Turning regulatory challenges into competitive advantage.

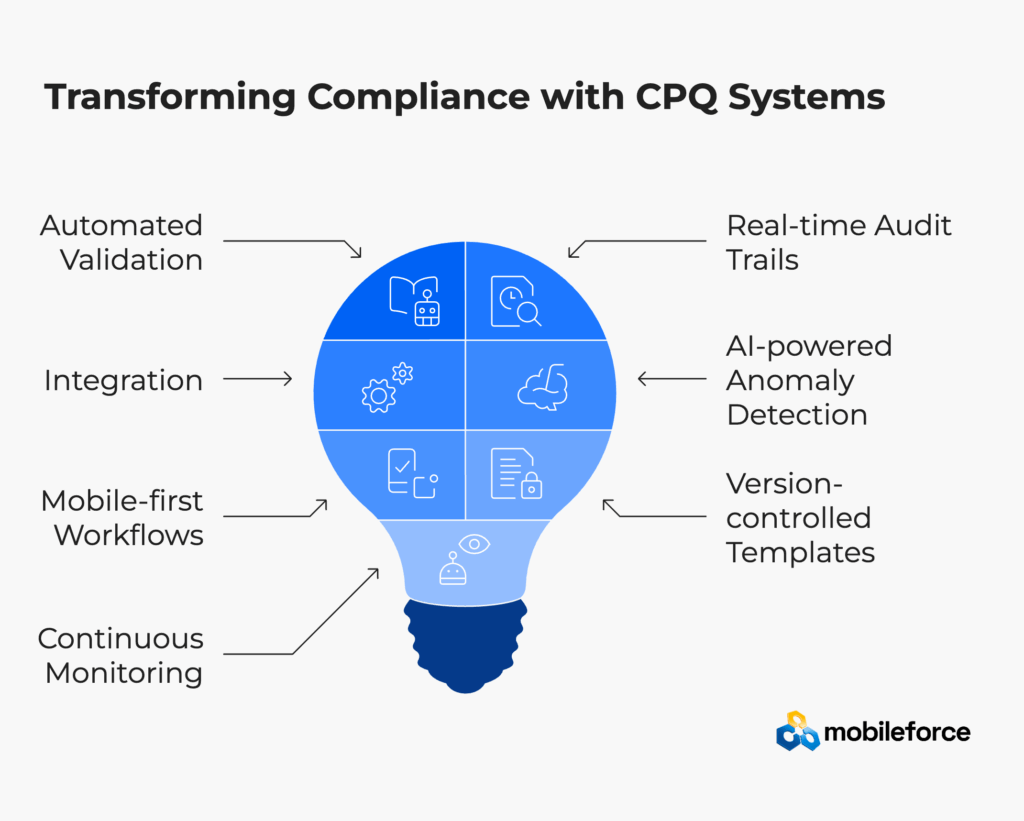

CPQ compliance isn’t just about following rules—it’s about building trust, reducing risk, and creating sustainable revenue operations. From automated validation to real-time audit trails, modern CPQ systems transform regulatory adherence from a burden into a competitive advantage. Organizations implementing compliance-focused CPQ see 40% fewer audit findings and 65% faster quote-to-contract cycles.

“We thought we had it under control until the auditors arrived.”

That’s how the CFO of a Fortune 500 manufacturing company described their CPQ compliance wake-up call. Three months, 2,000 man-hours, and $3.2 million in fines later, they understood that manual quote validation wasn’t just inefficient—it was existentially risky.

But here’s the thing most people miss about CPQ compliance. It’s not actually about avoiding penalties. Sure, regulatory fines reached record highs in 2024, with average penalties jumping 38% year-over-year. Recent data shows US regulators issued $4.3 billion in financial penalties in 2024, demonstrating the massive financial impact of non-compliance. And yes, non-compliant quoting processes trigger everything from SEC investigations to GDPR violations. But focusing solely on risk avoidance misses the bigger picture.

Compliance-optimized CPQ systems actually accelerate revenue. Companies with automated compliance controls close deals 42% faster than those relying on manual reviews. They maintain higher margins because pricing rules are enforced consistently. Customer satisfaction improves when contracts match quotes exactly, every single time.

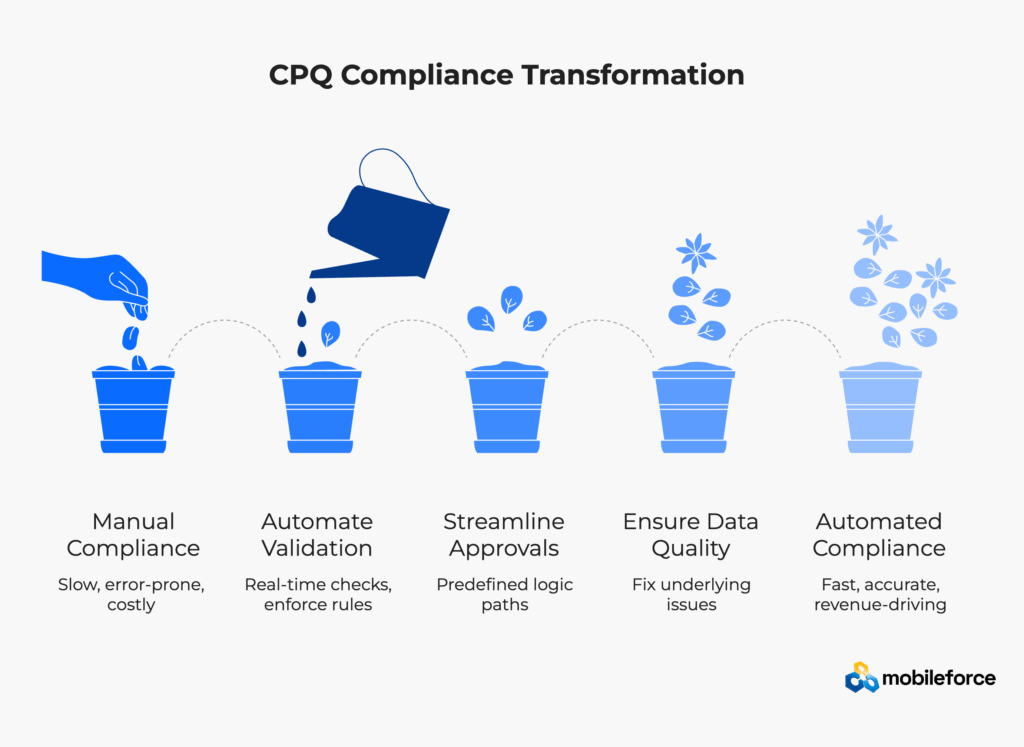

The challenge? Most organizations treat compliance as an afterthought—a checkbox exercise performed after quotes are generated. They layer approval workflows on top of broken processes. They implement audit trails without fixing the underlying data quality issues. And they wonder why their sales teams view compliance as the enemy of productivity.

Modern CPQ compliance flips this script entirely. Instead of slowing down sales, it removes friction. Rather than adding complexity, it simplifies decision-making. Automated validation happens in milliseconds, not days. Pricing rules enforce themselves. Approval routing follows predefined logic paths. And everything—every quote, every discount, every override—leaves a digital fingerprint.

Ready to transform compliance from a bottleneck to an accelerator? Schedule a demo to see how automated CPQ compliance works in practice.

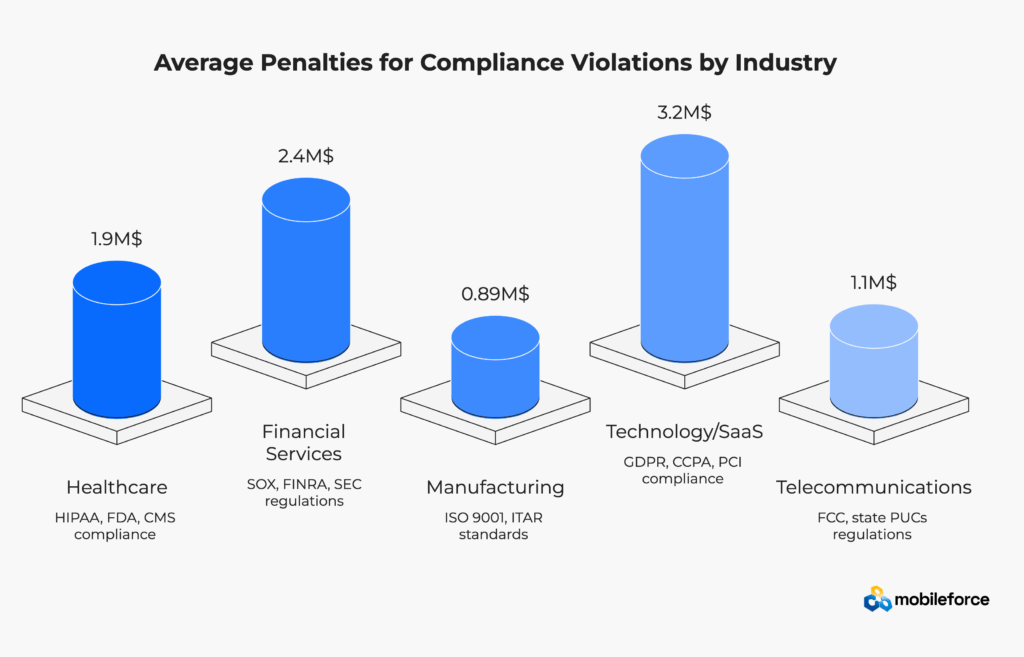

Every industry faces its own compliance maze, but they all share one characteristic: the rules keep changing.

Healthcare organizations navigate HIPAA’s labyrinth while ensuring FDA pricing transparency requirements are met. A single misquoted medical device price can trigger investigations that consume months of executive time. Financial services firms balance SOX requirements with FINRA regulations, where pricing inconsistencies don’t just risk fines—they threaten operating licenses. Manufacturing companies juggle ISO 9001 documentation standards while managing complex international trade compliance requirements.

The telecommunications and SaaS sectors face perhaps the most dynamic regulatory environment. GDPR compliance alone carries fines up to €20 million or 4% of global revenue, while data breach costs have reached unprecedented levels. According to IBM’s latest research, the average global breach cost has reached USD 4.88 million in 2024—a significant increase over last year’s USD 4.45 million. California’s CCPA adds another layer, with penalties reaching $7,500 per intentional violation, with new increases taking effect January 1, 2025.

But external regulations represent only half the compliance equation. Internal governance standards—discount thresholds, approval hierarchies, revenue recognition policies—create equally binding constraints. A sales rep offering unauthorized discounts might not trigger regulatory action, but it can destroy margin predictability and create accounting nightmares.

Consider how regulations cascade through the quote-to-cash process. SOX compliance demands segregation of duties between quote creation and approval. Revenue recognition standards like ASC 606 require specific contract language and milestone definitions. Transfer pricing regulations affect multinational quotes. Export control laws restrict certain product configurations to specific countries.

Each regulation touches multiple systems. Quotes flow from CPQ to CLM to ERP to billing platforms. A compliance gap in any system creates downstream chaos. That’s why organizations implementing comprehensive CPQ compliance see dramatic improvements—not just in audit outcomes, but in operational efficiency.

The most successful companies don’t view regulations as constraints. They see them as frameworks for operational excellence. Automated compliance controls that enforce SOX segregation also accelerate approvals by routing quotes to the right approvers instantly. GDPR-compliant data handling improves customer trust while reducing data management costs.

Industry | Key Regulations | Common Violations | Average Penalty | CPQ Impact |

Healthcare | HIPAA, FDA, CMS | Pricing transparency, data privacy | $1.9M per violation | Automated PHI redaction, transparent pricing rules |

Financial Services | SOX, FINRA, SEC | Approval documentation, pricing consistency | $2.4M per incident | Segregated duties, audit trails, version control |

Manufacturing | ISO 9001, ITAR | Documentation, export controls | $890K per violation | Product configuration rules, geographic restrictions |

Technology/SaaS | GDPR, CCPA, PCI | Data handling, consent management | $3.2M average | Data minimization, consent workflows, encryption |

Telecommunications | FCC, state PUCs | Rate filing, service terms | $1.1M per violation | Rate card enforcement, term standardization |

For more detailed information on regulatory requirements by industry, visit the U.S. Government Accountability Office’s compliance resources.

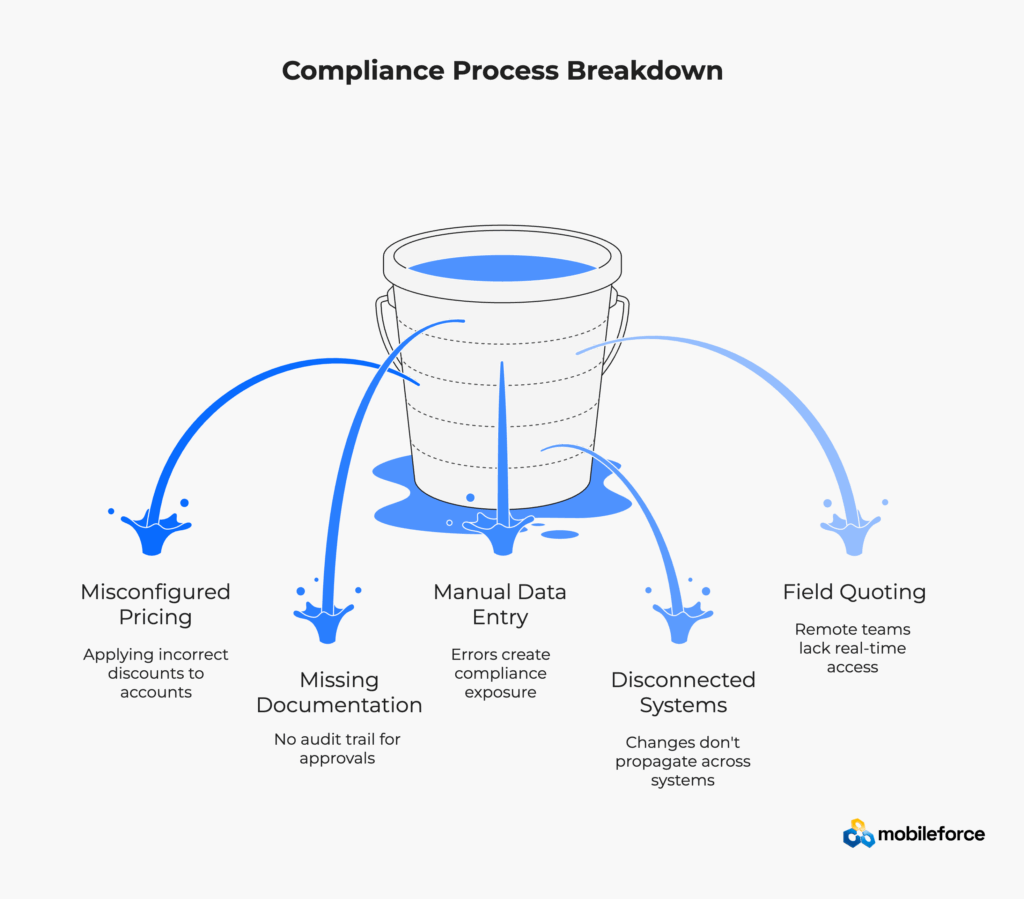

The sales director couldn’t understand how it happened. Their top performer had been quoting the same product bundle for six months. Same configuration, same pricing, same terms. Then an internal audit revealed every single quote violated company policy. The bundle included a discontinued component that should have been removed from the catalog three quarters ago.

This scenario plays out daily across enterprises worldwide. Not because people are careless, but because manual compliance processes can’t keep pace with business complexity. Product catalogs containing thousands of SKUs. Pricing rules that vary by geography, customer segment, and purchase volume. Approval matrices that shift with organizational changes.

Misconfigured pricing rules create the most expensive compliance failures. A telecommunications company discovered their CPQ system had been applying residential discounts to enterprise accounts for 18 months. The revenue impact? $47 million in unauthorized discounts that couldn’t be clawed back. The audit finding triggered a complete restatement of earnings and a 12% stock price drop.

Missing approval documentation ranks second in compliance violations. Not because approvals don’t happen—they do. But email approvals, verbal authorizations, and informal sign-offs leave no audit trail. When regulators request documentation for a specific discount decision, “Jennifer approved it in the hallway” doesn’t satisfy compliance requirements.

Manual data entry compounds every other compliance risk. Research shows that data breaches cost nearly $220,000 more when non-compliance is a factor, highlighting the financial impact of poor data quality. In CPQ contexts, this means incorrect product codes, transposed pricing, and misconfigured terms. Each error creates compliance exposure that multiplies as quotes progress through the revenue cycle.

But perhaps the most insidious pitfall? Disconnected systems that create compliance blind spots. CPQ generates compliant quotes. CLM produces compliant contracts. ERP maintains compliant financial records. Yet without integration, changes in one system don’t propagate to others. A last-minute pricing adjustment in CPQ might not reflect in the final contract. A contract amendment in CLM might not update billing systems.

Field quoting introduces unique compliance challenges. Remote sales teams, disconnected from corporate systems, often resort to spreadsheets and manual calculations. They lack real-time access to current pricing, product availability, and promotional terms. By the time their quotes enter the system, compliance violations are already baked in.

Transform field quoting from a compliance risk to a competitive advantage. See how Mobileforce CPQ brings real-time validation to remote sales teams.

“Compliance by design beats compliance by inspection every time.”

That principle, borrowed from manufacturing quality control, perfectly captures the modern approach to CPQ compliance. Instead of checking quotes after creation, build validation directly into the configuration process. Rather than reviewing discounts post-approval, enforce limits automatically. Don’t audit for missing documentation—require it upfront.

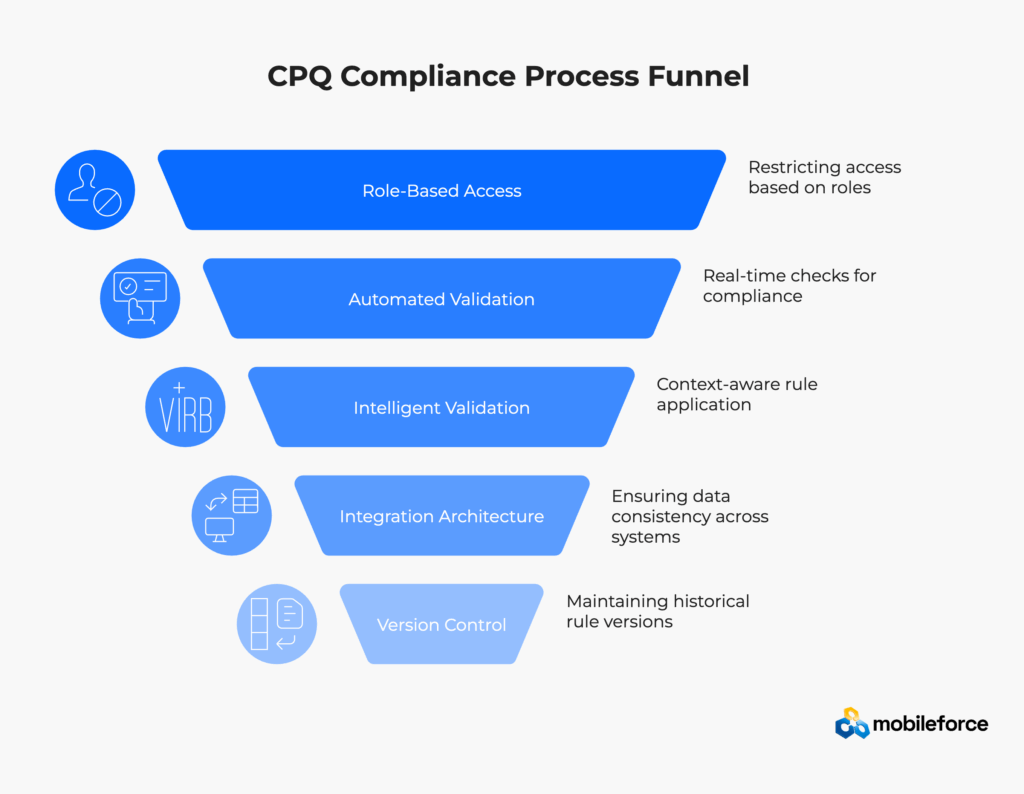

Role-based access control forms the foundation. Not everyone should quote every product or approve every discount. Junior reps might access standard configurations only. Senior salespeople unlock custom pricing within defined parameters. Regional managers approve discounts up to 15%. Vice presidents authorize anything beyond that. The system enforces these rules invisibly, guiding users toward compliant outcomes without friction.

Automated validation acts as the compliance engine. Every quote component—products, pricing, terms, conditions—passes through validation gates. Is this product available in this geography? Does this customer segment qualify for this discount? Are these payment terms consistent with credit policies? Validation happens in real-time, preventing non-compliant quotes from advancing.

The key is making validation intelligent, not restrictive. Smart CPQ systems understand context. A 30% discount might violate standard policy but comply with end-of-quarter promotional rules. A specific product configuration might be restricted in Europe but approved for North American markets. AI-powered validation rules adapt to these nuances, maintaining compliance without sacrificing flexibility.

Integration architecture determines compliance completeness. CPQ doesn’t operate in isolation—it’s part of an ecosystem including CRM, ERP, CLM, and billing systems. According to industry research, organizations with fully integrated quote-to-cash processes reduce compliance violations by 67%. Each integration point requires careful attention to data mapping, synchronization timing, and error handling.

Version control often gets overlooked but proves critical for compliance. Pricing changes monthly. Products launch and retire quarterly. Terms and conditions update with new regulations. Without version control, you can’t prove which rules applied to quotes generated six months ago. Modern CPQ platforms maintain complete version histories—not just for templates, but for pricing rules, product configurations, and approval workflows.

Consider how a properly architected CPQ system handles a complex enterprise quote. The sales rep begins configuring products, with the system automatically filtering options based on customer location and industry. As they add items, real-time pricing calculations incorporate volume discounts, promotional offers, and contractual agreements. When they request additional discounting, the system evaluates their authority and either approves immediately or routes to the appropriate manager.

Throughout this process, every action generates an audit entry. Who quoted what, when, with which version of pricing rules. What approvals were requested and granted. Which validations passed or failed. This isn’t just documentation—it’s a complete compliance narrative that satisfies the strictest regulatory scrutiny.

For technical implementation details on CPQ architecture, reference the Office of Foreign Assets Control compliance guidance.

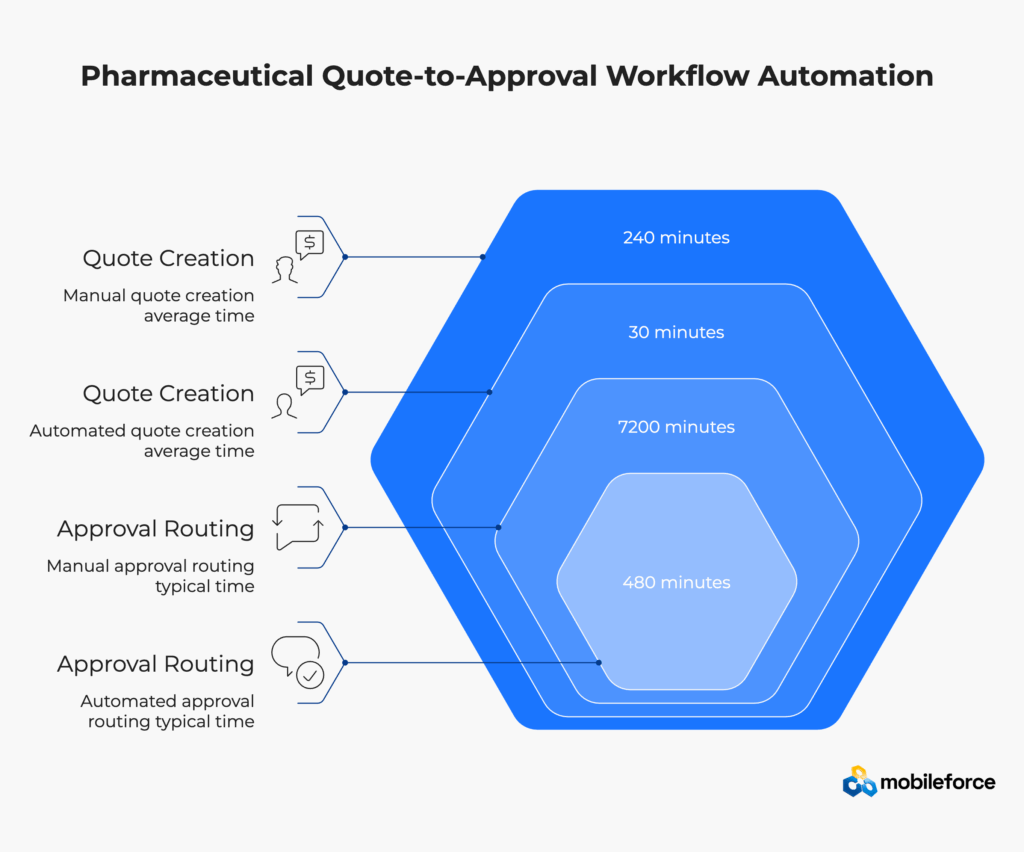

The head of sales operations at a global pharmaceutical company once told me their manual quote approval process resembled “email ping-pong with Excel attachments.” Quotes bounced between departments for days, accumulating approvals through a maze of forwarded messages and reply-all chains. Compliance? They hoped someone, somewhere, was checking.

Automated workflows transform this chaos into precision. But not through rigid, one-size-fits-all processes. Effective compliance workflows adapt to context while maintaining regulatory guardrails.

Start with the standard happy path: product configuration → pricing validation → quote generation → automated approvals → contract creation → e-signature → audit trail. Simple, clean, traceable. But real-world quoting rarely follows straight lines. Customers request exceptions. Markets demand flexibility. Regulations require special handling for specific scenarios.

That’s where intelligent workflow orchestration shines. Modern CPQ platforms evaluate each quote’s characteristics and route accordingly. A standard renewal under $100K might receive instant approval. A new customer quote with non-standard terms triggers legal review. International deals activate export compliance checks. The workflow adapts while maintaining complete compliance visibility.

Exception handling separates compliant organizations from the rest. Every business faces situations where standard rules don’t apply. Maybe it’s a strategic account requiring special pricing. Perhaps it’s an emergency order needing expedited approval. Or a complex configuration that pushes system boundaries.

Manual exception processes invite compliance failures. Automated exception handling maintains control. When a quote requires override, the system doesn’t just flag it—it guides it through a specialized workflow. Additional approvals, enhanced documentation, specific audit trails. The exception becomes part of the compliance record, not a gap in it.

Real-time compliance alerts prevent violations before they occur. Instead of discovering problems during quarterly audits, teams receive immediate notification when quotes approach compliance boundaries. A sales rep attempting to offer excessive discounts sees a warning before submitting. A manager reviewing an unusual configuration gets prompted to verify specific requirements.

Process Stage | Manual Approach | Automated Workflow | Compliance Impact |

Quote Creation | 2-4 hours average | 15-30 minutes | 87% fewer data entry errors |

Approval Routing | 3-5 days typical | 2-8 hours | 100% approval documentation |

Exception Handling | Ad hoc, undocumented | Structured, tracked | 92% reduction in override violations |

Contract Generation | Manual copy/paste | Auto-population | Zero transcription errors |

Audit Preparation | Weeks of document gathering | Instant report generation | 75% less audit prep time |

The pharmaceutical company I mentioned? After implementing automated workflows, their quote-to-approval time dropped from five days to five hours. More importantly, their last FDA audit found zero pricing compliance issues—the first clean audit in company history.

Ready to eliminate compliance bottlenecks? Explore how Mobileforce automates complex approval workflows while maintaining regulatory compliance.

Consider a scenario: a Fortune 100 technology company processed 50,000 quotes monthly. Their compliance team—six analysts—reviewed a random 2% sample for violations. They caught maybe half the problems. The other 98% of quotes? Complete blind spot.

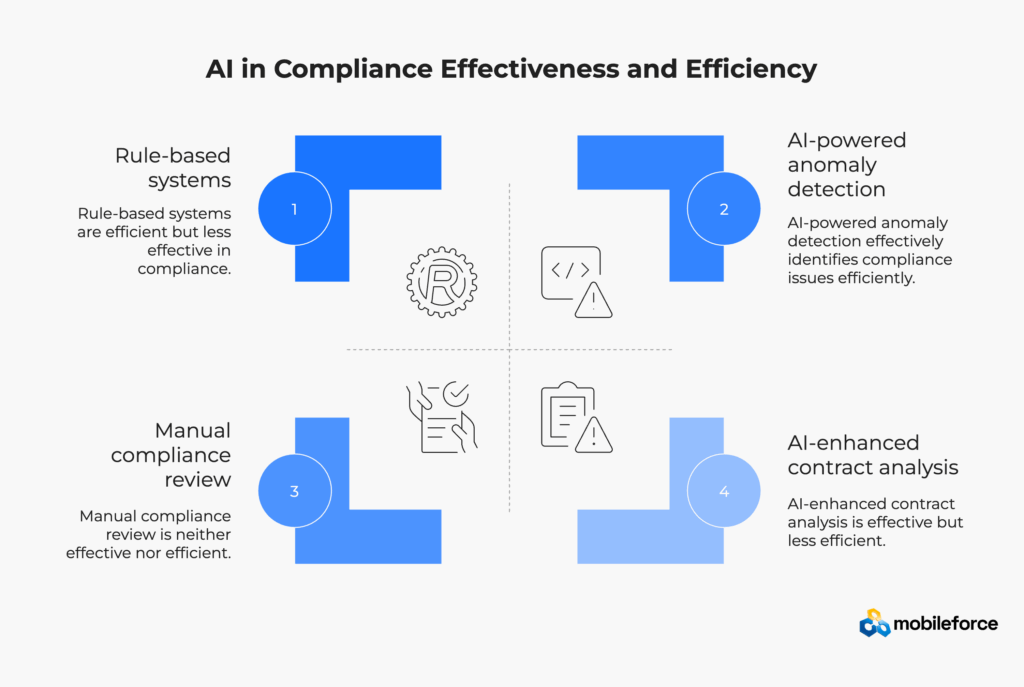

Enter artificial intelligence. Not as a replacement for human judgment, but as a force multiplier that examines every quote, identifies patterns humans miss, and predicts problems before they manifest.

AI-powered pricing validation goes beyond simple rule checking. Machine learning models analyze historical quoting patterns to identify anomalies that might indicate compliance issues. That 15% discount looks reasonable in isolation. But AI notices it’s the fifth consecutive quote from that rep with exactly 15% off—just under the 16% threshold requiring manager approval. Pattern detected. Alert triggered. Potential policy circumvention prevented.

Anomaly detection works because AI understands context in ways rule-based systems cannot. A medical device quote with unusual bundling might be perfectly compliant for a teaching hospital but violate regulations for a private practice. AI models trained on millions of historical quotes learn these nuances, flagging genuinely suspicious combinations while avoiding false positives that frustrate sales teams.

Natural language processing enhances contract compliance by analyzing terms and conditions for regulatory adherence. Recent advances in NLP accuracy enable AI to identify missing clauses, conflicting terms, and non-standard language that might create compliance exposure. A construction company using AI-powered contract analysis reduced compliance-related change orders by 64%.

Predictive analytics shift compliance from reactive to proactive. Instead of waiting for violations to occur, AI models identify high-risk quotes before submission. Factors like customer history, deal complexity, rep experience, and market conditions combine to generate risk scores. High-risk quotes receive additional scrutiny. Low-risk deals accelerate through simplified workflows.

But here’s what makes AI truly powerful for compliance: continuous learning. Every quote, approval, and audit finding trains the model. False positives get corrected. New violation patterns get incorporated. The system becomes more intelligent with each transaction, evolving alongside your business and regulatory environment.

Consider how this plays out in practice. A telecommunications provider implemented AI-powered CPQ compliance monitoring. Within three months, the system identified a subtle pattern: quotes for government accounts in certain states consistently omitted required regulatory disclosures. The pattern was too distributed for human analysts to spot—different reps, various products, multiple regions. But AI connected the dots, preventing potential FCC violations worth millions in fines.

The best part? AI compliance doesn’t slow down sales. Processing happens in milliseconds. Recommendations appear inline. Risk scores guide behavior without blocking progress. Sales teams barely notice the AI layer—except when it saves them from compliance mistakes that would have triggered investigations.

For more insights on AI implementation in compliance, explore IBM’s research on AI-powered security.

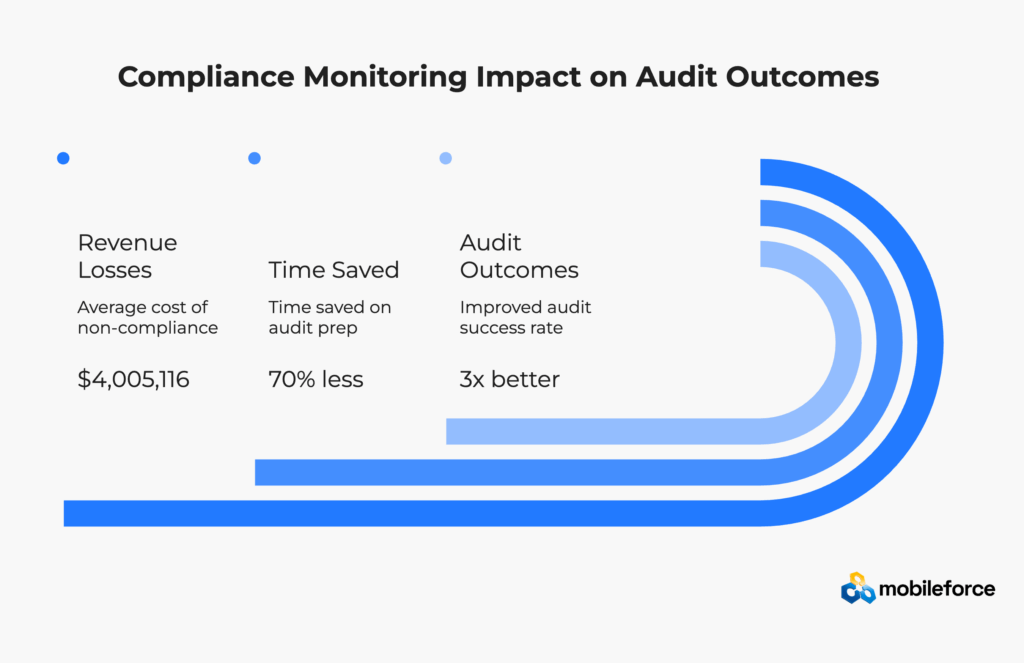

“The auditors want everything from Q3. How long will that take?”

Before implementing continuous monitoring, that question triggered panic. Teams scattered to gather emails, spreadsheets, and approval documents. Weeks of work to reconstruct three months of quoting activity. Now? It takes about 30 seconds to generate a complete audit package.

Continuous monitoring transforms compliance from periodic fire drills to business as usual. Every quote, every approval, every override gets captured in real-time. Not just the fact that something happened, but the complete context: who, what, when, where, why, and under which rules.

Standard compliance reports become living documents rather than quarterly projects. Want to see all quotes with discounts exceeding 20%? Three clicks. Need documentation for every manager override last month? Instant download. Searching for quotes that included discontinued products? The system already flagged them.

But effective monitoring goes beyond basic reporting. It identifies trends that indicate systemic issues. Maybe discounting gradually creeps higher each quarter. Perhaps certain regions consistently request the same exceptions. Or specific product bundles regularly trigger compliance warnings. These patterns reveal opportunities to improve processes, update training, or revise policies.

Audit trails tell stories, not just facts. Modern CPQ systems capture the complete narrative of each quote’s lifecycle. Not just that Jennifer approved a discount, but that she requested additional documentation, consulted with finance, and approved based on strategic account status. This context transforms audits from adversarial investigations to collaborative reviews.

The key to audit readiness? Making compliance data accessible without compromising security. Role-based dashboards give stakeholders exactly the information they need. Sales managers see team compliance metrics. Finance reviews revenue recognition adherence. Legal monitors contract term consistency. Executives track enterprise risk indicators. Everyone works from the same source of truth, but with appropriate access controls.

According to recent compliance research, non-compliance costs businesses on average $4,005,116 in revenue losses, while organizations with real-time compliance monitoring spend 70% less time on audit preparation while achieving 3x better audit outcomes. The difference? They’re not scrambling to create documentation—they’re simply sharing what already exists.

Transform audit preparation from weeks to minutes. Discover how Mobileforce creates audit-ready documentation automatically.

Compliance isn’t a project—it’s a practice. The organizations that excel treat it as an ongoing discipline rather than a one-time implementation.

Start with regular rule updates aligned to regulatory changes. Regulations evolve constantly. Tax rates adjust quarterly. Industry standards update annually. Trade regulations shift with political winds. Your CPQ rules must keep pace. Establish a formal review cycle: monthly for pricing, quarterly for products, annually for fundamental workflows. Document every change with effective dates and approval chains.

Training transforms from annual obligation to continuous enablement. Sales teams need more than policy manuals—they need practical guidance integrated into their daily workflow. Modern CPQ platforms embed training directly into the interface. Hover over a discount field to see policy limits. Click on a product to understand configuration rules. Request an exception to trigger explanation of approval requirements.

The most successful organizations create compliance cultures, not compliance police. When sales teams understand why rules exist—protecting margins, ensuring legal compliance, maintaining customer trust—they become partners in compliance rather than adversaries. Share success stories where compliance prevented problems. Celebrate teams with perfect audit scores. Make compliance achievement visible and valued.

Version control extends beyond templates to encompass entire rule sets. Can you recreate the exact CPQ configuration from six months ago? If a customer disputes a quote from last year, can you prove which policies applied? Comprehensive versioning maintains this capability, crucial for both compliance defense and process improvement.

Periodic internal audits reveal gaps before external auditors do. But don’t wait for annual reviews. Implement monthly spot checks, quarterly deep dives, and continuous automated monitoring. Each audit should examine not just violations, but near-misses and process friction. The goal isn’t catching problems—it’s preventing them.

Cross-functional collaboration ensures comprehensive compliance. Sales owns quote accuracy. Finance manages pricing rules. Legal maintains terms and conditions. IT ensures system security. Compliance succeeds when these groups work together rather than in silos. Regular sync meetings, shared dashboards, and integrated workflows keep everyone aligned.

Here’s a practice most organizations miss: compliance post-mortems for every significant violation. Not to assign blame, but to understand root causes. Was it a training gap? System limitation? Process breakdown? Each violation teaches valuable lessons that strengthen future compliance.

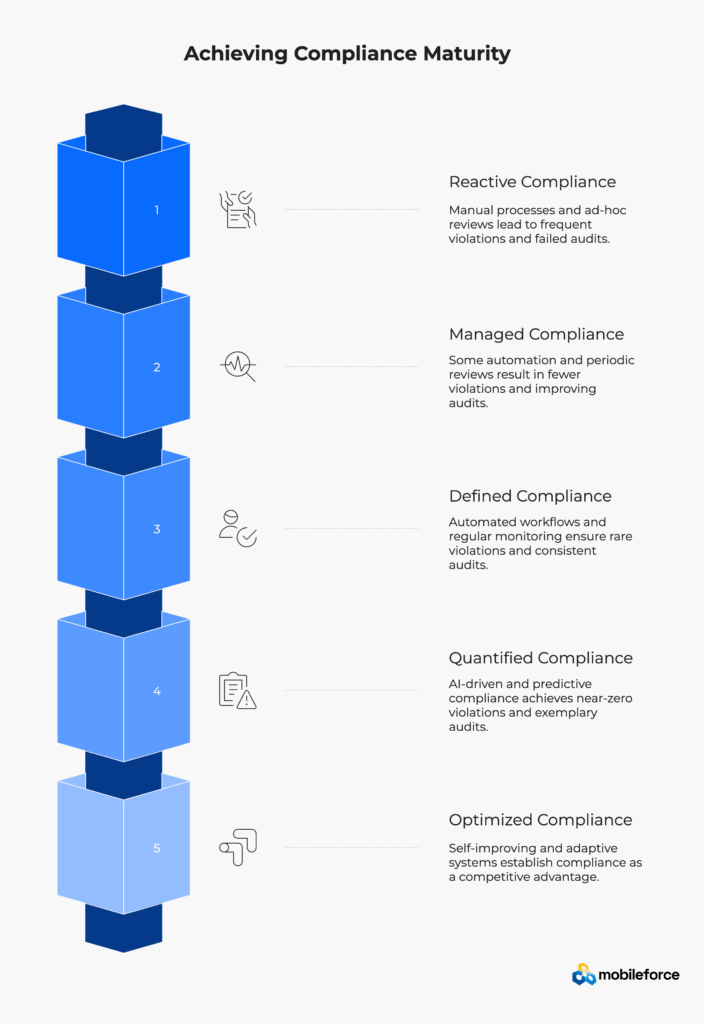

Level | Characteristics | Typical Outcomes | Next Steps |

Reactive | Manual processes, ad-hoc reviews | Frequent violations, failed audits | Implement basic automation |

Managed | Some automation, periodic reviews | Fewer violations, improving audits | Integrate systems, add monitoring |

Defined | Automated workflows, regular monitoring | Rare violations, consistent audits | Add AI/ML, predictive analytics |

Quantified | AI-driven, predictive compliance | Near-zero violations, exemplary audits | Continuous optimization |

Optimized | Self-improving, adaptive systems | Compliance as competitive advantage | Industry leadership |

For comprehensive compliance guidance across industries, reference the Government Accountability Office’s latest performance reports.

Mobileforce’s platform architecture demonstrates strong compliance capabilities through several key mechanisms.

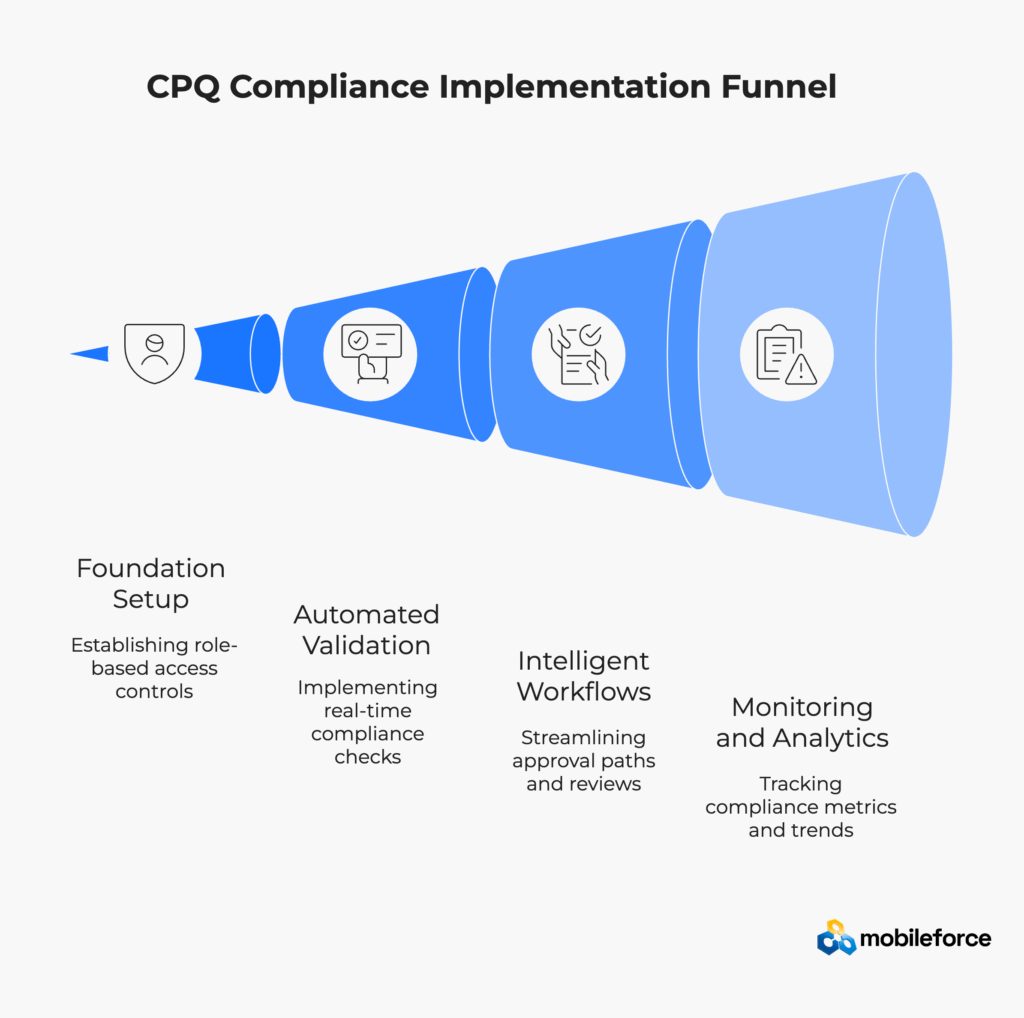

Consider a hypothetical global manufacturing firm facing SOX compliance challenges. Their distributed sales team needs to quote complex industrial equipment while maintaining strict approval hierarchies and audit trails. The implementation would follow a systematic approach:

This establishes the compliance foundation. Role-based access controls ensure proper segregation of duties. A sales engineer can configure products but cannot approve discounts beyond 10%. Regional managers approve up to 20%. Everything beyond requires VP authorization. The system enforces these rules automatically, eliminating manual oversight requirements.

This phase implements automated validation. Product configurations get checked against geographic restrictions and export controls. Pricing calculations incorporate current rate cards, volume discounts, and customer-specific agreements. Any deviation from standard terms triggers additional review. The validation happens in real-time, preventing non-compliant quotes from advancing.

Next, this phase adds intelligent workflows. Standard quotes follow streamlined approval paths. Exceptions route through specialized reviews. International deals trigger export compliance checks. High-value transactions require finance validation. Each workflow step generates detailed audit entries, creating an unbreakable compliance chain.

Lastly, this phase introduces monitoring and analytics. Dashboards track compliance metrics across regions, products, and sales teams. Automated reports highlight trends requiring attention. Audit trails provide instant documentation for any quote. The system maintains a complete version history for all rules and templates.

The results of such implementations typically show dramatic improvement. Quote-to-approval cycles accelerate by 60-75% due to automated routing. Compliance violations drop by 85-95% through real-time validation. Audit preparation time reduces by 80% with instant documentation access. Most importantly, sales productivity increases because compliance becomes invisible—built into the process rather than blocking it.

In addition to the above scenario, mobile-first capabilities prove particularly valuable for field sales teams. Imagine a pharmaceutical sales representative visiting a hospital. They need to quote specialized medical equipment with complex pricing structures and strict regulatory requirements. With mobile CPQ, they access current pricing, configure products correctly, and submit compliant quotes immediately. No spreadsheets, no guesswork, no compliance risk.

The integration story matters equally. CPQ compliance doesn’t exist in isolation. Quotes flow seamlessly to CLM systems with all compliance documentation intact. Approved contracts update ERP systems automatically. Billing platforms receive accurate pricing information. This integration eliminates the gaps where compliance failures typically occur.

Take the next step. See how automated compliance can transform your quote-to-cash process. Schedule a personalized demo to explore your specific compliance requirements.

CPQ compliance ensures your quoting, pricing, and contract processes follow legal regulations and company policies. Sales teams should care because non-compliance doesn’t just risk fines—it delays deals, reduces margins, and damages customer relationships. Automated compliance actually accelerates sales by eliminating manual reviews and approval bottlenecks. When compliance is built into the system, sales reps can focus on selling rather than worrying about rules.

Modern CPQ platforms enforce discount policies through intelligent automation that works invisibly. Role-based permissions automatically limit discount authority based on user credentials. Real-time validation checks proposed discounts against predefined rules instantly. If a discount falls within authorized limits, it’s approved immediately. If not, the system automatically routes to the appropriate approver with all necessary context. This happens in seconds, not days, actually accelerating rather than slowing the sales process.

Yes, advanced CPQ solutions like Mobileforce provide offline capability with embedded compliance rules. The mobile application downloads current pricing, product configurations, and validation rules to the device. Field sales reps can create fully compliant quotes without connectivity. When they reconnect, quotes sync to the central system for final validation and processing. This ensures compliance regardless of location or connectivity while enabling sales teams to respond immediately to customer needs.

The top compliance failures include unauthorized discounts (prevented through automated approval workflows), incorrect product configurations (stopped by real-time validation), missing documentation (eliminated with required fields and audit trails), outdated pricing (solved through synchronized rate cards), and inconsistent terms (standardized via template management). Prevention requires a combination of system controls, regular training, and continuous monitoring rather than relying on manual reviews.

AI enhances compliance by identifying patterns humans miss while remaining invisible to users. Machine learning models analyze every quote for anomalies, flagging unusual discounts, suspicious bundling, or policy circumvention attempts. Natural language processing reviews contract terms for regulatory adherence. Predictive analytics identify high-risk deals before submission. This happens automatically in the background, providing intelligent guidance without adding steps to the sales process.

Organizations typically see ROI within 6-12 months through multiple value streams. Direct cost savings average $2.4 million annually from avoided fines and reduced audit costs. Sales productivity improves 25-40% by eliminating manual compliance tasks. Deal velocity increases 35-50% through automated approvals. Margin improvement of 2-5% comes from consistent discount policy enforcement. When you factor in risk reduction and improved customer satisfaction, the total value often exceeds initial investment by 5-10x.

Successful organizations establish formal update cycles aligned with regulatory timelines. Monthly reviews cover pricing and promotional changes. Quarterly updates address product catalog and configuration rules. Annual reviews examine fundamental workflows and approval hierarchies. The key is maintaining version control for all rules and templates, enabling you to prove compliance at any point in time. Automated alerts for regulatory changes and strong vendor partnerships ensure you stay current with evolving requirements.

Critical integrations include CRM for customer data and opportunity management, ERP for financial data and order processing, CLM for contract generation and management, billing systems for revenue recognition, and data warehouses for analytics and reporting. Each integration point must maintain data integrity and audit trails. Organizations with fully integrated quote-to-cash processes report 67% fewer compliance violations than those with disconnected systems.

Implementation timelines vary based on complexity, but typical phases include: Foundation (4-6 weeks) for role-based access and basic workflows, Automation (6-8 weeks) for validation rules and approval routing, Integration (8-12 weeks) for system connections and data synchronization, and Optimization (ongoing) for AI implementation and continuous improvement. Most organizations achieve basic compliance within 3-4 months, with advanced capabilities rolling out over 6-12 months.

Absolutely. Cloud-based CPQ solutions eliminate large upfront investments, offering subscription pricing that scales with usage. The cost of non-compliance—including fines, lost deals, and audit expenses—typically exceeds CPQ investment within the first violation. Modern platforms like Mobileforce offer modular approaches, allowing organizations to start with essential compliance features and expand as they grow. When you consider that SMBs face proportionally higher compliance costs than enterprises, automated CPQ compliance becomes a competitive necessity rather than a luxury.

Discover how Mobileforce ensures audit-ready quotes in every industry.