real-time pricing optimization requires seamless integration between configure price quote tools and contract generation systems.

Approval Workflow Inconsistencies: Different enterprise software systems often have conflicting approval thresholds and routing rules. A complex deal might require legal approval for contract terms but finance approval for pricing structures. Without unified workflow automation, approvals happen in parallel but never reconcile, leading to signed contracts that haven’t received proper departmental oversight. Sales automation best practices emphasize coordinated approval processes that maintain deal velocity while ensuring compliance.

Billing Translation and Revenue Recognition Failures: When finance teams receive signed contracts, they must manually translate contract terms into billing system parameters. Subscription schedules, usage-based charges, milestone payments, and professional services billing all require careful interpretation. These manual processes cause billing errors in 25% of contracts, while automated contract management systems reduce incorrect payments by 75%–90%. Revenue recognition compliance becomes particularly complex when contract terms don’t align with billing system capabilities.

Revenue Leakage Analysis by Industry | ||

Industry | Primary Leakage Source | Average Impact |

Manufacturing | Product configuration errors | $45,000 per incorrect order |

Technology Services | Misaligned service level agreements | 15-20% margin erosion |

Healthcare | Compliance documentation gaps | 30-day contract delay average |

Financial Services | Regulatory approval misalignment | 45-day sales cycle extension |

Eliminate revenue leakage with Mobileforce’s unified platform. See how quote-to-service integration works for your industry.

Service Delivery and Customer Success Disconnects: Field service teams and customer success managers receive contracts that don’t clearly specify technical requirements, implementation timelines, or ongoing service deliverables. They either over-deliver (reducing profit margins) or under-deliver (risking customer satisfaction) because the original product configuration wasn’t accurately translated through the contract process. Service lifecycle management requires tight integration between initial quotes, contract specifications, and delivery execution.

Regulatory Compliance and Risk Management Gaps: Complex products often involve regulatory requirements that must be tracked from initial configuration through contract execution and ongoing service delivery. Healthcare technology, financial services, and manufacturing industries face particular challenges ensuring compliance requirements specified in quotes are properly reflected in contracts and monitored throughout the customer lifecycle. Contract compliance management becomes exponentially more difficult when compliance data is scattered across multiple systems.

The cumulative impact of these inefficiencies is staggering for enterprise organizations. The cost of manually creating and managing a single contract can range from $6,900 to $49,000, while mismanagement of contracts leads to a yearly loss of $270 billion due to lack of collaboration between commercial and legal teams. Contract lifecycle management software can address these issues, but only when properly integrated with CPQ and billing systems to create unified data flow.

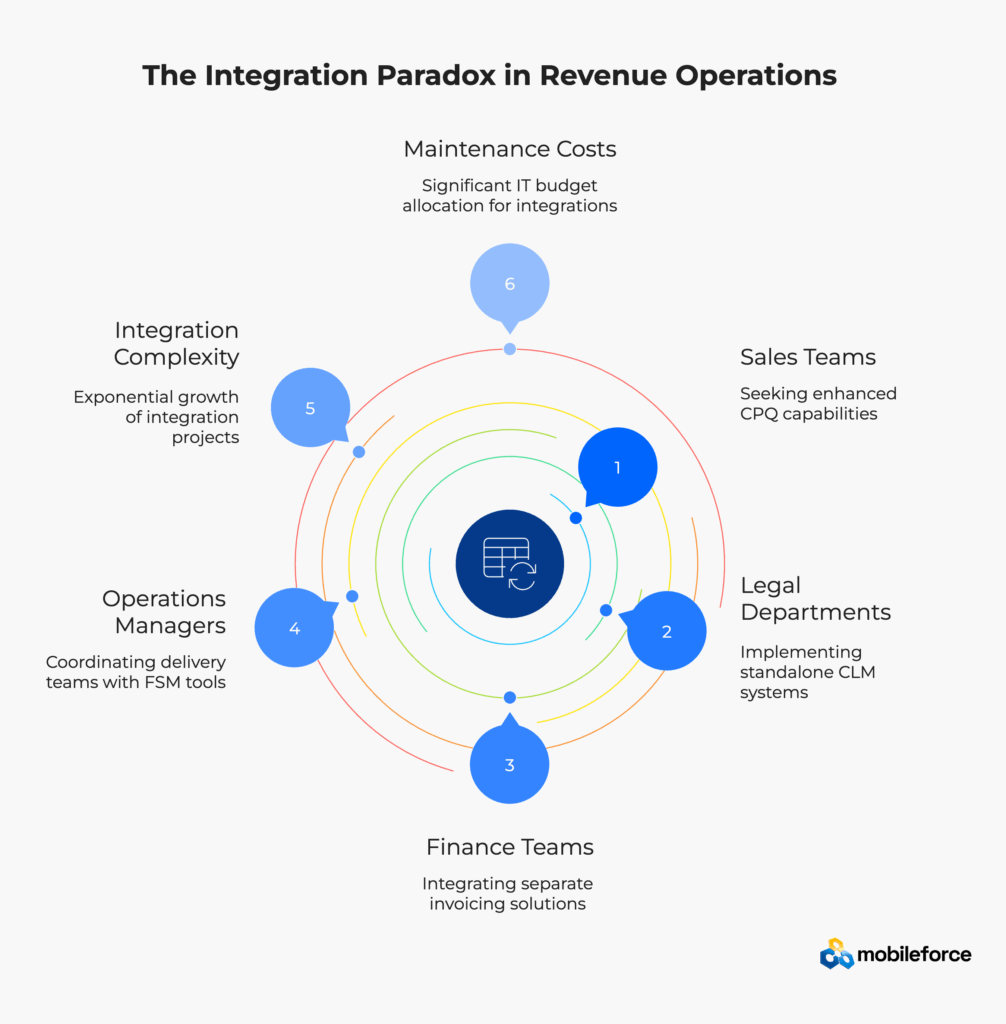

When revenue operations break down, the instinctive response is to purchase additional specialized software solutions. Sales teams want enhanced CPQ capabilities, so they evaluate and purchase more sophisticated quoting platforms. Legal departments demand improved contract lifecycle management, so they implement standalone CLM systems. Finance teams need better billing automation, so they integrate separate invoicing solutions. Operations managers seek field service management tools to coordinate delivery teams.

Each new enterprise software solution promises to solve specific departmental problems, and often they do deliver improvements within their narrow functional domain. The cloud-based software market category held the largest market share in CLM software deployments in 2024, while the software-as-a-service model dominated the delivery mechanism for CPQ platforms, accounting for nearly 74% of all new implementations globally. The underlying technology is powerful, proven, and continuously improving through artificial intelligence and machine learning enhancements.

But here’s the integration paradox that affects revenue operations efficiency: more specialized tools create more specialized data silos and integration complexity. Each system optimizes its own departmental processes while the handoffs between systems become increasingly complex and fragile. Integration projects multiply exponentially, requiring custom middleware development, API management expertise, and ongoing maintenance resources. IT departments estimate that companies spend 30-40% of their total technology budget just maintaining integrations between business systems, with additional costs for troubleshooting integration failures and managing data synchronization issues.

Point Solution Challenges vs Unified Platform Benefits | ||

Challenge | Point Solutions | Unified Platform |

System Integration | Exponential integration complexity | Native integration architecture |

Data Consistency | Manual translation between systems | Single source of truth |

Maintenance Costs | 30-40% of IT budget on integrations | Simplified maintenance overhead |

User Training | Multiple platform expertise required | Single platform proficiency |

Security Management | Multiple vulnerability points | Centralized security protocols |

Vendor Coordination | Complex multi-vendor relationships | Single vendor accountability |

The cumulative effect creates what revenue operations experts call “tool sprawl” – a proliferation of specialized systems that individually perform well but collectively create operational inefficiency. Sales automation becomes more complex rather than simpler, with sales representatives needing to access multiple systems to complete basic tasks like generating quotes, checking contract status, or updating customer information.

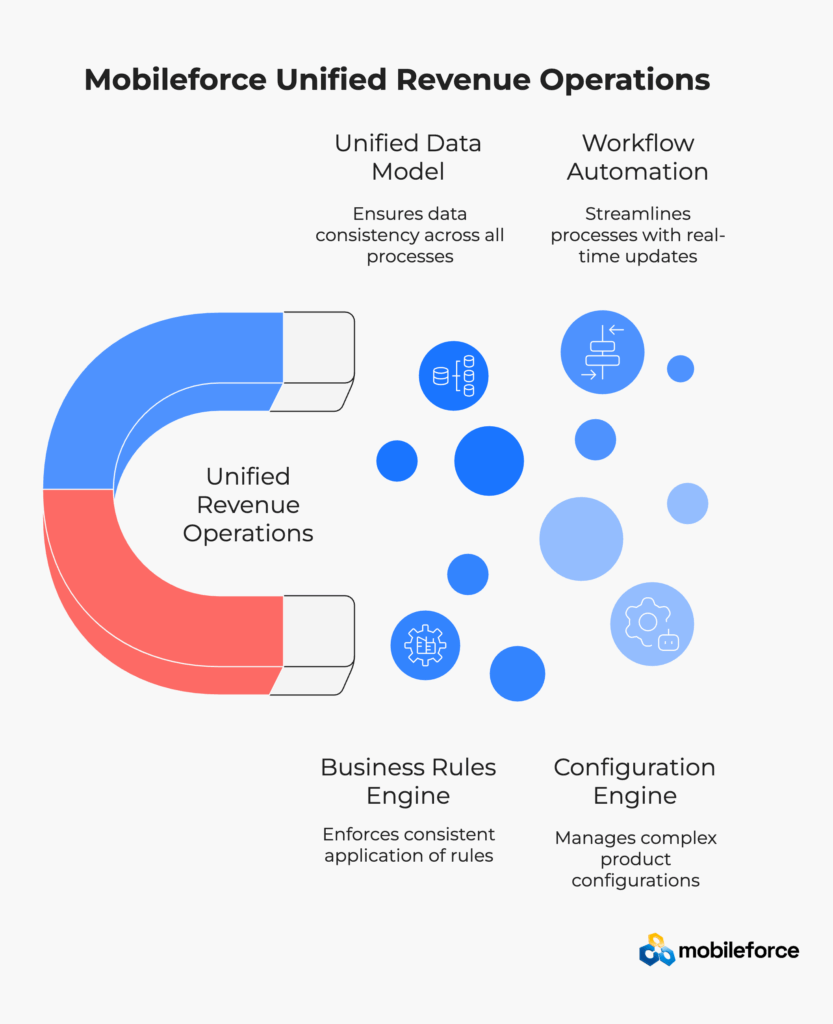

Mobileforce approaches revenue operations fundamentally differently than traditional enterprise software vendors. Instead of being a traditional CLM solution or connecting separate CPQ software, CLM platforms, and billing automation systems through complex integrations, Mobileforce has built a unified revenue engagement platform where the quote becomes the foundation for seamless contract processes and billing—all within a single, cohesive data architecture.

This isn’t contract lifecycle management in the traditional sense; it’s complete process unification that eliminates the translation layers between departmental functions. When a sales representative configures a complex product bundle in Mobileforce’s configure price quote engine, that exact configuration flows seamlessly through contract-ready documentation, approval workflows, billing system setup, and field service delivery without requiring data translation or manual re-entry.

Unified Data Model Architecture and Real-Time Synchronization

Every product option, pricing rule, contract-ready parameter, and billing component exists within the same underlying database structure, ensuring complete data consistency across all business processes. When sales teams update a product configuration, all downstream processes immediately reflect the updated information with corresponding terms and conditions. When approvals are completed, finance teams instantly receive the corresponding billing parameters and revenue recognition schedules. This eliminates version control issues, data synchronization delays, and translation errors that plague traditional multi-system approaches.

Business Rules Engine and Automated Validation

Pricing rules, approval thresholds, contract-ready terms, and compliance requirements are defined once and applied consistently across all revenue processes. If volume discounts require legal approval above certain monetary thresholds, that business rule applies whether the sales representative is generating initial quotes, contracts are being prepared, or finance is setting up recurring billing schedules. Real-time validation prevents invalid product configurations, unauthorized pricing discounts, and non-compliant contract terms before they can create downstream issues.

Intelligent Workflow Automation and Process Optimization

Mobileforce tracks each revenue opportunity through every stage of the customer lifecycle, maintaining complete visibility and accountability across all departments. Sales teams have real-time visibility into contract preparation status and approval progress. Legal and compliance teams see exactly what was quoted, to which customer, and under what specific terms. Finance teams receive contract-ready information that automatically translates into billing parameters with automated revenue recognition schedules. Service delivery teams get statements of work that perfectly match the original product configuration and pricing structure.

Advanced Configuration Engine and Product Complexity Management

The platform handles complex product configurations including interdependent options, compatibility constraints, and technical specifications that must remain consistent from initial quote through final delivery. Advanced product configurators guide users through selection processes while automatically validating technical compatibility and business rule compliance. This is particularly valuable for manufacturing companies with complex bill-of-materials, technology vendors with interdependent software modules, and service providers with customizable service level agreements.

Mobileforce Unified Platform Benefits |

✓ Reduces CPQ setup time by 85% compared to traditional implementations |

✓ Accelerates quote creation by 75% through automated configuration |

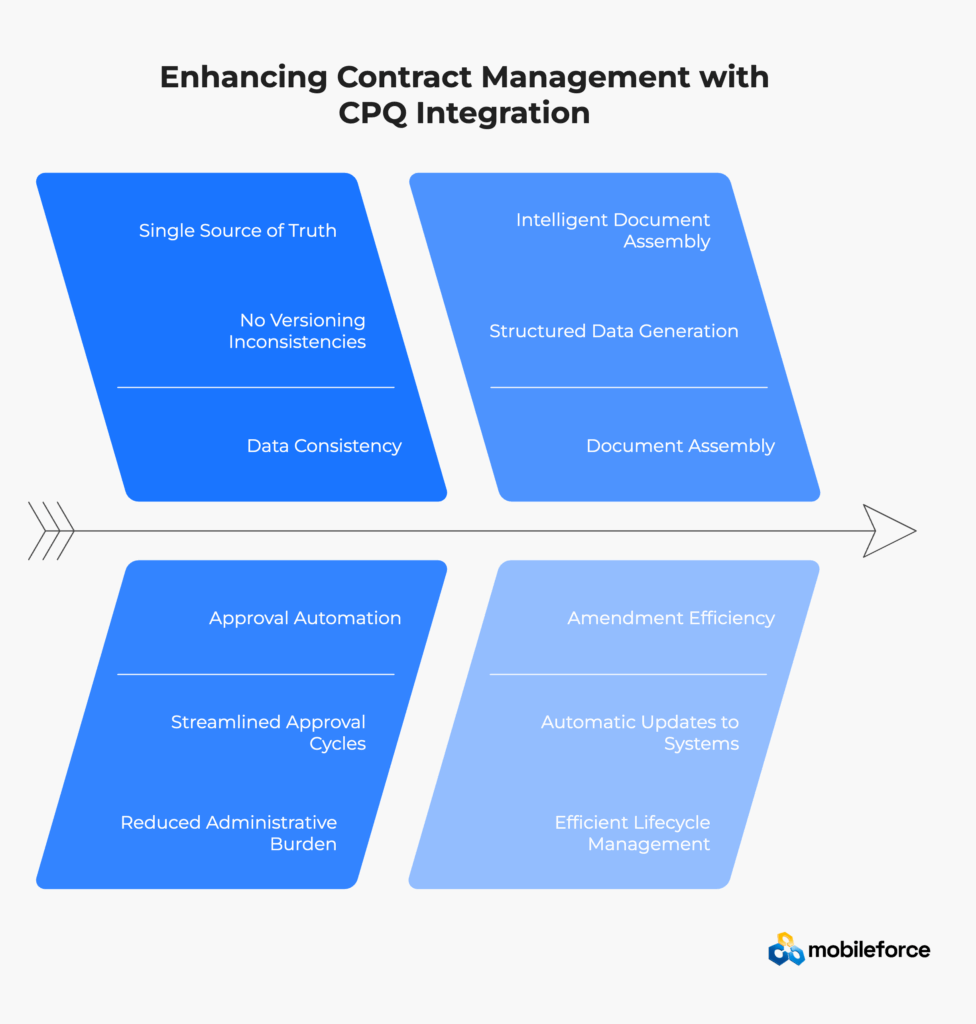

Rather than traditional contract lifecycle management software that treats contracts as legal documents requiring manual data entry, Mobileforce fundamentally reimagines this approach: contracts become structured business data that happen to be rendered as professional legal documents. This paradigm shift transforms every aspect of contract preparation, from initial creation through ongoing administration and renewal processes.

This revolutionary approach eliminates the traditional disconnect between sales quotations and legal agreements. When legal departments receive contract preparation requests, they’re no longer starting from blank templates and manually entering quote details from separate systems. Instead, they’re working with pre-structured contract-ready documentation that already contains validated pricing information, approved product configurations, and compliant terms and conditions. The quote data automatically populates contract sections using predefined legal language templates that ensure consistency and compliance.

Structured Data Generation and Intelligent Document Assembly

Product configurations from CPQ software automatically generate corresponding contract specifications using advanced template automation. If a customer orders enterprise software licenses with specific user limits, geographic restrictions, and service level agreements, the contract language for those limitations is automatically generated using approved legal templates and clause libraries. Complex product bundles with interdependent components create corresponding contract sections that accurately reflect technical dependencies and implementation requirements.

Contract management best practices emphasize consistency and accuracy in document creation. Mobileforce’s intelligent document assembly eliminates the manual translation between sales specifications and legal language that traditionally creates errors and inconsistencies. Legal teams focus on strategic review and risk assessment rather than routine data entry and formatting tasks.

Advanced Approval Automation and Workflow Intelligence

Because pricing structures and product configurations are already validated during the quote generation process, contract approval workflows focus on legal review and risk assessment rather than commercial verification. This dramatically streamlines approval cycles and reduces the administrative burden on legal departments. Automating contract management processes has demonstrably saved lawyers 82% of their time by eliminating routine commercial validation tasks that were previously required for every contract.

Smart approval routing considers contract value, customer risk profiles, non-standard terms, and regulatory requirements to automatically direct contracts to appropriate reviewers. High-value deals with standard terms might require only finance approval, while complex contracts with custom service level agreements trigger legal review. International contracts automatically include appropriate jurisdiction and compliance specialists in the approval process.

Traditional CLM vs Mobileforce Contract Process | ||

Process Stage | Traditional CLM | Mobileforce Approach |

Contract Initiation | Manual data entry from quotes | Automated population from CPQ data |

Template Management | Separate template libraries | Integrated quote-to-contract templates |

Data Validation | Manual verification required | Real-time validation from source |

Approval Routing | Generic workflow rules | Context-aware intelligent routing |

Version Control | Multiple document versions | Single source of truth |

Billing Setup | Manual translation to finance | Automated billing parameter flow |

See how MobileForce’s unified approach eliminates contract-quote mismatches. Explore document creation capabilities tailored for your business.

Version Control Elimination and Single Source of Truth

Since contract terms flow directly from approved quotes within the unified platform, there’s no versioning inconsistency between sales proposals and legal agreements. What customers see in the initial quote is exactly what appears in the final contract, eliminating confusion and reducing negotiation cycles. Contract amendments and modifications update the underlying business data, ensuring billing and service delivery teams always have current information.

This approach eliminates the common problem where sales teams offer terms that aren’t reflected in standard contract templates, or where legal teams modify agreements without updating pricing or configuration data in other systems. Every change is immediately visible across all departments with appropriate access controls and audit trails.

Amendment Efficiency and Lifecycle Management

Mid-term contract modifications trigger automatic updates to billing systems and service delivery teams without requiring manual coordination. Adding user licenses automatically adjusts recurring billing charges and sends updated service parameters to delivery teams. Changing service levels immediately updates performance monitoring systems and customer success team dashboards. Contract renewal processes automatically incorporate current product configurations and pricing while maintaining customer-specific terms and conditions.

Finance teams in traditional organizations spend enormous amounts of time interpreting contracts and manually translating legal language into billing system parameters. This manual process creates opportunities for errors, delays revenue recognition, and requires significant administrative overhead. Mobileforce completely eliminates this translation layer by making billing parameters native to the original quote structure, creating seamless automation from initial customer engagement through final payment collection.

Direct Parameter Flow and Automated Billing Setup

When sales representatives generate quotes with subscription pricing, usage-based charges, milestone payments, or professional services components, those exact billing parameters flow directly into the invoicing system without requiring manual interpretation or setup. Complex pricing structures including volume tiers, geographic adjustments, and customer-specific discounts are automatically configured in the billing engine. No interpretation is required, no manual setup processes needed, and no delays between contract execution and billing activation.

This direct parameter flow is particularly valuable for organizations with complex pricing models such as software-as-a-service companies with multiple subscription tiers, manufacturing companies with usage-based pricing, and service providers with milestone-based project billing. Traditional billing automation systems require extensive manual configuration for each contract, while unified platforms automate this entire process.

Billing Automation Comparison | ||

Billing Aspect | Traditional Approach | Mobileforce Integration |

Setup Time | Days to weeks manually | Immediate automated setup |

Error Rate | 25% of contracts have billing errors | 90% reduction in billing errors |

Revenue Recognition | Manual interpretation required | Automated compliance setup |

Contract Changes | Manual billing adjustments | Real-time parameter updates |

Multi-currency | Complex manual configuration | Native multi-currency support |

Usage Tracking | Separate integration required | Integrated monitoring system |

Advanced Revenue Recognition and Compliance Automation

Complex revenue recognition rules for subscriptions, professional services, and milestone-based projects are automatically configured based on the original quote structure and contract terms. Finance teams focus on strategic financial analysis rather than operational billing setup and manual revenue allocation. Revenue recognition compliance with ASC 606, IFRS 15, and other accounting standards is built into the billing automation process.

Usage-Based Billing Integration and Real-Time Monitoring

For products and services with consumption-based pricing models, usage monitoring and billing calculations are automatically configured when the original quote is generated. The billing system knows exactly what metrics to measure, how to apply pricing tiers, and when to generate invoices. Real-time usage data flows seamlessly from delivery systems into billing calculations without requiring manual data entry or separate integration projects.

Manufacturing companies benefit from automated billing for materials consumption, machine usage hours, and maintenance service calls. Technology providers can automate billing for data storage, API calls, bandwidth usage, and user activity metrics. Professional services organizations automate time tracking, expense billing, and project milestone invoicing.

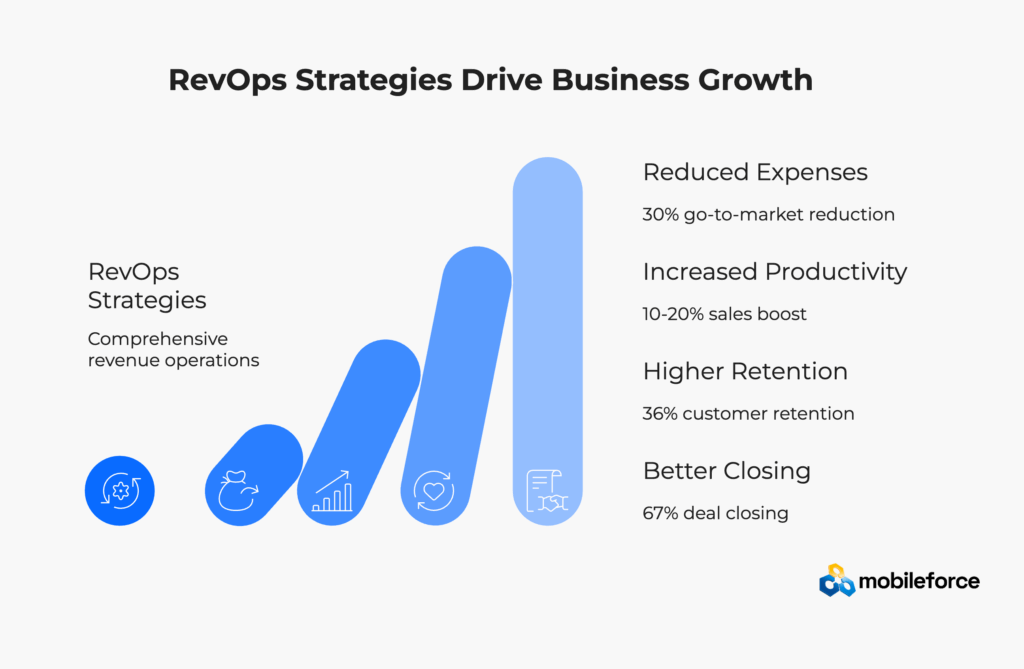

Revenue Operations leaders face unprecedented pressure in 2025. Market volatility, increased competition, and evolving customer expectations are forcing organizations to operate with greater efficiency while delivering superior customer experiences. The statistics paint a stark picture: only 7% of revenue leaders feel confident about hitting their growth targets, while companies that invest in comprehensive RevOps strategies report 30% reduction in go-to-market expenses and 10-20% increases in sales productivity. The challenge isn’t just meeting current quarterly targets—it’s building scalable, resilient processes that can handle increasing operational complexity without proportional cost increases.

Market Pressure Intensifies Across All Industries

Highly aligned companies grow revenue 58% faster and achieve 72% higher profitability compared to organizations with siloed operations. Competition is forcing shorter sales cycles while customers demand more personalized solutions and transparent pricing. Traditional approaches that worked with simpler products and longer decision cycles are breaking under this pressure. The average B2B sales cycle has condensed significantly, with companies using AI-driven CPQ tools seeing 20% increases in customer satisfaction through improved responsiveness.

Sales and marketing alignment has become critical for competitive advantage. Organizations with tightly aligned sales and marketing functions enjoy 36% higher customer retention rates and are 67% better at closing deals. Bringing sales and marketing departments into alignment can result in a 209% increase in revenue generated from marketing activities. However, 30% of organizations still lack joint accountability between Sales and Marketing for demand generation activities, representing a significant opportunity for RevOps optimization.

CFO Scrutiny and Financial Performance Requirements

Chief Financial Officers are demanding predictable revenue forecasting, accurate margin analysis, and demonstrable return on technology investments. When quote-to-cash processes are fragmented across multiple systems, financial planning becomes reactive rather than strategic. Traditional approaches create forecasting challenges because data is scattered across CPQ systems, contract management platforms, billing software, and service delivery applications.

Improved contract management processes could boost company annual revenue by approximately 9%, while contract automation reduces the average contract cycle time by up to 50%. Finance leaders want visibility into deal progression, contract profitability, and revenue recognition schedules without waiting for monthly reporting cycles. Real-time financial dashboards require unified data architecture that most point-solution approaches cannot provide effectively.

RevOps Performance Metrics Comparison | ||

Metric | Siloed Operations | Unified Platform |

Quote-to-Cash Cycle | 84+ days average | 40% reduction achievable |

Revenue Leakage | 9.2% annual revenue loss | <3% with unified processes |

Sales Productivity | 73% slower without automation | 10-20% productivity increase |

Contract Accuracy | 25% billing error rate | 90% accuracy improvement |

Go-to-Market Costs | Baseline | 30% reduction potential |

Customer Satisfaction | Variable by department | 20% increase with consistency |

Transform your RevOps approach with Mobileforce’s unified platform. Book a personalized demo to see how process unification drives revenue growth.

Legal Department Overwhelm and Efficiency Requirements

Legal departments are experiencing unprecedented workload challenges. Research shows that 80.8% of in-house lawyers participated in contract management by reviewing and drafting documents, yet only 12% of legal departments utilize artificial intelligence tools to automate routine tasks. Legal teams are overwhelmed with routine contract work while struggling to focus on strategic risk management and compliance oversight.

Contract lifecycle management automation has saved lawyers 82% of their time by eliminating routine commercial validation tasks. However, these time savings disappear if contracts must be manually recreated because CPQ systems don’t integrate with contract generation platforms. Legal teams need unified systems that automatically generate contract-ready documentation from approved quotes while maintaining proper legal review and approval processes.

Artificial Intelligence Integration and Future-Proofing

AI adoption in revenue operations is accelerating rapidly. 68% of professionals predict AI will be built into most software by 2024, with high-performing sales professionals being twice as likely to use AI for selling activities. However, AI amplifies existing processes rather than fixing fundamental inefficiencies. If quote-to-cash workflows are fragmented across multiple systems, AI will make those fragments faster without eliminating the underlying coordination problems.

Successful AI implementation in revenue operations requires clean, unified data architecture. Machine learning algorithms need consistent data formats and complete customer interaction histories to provide valuable insights. Fragmented systems create data quality issues that limit AI effectiveness and require significant data cleansing efforts.

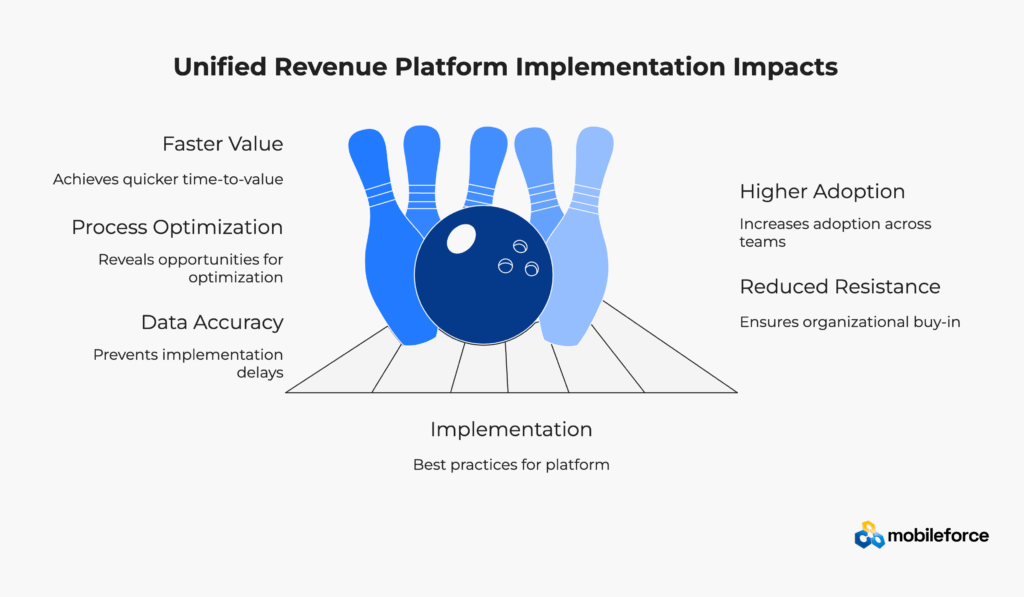

Successful unified revenue platform implementations require careful planning, stakeholder alignment, and systematic change management. Organizations that follow proven implementation methodologies achieve faster time-to-value and higher adoption rates across sales, legal, finance, and service delivery teams.

Pre-Implementation Assessment and Planning

Comprehensive business process analysis identifies current inefficiencies, integration requirements, and success metrics before platform selection. Organizations should document existing quote-to-cash workflows, system dependencies, data quality issues, and user pain points. This assessment phase typically reveals significant opportunities for process optimization beyond simple system replacement.

Stakeholder Alignment and Executive Sponsorship

Revenue operations transformation requires executive sponsorship and cross-functional collaboration. Successful implementations establish steering committees with representatives from sales, legal, finance, IT, and customer success teams. Clear communication about benefits, timeline expectations, and change management requirements ensures organizational buy-in and reduces resistance to new processes.

Data Migration and System Integration Strategy

Data cleansing and migration planning prevents implementation delays and ensures data accuracy in the new platform. Organizations should prioritize data quality over data quantity, focusing on active customers, current product catalogs, and recent pricing agreements. Legacy system data often requires significant cleanup to meet modern platform requirements.

Phased Rollout and User Training Programs

Phased implementation approaches reduce risk and enable iterative improvements. Best practice implementations start with core sales teams, expand to legal and finance departments, and finally include service delivery and customer success functions. Comprehensive training programs ensure users understand new workflows and can leverage platform capabilities effectively.

Implementation Phase Recommendations | |||

Phase | Duration | Focus Areas | Success Metrics |

Phase 1: Foundation | 4-6 weeks | Data migration, core CPQ setup | Quote generation speed |

Phase 2: Workflow | 6-8 weeks | Approval automation, integrations | Process cycle time |

Phase 3: Optimization | 8-10 weeks | Advanced features, reporting | User adoption rates |

Phase 4: Scale | Ongoing | Training, continuous improvement | ROI achievement |

Change Management and Adoption Strategies

User adoption requires more than technical training—it demands cultural change toward unified processes and shared accountability. Organizations should identify platform champions within each department, provide ongoing support during the transition period, and measure adoption metrics to ensure successful change management.

Experience rapid deployment with Mobileforce’s streamlined approach. Learn about our 24-hour migration process that ensures zero business disruption.

The next competitive edge isn’t incremental feature improvements—it’s operational continuity across the entire customer lifecycle. Companies that successfully unify quote generation, contract-ready documentation, billing automation, and service delivery processes will establish sustainable competitive advantages through faster cash conversion, improved customer experiences, and scalable revenue operations. Market evidence demonstrates that organizations embracing unified platforms achieve measurably superior performance compared to those managing point solution integration complexity.

Mobileforce represents this fundamental evolution in revenue operations technology. By treating the entire customer lifecycle as a single, continuous business process rather than separate departmental functions, they enable organizations to scale revenue efficiently without adding proportional operational complexity or system maintenance overhead. This approach addresses the root cause of revenue operations inefficiency rather than optimizing individual components within a fragmented system architecture.

Market Evidence Supporting Platform Unification

Current market data validates the unified platform approach: 85% of companies still rely on manual processes for contract management, while 78% of companies report that CPQ software reduced quote turnaround times by more than 50%. However, these CPQ benefits disappear if contracts don’t accurately reflect quotes, and contract efficiency provides no value if billing systems cannot consume contract data directly without manual interpretation.

The Configure Price Quote software market shows explosive growth, with 85% of B2B organizations now integrating CPQ solutions into sales operations. Simultaneously, the contract lifecycle management market reached $3.0 billion in 2024 and is projected to grow at 12.1% CAGR through 2035. This parallel growth in adjacent markets indicates market recognition that both functions are essential, but most organizations haven’t yet realized the benefits of true unification.

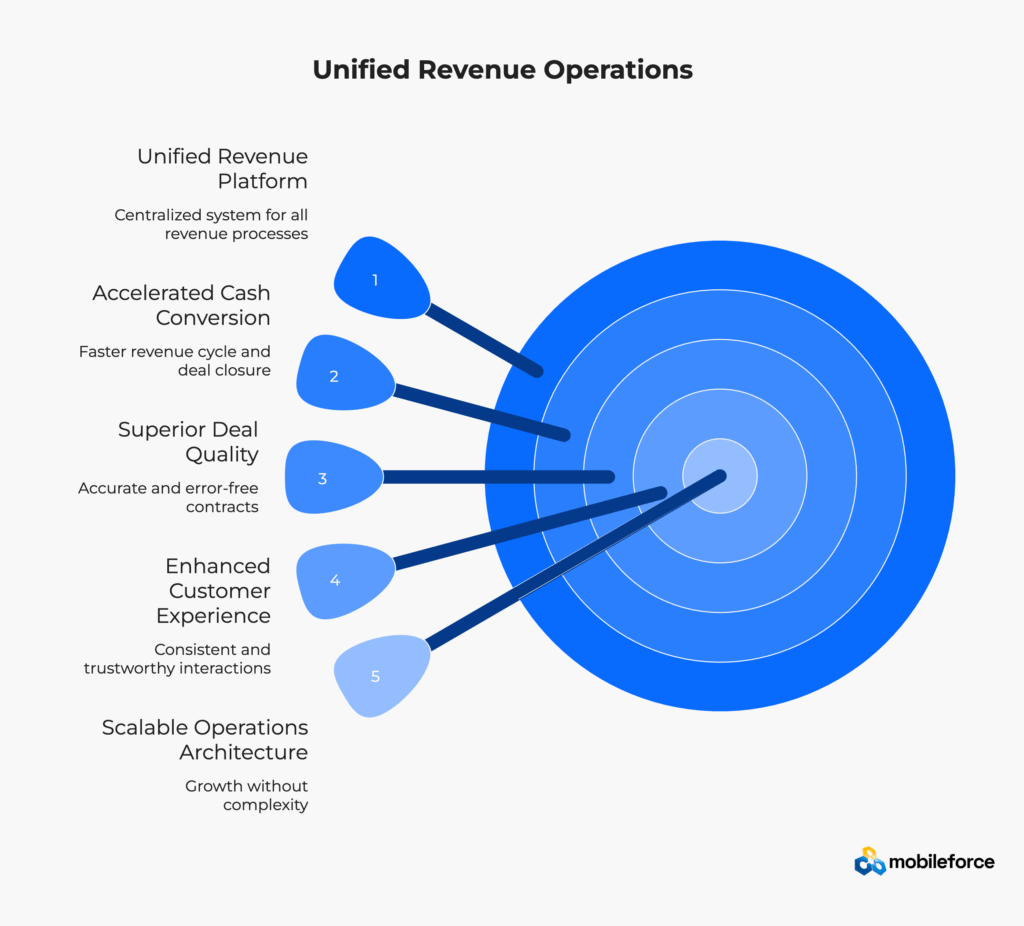

Competitive Advantages of Unified Revenue Operations

Forward-thinking organizations implementing unified revenue platforms now will establish significant competitive advantages that become increasingly difficult for competitors to replicate:

Accelerated Cash Conversion: Eliminating handoff delays and manual processes between departments accelerates the entire revenue cycle from initial customer contact through final payment collection. Organizations report 40% faster deal closure and 75% reduction in quote-to-cash cycle times.

Superior Deal Quality: Real-time validation prevents configuration errors, pricing mistakes, and contract inconsistencies that traditionally create customer dissatisfaction and margin erosion. Unified platforms ensure every deal meets quality standards before customer presentation.

Enhanced Customer Experience: Consistent information and coordinated responses across all customer touchpoints build trust and reduce friction throughout the buying process. Customers receive accurate information regardless of which department they contact, creating professional impressions that influence purchase decisions.

Scalable Operations Architecture: Process unification enables revenue growth without proportional increases in operational complexity or administrative overhead. Organizations can handle larger deal volumes, more complex products, and expanded geographic markets without adding departmental coordination layers.

Strategic Focus Optimization: Teams focus on growth activities and customer value creation rather than operational firefighting and system coordination. Sales representatives spend time selling rather than managing quotes through approval processes. Legal teams focus on strategic risk management rather than routine document preparation.

Future-Ready Revenue Operations | ||

Capability | Traditional Approach | Unified Platform Future |

AI Integration | Fragmented data limits effectiveness | Clean data enables advanced AI |

Scalability | Linear cost increases with growth | Exponential efficiency gains |

Customer Experience | Inconsistent departmental interactions | Seamless unified engagement |

Competitive Response | Slow multi-system coordination | Rapid unified platform adaptation |

Market Expansion | Complex system replication required | Simple configuration extension |

Innovation Speed | Integration bottlenecks slow progress | Native platform acceleration |

The evidence is overwhelming: companies that invest in comprehensive RevOps strategies report 30% reduction in go-to-market expenses, 10-20% increases in sales productivity, and 38% improvements in sales win rates. These benefits compound over time as streamlined processes enable faster market response, improved customer retention, and enhanced operational efficiency.

Organizations ready to embrace unified revenue operations should evaluate platforms based on their ability to eliminate system handoffs, reduce manual processes, and provide single-source-of-truth data architecture. The question isn’t whether to adopt individual CPQ, CLM, or billing solutions—it’s whether to continue managing integration complexity or adopt platforms that eliminate it entirely through native unification.

CPQ (Configure, Price, Quote) systems focus on product configuration and quote generation for pre-sales activities, while traditional contract management systems handle post-sales contract processes like approvals and compliance tracking. Sales representatives take 73% more time to produce quotes without CPQ software, while contract automation saves lawyers 82% of their time. The key difference lies in their primary functions and user bases, but unified platforms eliminate the traditional handoff challenges between these systems by treating quotes and contracts as integrated business processes rather than separate departmental functions.

Companies implementing comprehensive RevOps strategies report 30% reduction in go-to-market expenses and 10-20% increases in sales productivity. Configure price quote software reduces quote generation time by up to 80%, while contract automation cuts cycle times by 50%. Organizations with unified platforms report 75% faster quote creation and 40% acceleration in overall sales cycles by eliminating departmental handoff delays.

Manufacturing and IT sectors contributed over 40% of CPQ software market revenue in 2024 due to configuration complexity. Manufacturing companies benefit from automated bill-of-materials generation and complex pricing calculations, while technology providers leverage subscription billing automation and usage-based pricing models. Professional services organizations gain value from project-based billing and milestone automation. Healthcare and life sciences require compliance monitoring and regulatory documentation automation for equipment leasing and service agreements.

Mobileforce offers rapid implementation with 24-hour migration capabilities with comprehensive training and dedicated support, significantly faster than traditional multi-system approaches that often require 6-12 months. Implementation factors include system complexity, data migration requirements, integration scope, user training needs, and customization requirements. Best practice implementations use phased rollouts starting with core sales teams, followed by legal and finance departments, and finally expanding to service delivery teams.

Organizations implementing unified revenue platforms report measurable ROI through process optimization and efficiency gains. Businesses can save up to 2% of annual costs through effective contract management, while improved contract processes could boost company annual revenue by approximately 9%. Direct cost savings include reduced administrative overhead, with contract automation saving $6,900 to $49,000 per contract compared to manual processes. Organizations typically eliminate $2.5 to $3.5 million annually spent searching for lost documents.

Unified platforms automate approval routing based on deal parameters, contract terms, pricing thresholds, and organizational policies while enabling parallel processing instead of sequential approvals. Smart routing analyzes deal characteristics to determine required approvers – high-value deals with standard terms might need only finance approval, while complex contracts trigger legal review. International deals automatically include jurisdiction specialists. All stakeholders have real-time visibility into approval status with automated notifications and escalation procedures to prevent bottlenecks.

Modern unified revenue platforms provide native integrations with leading business systems including Salesforce, HubSpot, Microsoft Dynamics 365, SAP, Oracle, and other enterprise applications. Mobileforce offers pre-built connectors that synchronize customer data, product catalogs, pricing rules, and order information without requiring custom development. API-first architecture enables real-time data synchronization while maintaining enterprise-grade security protocols and compliance requirements across all connected systems.

Ready to transform your revenue operations with a unified approach? Schedule a demo with Mobileforce to see how quote-to-service integration can accelerate your sales cycles and eliminate revenue leakage.