From raw quotes to real insights — unlock revenue growth with data-driven CPQ intelligence

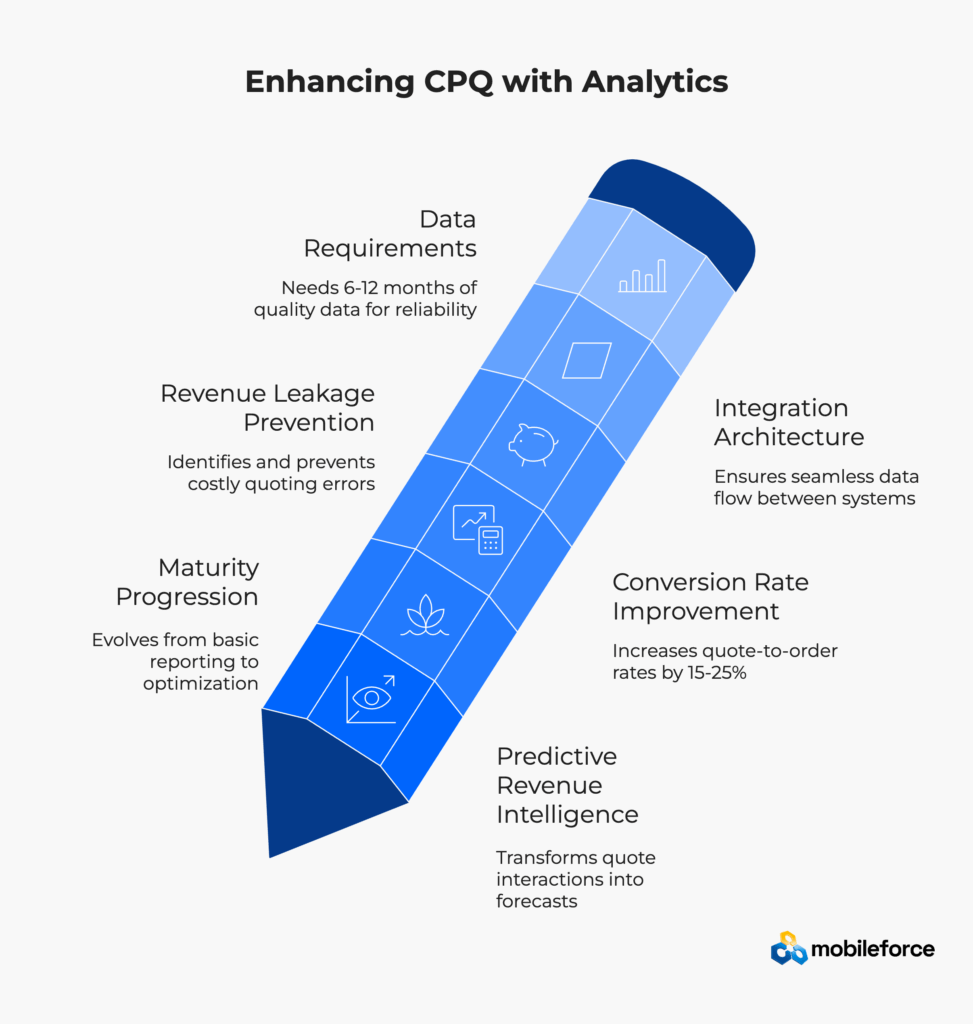

Your CPQ system isn’t just processing quotes—it’s generating a goldmine of revenue intelligence. Companies using advanced CPQ analytics see 15-25% improvement in win rates and reduce quote-to-cash cycles by up to 40%. Quote analytics software transforms raw pricing data into predictive insights that drive real business outcomes. Most organizations barely scratch the surface, treating their configure price quote tools as glorified calculators rather than strategic revenue engines. This comprehensive guide reveals how to transform quote data into revenue intelligence that forecasts deal outcomes and optimizes pricing strategies.

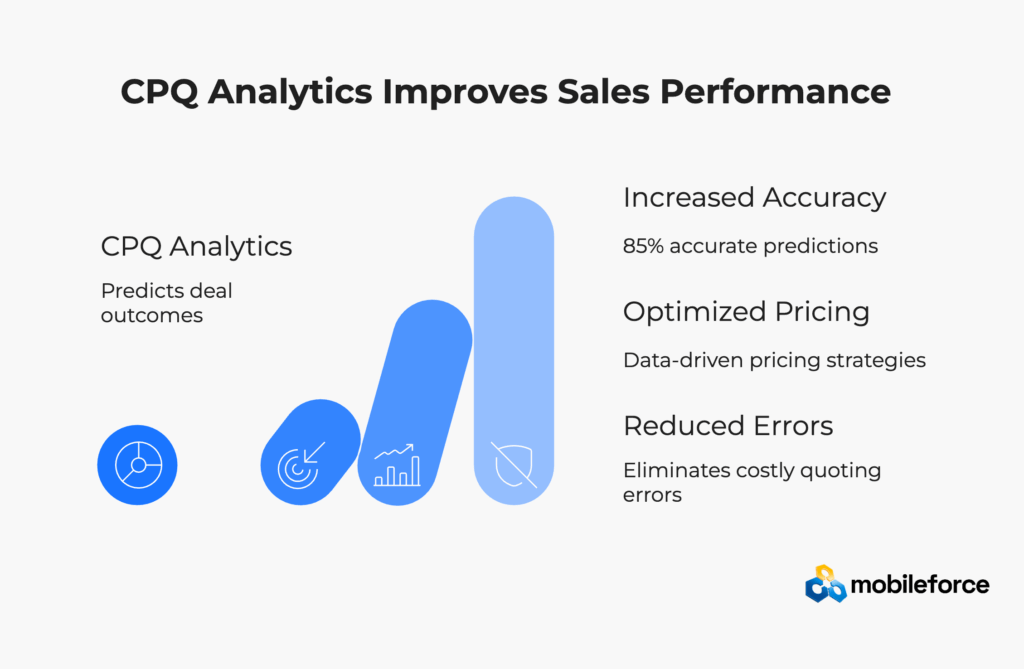

“We were flying blind with our quotes until we implemented proper analytics. Now we can predict which deals will close with 85% accuracy three weeks before the decision.” This comment from a sales operations director at a mid-sized SaaS company captures exactly why CPQ analytics has become the secret weapon of high-performing revenue teams using quote-to-cash analytics.

But here’s the thing—most companies are sitting on a treasure trove of quote data without realizing its potential. Every configuration choice, pricing decision, discount approval, and quote revision tells a story about customer behavior and market dynamics. The question isn’t whether your quotes contain valuable insights about revenue intelligence from quoting. It’s whether you’re listening to what they’re trying to tell you about your sales performance.

The pressure on revenue teams has never been higher. According to Salesforce’s State of Sales report, 72% of sales professionals say they spend too much time on administrative tasks rather than selling. Meanwhile, buying journeys have grown increasingly complex, with Gartner research showing that B2B purchase decisions now involve an average of 6-10 stakeholders.

This complexity creates both challenges and opportunities for organizations implementing CPQ for RevOps. Smart organizations are turning their CPQ systems from quote generators into revenue intelligence platforms using advanced CPQ analytics tools. They’re using predictive CPQ analytics to forecast deal outcomes, optimize data-driven pricing strategies, and eliminate the costly quoting errors that silently drain margins.

The transformation from reactive quoting to predictive revenue intelligence represents one of the most significant opportunities in modern sales operations and revenue operations insights. Companies that master this transition don’t just quote faster—they quote smarter using guided quoting analytics, win more often, and protect their margins more effectively through quote-to-cash analytics.

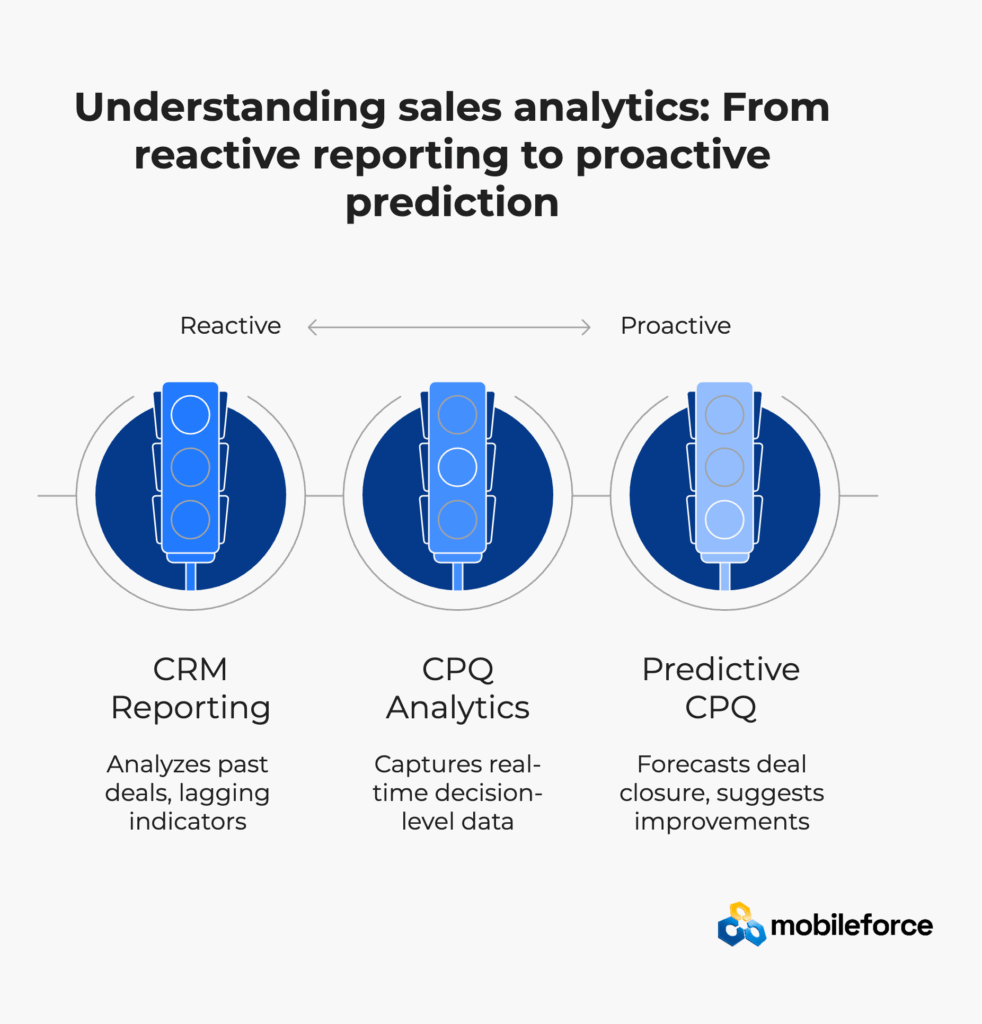

Walk into most sales meetings, and you’ll hear plenty of discussion about pipeline health, conversion rates, and forecasting accuracy. But dig deeper, and you’ll often find these conversations rely on lagging indicators—what happened after deals closed rather than insights that could influence outcomes while opportunities are still in motion.

CPQ analytics flips this script entirely. Instead of waiting to analyze won or lost deals, it captures decision-level data at the moment of truth—when prospects are evaluating configurations, comparing options, and making pricing decisions. This granular visibility creates unprecedented opportunities for real-time optimization.

Traditional CRM reporting tells you that a deal worth $50,000 closed last quarter. CPQ analytics reveals that the prospect requested quotes for three different configurations, spent two weeks evaluating a premium option before settling on the standard package, and negotiated a 12% discount that could have been avoided with better positioning of the mid-tier offering.

The distinction matters because CPQ systems sit at the unique intersection of product, pricing, sales, and operations. They capture data that no other system sees:

Research from Aberdeen Group shows that organizations with mature quote analytics capabilities achieve 23% higher quote-to-order conversion rates and 19% shorter sales cycles compared to companies using basic reporting approaches.

But the real power emerges when CPQ analytics moves beyond description into prediction. Instead of simply reporting that 65% of quotes convert to orders, predictive CPQ analytics can forecast which specific quotes in your current pipeline have the highest probability of closing—and more importantly, what actions could improve those odds.

Ready to transform your quote data into revenue intelligence? Schedule a demo to see how advanced CPQ analytics can optimize your sales performance.

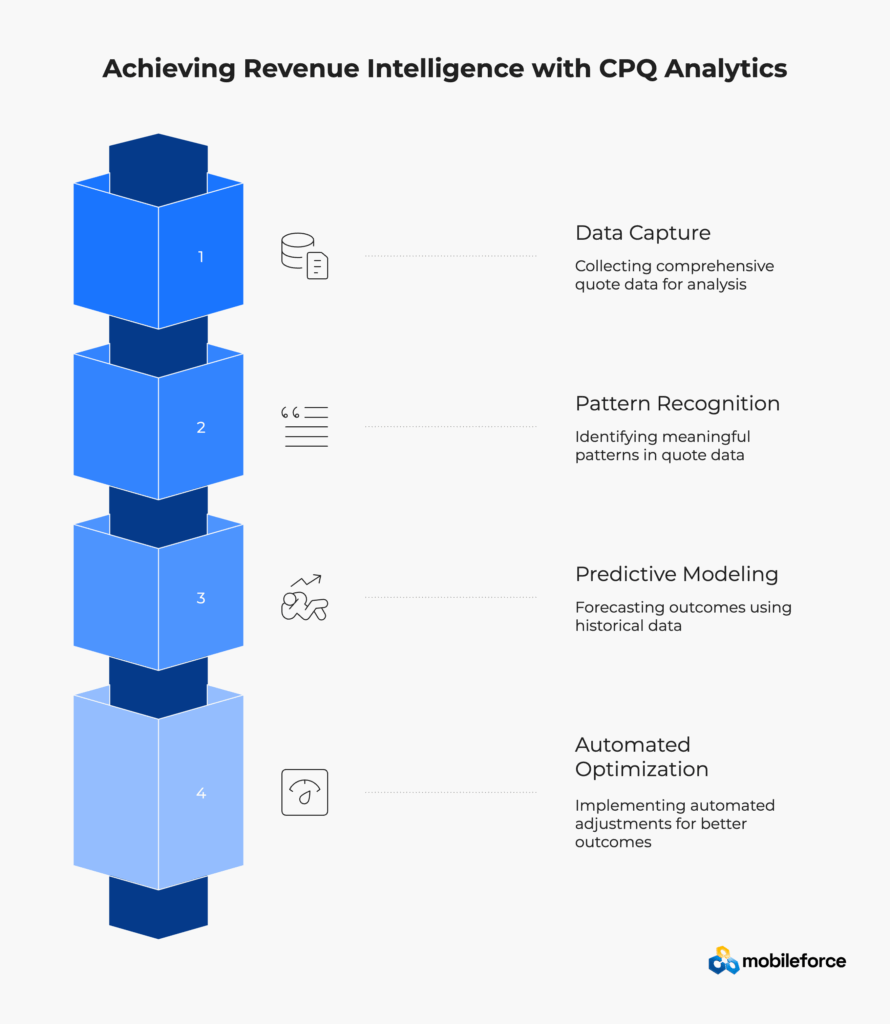

Understanding CPQ analytics requires thinking in terms of a value chain that transforms raw quote interactions into strategic business outcomes using quote-to-cash analytics. Each stage builds on the previous one, creating compounding benefits that extend far beyond the quoting process itself through revenue intelligence from quoting.

Every quote interaction generates multiple data points: product selections, pricing parameters, discount requests, approval workflows, revision cycles, and ultimately, win or loss outcomes. But not all quote analytics software captures this data with equal fidelity for turning quote data into revenue optimization.

High-quality CPQ analytics starts with comprehensive data collection using CPQ reporting and dashboards. This includes obvious metrics like quote value and closure rates, but also subtle signals like time spent evaluating different configurations, the sequence of quote modifications, and the decision-makers involved in approval processes affecting quoting error leakage.

Raw data becomes meaningful when patterns emerge using CPQ analytics tools. Advanced quote analytics software identifies segments within your quote population: high-velocity deals that close quickly with minimal negotiation, complex evaluations that require multiple revisions, price-sensitive opportunities that hinge on discount levels, and competitive situations that demand strategic positioning through discounting optimization.

These patterns often reveal surprising insights through CPQ + BI integration. One manufacturing company discovered that quotes requiring more than two revisions actually had higher win rates than those that closed immediately—suggesting that engagement depth, not speed, predicted deal quality using predictive CPQ analytics.

The transition from descriptive to predictive CPQ analytics represents a fundamental shift in capability. Instead of explaining what happened, quote analytics software begins forecasting what will happen using AI-powered CPQ insights. Machine learning models trained on historical quote patterns can predict closure probability, optimal pricing levels, and likely negotiation outcomes through win/loss analysis in CPQ.

According to McKinsey research, companies using predictive analytics in sales processes see 10-15% improvements in conversion rates and 5-10% increases in deal sizes through CPQ data-driven pricing strategies.

The most advanced CPQ analytics implementations close the loop between insights and action using guided quoting analytics. Rather than simply flagging opportunities for improvement, they automatically adjust quoting parameters, suggest optimal configurations, and guide sales teams toward higher-probability outcomes through leveraging CPQ data.

This might involve dynamic discount recommendations based on deal characteristics, automated upsell suggestions triggered by configuration patterns, or intelligent approval routing that accelerates quotes with high closure probability while adding scrutiny to riskier opportunities using CPQ for RevOps optimization.

The gap between CPQ analytics potential and current practice remains substantial. Most organizations barely scratch the surface of what’s possible, focusing on basic metrics like quote volume and average deal size rather than the strategic insights that drive competitive advantage.

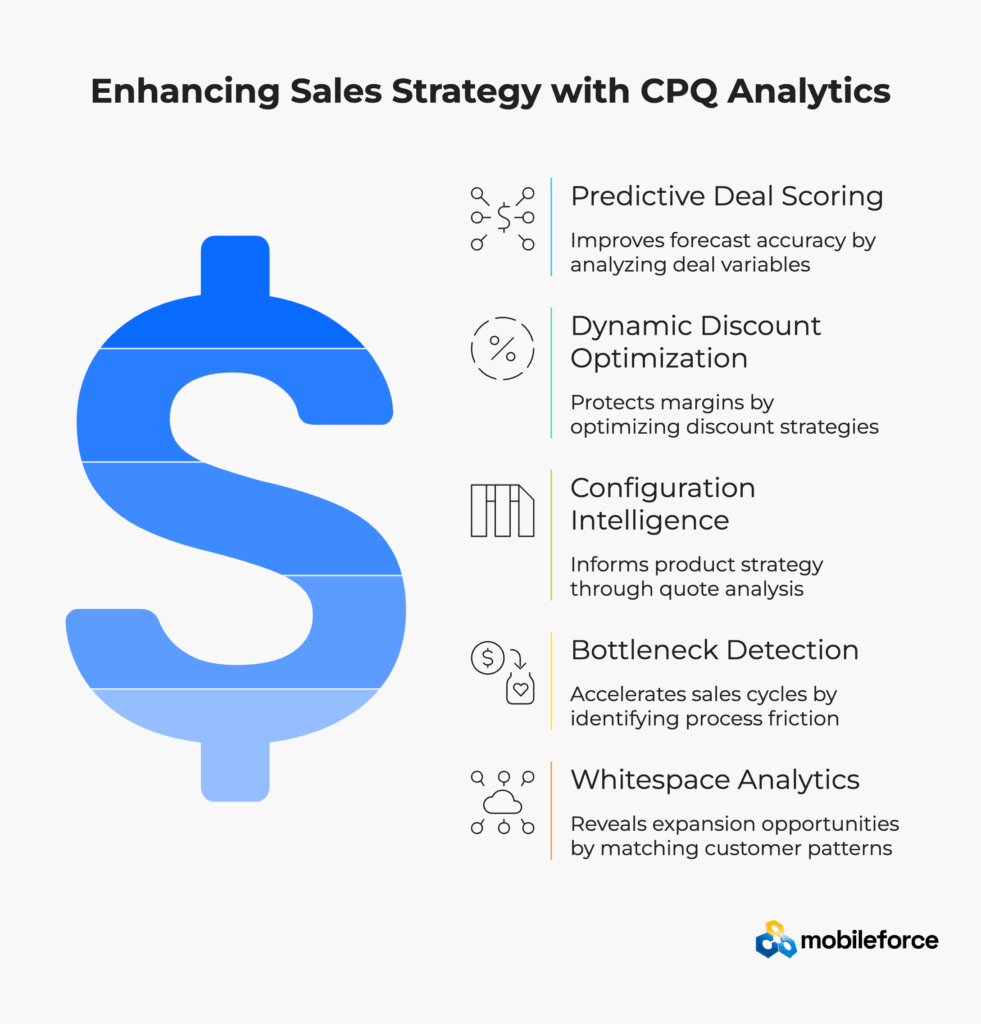

Traditional sales forecasting relies heavily on sales rep intuition and stage-based probability estimates. CPQ analytics introduces objective, data-driven deal scoring that often proves more accurate than human judgment.

A predictive scoring model analyzes dozens of variables: configuration complexity, pricing parameters, discount levels, revision patterns, approval workflows, and historical outcomes for similar opportunities. The result is a dynamic probability score that updates automatically as quotes evolve.

One technology company saw forecast accuracy improve from 67% to 89% after implementing predictive deal scoring. More importantly, their sales managers could identify at-risk opportunities weeks earlier, enabling proactive intervention rather than reactive damage control.

Discounting represents one of the fastest ways to erode profitability, yet most organizations lack systematic approaches to discount management. CPQ analytics transforms discount decisions from gut instinct into data-driven optimization.

Advanced discount analytics examines the relationship between discount levels, deal characteristics, and closure probability. It identifies the “discount cliff”—the point where additional price reductions don’t meaningfully improve win rates but significantly impact margins.

The insights often surprise sales teams. One SaaS company discovered that deals with 8-12% discounts closed at nearly the same rate as those with 15-20% discounts, but generated 40% higher lifetime value due to better margin preservation.

Product management teams traditionally rely on surveys, focus groups, and market research to understand customer preferences. CPQ analytics offers a different lens: actual configuration choices made by prospects with real budget authority.

This data reveals which product combinations generate the highest win rates, identify underperforming features that add complexity without value, and highlight upsell opportunities that sales teams might miss. One manufacturing company used configuration analytics to redesign their product packaging, eliminating 30% of SKUs while improving win rates by 18%.

Sales velocity often suffers from hidden friction in the quoting process. CPQ analytics makes these bottlenecks visible through detailed process analysis that tracks quotes through every stage of the approval workflow.

The insights frequently challenge conventional assumptions. Instead of complex approvals causing delays, one company found that simple quotes were stalling because sales reps weren’t following up aggressively on “easy” deals. Another discovered that their fastest-closing opportunities required the most revisions—suggesting that engagement intensity, not efficiency, predicted success.

Most sales teams obsess over new customer acquisition while sitting on a goldmine of expansion opportunities. CPQ analytics transforms whitespace analysis from guesswork into surgical precision, revealing exactly what to sell to whom and when.

Think of it as customer pattern matching at scale. Customer X spends $50K annually. Customer Y, with nearly identical characteristics, spends $75K. Your CPQ data knows exactly why that gap exists—and what specific products could close it. One SaaS company discovered their “standard” customers actually fell into three revenue tiers based on configuration patterns, with top performers consistently bundling services that mid-tier customers overlooked entirely.

Discover how CPQ analytics can accelerate your sales cycles. Book a consultation with our revenue optimization experts.

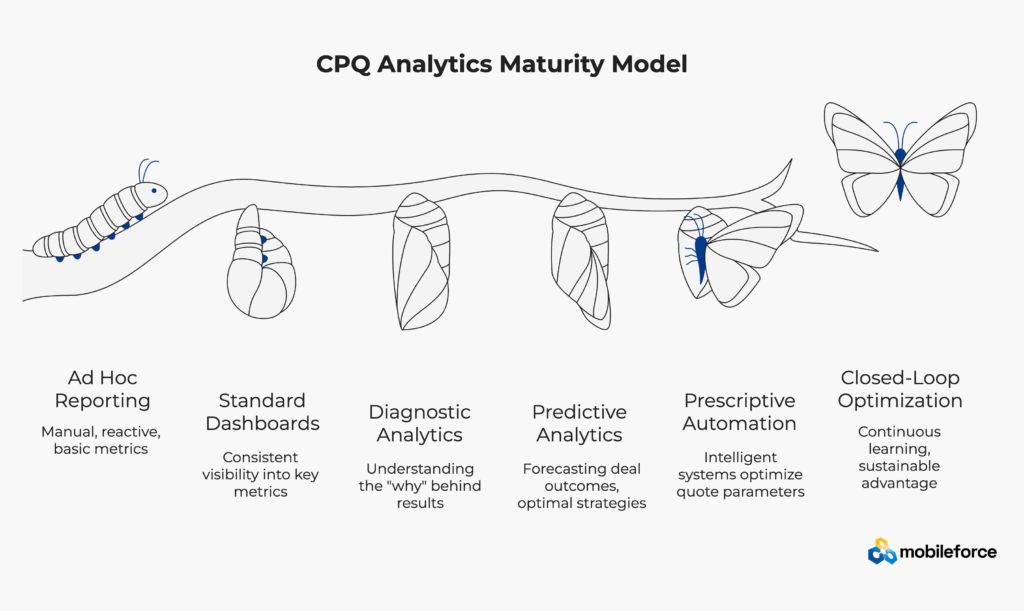

Organizations don’t develop sophisticated quote analytics software capabilities overnight. The journey typically follows a predictable maturation path using CPQ analytics tools, with each stage building on the previous one while delivering incremental value through revenue intelligence from quoting.

Most companies begin here—generating occasional reports from their CPQ system when specific questions arise. Reporting is manual, reactive, and focused on basic metrics like quote volume, average deal size, and win rates using basic CPQ reporting and dashboards.

Characteristics: Excel-based analysis, monthly or quarterly reporting cycles, limited data integration, reactive decision-making affecting quote-to-cash analytics.

Business Impact: Minimal—provides historical perspective but little actionable insight for turning quote data into revenue optimization.

The first real step involves creating standardized dashboards that provide consistent visibility into key CPQ metrics using CPQ reporting and dashboards. This stage focuses on descriptive analytics—what happened, when, and how much through leveraging CPQ data.

Characteristics: Automated dashboard generation, weekly reporting cycles, basic segmentation capabilities, integration with CRM and ERP systems using CPQ + BI integration.

Business Impact: Moderate—enables trend identification and basic performance management using quote analytics tools, typically delivers 5-10% improvement in quote-to-order conversion rates.

Organizations at this stage move beyond “what happened” to explore “why it happened” using advanced quote analytics software. They develop sophisticated segmentation approaches and begin identifying the factors that drive quote success or failure through win/loss analysis in CPQ.

Characteristics: Multi-dimensional analysis, cohort tracking, A/B testing capabilities, integration with external data sources like competitive intelligence platforms using quoting bottleneck analytics.

Business Impact: Significant—enables targeted optimization efforts using CPQ data-driven pricing strategies, typically delivers 10-15% improvement in win rates and 15-20% reduction in quote cycle times.

The transition to predictive CPQ analytics represents a fundamental shift in capability. Organizations deploy machine learning models that forecast deal outcomes and recommend optimal strategies using AI-powered CPQ insights.

Characteristics: Real-time scoring models, automated alerts and recommendations, integration with sales engagement platforms, continuous model improvement using predictive CPQ analytics.

Business Impact: Substantial—transforms sales forecasting and deal management through guided quoting analytics, typically delivers 15-25% improvement in conversion rates and 10-15% increase in average deal sizes.

Advanced organizations embed analytics directly into their quoting workflows, creating intelligent systems that automatically optimize quote parameters and guide user behavior using CPQ for RevOps.

Characteristics: Automated discount optimization, intelligent upsell recommendations, dynamic approval workflows, self-learning rule engines using discounting optimization.

Business Impact: Transformational—fundamentally changes how organizations approach pricing and quoting through leveraging CPQ data, typically delivers 20-30% improvement in overall sales efficiency and 15-25% improvement in margin realization.

The most mature implementations create feedback loops that continuously improve performance based on outcomes using revenue operations insights. The CPQ system becomes a learning platform that gets smarter with every quote through quote-to-cash analytics.

Characteristics: Reinforcement learning algorithms, automated strategy adjustment, real-time market response, integration with broader revenue orchestration platforms using revenue intelligence from quoting.

Business Impact: Revolutionary—creates sustainable competitive advantages through continuous optimization using CPQ ROI and metrics, typically delivers 25-35% improvement in revenue predictability and 20-30% improvement in margin realization.

Success with CPQ analytics depends as much on implementation approach as technical capabilities. Organizations that achieve transformational results follow proven practices that address both technical and organizational challenges.

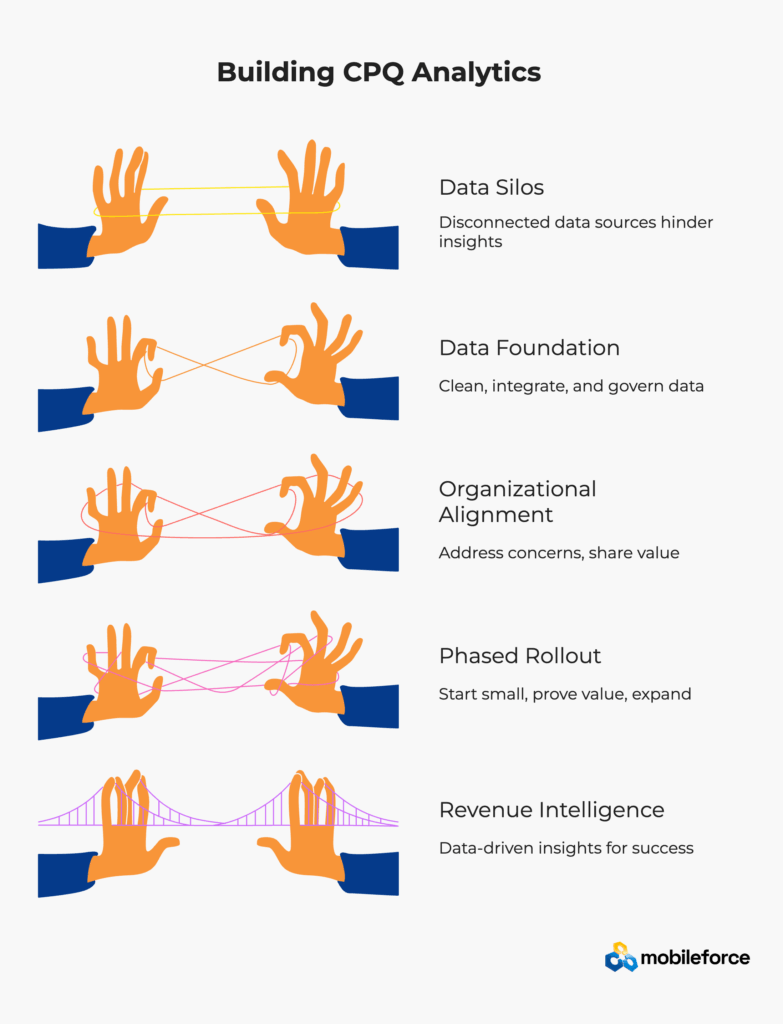

The quality of your CPQ analytics insights directly correlates with the quality of your underlying data. This seems obvious, yet many organizations underestimate the effort required to establish solid data foundations.

Start with master data governance. Product catalogs, pricing rules, and discount matrices must be accurate, complete, and consistently maintained. One SaaS company spent six months cleaning up their product catalog before implementing advanced analytics—and later credited that foundational work as the key to their success.

Data integration architecture matters tremendously. CPQ analytics requires seamless data flows between multiple systems: CRM for opportunity context, ERP for fulfillment data, billing systems for revenue recognition, and product management tools for catalog updates. The most successful implementations treat integration as a strategic capability, not a technical afterthought.

CPQ analytics initiatives often fail not because of technical issues, but because of organizational resistance. Sales teams worry about being micromanaged. Product managers fear losing pricing flexibility. Finance wants more controls while sales wants more speed.

The most successful implementations address these concerns proactively. They start with clear value propositions for each stakeholder group: sales teams get better tools for winning deals, product managers get clearer market feedback, and finance gets improved margin visibility.

Change management matters more than most organizations recognize. One manufacturing company saw their CPQ analytics initiative stall for months because sales reps weren’t convinced the insights were accurate. The breakthrough came when they started sharing success stories from early adopters and providing transparent explanations of how recommendations were generated.

Ambitious organizations often try to implement advanced CPQ analytics capabilities too quickly. The most successful approaches start small, prove value, and expand incrementally.

Begin with diagnostic analytics focused on a specific problem—discount leakage, quote approval bottlenecks, or product mix optimization. Demonstrate clear ROI from these initial use cases before expanding to predictive models or automation.

One technology company started by analyzing why certain quotes required multiple revisions. They discovered that sales reps were consistently under-configuring solutions, leading to scope creep during implementation. This single insight led to changes in sales training and quoting templates that improved project margins by 12%.

Ready to start your CPQ analytics journey? Connect with our implementation specialists to develop your roadmap to revenue intelligence.

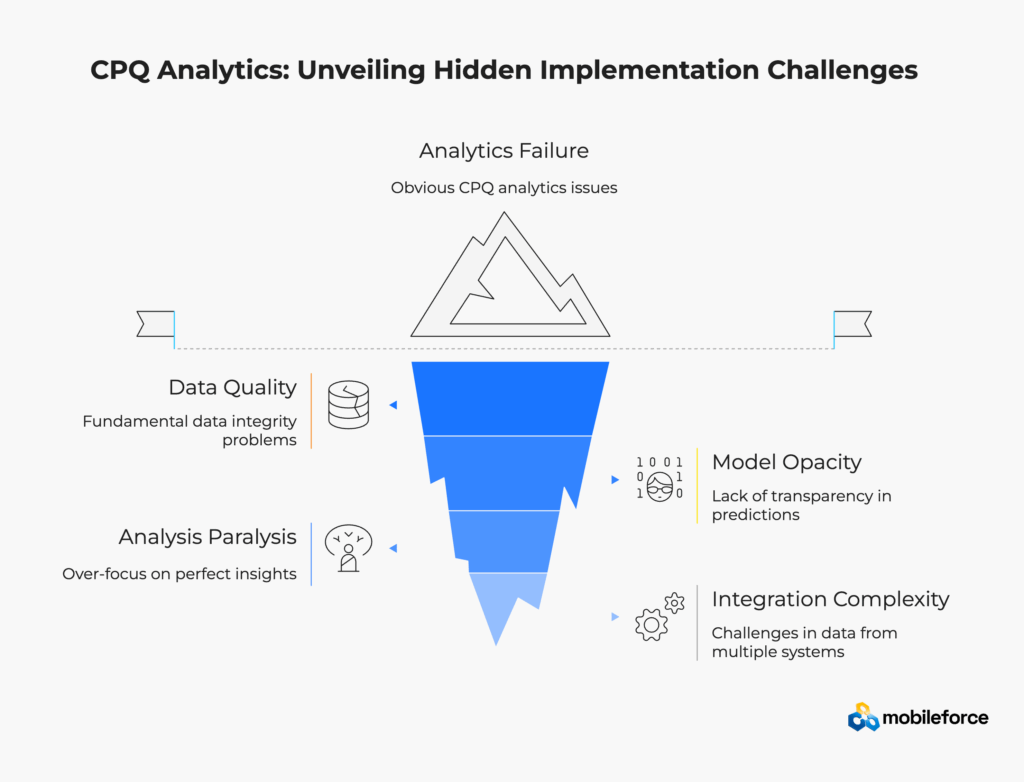

Even well-intentioned CPQ analytics initiatives can stumble. Understanding common failure patterns helps organizations navigate implementation challenges more effectively.

Poor data quality represents the number one cause of CPQ analytics failure. Organizations often discover fundamental data integrity issues only after investing significant time and resources in analytics infrastructure.

The solution involves systematic data auditing before major analytics investments. One approach that works well: start by manually analyzing a representative sample of quotes to understand data completeness, accuracy, and consistency patterns. This upfront investment pays dividends by identifying issues that would otherwise undermine analytical insights.

Advanced machine learning models can generate accurate predictions while remaining completely opaque to business users. Sales teams resist recommendations they can’t understand or validate, limiting adoption regardless of technical accuracy.

The most successful implementations balance predictive power with interpretability. They use techniques like SHAP (SHapley Additive exPlanations) values to explain why specific recommendations were generated, building user confidence through transparency.

Some organizations become so focused on generating perfect insights that they never take action. They continuously refine models, expand data sets, and improve accuracy while missing opportunities to drive real business impact.

The antidote involves setting clear action thresholds upfront. Define what level of confidence justifies specific decisions, and commit to taking action when those thresholds are met. One company established a rule that any recommendation with 70% or higher confidence would be implemented within two weeks, preventing endless refinement cycles.

CPQ analytics requires data from multiple systems, each with different formats, update frequencies, and quality standards. Integration complexity often exceeds initial estimates, delaying value realization and inflating costs.

Successful organizations treat integration as a strategic capability worthy of dedicated resources. They invest in robust data pipeline architectures that can handle schema changes, data quality issues, and system updates without breaking downstream analytics processes.

Understanding current market limitations helps organizations make better vendor selection decisions and set realistic implementation expectations.

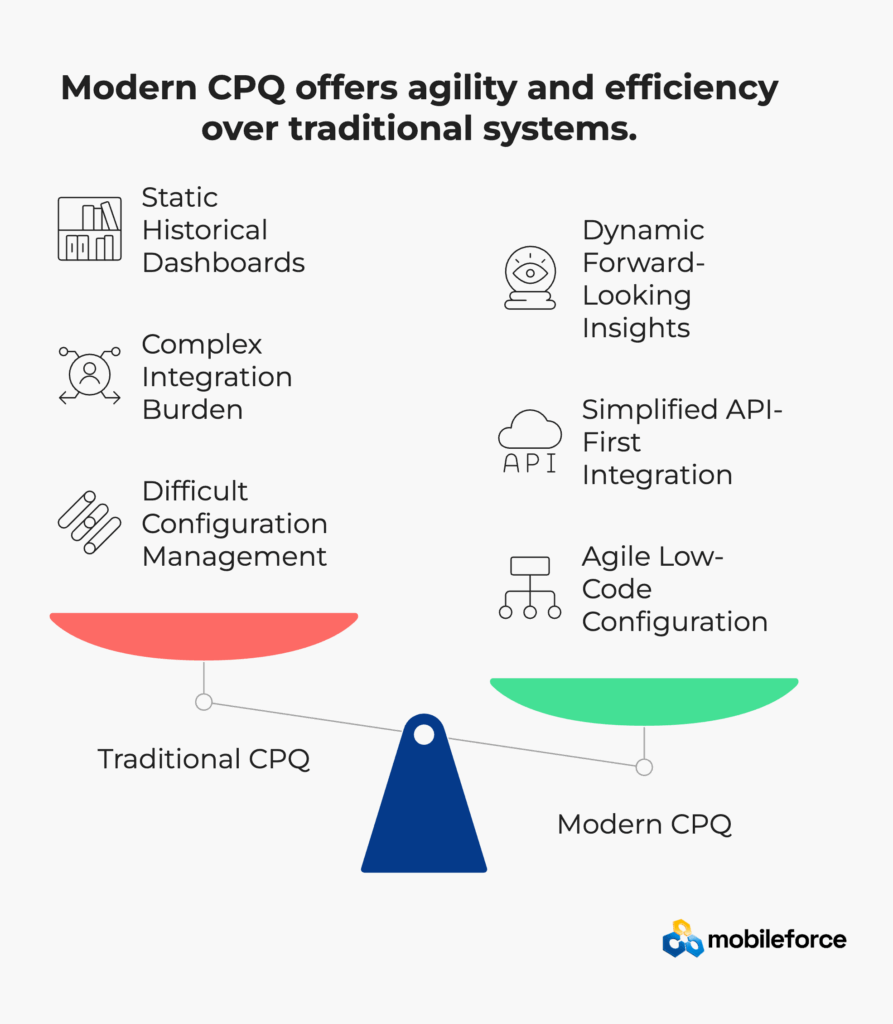

Most CPQ vendors provide basic reporting capabilities focused on historical metrics. These dashboards answer “what happened” questions but offer limited insight into “what should happen next.” Sales teams can see that win rates declined last quarter, but not which specific quotes in their current pipeline are most at risk.

Advanced CPQ analytics platforms address this gap by providing forward-looking insights embedded directly in the quoting workflow. Instead of separate reporting systems, recommendations and alerts appear contextually when sales reps are actually building quotes.

Traditional CPQ implementations often require extensive customization to integrate with existing systems. IT teams spend months building and maintaining complex integration frameworks that become brittle over time.

Modern platforms like MobileForce.ai address this challenge through API-first architectures and pre-built connectors that simplify integration with popular CRM, ERP, and billing platforms. The result is faster implementations with lower ongoing maintenance costs.

Legacy CPQ systems handle complex product configurations and pricing rules, but they often become difficult to maintain as business requirements evolve. Small changes require technical resources and lengthy testing cycles.

Next-generation platforms provide low-code configuration environments that enable business users to modify rules and test scenarios without IT involvement. This agility becomes crucial as organizations need to respond rapidly to market changes and competitive pressures.

According to Forrester research, organizations using modern, API-first CPQ platforms see 40% faster time-to-market for new products and 60% reduction in IT maintenance costs compared to legacy implementations.

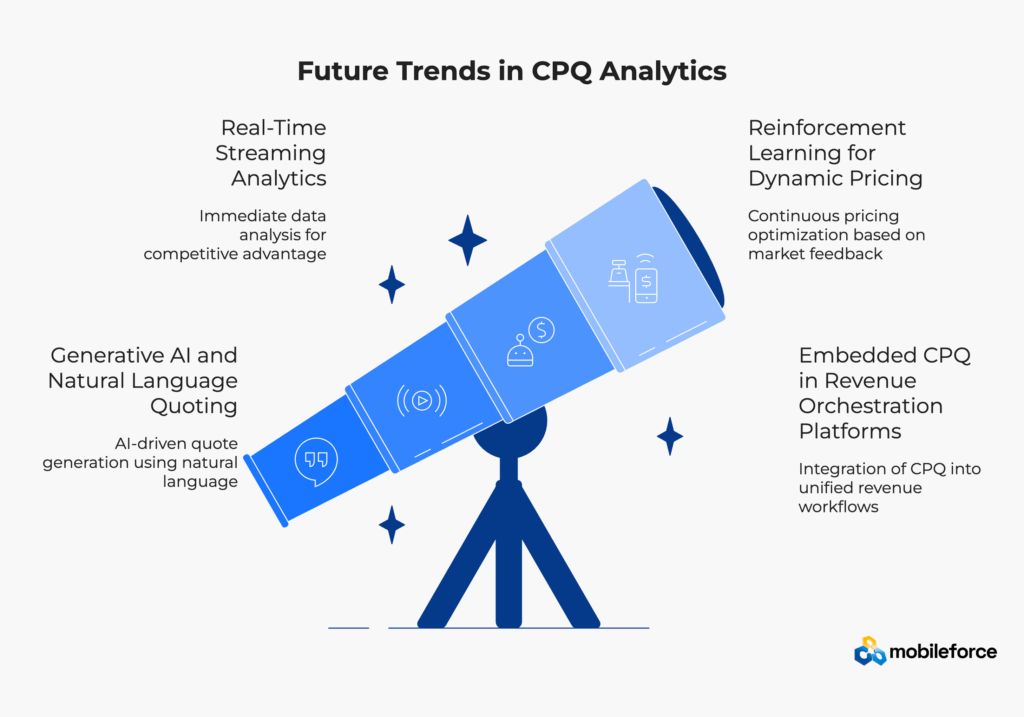

CPQ analytics continues evolving rapidly, driven by advances in artificial intelligence, machine learning, and real-time data processing. Organizations planning long-term investments should understand emerging trends that will shape the next generation of revenue intelligence platforms.

Large language models are beginning to transform how sales teams interact with CPQ systems. Instead of navigating complex product catalogs and pricing rules, sales reps can describe customer requirements in natural language and receive optimized quote recommendations.

Early implementations of “conversational CPQ” show promising results. One pilot program reduced average quote generation time by 65% while improving configuration accuracy through AI-powered validation checks.

Traditional CPQ analytics operates on batch processing cycles—analyzing data after quotes are generated and outcomes are determined. Streaming analytics enables real-time optimization based on live quote interactions.

This capability becomes particularly powerful for competitive situations. If a prospect requests multiple quote variations, streaming analytics can immediately identify patterns that suggest competitive pressure and recommend response strategies before opportunities are lost.

Future CPQ platforms will implement reinforcement learning algorithms that continuously optimize pricing strategies based on market feedback. Instead of static pricing rules, these systems will adjust recommendations automatically based on win/loss patterns, competitive intelligence, and market conditions.

The early results are encouraging. A beta implementation at a SaaS company improved win rates by 23% over six months by automatically adjusting discount recommendations based on deal characteristics and historical outcomes.

CPQ analytics is evolving from standalone capability to integrated component of broader revenue orchestration platforms. These systems connect quoting, proposal generation, contract management, and revenue recognition in unified workflows optimized for specific business outcomes.

Stay ahead of CPQ analytics evolution. Schedule a demo to see how next-generation platforms can transform your revenue operations.

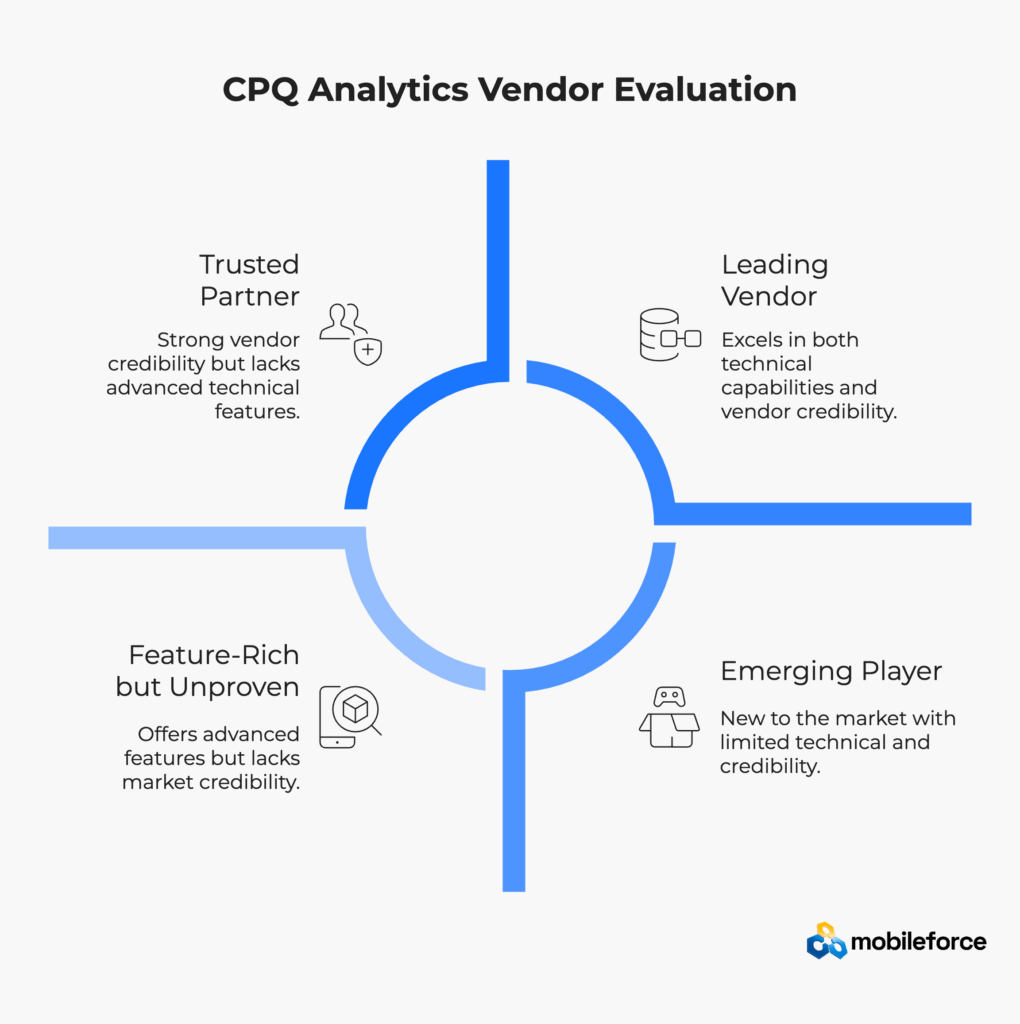

Selecting the right CPQ analytics platform requires balancing current needs with future capabilities. Organizations often underestimate the importance of vendor selection, focusing on feature checklists rather than strategic alignment and long-term viability.

Start with core functionality: does the platform provide the analytical capabilities your organization needs today and can reasonably expect to need in the next 3-5 years? Key areas to evaluate include:

Predictive Analytics Depth: Can the system generate deal scoring, price optimization recommendations, and outcome forecasting with quantified confidence levels?

Integration Flexibility: How easily does the platform connect with your existing CRM, ERP, and billing systems? Are pre-built connectors available, or will you need custom development?

Real-Time Processing: Can the system provide recommendations and alerts within your quoting workflow, or are insights limited to separate reporting interfaces?

Scalability Architecture: Will the platform handle your transaction volumes and user counts as your business grows?

Technical capabilities matter, but vendor stability and market credibility often prove more important for long-term success. Evaluate:

Customer References: Can the vendor provide references from companies in your industry with similar use cases and scale requirements?

Implementation Track Record: What’s the vendor’s average time-to-value, and how do their implementation success rates compare to industry benchmarks?

Product Roadmap Transparency: Does the vendor share clear development priorities and timelines for capability enhancements?

Support and Services Quality: What level of ongoing support can you expect, and does the vendor provide professional services for complex implementations?

CPQ analytics investments often require significant upfront costs and organizational change management. Clear ROI frameworks help justify investments and measure success:

Time to First Value: How quickly can you expect to see measurable improvements in key metrics like win rates or quote cycle times?

Implementation Costs: Beyond software licensing, what are the total costs for data integration, user training, and change management?

Ongoing Operational Impact: How will the platform affect your current staffing requirements and operational processes?

Quantified Business Benefits: Can you model specific improvements in revenue, margins, and operational efficiency based on vendor benchmarks and your current performance?

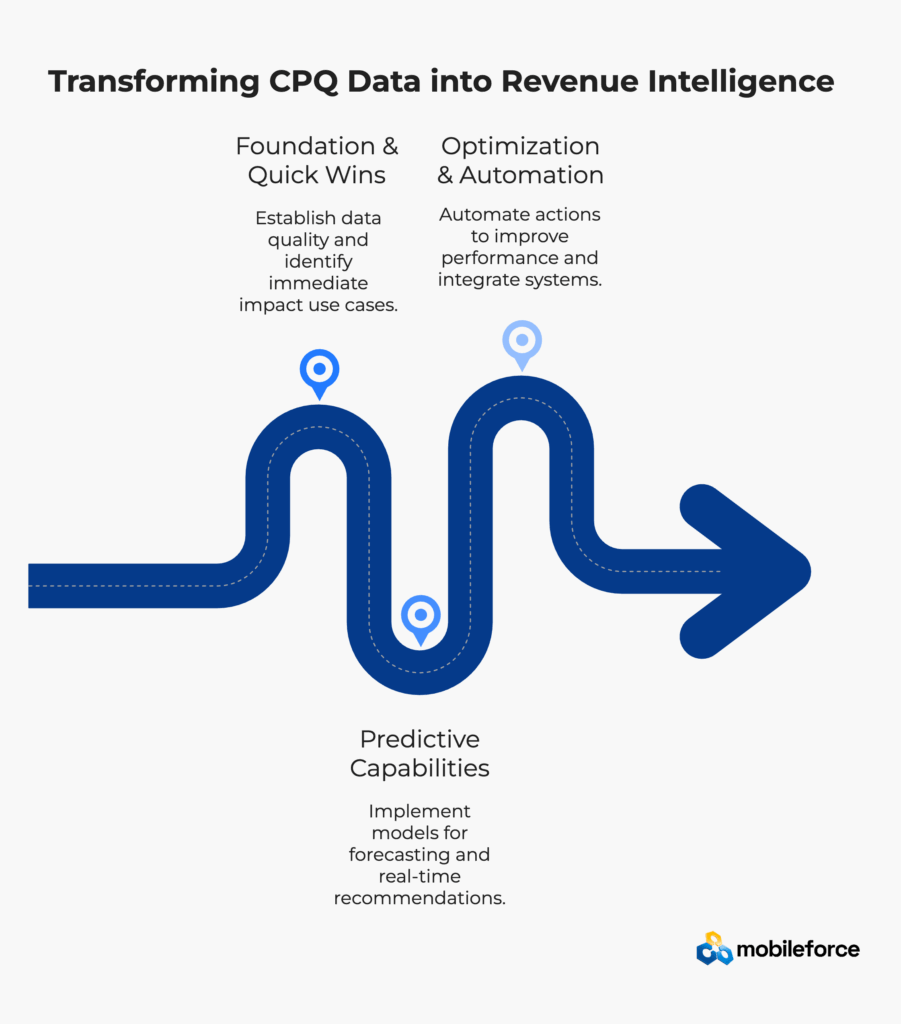

Transforming CPQ data into revenue intelligence requires systematic planning and execution. Organizations that achieve the best results follow structured approaches that balance quick wins with long-term capability building.

Begin by establishing data quality baselines and identifying high-impact, low-complexity use cases that can demonstrate value quickly.

Data Assessment: Audit your current CPQ data quality, completeness, and integration readiness. Identify and address critical gaps that would undermine analytical insights.

Quick Win Identification: Select 2-3 specific problems that CPQ analytics can address with immediate impact. Common examples include discount leakage analysis, quote approval bottleneck identification, or win/loss pattern analysis.

Stakeholder Alignment: Secure buy-in from sales, operations, and IT teams by clearly communicating value propositions and addressing concerns proactively.

Expand beyond descriptive analytics to implement predictive models that forecast outcomes and recommend actions.

Deal Scoring Implementation: Deploy predictive models that assess closure probability based on quote characteristics and historical patterns.

Dynamic Recommendations: Implement systems that provide real-time guidance for discount decisions, configuration optimization, and upsell opportunities.

Integration Expansion: Connect CPQ analytics with broader sales and marketing systems to create unified customer intelligence.

Transform insights into automated actions that improve performance without requiring manual intervention.

Intelligent Automation: Implement rules that automatically approve low-risk quotes, flag high-risk opportunities, and optimize pricing parameters based on deal characteristics.

Continuous Learning: Deploy feedback loops that improve model accuracy and recommendation quality based on actual outcomes.

Strategic Integration: Connect CPQ analytics with broader revenue operations platforms to create comprehensive revenue intelligence capabilities.

Establish clear measurement frameworks that track progress and demonstrate ROI:

The evolution from basic quoting tools to intelligent revenue platforms represents one of the most significant opportunities in modern sales operations. Organizations that master CPQ analytics don’t just process quotes more efficiently—they predict outcomes more accurately, optimize pricing more systematically, and protect margins more effectively.

The path forward requires balancing technical capabilities with organizational readiness. Start with solid data foundations, focus on high-impact use cases, and build capabilities incrementally. The companies that get this right will find themselves with sustainable competitive advantages that compound over time.

Your CPQ system is already generating the insights you need to transform your revenue performance. The question isn’t whether the opportunity exists—it’s whether you’ll seize it before your competitors do.

Ready to unlock the revenue intelligence hidden in your quote data? Schedule a demo to discover how CPQ analytics can transform your sales performance.

CRM analytics focuses on opportunity management and sales pipeline health, typically analyzing data after deals close or are lost. CPQ analytics operates at the quote level, capturing decision-making data during the evaluation process. This granular visibility enables predictive insights about deals still in progress, while CRM analytics primarily provides historical perspective on completed sales cycles.

Yes, but with significant limitations. Legacy CPQ systems often lack the data capture capabilities and API flexibility needed for advanced analytics. While basic reporting improvements are possible, predictive capabilities and real-time optimization typically require modern platforms designed with analytics as a core capability rather than an afterthought.

Most predictive CPQ models require at least 6-12 months of quality historical data to generate reliable forecasts, though the exact timeline depends on quote volumes and deal complexity. Organizations with high transaction volumes can often build effective models with 3-6 months of data, while companies with longer sales cycles may need 12-18 months for sufficient statistical significance.

CPQ analytics addresses over-discounting through systematic analysis of discount effectiveness. By correlating discount levels with closure rates and deal characteristics, organizations can identify the optimal discount ranges that maximize win rates without unnecessarily eroding margins. Advanced implementations provide real-time discount recommendations based on deal-specific factors and competitive intelligence.

Quote revisions provide valuable intelligence about customer decision-making processes and sales effectiveness. Advanced CPQ analytics tracks revision patterns to identify which changes improve closure probability and which indicate fundamental misalignment with customer needs. Version analysis can reveal whether multiple revisions suggest healthy engagement or problematic sales approaches.

Model retraining frequency depends on business volatility and seasonal patterns. Most organizations retrain quarterly to capture changing market conditions and customer behavior patterns. Companies in rapidly evolving markets may need monthly retraining, while stable businesses can often extend to semi-annual updates. Continuous monitoring helps identify when model accuracy degrades enough to justify retraining.

Well-implemented CPQ analytics typically delivers measurable ROI within 6-12 months, with payback periods averaging 12-18 months for comprehensive implementations. Organizations should expect 3-6 months for initial insights and improvements, with full value realization occurring as predictive capabilities mature and automation increases.

Modern CPQ analytics platforms provide API-first architectures that simplify integration with popular business intelligence tools like Tableau, Power BI, and Looker. The key is establishing real-time or near-real-time data pipelines that keep BI systems current with quote activity. Many organizations find success using cloud data warehouses as intermediary layers that aggregate CPQ data with other business metrics.